EIA Weekly Refinery Utilization Drops -0.2% – A Crossroads for Energy and Autos – AInvest

Analysis of U.S. Energy Inventories and Sustainable Development Implications

Report for the Week Ending July 4, 2025

This report analyzes the U.S. Energy Information Administration (EIA) data for the week ending July 4, 2025, focusing on its implications for key economic sectors and progress toward the United Nations Sustainable Development Goals (SDGs).

Key Data Findings: A Divergence in Energy Stockpiles

The EIA report revealed a significant divergence between crude oil and gasoline inventories, signaling underlying imbalances in energy supply chains and consumption patterns.

- Crude Oil Inventories: Surged by 7.07 million barrels, marking the largest weekly increase since January. This surplus, influenced by reduced domestic production and export limitations, points to challenges in aligning production with global demand, impacting SDG 7 (Affordable and Clean Energy).

- Gasoline Inventories: Decreased by 2.658 million barrels, placing stockpiles 1% below the five-year seasonal average. Despite weaker crude prices, gasoline demand remained resilient at 9.2 million barrels per day, highlighting persistent reliance on fossil fuels for transportation, a key concern for SDG 13 (Climate Action).

Implications for Sustainable Development Goals (SDGs)

The inventory data underscores critical challenges and opportunities related to the global sustainability agenda. The continued volatility and reliance on fossil fuels directly conflict with long-term climate and energy objectives.

SDG 7: Affordable and Clean Energy

The data indicates persistent volatility in energy markets. While a crude surplus may temporarily suppress prices, declining gasoline inventories threaten price spikes, potentially impacting energy affordability for consumers. This dynamic highlights the vulnerability of an energy system heavily dependent on fossil fuels and detracts from the goal of ensuring access to affordable, reliable, and modern energy for all.

SDG 12: Responsible Consumption and Production

The resilient demand for gasoline, even amidst market fluctuations, reflects unsustainable consumption patterns. The inventory drawdowns during a peak demand season underscore the urgent need to accelerate the transition to more sustainable transportation systems and reduce material consumption, in line with the objectives of SDG 12.

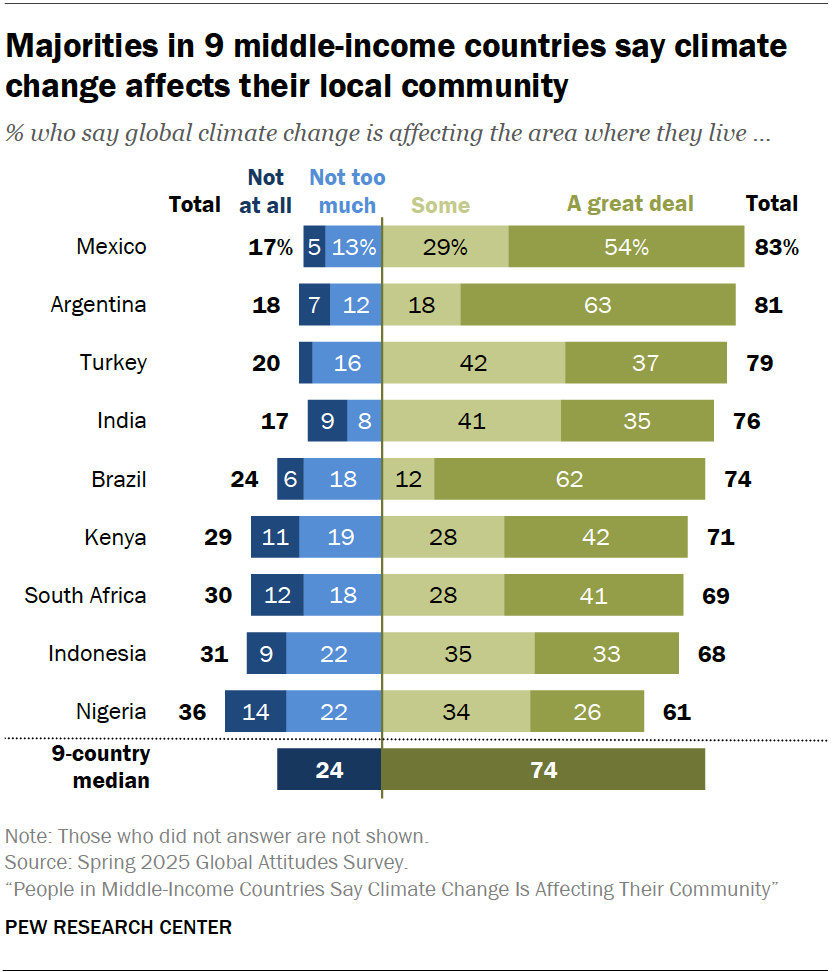

SDG 13: Climate Action

The report’s findings are a stark reminder of the challenges in combating climate change. The large-scale consumption of gasoline and the infrastructure supporting crude oil stockpiles are intrinsically linked to greenhouse gas emissions. The market’s response to these inventory levels prioritizes short-term economic gains over the long-term imperative to take urgent action on climate change.

Sectoral Economic Impact Analysis

The divergent inventory trends create asymmetric economic pressures, affecting industries central to economic growth and sustainable development.

Automotive Sector: Economic and Sustainability Headwinds

The automotive sector faces significant challenges that conflict with SDG 8 (Decent Work and Economic Growth) and SDG 9 (Industry, Innovation, and Infrastructure).

- Margin and Consumer Pressure: Tightening gasoline supplies risk raising retail fuel prices, which can reduce consumer disposable income and dampen demand for new vehicles, particularly those with internal combustion engines.

- Transition Risks: The market dynamics reinforce the economic risks for industries that have not fully transitioned to sustainable technologies. Historical data indicates a 21-day period of underperformance for auto stocks following such inventory draws.

Trading and Logistics Sector: Short-Term Gains

Trading and shipping companies may see temporary benefits from market inefficiencies, though these activities are rooted in a fossil fuel-based economy.

- Arbitrage Opportunities: The crude surplus in the U.S. relative to other global markets creates opportunities for arbitrage, increasing shipping and logistics demand.

- Economic Performance: Historical analysis suggests a 58-day window of positive performance for trading firms during periods of divergent crude and gasoline inventories. However, this economic activity is tied to the perpetuation of an unsustainable energy system.

Risk Factors and Strategic Outlook

Monitoring key indicators is crucial for assessing the trajectory of energy markets and their alignment with sustainability goals.

Key Risks to Monitor

- Refinery Utilization: A decline below 85% could signal a broader economic slowdown and weakening energy demand, further complicating the transition.

- Geopolitical and Policy Shifts: International relations and national energy policies, particularly regarding major economies, remain a significant source of uncertainty for global energy stability and climate action.

Conclusion and Recommendations

The July 4, 2025, EIA report serves as a critical data point, illustrating the deep-seated challenges in transitioning to a sustainable economy. The market’s reaction highlights a continued focus on short-term, fossil fuel-driven economic opportunities at the expense of long-term goals outlined in the SDGs. Stakeholders and policymakers must utilize such data to accelerate investments in clean energy infrastructure and promote policies that foster responsible consumption and production, ensuring that economic strategies are aligned with the imperatives of climate action and sustainable development.

SDGs Addressed in the Article

SDG 7: Affordable and Clean Energy

- The article’s core subject is the supply, demand, and pricing of energy products, specifically crude oil and gasoline. It directly discusses the affordability of energy for consumers through projected gasoline prices and the reliability of the energy supply chain, as seen in the inventory fluctuations.

SDG 8: Decent Work and Economic Growth

- The analysis focuses on the economic consequences of energy market dynamics, detailing the performance of specific sectors like automobiles and trading. It highlights how supply-demand imbalances create “sector-specific dislocation,” impacting corporate performance and investment strategies, which are components of overall economic activity.

SDG 9: Industry, Innovation and Infrastructure

- The article refers to key industrial infrastructure, such as refineries (“Refinery Utilization”) and shipping logistics (“shipping demand,” “tanker demand”). The discussion of inventory builds and draws points to the capacity and resilience of the infrastructure used to produce, store, and transport energy.

SDG 12: Responsible Consumption and Production

- The entire report is an analysis of consumption and production patterns for fossil fuels. It quantifies gasoline demand (“9.2 million barrels/day”) and crude oil production/supply (surge of “7.07 million barrels” in inventories), providing a snapshot of how these natural resources are being managed and consumed.

Specific Targets Identified

Under SDG 7: Affordable and Clean Energy

-

Target 7.1: By 2030, ensure universal access to affordable, reliable and modern energy services.

The article connects directly to the “affordable” aspect of this target by projecting that higher retail gasoline prices will average “$3.14/gallon in Q3.” It further explains that this price pressure can “squeeze disposable income” and “dampen demand,” highlighting the direct link between energy prices and consumer affordability.

-

Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology.

The article discusses the international dimension of energy markets, noting that a crude surplus in the U.S. creates “global arbitrage opportunities.” The specific example of “U.S. crude at $67/bbl vs. European benchmarks at $69/bbl” incentivizing exports demonstrates the international trade and investment in energy infrastructure (like shipping) that this target addresses.

Under SDG 8: Decent Work and Economic Growth

-

Target 8.1: Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7 per cent gross domestic product growth per annum in the least developed countries.

While not measuring national GDP, the article provides a micro-level analysis of economic growth dynamics by forecasting sector-specific performance. The prediction that “Auto stocks typically underperform for 21 days” while “Trading firms historically outperform for 58 days” illustrates the shifting drivers of economic activity and growth within an economy.

Under SDG 9: Industry, Innovation and Infrastructure

-

Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure, including regional and transborder infrastructure, to support economic development and human well-being.

The article implicitly assesses the resilience of energy infrastructure. The “unexpected crude build” and falling gasoline stocks reveal a “mismatch in supply-demand dynamics” that tests the limits of refinery and storage infrastructure. The mention of “Refinery Utilization” as a key risk factor directly relates to the performance and reliability of this industrial infrastructure.

Under SDG 12: Responsible Consumption and Production

-

Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources.

The article is a detailed report on the management and use of a natural resource (crude oil). The data on gasoline stocks falling by “2.658 million barrels” while crude inventories surged by “7.07 million barrels” provides a direct measure of the efficiency (or inefficiency) of the production and supply chain in matching resource supply with consumption patterns.

Indicators for Measuring Progress

Indicators for SDG 7 (Affordable and Clean Energy)

- Retail Price of Gasoline: The article projects an average price of “$3.14/gallon,” which serves as a direct indicator of energy affordability for consumers (Target 7.1).

- Regional Price Differentials: The arbitrage opportunity mentioned (“U.S. crude at $67/bbl vs. European benchmarks at $69/bbl”) is an indicator of international energy market integration and infrastructure flows (Target 7.a).

Indicators for SDG 9 (Industry, Innovation and Infrastructure)

- Refinery Utilization Rate: The article identifies a potential drop “below 85%” as a critical risk factor. This percentage is a direct indicator of the operational status and efficiency of essential industrial infrastructure (Target 9.1).

- Crude Oil and Gasoline Inventory Levels: The weekly changes (+7.07 million barrels for crude, -2.658 million for gasoline) serve as indicators of the capacity and balance of the storage and logistics infrastructure.

Indicators for SDG 12 (Responsible Consumption and Production)

- Fossil Fuel Demand: The figure for gasoline demand, “steady at 9.2 million barrels/day,” is a primary indicator of consumption patterns for a key natural resource (Target 12.2).

- Inventory-to-Demand Ratio: The fact that gasoline inventories are “1% below the five-year seasonal average” despite steady demand is an implied indicator measuring the efficiency of the supply chain in meeting production and consumption needs (Target 12.2).

Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.1: Ensure access to affordable and reliable energy. | Retail gasoline price (projected at $3.14/gallon). |

| SDG 7: Affordable and Clean Energy | 7.a: Promote investment in energy infrastructure. | Crude oil price arbitrage (U.S. at $67/bbl vs. Europe at $69/bbl) driving exports and shipping demand. |

| SDG 8: Decent Work and Economic Growth | 8.1: Sustain per capita economic growth. | Sector-specific performance metrics (21-day bearish signal for autos, 58-day bullish signal for traders). |

| SDG 9: Industry, Innovation and Infrastructure | 9.1: Develop reliable and resilient infrastructure. | Refinery utilization rate (risk of dropping below 85%). |

| SDG 12: Responsible Consumption and Production | 12.2: Achieve the sustainable management and efficient use of natural resources. | Weekly change in crude oil inventories (+7.07M barrels), gasoline inventories (-2.658M barrels), and daily gasoline demand (9.2M barrels/day). |

Source: ainvest.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0