The Market Lifts Thermal Energy International Inc. (CVE:TMG) Shares 31% But It Can Do More – simplywall.st

Financial Performance and Market Valuation Report: Thermal Energy International Inc. (CVE:TMG)

Recent Stock Performance

Thermal Energy International Inc. (TMG) has demonstrated significant short-term momentum, with its share price increasing by 31% over the past month. However, this recent gain is contrasted by a longer-term view, which shows a 26% decline in share price over the last twelve months.

Alignment with Sustainable Development Goals (SDGs)

Thermal Energy International’s core business of providing energy efficiency and emission reduction solutions places it in direct alignment with several key United Nations Sustainable Development Goals (SDGs). The company’s performance and market position are intrinsically linked to its contributions toward a more sustainable global economy.

Core SDG Contributions

- SDG 7 (Affordable and Clean Energy): By optimizing energy use and reducing waste through its proprietary technologies, the company directly contributes to improving energy efficiency, a primary target of SDG 7.

- SDG 9 (Industry, Innovation, and Infrastructure): TMG provides innovative technologies that enable industries to upgrade their infrastructure for cleaner, more efficient, and sustainable operations.

- SDG 12 (Responsible Consumption and Production): The company’s solutions help clients reduce their energy consumption, fostering more sustainable production patterns and corporate responsibility.

- SDG 13 (Climate Action): A direct consequence of improved energy efficiency is the reduction of greenhouse gas emissions, positioning the company as a key contributor to climate action initiatives.

Analysis of Revenue and Price-to-Sales (P/S) Ratio

Historical Revenue Growth

The company’s positive trajectory is supported by strong revenue growth, which stands in contrast to many competitors facing revenue declines. Key performance indicators include:

- A 15% increase in revenue over the last fiscal year.

- A cumulative revenue growth of 100% over the past three years.

This sustained growth reflects successful market adoption of its SDG-aligned energy solutions.

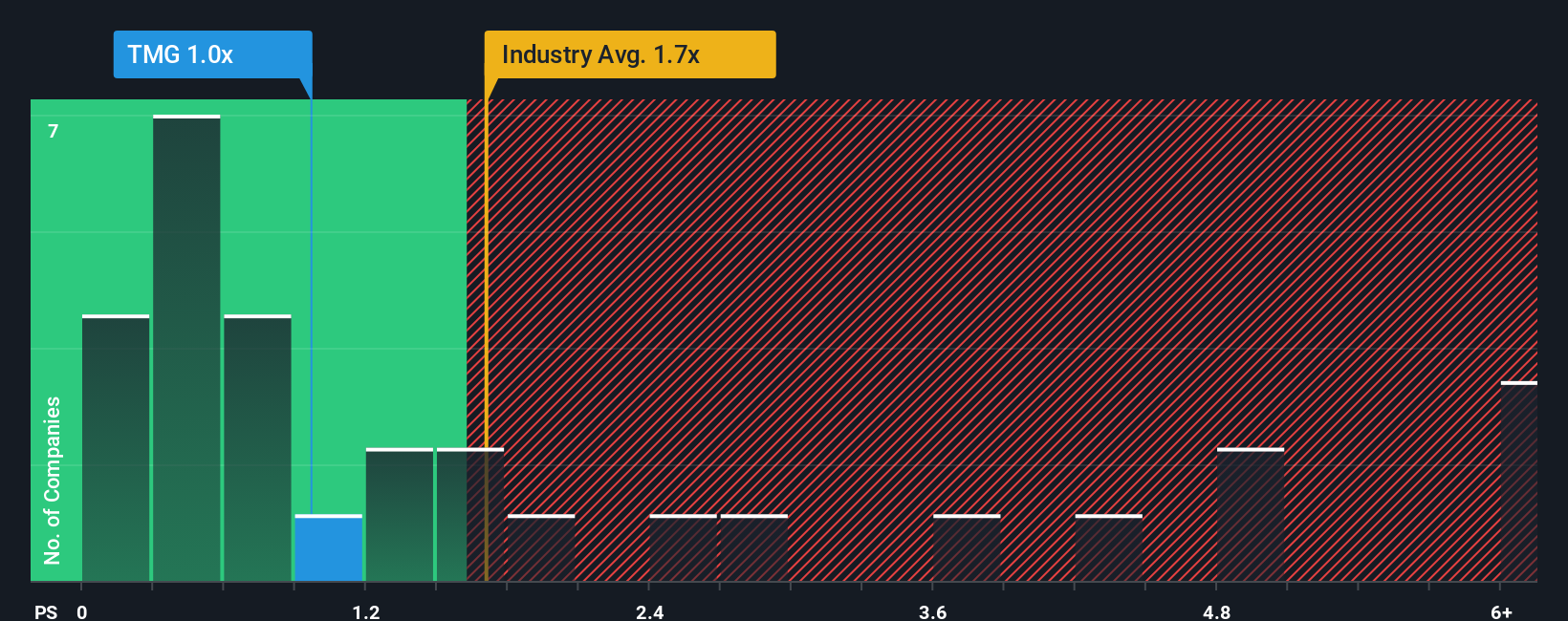

Price-to-Sales (P/S) Ratio Assessment

Despite its strong performance and positive market positioning, Thermal Energy International’s price-to-sales (P/S) ratio is currently 1.0x. This valuation is considered “middle-of-the-road” as it aligns closely with the average P/S ratio for the broader Canadian Machinery industry. The lack of a premium valuation, given the company’s growth, suggests that the market may not have fully priced in its strong performance and contribution to sustainability targets.

Future Outlook and Analyst Projections

Growth Forecasts

Analyst forecasts indicate a continued positive outlook for the company. Revenue is projected to grow by 23% in the coming year. This significantly outpaces the 16% growth forecast for the wider industry, highlighting the company’s potential to capture a greater market share, driven by the increasing demand for sustainable industrial solutions.

Market Sentiment and Potential Risks

The discrepancy between the company’s strong growth forecasts and its average P/S ratio suggests that some investors may be skeptical or pricing in potential risks. While the risk of a price decline appears subdued, the market sentiment implies that future revenue streams could face volatility. It is noted that the company has 2 warning signs that investors should consider as part of their due diligence.

Key Takeaways

- Contrasting Performance: The company exhibits strong recent stock momentum (31% monthly gain) against a challenging 12-month performance (26% decline).

- Strong SDG Alignment: Thermal Energy International’s business model is fundamentally linked to achieving SDGs 7, 9, 12, and 13, positioning it favorably within the growing sustainable investment landscape.

- Superior Growth Metrics: Historical and projected revenue growth significantly exceed industry averages, indicating strong operational execution and market demand.

- Valuation Anomaly: The moderate P/S ratio, which is in line with the industry despite superior growth, may indicate either a potential undervaluation or that the market is pricing in unperceived risks.

1. Which SDGs are addressed or connected to the issues highlighted in the article?

Analysis

- Based on a thorough review of the provided text, no Sustainable Development Goals (SDGs) are directly addressed or connected to the issues discussed.

- The article is a financial analysis focused on Thermal Energy International Inc.’s stock performance. The key issues highlighted are its share price momentum (“31% gain in the last month”), its price-to-sales (P/S) ratio (“P/S ratio of 1x”), and its revenue growth (“revenue up by 100% in total over the last three years”).

- The content is exclusively concerned with financial metrics for investment purposes and does not contain any information regarding environmental, social, or economic sustainability. While the company’s name, “Thermal Energy International Inc.,” might imply a connection to energy-related goals, the article itself provides no details about the company’s operations, products, or impact on sustainability to substantiate such a link.

2. What specific targets under those SDGs can be identified based on the article’s content?

Analysis

- As no SDGs can be identified from the article’s content, it is not possible to identify any specific SDG targets.

- The article does not mention any activities or outcomes related to sustainable industrialization, energy efficiency, climate action, or any other area covered by SDG targets. The discussion is limited to financial forecasts and valuation metrics, such as the analyst estimate that “the next year should generate growth of 23%.” This is a financial projection for investors, not a sustainability target.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Analysis

- The article does not mention or imply any indicators that can be used to measure progress towards SDG targets.

- The quantitative data points provided in the article are purely financial indicators used for stock valuation. These include:

- Share price change (31% gain, 26% down)

- Price-to-sales (P/S) ratio (1x)

- Revenue growth (15% in the last year)

- These metrics serve to gauge the company’s financial health and market valuation for potential investors. They are not designed as, nor do they function as, indicators for sustainable development progress as defined by the official SDG framework.

4. SDGs, Targets and Indicators Table

| SDGs | Targets | Indicators |

|---|---|---|

| None identified in the article. | None identified in the article. | None identified in the article. |

Source: simplywall.st

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

-1920w.png?#)

;Resize=805#)