OPEC+ Output Hike 2025: Navigating Volatility and Strategic Energy Equity Positioning – AInvest

Analysis of OPEC+ Production Increase and its Implications for Sustainable Development Goals

Impact on SDG 7 (Affordable and Clean Energy) and SDG 12 (Responsible Production)

The July 2025 decision by OPEC+ to increase global oil supply by 548,000 barrels per day (bpd) represents a significant challenge to the principles of the Sustainable Development Goals (SDGs). This strategic shift, aimed at unwinding 2.2 million bpd in production cuts, prioritizes market share over price stability. While potentially making energy more affordable in the short term, a core target of SDG 7, it fundamentally undermines the goal’s “clean energy” component by reinforcing global dependence on fossil fuels. The strategy directly conflicts with SDG 12 by promoting production patterns that are environmentally unsustainable.

- Announced Output Hike: 548,000 bpd added to global supply.

- Broader Strategy: Unwinding a total of 2.2 million bpd in cuts.

- Projected Surplus: The International Energy Agency (IEA) forecasts a potential surplus of 500,000–600,000 bpd in 2025, highlighting a move towards irresponsible overproduction.

Economic Volatility and its Effect on SDG 8 (Economic Growth) and SDG 1 (No Poverty)

The immediate market reaction to the OPEC+ announcement was severe price volatility, which threatens stable and inclusive economic growth as outlined in SDG 8. Initial price drops in Brent and WTI crude were followed by a sharp rebound, demonstrating market fragility. Such instability creates an unpredictable economic environment, making long-term planning difficult for governments and industries. Furthermore, energy price shocks can disproportionately affect developing nations and low-income households, potentially reversing progress on SDG 1 by increasing the cost of living and hampering poverty reduction efforts. Analyst forecasts of sub-$60 per barrel prices for 2025–2026 underscore a prolonged period of uncertainty that is detrimental to sustainable economic development.

Geopolitical Tensions and the Challenge to SDG 16 (Peace and Justice) and SDG 17 (Partnerships)

The market’s volatility is exacerbated by geopolitical factors that run counter to the spirit of global cooperation enshrined in the SDGs. U.S. trade policies, including an 18.3% effective tariff on oil imports, disrupt international trade and undermine SDG 17 (Partnerships for the Goals). Regional conflicts and tensions in the Strait of Hormuz and the Red Sea threaten global peace and security, directly challenging the aims of SDG 16 (Peace, Justice and Strong Institutions). These dynamics create a high-risk environment that impedes the collaborative international action required to address global challenges, including climate change and sustainable development.

The Energy Transition Imperative: Aligning Investment with SDG 13 (Climate Action)

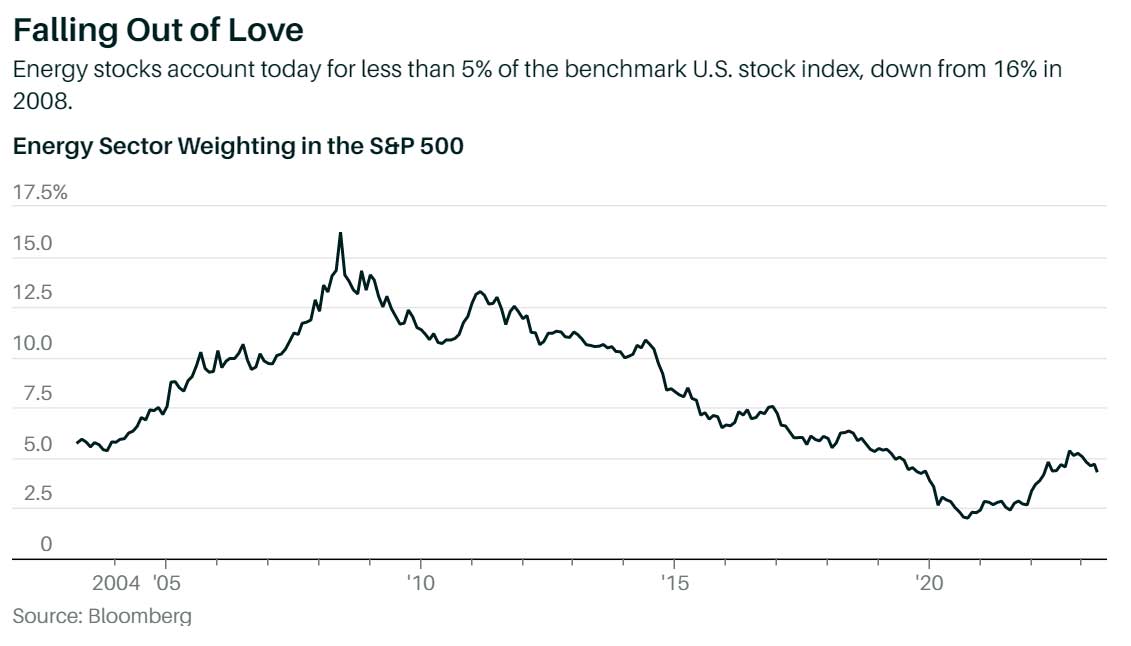

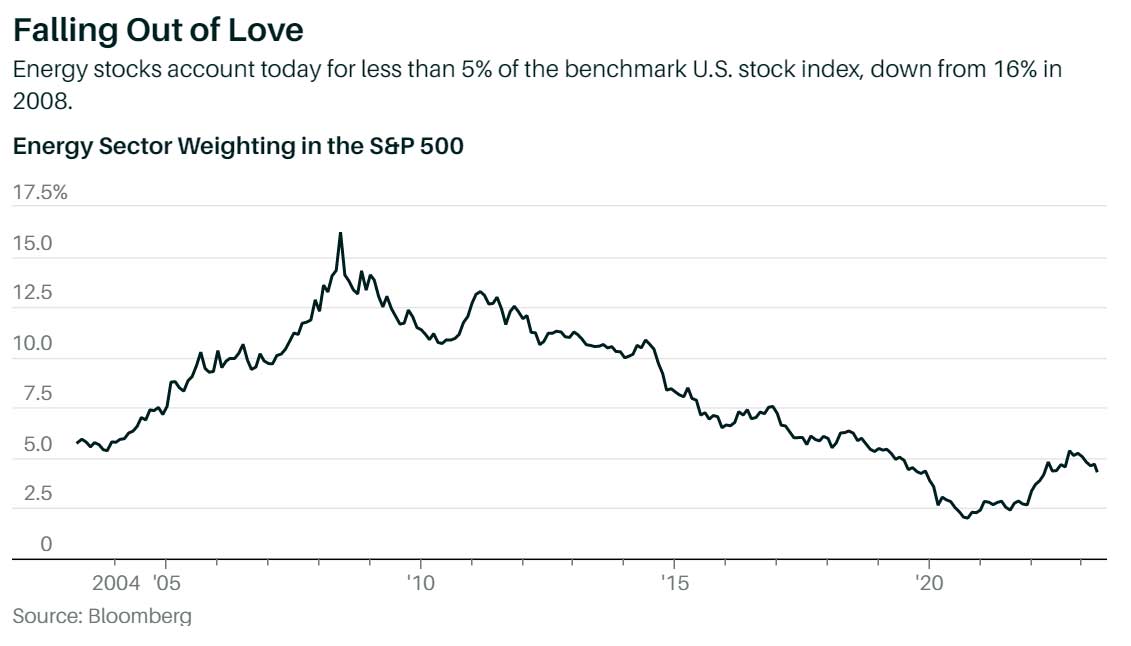

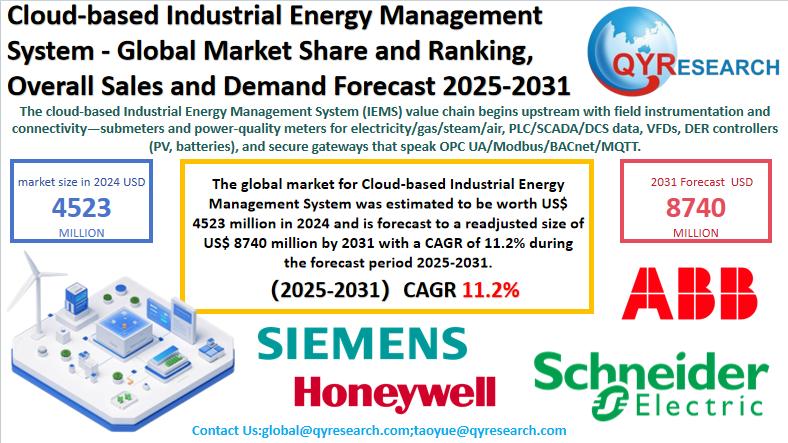

The market turbulence is reshaping investment flows, creating a critical opportunity to accelerate progress toward SDG 13 (Climate Action). Sustained low crude oil prices weaken the financial viability of overleveraged exploration and production (E&P) firms and may accelerate the economic case for renewable energy sources. This dynamic encourages a strategic reallocation of capital from fossil fuel assets to sectors aligned with the energy transition.

- Shift in Capital: Investors are moving towards integrated energy companies with resilient balance sheets and, more significantly, toward the renewable energy sector.

- Support for Green Infrastructure: The trend benefits companies focused on solar power, EV battery manufacturing, and other green technologies, thereby advancing SDG 9 (Industry, Innovation and Infrastructure).

- Growth in Renewables: Companies like NextEra Energy (NEE) and Enphase Energy (ENPH) are positioned to gain from this structural shift as investment prioritizes long-term sustainability over cyclical fossil fuel plays.

Strategic Outlook and Recommendations for SDG Alignment

The OPEC+ output decision has created a new era of volatility that necessitates a strategic realignment of energy policy and investment with the Sustainable Development Goals. To navigate this period, stakeholders should focus on actions that promote long-term sustainability over short-term market share.

- Foster Economic Stability: Implement policies and corporate strategies that mitigate the economic shocks from oil price volatility, thereby protecting vulnerable economies and supporting the objectives of SDG 8.

- Promote Responsible Investment: Allocate capital toward resilient, integrated energy firms with clear commitments to sustainability and away from pure-play fossil fuel extraction, in line with the principles of SDG 12.

- Accelerate the Clean Energy Transition: Actively diversify investment portfolios into renewable energy and EV infrastructure to channel capital toward solutions that directly support SDG 7 and SDG 13, ensuring a sustainable energy future.

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 7: Affordable and Clean Energy

The article is centered on the global energy market, specifically the supply and price of oil, which is a key component of energy affordability worldwide. It discusses the OPEC+ decision to increase oil output, the resulting price volatility (“Brent crude fell 1% to $67.63”), and the strategic shift of investments toward renewable energy sources. The text explicitly mentions that “Prolonged weak crude prices could accelerate the shift to renewables, benefiting solar developers and EV battery manufacturers,” directly linking fossil fuel market dynamics to the growth of clean energy.

-

SDG 8: Decent Work and Economic Growth

The article connects energy market volatility to broader economic conditions, noting that demand-side pressures are driven by “global economic slowdowns.” It also analyzes the economic impact on different types of companies, highlighting how overleveraged firms face “margin compression,” while integrated giants are “better positioned to navigate volatility.” This illustrates the link between energy policy, market stability, and overall economic health.

-

SDG 12: Responsible Consumption and Production

This goal is relevant through the article’s focus on the management of a key natural resource: crude oil. The OPEC+ strategy to “unwind 2.2 million bpd in production cuts” and add “548,000 barrels per day (bpd) to global supply” is a clear example of managing production patterns on a global scale. The discussion of a potential “500,000–600,000 bpd surplus” also relates to the efficiency of production and consumption patterns.

-

SDG 13: Climate Action

The article implicitly and explicitly addresses climate action by discussing the “energy transition.” It states that investors are shifting capital toward “energy transition assets” and that a key investment strategy is to “Diversify into Energy Transition: Invest in renewables and EV infrastructure as capital shifts away from fossil fuels.” This shift is a direct market-based response to the long-term risks associated with fossil fuels and a move towards mitigating climate change.

-

SDG 17: Partnerships for the Goals

The entire context of the article is framed by the actions of OPEC+, a partnership of oil-producing nations (“key players like Saudi Arabia, Russia, and the UAE”). Furthermore, it highlights the role of international policy and geopolitical tensions, such as the “Trump administration’s 18.3% effective tariff rate on global oil imports” and potential “U.S.-China trade frictions,” which affect global cooperation and market stability.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

SDG 7: Affordable and Clean Energy

- Target 7.1: By 2030, ensure universal access to affordable, reliable and modern energy services. The article’s core subject is the price of oil (“Brent crude fell 1% to $67.63,” “sub-$60 per barrel prices for 2025–2026”), which is a primary determinant of energy affordability globally. The volatility and strategic pricing decisions by OPEC+ directly impact this target.

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. This target is directly identified when the article notes that investors are “shifting capital toward energy transition assets” and that “Prolonged weak crude prices could accelerate the shift to renewables, benefiting solar developers and EV battery manufacturers.”

-

SDG 8: Decent Work and Economic Growth

- Target 8.1: Sustain per capita economic growth in accordance with national circumstances. The article links the energy market to the wider economy by mentioning “global economic slowdowns” as a driver of demand-side pressure, showing how energy instability can threaten sustained economic growth.

-

SDG 12: Responsible Consumption and Production

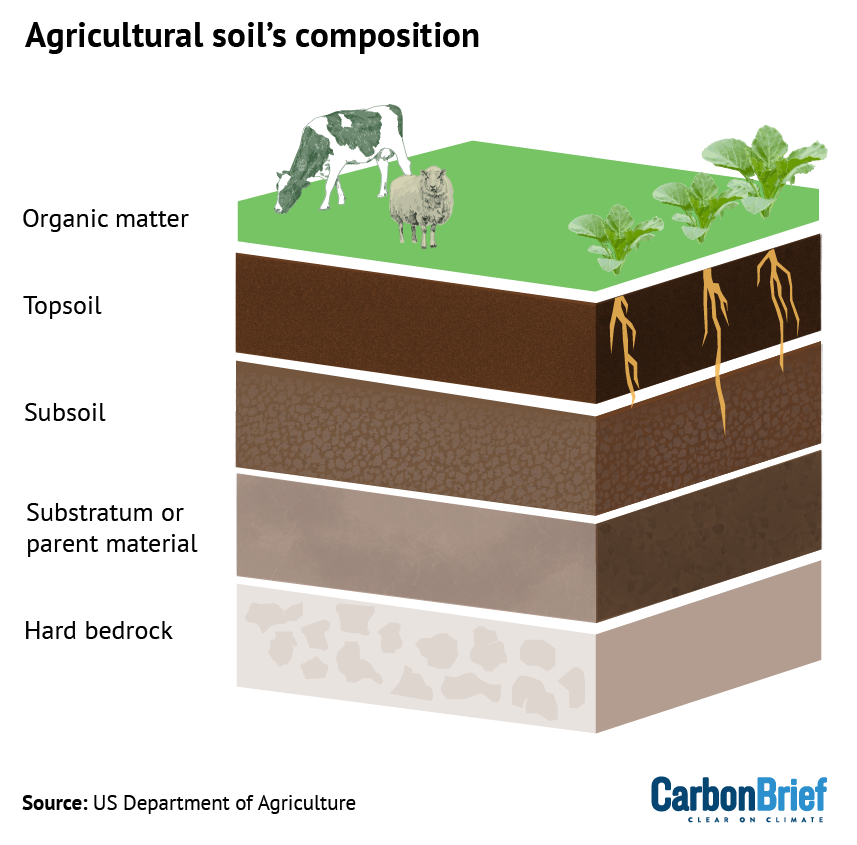

- Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources. The article describes OPEC+’s strategy to manage oil production levels, such as the plan to “unwind 2.2 million bpd in production cuts,” which is a direct attempt to manage the global supply of a natural resource.

-

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. While the article focuses on market and investor strategies rather than national policies, the strategic advice to “Diversify into Energy Transition” and the observation that capital is reallocating to “structural growth opportunities” in renewables like NextEra Energy and Enphase Energy reflect the integration of climate considerations into financial planning and strategy.

-

SDG 17: Partnerships for the Goals

- Target 17.13: Enhance global macroeconomic stability. The article is a case study in threats to macroeconomic stability, describing “heightened short-term volatility,” a “sharp selloff in oil prices,” and volatility indices surging to a “14-month high.”

- Target 17.14: Enhance policy coherence for sustainable development. The article highlights a lack of coherence, with OPEC+ pursuing market share, the U.S. implementing tariffs (“18.3% effective tariff rate”), and investors simultaneously pushing an energy transition, creating a “volatile backdrop” and “layers of uncertainty.”

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

SDG 7: Affordable and Clean Energy

- Implied Indicator for Target 7.1: The article provides specific price points for oil, such as “Brent crude fell 1% to $67.63” and “WTI dropped to $65.80,” along with price forecasts (“sub-$60 per barrel prices for 2025–2026”). These prices are direct measures of energy affordability.

- Implied Indicator for Target 7.2: The shift in capital towards renewable energy companies like “NextEra Energy (NEE) and Enphase Energy (ENPH)” implies a measurement of investment flows into renewables, which is a proxy for tracking the increasing share of renewable energy.

-

SDG 12: Responsible Consumption and Production

- Implied Indicator for Target 12.2 (related to Material Footprint): The article provides specific figures on oil production and supply, such as the “548,000 barrels per day (bpd)” output hike and the unwinding of “2.2 million bpd in production cuts.” These quantities measure the rate of natural resource extraction and consumption.

- Implied Indicator for Target 12.c (related to Fossil-Fuel Subsidies): While not a subsidy, the article mentions a specific policy-driven cost: the “18.3% effective tariff rate on global oil imports” by the U.S. This is a quantifiable measure of a policy instrument affecting fossil fuel prices.

-

SDG 17: Partnerships for the Goals

- Implied Indicator for Target 17.13 (related to Macroeconomic Dashboard): The article provides several data points that would feature on a macroeconomic dashboard used to monitor stability. These include oil price volatility (“Daily Brent implied volatility surged to 68%”), specific commodity prices (Brent and WTI), and supply/demand surplus projections (“a potential 500,000–600,000 bpd surplus in 2025”).

4. Create a table with three columns titled ‘SDGs, Targets and Indicators” to present the findings from analyzing the article.

| SDGs | Targets | Indicators (Mentioned or Implied in the Article) |

|---|---|---|

| SDG 7: Affordable and Clean Energy |

|

|

| SDG 8: Decent Work and Economic Growth |

|

|

| SDG 12: Responsible Consumption and Production |

|

|

| SDG 13: Climate Action |

|

|

| SDG 17: Partnerships for the Goals |

|

|

Source: ainvest.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

;Resize=805#)

![China’s photovoltaic cell exports reached 10.38GW in September as third-quarter surge subsided [ SMM Analysis] – Shanghai Metals Market](https://imgqn.smm.cn/production/admin/news/en/pic/XTwWi20251028115805.png?#)