Survey on the Access to Finance of Enterprises in the euro area – Second quarter of 2025 – European Central Bank

Report on the Access to Finance of Enterprises (SAFE) and its Implications for Sustainable Development Goals

Executive Summary

This report analyzes the findings of the 35th round of the Survey on the Access to Finance of Enterprises (SAFE), conducted in the euro area from 30 May to 27 June 2025. The survey, encompassing 5,367 firms, provides critical insights into the financial landscape and its alignment with the United Nations’ Sustainable Development Goals (SDGs). Key findings indicate that while monetary policy is easing interest rates, the benefits are disproportionately favouring large corporations over Small and Medium-sized Enterprises (SMEs). This trend poses a challenge to SDG 10 (Reduced Inequalities) and SDG 8 (Decent Work and Economic Growth). Concurrently, firms are directing capital towards fixed investment and innovation, including Artificial Intelligence (AI), which supports SDG 9 (Industry, Innovation, and Infrastructure). However, global trade tensions are creating significant disruptions, impacting supply chains and business strategies, thereby threatening progress on SDG 17 (Partnerships for the Goals) and SDG 12 (Responsible Consumption and Production). This report synthesizes these dynamics, offering a comprehensive overview of how corporate finance trends in the euro area intersect with the global 2030 Agenda for Sustainable Development.

Analysis of Financing Conditions and Sustainable Economic Growth (SDG 8 & 10)

Monetary Policy Impact and Access to Finance

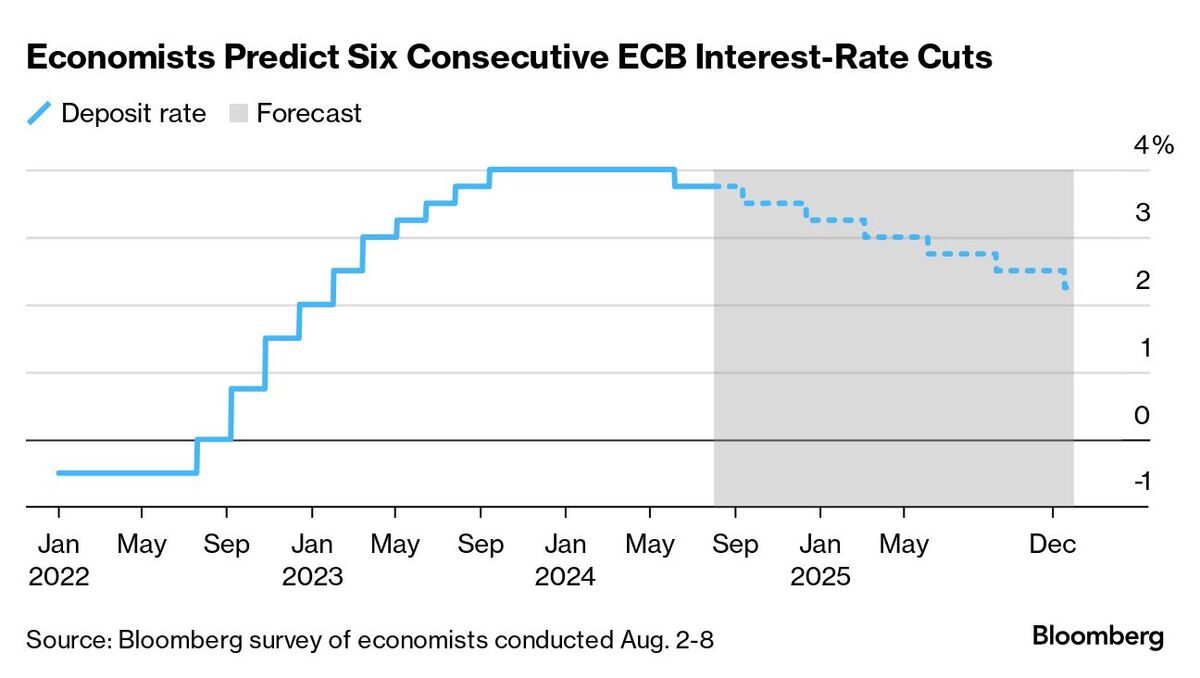

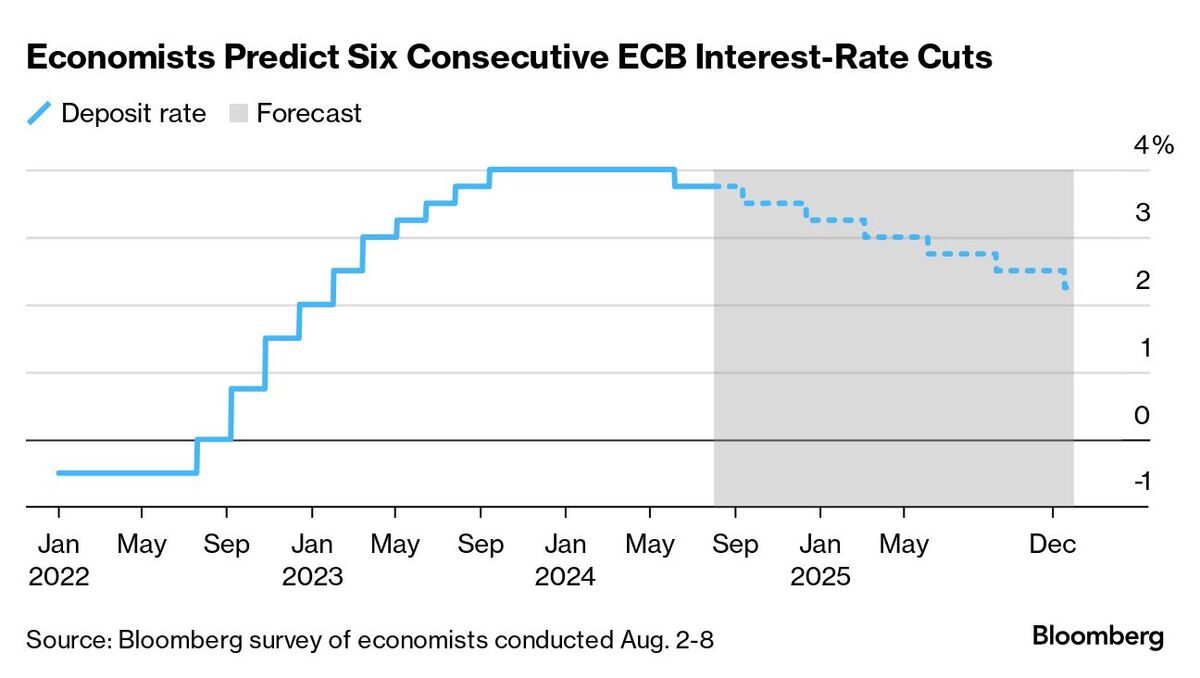

The survey highlights a continued easing of monetary policy, yet its effects on enterprise financing are uneven, creating concerns for inclusive economic growth as outlined in SDG 8.

- A net 14% of all firms reported lower bank interest rates in Q2 2025, an improvement from a net 12% in the previous quarter.

- However, firms indicated a slight net tightening of non-interest rate conditions, such as collateral requirements and other financing costs.

- The availability of bank loans was reported as broadly unchanged, with a net 1% of firms reporting an improvement. This stability is crucial for maintaining economic momentum.

Disparities in Financing: SMEs vs. Large Enterprises

A significant divergence in financing conditions between SMEs and large firms underscores challenges to SDG 10 (Reduced Inequalities). SMEs, which constitute 92% of the survey sample and are vital for job creation, face more restrictive conditions than their larger counterparts.

- Interest Rates: A net 31% of large firms reported a drop in interest rates, whereas a net 2% of SMEs reported an increase.

- Financing Conditions Indicator: The overall indicator of financing conditions showed easing driven entirely by large firms, while SMEs continued to face tightening pressures.

- Profitability: The reported decline in profits was more pronounced among SMEs (a net 13% decline) than among large firms.

This disparity risks hindering the growth potential of smaller businesses, which are fundamental to achieving equitable economic development and decent work for all.

Overall Firm Performance and Financial Vulnerability

The general economic health of euro area firms shows mixed signals, with low financial vulnerability being a positive indicator for economic resilience under SDG 8.

- Turnover increased for a net 8% of firms, but expectations for the next quarter have become less optimistic.

- The share of financially vulnerable firms remained low and stable at 3%, suggesting a degree of resilience in the corporate sector.

- Bank loan applications rose to 23%, indicating active pursuit of financing for business plans, though many firms (49%) cited sufficient internal funds as a reason for not applying.

Investment in Innovation and Resilient Infrastructure (SDG 9)

Allocation of Capital for Fixed Investment

Firms are prioritizing the use of capital for long-term productive capacity, a key component of SDG 9 (Industry, Innovation, and Infrastructure).

- Fixed investment was the most common use of financing, cited by 39% of firms, alongside inventories and working capital.

- A net 3% of firms reported an increase in investment over the past three months, with optimistic expectations for a net 10% increase in the next quarter.

- Large firms were more likely than SMEs to use external financing for fixed investments, highlighting another area where scale provides an advantage in driving innovation and infrastructure development.

The Rise of Artificial Intelligence in Business Strategy

Investment in advanced technologies like AI is a direct contribution to the innovation targets of SDG 9. The survey reveals a growing commitment to digital transformation.

- Adoption Rate: 34% of all firms reported investing in AI technologies. This figure rises to 47% for large firms and 38% for firms in the service sector.

- Investment Allocation: Among firms investing in AI, an average of 5.6% of their total investment was dedicated to these technologies.

- Drivers of AI Investment: Firms reporting higher overall investment and those using more internal funds were more likely to invest in AI, suggesting that financial health is a prerequisite for technological advancement.

Global Trade, Supply Chains, and International Cooperation (SDG 12 & 17)

Impact of Trade Tensions on Euro Area Firms

Recent trade tensions, particularly tariffs announced by the United States, pose a significant threat to stable global partnerships and sustainable production, affecting SDG 17 and SDG 12.

- 22% of firms reported a high impact from trade tensions, with the figure rising to 34% among firms exporting to the United States.

- The general economic outlook was cited by a net 17% of firms as the main factor hampering the availability of external financing, reflecting the macroeconomic uncertainty caused by trade disputes.

- Manufacturing firms were disproportionately affected, with 30% experiencing a significant impact.

Strategic Responses and Supply Chain Realignment

In response to these challenges, firms are adapting their strategies. This period of disruption presents an opportunity to build more resilient and sustainable supply chains in line with SDG 12 (Responsible Consumption and Production).

- Market Refocus: 38% of firms are refocusing sales on domestic and EU markets.

- Supply Chain Disruption: Approximately 30% of firms reported current or expected delays and shortages, necessitating a search for alternative suppliers.

- Diversification: 21% of firms are diversifying into non-EU markets to mitigate risks.

These adaptive strategies highlight the need for robust international cooperation (SDG 17) to ensure that global trade supports, rather than undermines, sustainable development.

Economic Outlook and Price Stability

Expectations for Prices, Wages, and Costs

Firms’ expectations for key economic indicators are moderating, which could signal a move towards a more stable economic environment.

- Selling Prices: Expected increases declined to an average of 2.5% over the next 12 months, down from 2.9%.

- Wage Growth: Expectations for wage increases fell to 2.8%, down from 3.0%.

- Non-Labour Input Costs: Expected increases moderated to 3.4%, down from 4.0%.

Inflation Outlook and Perceived Risks

Median inflation expectations have decreased for the short term while remaining stable for longer horizons, providing a degree of predictability for business planning.

- One-Year Horizon: Median inflation expectations decreased to 2.5% from 2.9%.

- Longer Horizons: Expectations remained unchanged at 3.0% for the three- and five-year horizons.

- Perceived Risks: A majority of firms (52%) continue to see upside risks to long-term inflation, although this share has decreased from 55%, suggesting a slight easing of concerns.

Which SDGs are addressed or connected to the issues highlighted in the article?

SDG 8: Decent Work and Economic Growth

- The article’s central theme is the “Access to Finance of Enterprises (SAFE),” which is crucial for business operations, investment, and job creation, thereby driving economic growth.

- It extensively discusses the financial health of enterprises, including their turnover, profits, and cost pressures (labour, materials), which are fundamental components of economic activity.

- There is a specific focus on Small and Medium-sized Enterprises (SMEs), analyzing their access to finance, profitability, and investment behaviour separately from large firms. Supporting SMEs is a key aspect of fostering inclusive economic growth.

- The report measures firms’ employment growth expectations, directly linking financial conditions to job creation prospects.

SDG 9: Industry, Innovation and Infrastructure

- The article details how firms use financing, with “fixed investment” being a primary purpose. This relates to building and upgrading infrastructure and industrial capacity.

- A dedicated section analyzes firms’ “Investment in artificial intelligence technologies (AI),” which is a core element of fostering innovation and technological upgrading.

- It examines the challenges faced by the manufacturing sector due to trade tensions and how firms are restructuring supply chains, which pertains to building resilient and sustainable industrialization.

- The analysis of access to finance for SMEs, particularly in the manufacturing and service sectors, connects directly to promoting inclusive industrial development.

SDG 17: Partnerships for the Goals

- The article includes a detailed analysis of the “Impact of trade tensions and US tariffs on euro area firms.” This directly addresses the stability and fairness of the global trading system.

- It examines how firms are adapting to trade challenges by changing export strategies, such as “refocusing sales within domestic and EU markets” or “diversifying into non-EU markets,” which reflects the dynamics of global trade partnerships.

- The discussion on supply chain disruptions (“delays or shortages in supply chains”) highlights the interconnectedness of the global economy and the importance of stable international trade for economic activity.

What specific targets under those SDGs can be identified based on the article’s content?

-

SDG Target 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation, and encourage the formalization and growth of micro-, small- and medium-sized enterprises, including through access to financial services.

- The entire article is a direct evaluation of this target’s components. It analyzes the “Access to Finance of Enterprises” and specifically differentiates between SMEs and large firms. It reports that “a net 2% of small and medium-sized enterprises (SMEs) reported an increase in interest rates” while large firms saw a decrease, highlighting the specific challenges SMEs face. It also notes that only “5% faced obstacles when seeking to obtain a loan,” providing a measure of access to financial services.

-

SDG Target 9.3: Increase the access of small-scale industrial and other enterprises… to financial services, including affordable credit, and their integration into value chains and markets.

- The article provides detailed data on SMEs’ access to finance. It notes that “the share of firms submitting loan applications rose to 23%,” with SMEs at 18%. It also discusses the “euro area bank loan financing gap indicator” and the “willingness of banks to lend,” which are direct measures of access to affordable credit for enterprises, including small-scale ones. The discussion on supply chain restructuring due to trade tensions relates to their integration into value chains.

-

SDG Target 9.b: Support domestic technology development, research and innovation…

- The article directly addresses this target with a special section on “Investment in artificial intelligence technologies by euro area firms.” It finds that “34% of all firms have invested in AI technologies” and that this investment is linked to firms that have “increased overall investment in the past three months.” This provides insight into how firms are engaging in technological upgrading and innovation.

-

SDG Target 17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system…

- The article highlights challenges to this target by examining the “impact of recent trade tensions, specifically the announcements of tariffs imposed by the United States.” It reports that “22% of firms reported a high impact” from these tensions, illustrating a deviation from an open and rules-based trading environment.

Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Indicators for Access to Finance (Targets 8.3, 9.3)

- Percentage of firms applying for bank loans: The article states, “In the second quarter of 2025, the share of firms submitting loan applications rose to 23%.”

- Percentage of firms facing financing obstacles: The report mentions, “The percentage of firms reporting obstacles to obtaining a bank loan remained low,” at 5%.

- Availability of bank loans: Measured as a net percentage of firms reporting an increase. “The net percentage of firms reporting an increase in the availability of bank loans was 1%.”

- Bank interest rates: Measured as a net percentage of firms reporting changes. “A net 14% of firms reported lower bank interest rates.”

- Share of financially vulnerable firms: The article reports that “Only 3% of firms experienced significant difficulties in managing their businesses and servicing their debts.”

-

Indicators for Innovation and Investment (Targets 8.2, 9.b)

- Percentage of firms investing in new technologies: The article finds that “Investing in artificial intelligence technologies (AI) was reported by 34% of firms.”

- Share of investment in new technologies: The report specifies an “average of 5.6% of overall investment” is directed towards AI.

- Use of financing for fixed investment: The article notes that “Fixed investment was identified as the most common use of financing… with 39% of firms citing” it as a purpose.

-

Indicators for Employment (Target 8.3)

- Employment growth expectations: The article states, “firms continue to expect employment growth to increase by 1.3% over the next year.”

-

Indicators for International Trade (Target 17.10)

- Perceived impact of trade tensions: The survey results show “22% of firms reported a high impact, 31% reported a medium impact and 47% reported a low impact” from trade tensions.

- Firm strategies in response to tariffs: The article quantifies adaptive strategies, such as “refocusing sales within domestic and EU markets (38%)” and “diversifying into non-EU markets (21%).”

SDGs, Targets, and Indicators Analysis

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | 8.3: Encourage the growth of SMEs, including through access to financial services. |

|

| 8.2: Achieve higher levels of economic productivity through technological upgrading and innovation. |

|

|

| SDG 9: Industry, Innovation and Infrastructure | 9.3: Increase the access of small-scale enterprises to financial services and their integration into value chains. |

|

| 9.b: Support domestic technology development, research and innovation. |

|

|

| SDG 17: Partnerships for the Goals | 17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system. |

|

Source: ecb.europa.eu

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0