Biodiversity: Investing in the world’s most important asset

Why is biodiversity important?

Biodiversity is the variety of all living species on Earth. It helps maintain healthy life-supporting ecosystems, including the provision of food and clean water, as well as the invisible functions necessary for life, such as flood protection, nutrient cycling, water filtration, and pollination. It’s fundamental to maintaining high-quality natural capital. A good example is a single English oak tree, which is estimated to support 2,300 different species of insects, fungi, plant life, and birds.

What is “natural capital”?

Natural capital is the world’s stocks of natural assets, including geology, soil, air, water, and all living things. Humans derive a wide range of services from this natural capital, such as food, water, and plant materials used for fuel, building materials, and medicines.

The financial impact of biodiversity

Investors are recognizing biodiversity and nature loss as potential systemic risks to society, business, and the economy. The World Economic Forum has estimated that more than half of the world’s GDP, about $44 trillion, is either moderately or highly dependent on nature and its services.

An example of this dependency is the critical importance of more than 20,000 species of pollinators to global food production. According to Global Change Biology, we are partially dependent on these pollinators for more than 75 percent of global food crop types, and approximately 35 percent of total food production globally. Yet the UN cites that the main driver of biodiversity loss remains our use of land—primarily for food production.

Our relationship with nature can be a delicate balance, and businesses that directly impact or depend upon nature are typically the most exposed to nature-related risks. These risks may create disruption in companies’ activities or value chains, ultimately affecting their risk-return profile as investible assets and challenging their long-term survival.

The agricultural sector is a good example of how being highly dependent—and having an impact—on nature can affect the financial performance of a business.

The next frontier of sustainability

Significant investment in solutions to nature and biodiversity loss is required if nature-related risks are to be constrained. Yet the funding gap is seismic. As highlighted in the UN’s State of Finance for Nature report, $4.1 trillion in financing for nature protection must be bridged by 2050 to limit global warming, stop biodiversity loss, and achieve land degradation neutrality.

More commitment is needed from the private sector. According to the UN, currently only 17 percent—or $26 billion per year—of total global investment in nature-based solutions comes from private industry. But there are signs of progress. Although a recent CDP report found that only 10 percent of financial institutions currently measure their portfolio impact for forests and water, an additional 30 percent plan to do so within the next two years.

Solutions leveraging nature—such as reforestation, regenerative agriculture, and wetland restoration—represent one of the most cost-efficient and effective tools to combat climate change. Equally, products and services that alleviate pressures on land and sea use, reduce demand for natural resources, and lessen pollution are all key to maintaining our supply of natural capital.

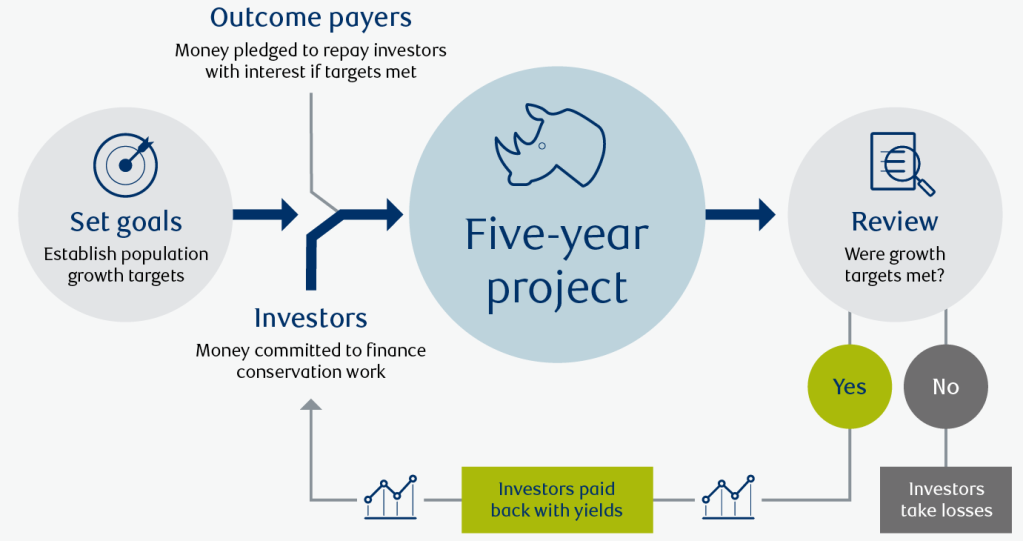

New forms of finance are being developed to support activities focused on protecting nature and biodiversity. A prime example is the World Bank’s “Rhino Bond,” a pioneering financial instrument that channels investments to achieve conservation outcomes, measured in this case by a boost in black rhino populations. Rhinos are considered an umbrella species that play a crucial role in shaping entire ecosystems on which countless other species depend.

Explained: The “Rhino Bond”

Categorizing and quantifying nature-related risks can be challenging, but data and tools are improving. Initiatives such as the Task Force for Nature-Related Financial Disclosures (TNFD) are progressing to provide a framework for companies to identify, assess, manage, and disclose nature- and biodiversity-related risks and opportunities.

“The TNFD enables business and finance to integrate nature and biodiversity into decision-making,” McClanahan says. “It offers a structured framework that allows companies to scan and triage nature-related issues, even with limited data, knowledge, or expertise. Ultimately, this will support a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes.”

McClanahan says assessing the potential impacts of nature loss on expected returns across portfolios will become more important for investors. “By supporting companies with robust biodiversity-management policies and practices, and prioritizing products that promote conservation and sustainable land use, investors can safeguard natural capital, contribute to sustainable development, and mitigate financial risk.”

RBC Wealth Management, a division of RBC Capital Markets, LLC, registered investment adviser and Member NYSE/FINRA/SIPC.

SDGs, Targets, and Indicators

-

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies, and planning

- Indicator: The article mentions that biodiversity is a key component of climate change solutions.

-

SDG 15: Life on Land

- Target 15.1: By 2020, ensure the conservation, restoration, and sustainable use of terrestrial and inland freshwater ecosystems and their services

- Indicator: The article discusses the importance of biodiversity in maintaining healthy ecosystems and the provision of various ecosystem services.

-

SDG 8: Decent Work and Economic Growth

- Target 8.4: Improve progressively, through 2030, global resource efficiency in consumption and production and endeavor to decouple economic growth from environmental degradation

- Indicator: The article mentions that nature-positive projects and transitions could generate economic opportunities and create jobs.

-

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes

- Indicator: The article discusses the need for significant investment in solutions to nature and biodiversity loss.

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 13: Climate Action | Target 13.2: Integrate climate change measures into national policies, strategies, and planning | The article mentions that biodiversity is a key component of climate change solutions. |

| SDG 15: Life on Land | Target 15.1: By 2020, ensure the conservation, restoration, and sustainable use of terrestrial and inland freshwater ecosystems and their services | The article discusses the importance of biodiversity in maintaining healthy ecosystems and the provision of various ecosystem services. |

| SDG 8: Decent Work and Economic Growth | Target 8.4: Improve progressively, through 2030, global resource efficiency in consumption and production and endeavor to decouple economic growth from environmental degradation | The article mentions that nature-positive projects and transitions could generate economic opportunities and create jobs. |

| SDG 9: Industry, Innovation, and Infrastructure | Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes | The article discusses the need for significant investment in solutions to nature and biodiversity loss. |

Copyright: Dive into this article, curated with care by SDG Investors Inc. Our advanced AI technology searches through vast amounts of data to spotlight how we are all moving forward with the Sustainable Development Goals. While we own the rights to this content, we invite you to share it to help spread knowledge and spark action on the SDGs.

Fuente: rbcwealthmanagement.com

Join us, as fellow seekers of change, on a transformative journey at https://sdgtalks.ai/welcome, where you can become a member and actively contribute to shaping a brighter future.