Poorest Countries And Fragile States Are Increasingly Falling Behind – Analysis – Eurasia Review

Report on Economic Challenges and Sustainable Development in Low-Income and Fragile States

Introduction

The global economy has faced significant shocks over the past five years, disproportionately impacting low-income countries and fragile, conflict-affected states. This report emphasizes the importance of aligning recovery efforts with the Sustainable Development Goals (SDGs) to ensure inclusive and sustainable growth.

Economic Recovery and Growth Disparities

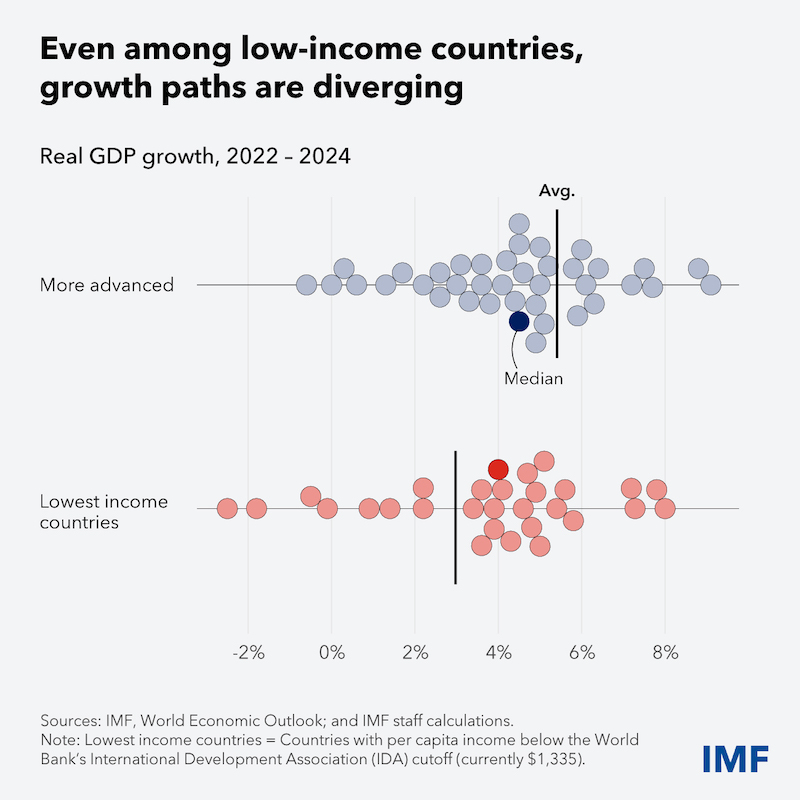

Post-pandemic recovery in low-income countries has lagged behind emerging market economies, which began reviving in 2021. Among the 70 low-income countries eligible for IMF concessional lending (Poverty Reduction and Growth Trust), there is a stark contrast in growth rates:

- 38 more advanced low-income countries, characterized by higher income levels, diversified exports, and access to international capital markets, are projected to grow at an average rate of 5.3% from 2022 to 2024.

- The poorest 32 countries in this group are expected to grow at 3.3%.

- Fragile and conflict-affected states have the lowest projected growth at 2.6%.

This divergence threatens the achievement of SDG 1 (No Poverty) and SDG 10 (Reduced Inequalities), as the poorest and most fragile countries risk falling further behind.

Challenges Affecting Low-Income and Fragile States

- Poverty and Food Insecurity: These remain critical issues, undermining SDG 2 (Zero Hunger) and SDG 3 (Good Health and Well-being).

- Debt Vulnerabilities: Increasing debt burdens threaten fiscal sustainability and progress towards SDG 8 (Decent Work and Economic Growth).

- Decline in Financing Flows: Since the pandemic onset, financing to developing countries, especially low-income ones, has significantly decreased, impeding investments in education, health, and infrastructure, crucial for SDG 4 (Quality Education), SDG 3, and SDG 9 (Industry, Innovation, and Infrastructure).

Strategies for Financial Support and Development

Addressing these challenges requires tailored financial strategies aligned with the SDGs:

- For Wealthier Developing Countries: Focus on attracting foreign investment and international private finance, supported by bilateral and multilateral partners, to foster sustainable economic growth (SDG 8).

- For Poorest and Fragile Countries: Provide adequate financial support through grants and highly concessional loans, alongside technical assistance to build institutional capacity, supporting SDG 16 (Peace, Justice, and Strong Institutions).

- Debt Restructuring: Improve restructuring processes to enable efficient and timely debt relief, ensuring fiscal sustainability and progress towards SDG 17 (Partnerships for the Goals).

Building Institutional Capacity

Enhancing Public Financial Management and Tax Capacity

Strengthening public financial management, spending efficiency, and tax capacity is essential for sustainable development. Research by the IMF indicates that a 7 percentage-point increase in the tax-to-GDP ratio is achievable for low-income countries through tax reform and institutional capacity building, which supports SDG 16 and SDG 17.

IMF’s Role in Capacity Development

- Between 2022 and 2024, over 40% of the IMF’s capacity development efforts targeted low-income countries.

- The IMF provides economic surveillance, concessional lending, policy advice, and balance of payments support to help countries achieve economic and financial stability, a prerequisite for attaining the SDGs.

International Community Support

The international community can accelerate progress by:

- Increasing technical and financial assistance, including grants and concessional loans.

- Facilitating timely debt restructuring where necessary.

- Developing risk-sharing instruments to attract private investment sustainably, ensuring private debt aligns with long-term development goals.

Conclusion

To achieve the Sustainable Development Goals, particularly SDG 1, SDG 2, SDG 3, SDG 8, SDG 10, SDG 16, and SDG 17, concerted efforts are required to support low-income and fragile countries. This includes reversing declines in financing flows, strengthening institutional capacities, and ensuring sustainable debt management.

About the Authors

- Guillaume Chabert: Graduate of Ecole Centrale de Paris, Paris Institute of Political Studies, and French Senior Civil Service School (ENA). Formerly worked at the French Ministry of the Interior.

- Robert Powell: IMF’s Special Representative to the United Nations with extensive experience in policy development, aid effectiveness, debt relief, and capacity building.

Source: IMF Blog

1. Sustainable Development Goals (SDGs) Addressed or Connected

- SDG 1: No Poverty

- The article discusses poverty disproportionately affecting the poorest and fragile countries.

- SDG 2: Zero Hunger

- Food insecurity is highlighted as a critical issue in low-income and fragile states.

- SDG 3: Good Health and Well-being

- Financing critical spending such as health is mentioned as a priority.

- SDG 4: Quality Education

- Education financing needs are emphasized for developing countries.

- SDG 8: Decent Work and Economic Growth

- Economic growth disparities and recovery post-pandemic are discussed.

- Building institutional capacity and tax revenue improvements relate to economic growth.

- SDG 9: Industry, Innovation and Infrastructure

- Infrastructure financing is identified as a critical spending need.

- SDG 10: Reduced Inequalities

- The widening gap between more advanced low-income countries and fragile states implies inequality issues.

- SDG 16: Peace, Justice and Strong Institutions

- Building institutional capacity and strengthening public financial management are key themes.

- Debt restructuring and governance improvements are discussed.

- SDG 17: Partnerships for the Goals

- International financial support, concessional lending, and technical assistance highlight partnerships.

- Mobilizing financing and risk-sharing instruments involve global cooperation.

2. Specific Targets Under Those SDGs Identified

- SDG 1: No Poverty

- Target 1.2: Reduce at least by half the proportion of people living in poverty in all its dimensions.

- SDG 2: Zero Hunger

- Target 2.1: End hunger and ensure access to safe, nutritious and sufficient food all year round.

- SDG 3: Good Health and Well-being

- Target 3.8: Achieve universal health coverage, including financial risk protection.

- SDG 4: Quality Education

- Target 4.a: Build and upgrade education facilities that are child, disability and gender sensitive.

- SDG 8: Decent Work and Economic Growth

- Target 8.1: Sustain per capita economic growth in accordance with national circumstances.

- Target 8.3: Promote development-oriented policies that support productive activities and decent job creation.

- SDG 9: Industry, Innovation and Infrastructure

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure.

- SDG 10: Reduced Inequalities

- Target 10.1: Achieve and sustain income growth of the bottom 40% of the population at a rate higher than the national average.

- SDG 16: Peace, Justice and Strong Institutions

- Target 16.6: Develop effective, accountable and transparent institutions at all levels.

- Target 16.9: Provide legal identity for all, including birth registration.

- Target 16.7: Ensure responsive, inclusive, participatory and representative decision-making.

- SDG 17: Partnerships for the Goals

- Target 17.3: Mobilize additional financial resources for developing countries from multiple sources.

- Target 17.9: Enhance international support for implementing effective and targeted capacity-building.

- Target 17.17: Encourage and promote effective public, public-private and civil society partnerships.

3. Indicators Mentioned or Implied to Measure Progress

- Economic Growth Rate

- Growth percentages of low-income countries and fragile states (e.g., 5.3%, 3.3%, 2.6%) are used to measure economic recovery progress.

- Tax Revenue to GDP Ratio

- Indicator of institutional capacity and public financial management effectiveness; a 7 percentage-point increase is noted as feasible.

- Financing Flows to Developing Countries

- Volume and affordability of financing, including concessional loans and grants, are implied indicators of financial support.

- Debt Sustainability and Restructuring Efficiency

- Indicators related to debt vulnerabilities and timely restructuring processes are implied to assess financial stability.

- Capacity Development Delivery

- Percentage of IMF capacity development allocated to low-income countries (over 40%) is an indicator of institutional support.

- Food Security and Poverty Levels

- Though not quantified, food insecurity and poverty rates are implied indicators relevant to SDG 1 and 2 progress.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 1: No Poverty | Target 1.2: Reduce poverty by half in all its dimensions | Poverty rates; economic growth rates in low-income and fragile countries |

| SDG 2: Zero Hunger | Target 2.1: End hunger and ensure access to safe, nutritious food | Food insecurity levels (implied) |

| SDG 3: Good Health and Well-being | Target 3.8: Achieve universal health coverage | Health financing flows (implied) |

| SDG 4: Quality Education | Target 4.a: Build and upgrade education facilities | Education financing flows (implied) |

| SDG 8: Decent Work and Economic Growth |

|

GDP growth rates; tax revenue to GDP ratio |

| SDG 9: Industry, Innovation and Infrastructure | Target 9.1: Develop sustainable infrastructure | Infrastructure financing flows (implied) |

| SDG 10: Reduced Inequalities | Target 10.1: Increase income growth of bottom 40% | Income per capita convergence rates (implied) |

| SDG 16: Peace, Justice and Strong Institutions |

|

Tax capacity; public financial management efficiency; debt restructuring timeliness |

| SDG 17: Partnerships for the Goals |

|

Volume of concessional loans and grants; IMF capacity development allocation; private investment participation |

Source: eurasiareview.com