Dogwifhat Price Forecast: WIF looks to extend gains amid increasing Social Dominance score – FXStreet

Dogwifhat Market Analysis with Emphasis on Sustainable Development Goals (SDGs)

1. Overview of Dogwifhat Performance

- Dogwifhat maintains position above 50-day and 100-day EMAs following a 4.82% increase.

- Social Dominance score reaches highest level since mid-May, reflecting increased public engagement.

- Derivatives data indicates heightened buying activity with rising Open Interest and positive funding rates.

Dogwifhat (WIF) is currently trading at $0.85, slightly lower after reclaiming dynamic support levels. Social dominance and derivatives data suggest a bullish trend, while technical analysis points to a potential broadening wedge pattern nearing completion.

Social Sentiment and Sustainable Development Goals

Increasing Social Engagement and Positive Sentiment

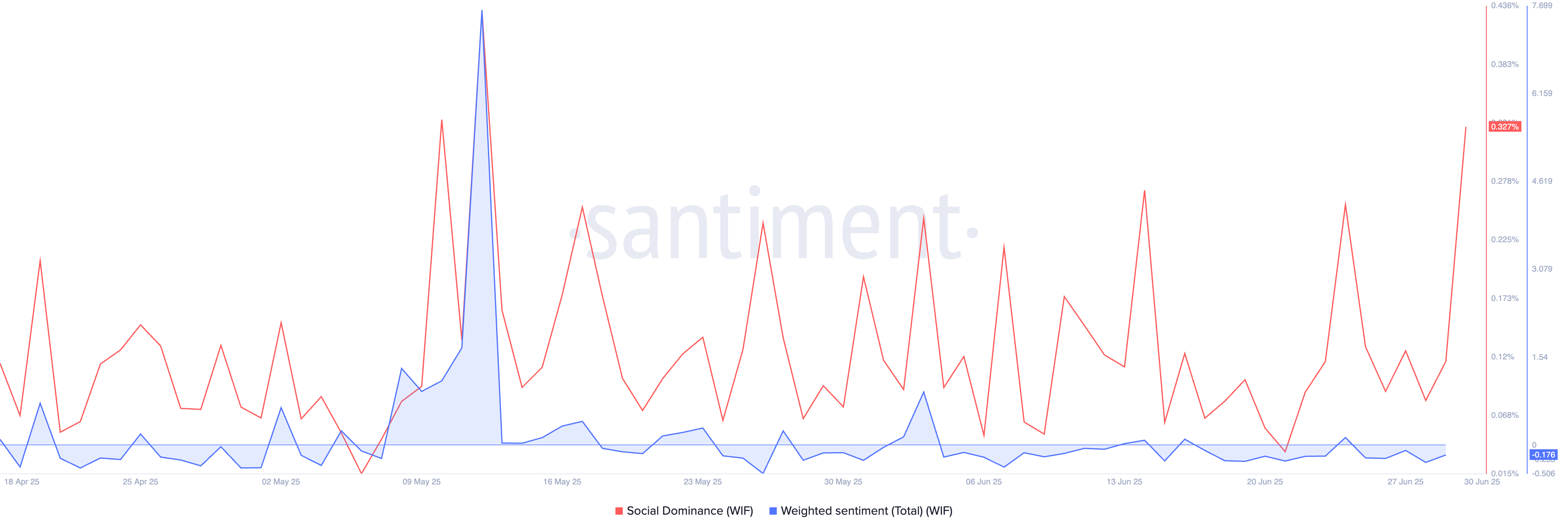

- Santiment’s social dominance score for Dogwifhat reached 0.327%, the highest since mid-May, indicating amplified social discourse.

- Weighted sentiment improved from -0.305 to -0.176, signaling a reduction in bearish sentiment.

- A potential shift to positive sentiment would reflect growing investor confidence.

This growing social engagement aligns with SDG 9 (Industry, Innovation, and Infrastructure) by fostering innovation and inclusive technology discussions within the community.

WIF social dominance. Source: Santiment

Derivatives Market Activity and Optimism

Open Interest and Funding Rate Trends

- Open Interest (OI) surged by 7.41% to $379.54 million, indicating increased buying activity.

- OI-weighted funding rate turned positive at 0.0052%, showing a shift from selling to buying dominance.

- Positive funding rates help balance spot and swap prices, reflecting market stability.

These market dynamics contribute to SDG 8 (Decent Work and Economic Growth) by promoting sustainable economic activities and market resilience.

Dogwifhat derivatives data. Source: Coinglass

Technical Analysis and Future Outlook

Broadening Wedge Pattern and Price Targets

- Dogwifhat currently trades 1% lower but remains above critical support levels at the 50-day ($0.83) and 100-day ($0.84) EMAs.

- Potential resistance trendline formed by peaks on May 12, May 29, and June 10 suggests a descending broadening wedge pattern.

- Successful breakout above $0.92 could lead to testing the 200-day EMA at $1.08, indicating bullish momentum.

- Relative Strength Index (RSI) at 52 shows increased buying pressure after recovering from oversold conditions.

This technical resilience supports SDG 12 (Responsible Consumption and Production) by encouraging informed and sustainable investment decisions.

WIF/USDT daily price chart.

Risk Considerations

- Failure to maintain support above the 50-day EMA ($0.83) may lead to testing the June 22 low at $0.63.

- Investors should monitor technical levels closely to manage risk effectively.

1. Sustainable Development Goals (SDGs) Addressed or Connected

- SDG 8: Decent Work and Economic Growth

- The article discusses market activity, trading, and investment optimism related to Dogwifhat (WIF), which connects to promoting sustained economic growth and productive employment.

- SDG 9: Industry, Innovation, and Infrastructure

- The focus on derivatives data, technical analysis, and market indicators reflects innovation in financial markets and infrastructure supporting digital assets.

- SDG 12: Responsible Consumption and Production

- Implied through the monitoring of market sentiment and trading behavior, which can influence sustainable investment and consumption patterns.

2. Specific Targets Under Identified SDGs

- SDG 8 Targets

- Target 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity, and innovation.

- Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance, and financial services for all.

- SDG 9 Targets

- Target 9.5: Enhance scientific research, upgrade technological capabilities of industrial sectors, including financial technologies.

- Target 9.b: Support domestic technology development, research, and innovation in financial markets.

- SDG 12 Targets

- Target 12.6: Encourage companies to adopt sustainable practices and integrate sustainability information into their reporting cycle.

3. Indicators Mentioned or Implied to Measure Progress

- Market and Trading Indicators

- Social Dominance Score: Measures the percentage share of media discussions about Dogwifhat, indicating social engagement and market sentiment.

- Weighted Sentiment Total: Reflects bullish or bearish sentiment trends among traders.

- Open Interest (OI): Indicates the total value of outstanding derivative contracts, showing market activity and investor confidence.

- OI-weighted Funding Rate: Measures the balance between buying and selling dominance in the derivatives market.

- Exponential Moving Averages (50-day, 100-day, 200-day EMAs): Technical indicators used to assess price trends and support/resistance levels.

- Relative Strength Index (RSI): Technical momentum indicator showing buying pressure and potential price reversals.

- Implied Indicators for SDG Progress

- Levels of market participation and innovation adoption as proxies for economic growth and financial inclusion.

- Transparency and availability of market data supporting responsible investment decisions.

4. Table: SDGs, Targets and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth |

|

|

| SDG 9: Industry, Innovation, and Infrastructure |

|

|

| SDG 12: Responsible Consumption and Production |

|

|

Source: fxstreet.com