GEA Group’s Strategic Reinvention: Industrial Tech and Sustainable Growth Power Refined 2025 Guidance – AInvest

Report on GEA Group’s Strategic Realignment and Sustainable Growth Trajectory

GEA Group Aktiengesellschaft (GEA) has revised its 2025 financial guidance, reflecting a strategic realignment toward high-margin industrial technology and sustainable value chains. This report analyzes the company’s operational performance, its strategic positioning in relation to the United Nations Sustainable Development Goals (SDGs), its financial outlook, and associated risks.

Strategic Alignment with Sustainable Development Goals (SDGs)

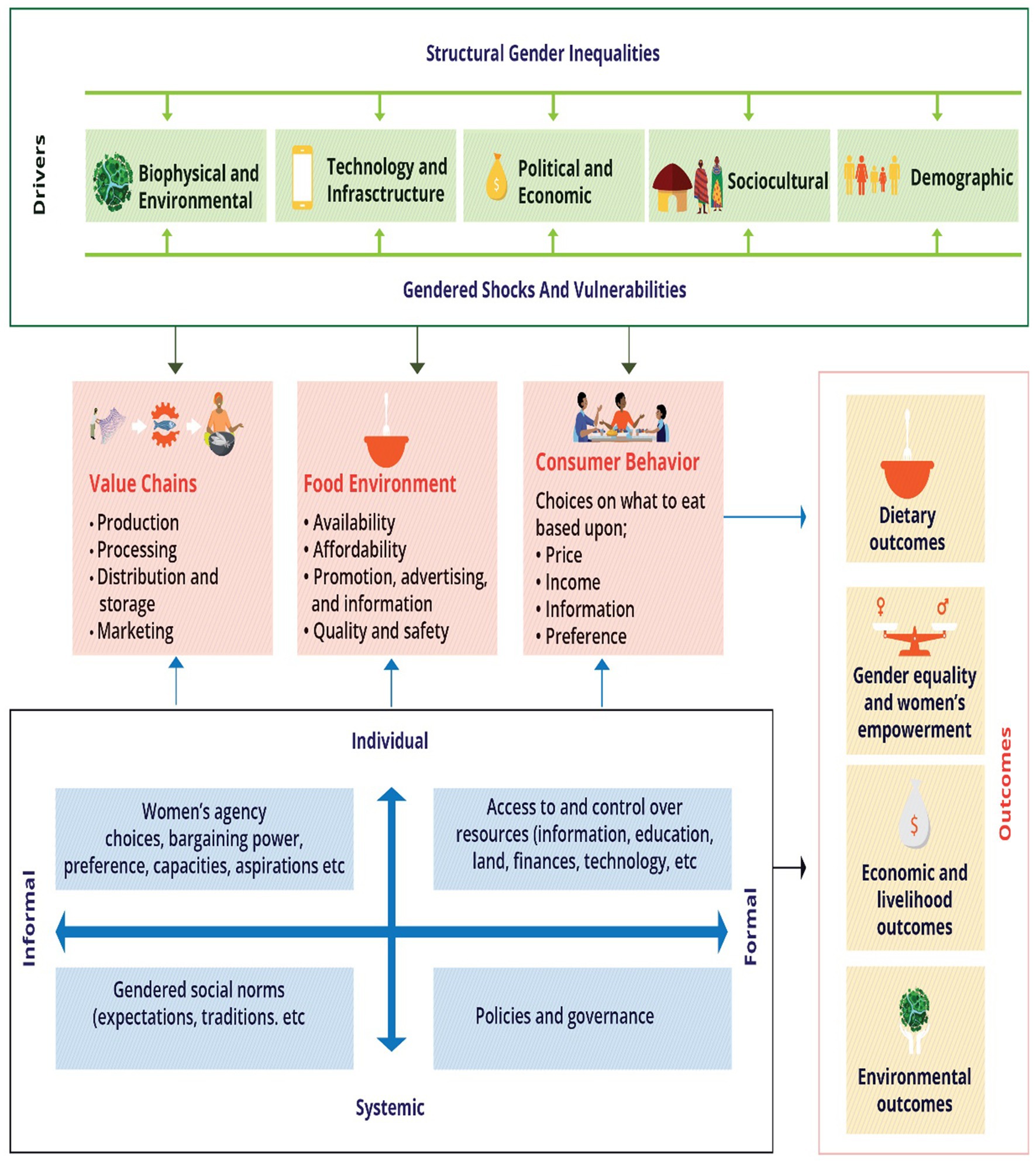

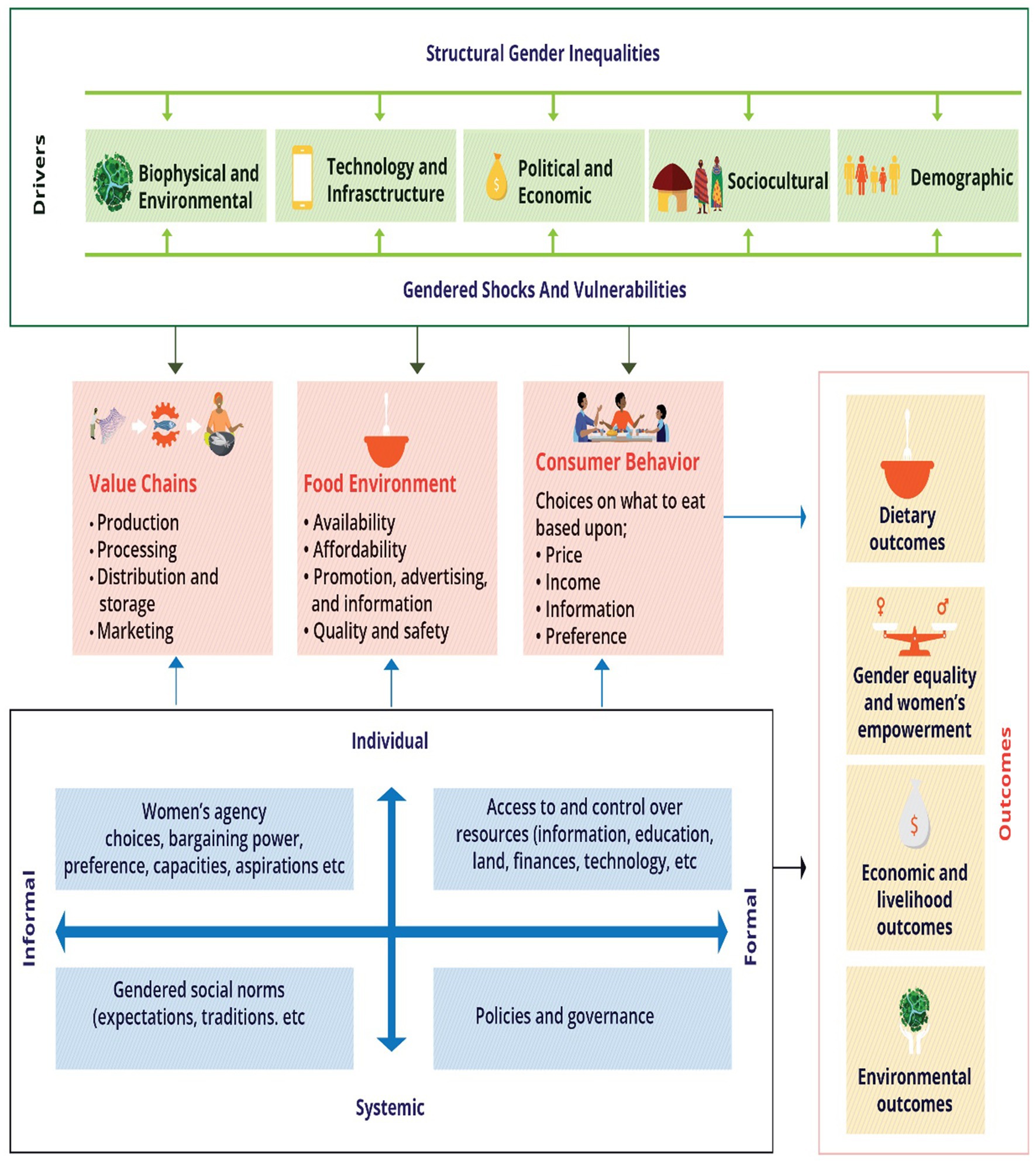

GEA’s corporate strategy is increasingly integrated with global sustainability mandates, driving both financial performance and positive environmental impact. The company’s focus on decarbonization and digitalization directly contributes to several key SDGs.

SDG 9: Industry, Innovation, and Infrastructure

GEA is advancing industrial infrastructure through technological innovation, a core tenet of SDG 9. The company’s adoption of advanced digital solutions has yielded significant operational efficiencies and created new value streams.

- Digital Transformation: The implementation of digital twins and AI-driven predictive maintenance has reduced manufacturing unit downtime by 18%.

- End-to-End Solutions: Digital offerings, from smart dairy processing to hydrogen electrolysis systems, now constitute 30% of GEA’s order intake.

- Modular Design: Standardization of components for large-scale projects accelerates the deployment of critical infrastructure, such as clean energy facilities, by shortening delivery timelines and reducing costs.

SDG 7: Affordable and Clean Energy

The company is a key enabler of the global energy transition, contributing directly to SDG 7 by developing and scaling clean energy technologies.

- Hydrogen Electrolysis: As a cornerstone technology for decarbonizing heavy industry, GEA’s hydrogen electrolysis segment has recorded a 40% year-on-year increase in order intake.

- Scalable Projects: A recent order for hydrogen electrolysis equipment, valued between €140–€170 million, demonstrates the company’s capacity to deliver large-scale clean energy projects. These projects are projected to contribute significantly to 2026 growth.

- Market Leadership: Through collaborations with green hydrogen consortia, GEA is positioning itself as a leader in a market projected to reach €100 billion by 2030.

SDG 12: Responsible Consumption and Production

GEA’s commitment to SDG 12 is evident in its sustainable food processing division, which promotes circular economy models and resource efficiency.

- Sustainable Processing: The division, featuring energy-efficient dairy and beverage systems, grew 6.5% in H1 2025, driven by client demand for reduced water and energy consumption.

- Zero-Waste Technology: Proprietary zero-waste processing technologies have secured contracts with major food corporations, establishing a recurring revenue model through ongoing maintenance and optimization services.

Financial Performance and Outlook

The strategic pivot is supported by strong financial discipline and a robust performance outlook, as reflected in the company’s revised guidance and key performance indicators.

Revised 2025 Guidance and Key Metrics

GEA has updated its medium-term financial targets based on strong H1 2025 performance.

- Revised 2025 Guidance:

- Organic Sales Growth: 2–4%

- EBITDA Margin before Restructuring: 16.2–16.4%

- H1 2025 Performance Highlights:

- Organic Sales Growth: 1.2%

- EBITDA Margin: 16.1%

- Return on Capital Employed (ROCE): 35.3%

- Long-Term ROCE Target: The company’s “Mission 30” aims for a ROCE of 30% by 2030. The current ROCE of 35.3% exceeds the updated 2025 target range of 34–38%.

Order Backlog and Revenue Resilience

A strong order backlog provides clear visibility for future revenue and enhances the company’s resilience to market cyclicality.

- Order Backlog: The H1 2025 order backlog stands at €2.72 billion, a 4.2% year-on-year increase.

- Recurring Revenue: 60% of the backlog is associated with long-term service contracts, which provide stable cash flows and mitigate exposure to fluctuations in capital spending.

Risk Assessment and Mitigation Strategies

While the outlook is positive, certain risks persist. The primary risk involves a potential slowdown in global industrial capital spending due to macroeconomic pressures. GEA employs several strategies to mitigate this risk:

- Customer Diversification: The company’s revenue is split between food processing (70%) and energy (30%), reducing dependence on a single sector.

- Service-Based Income: Recurring service revenue accounts for 25% of total income, providing a buffer against project delays.

- Investment in Innovation: A commitment to R&D, representing 4.5% of revenue, ensures technological leadership and competitive differentiation.

Conclusion: An Industrial Model Aligned with Global Sustainability Mandates

GEA Group’s strategic reorientation has successfully transformed the company into an innovation leader whose financial objectives are intrinsically linked to sustainable development. By aligning its core business with SDG 7, SDG 9, and SDG 12, GEA has built a resilient model that capitalizes on the global megatrends of digitalization and decarbonization. The revised 2025 guidance, strong ROCE performance, and growing order backlog indicate that this strategy is delivering tangible financial results, positioning the company for sustained long-term growth.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 7: Affordable and Clean Energy

- The article extensively discusses GEA’s role in the clean energy sector, particularly its focus on “hydrogen electrolysis” as a cornerstone for “decarbonizing heavy industries.” This directly supports the transition to sustainable energy sources.

-

SDG 9: Industry, Innovation, and Infrastructure

- The core theme of the article is GEA’s “strategic reinvention” through “industrial tech innovation.” It highlights the adoption of advanced technologies like “digital twins” and “AI-driven predictive maintenance,” the development of “modular design” for clean energy infrastructure, and significant investment in R&D, all of which are central to this goal.

-

SDG 12: Responsible Consumption and Production

- The article points to GEA’s commitment to “sustainable value chains” and “circular economy models.” Its development of “sustainable food processing” systems, “zero-waste processing technologies,” and solutions that “reduce water and energy consumption” directly addresses the need for more sustainable production patterns.

-

SDG 13: Climate Action

- The emphasis on “decarbonization” as a transformative megatrend and GEA’s role in providing technologies like hydrogen electrolysis to achieve it is a direct contribution to mitigating climate change.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Under SDG 7 (Affordable and Clean Energy):

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. GEA’s work in scaling up “hydrogen electrolysis” equipment contributes directly to increasing the capacity for green hydrogen, a key component of the future renewable energy mix.

- Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology. The article mentions GEA’s “collaboration with a European green hydrogen consortium to build modular electrolyzer plants,” which exemplifies facilitating access to and scaling up clean energy technology.

-

Under SDG 9 (Industry, Innovation, and Infrastructure):

- Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies. GEA’s provision of “end-to-end digital solutions,” “smart dairy processing plants,” and “hydrogen electrolysis systems” helps its clients retrofit their industries to be more efficient and sustainable.

- Target 9.5: Enhance scientific research, upgrade the technological capabilities of industrial sectors. GEA’s strategic reinvestment into “R&D—now 4.5% of revenue” and its adoption of “digital twins” and “AI” are direct actions to upgrade its own and its clients’ technological capabilities.

-

Under SDG 12 (Responsible Consumption and Production):

- Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources. GEA’s proprietary technologies that help clients “reduce water and energy consumption” are a direct contribution to this target.

- Target 12.5: By 2030, substantially reduce waste generation through prevention, reduction, recycling and reuse. The development and implementation of “zero-waste processing technologies” align perfectly with this target.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Indicators for SDG 7 & 13:

- The “order intake surge by 40% year-on-year” for hydrogen electrolysis equipment serves as a direct indicator of the adoption rate of clean energy technology.

- The “€140–170 million order for hydrogen electrolysis equipment” quantifies the financial investment and scale of clean energy infrastructure projects.

-

Indicators for SDG 9:

- The “18% reduction in downtime” in manufacturing units is a specific metric showing increased efficiency from technological innovation.

- The fact that “R&D is now 4.5% of revenue” is a clear indicator of investment in research and innovation (related to official indicator 9.5.1).

- “Digital solutions” accounting for “30% of its order intake” measures the market adoption of advanced industrial technologies.

-

Indicators for SDG 12:

- The “6.5% growth in H1 2025” of the “sustainable food processing division” indicates progress in promoting sustainable production.

- The mention of attracting “contracts from major food corporations” for “zero-waste processing technologies” implies a measurable reduction in waste generation at client facilities.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.2: Increase the share of renewable energy. 7.a: Facilitate access to clean energy technology. |

|

| SDG 9: Industry, Innovation, and Infrastructure | 9.4: Upgrade infrastructure and retrofit industries to be sustainable. 9.5: Enhance research and upgrade technological capabilities. |

|

| SDG 12: Responsible Consumption and Production | 12.2: Achieve sustainable management and efficient use of natural resources. 12.5: Substantially reduce waste generation. |

|

| SDG 13: Climate Action | Contributes to the overall goal of taking urgent action to combat climate change and its impacts. |

|

Source: ainvest.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0