HA Sustainable Infrastructure Capital (NYSE:HASI) Rating Increased to Hold at Wall Street Zen – MarketBeat

Company Profile and Alignment with Sustainable Development Goals (SDGs)

HA Sustainable Infrastructure Capital, Inc. (NYSE: HASI) is an investment firm that finances projects with a direct and positive impact on global sustainability challenges. The company’s investment portfolio is strategically aligned with several key United Nations Sustainable Development Goals (SDGs), positioning it as a critical enabler of the transition to a low-carbon economy.

Commitment to Sustainable Development Goals

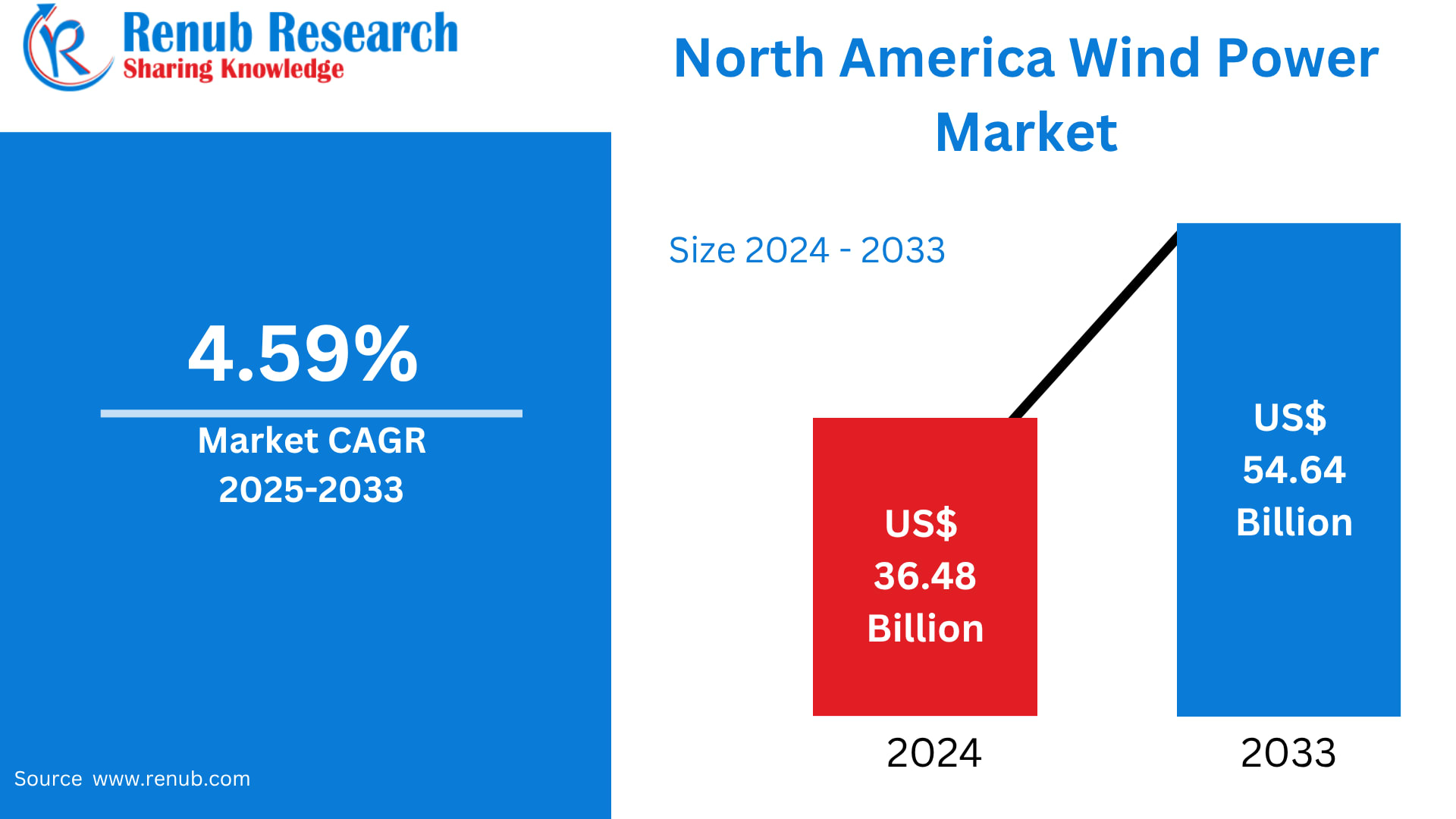

- SDG 7 (Affordable and Clean Energy): HASI’s core mission involves financing renewable energy projects, including solar and wind, which directly contributes to increasing the share of renewable energy in the global energy mix.

- SDG 9 (Industry, Innovation and Infrastructure): The company’s focus on “sustainable infrastructure” supports the development of resilient, reliable, and sustainable infrastructure, which is a primary target of this goal.

- SDG 11 (Sustainable Cities and Communities): By investing in energy efficiency upgrades for commercial and government buildings, HASI helps reduce the environmental impact of cities and enhances their sustainability.

- SDG 13 (Climate Action): Through its comprehensive investment strategy in climate solutions, HASI actively contributes to climate change mitigation by deploying capital into projects that reduce greenhouse gas emissions.

Analyst Ratings and Market Sentiment

Recent evaluations from financial analysts reflect a generally positive but moderated outlook on HA Sustainable Infrastructure Capital’s stock performance.

Recent Rating Changes

- Wall Street Zen: Upgraded the company’s rating from “Sell” to “Hold”.

- Robert W. Baird: Maintained an “Outperform” rating but decreased the price objective from $47.00 to $41.00.

Consensus Rating

According to data compiled by MarketBeat, the consensus among investment analysts is a “Moderate Buy.” The distribution of ratings is as follows:

- Strong Buy: 1 analyst

- Buy: 8 analysts

- Hold: 2 analysts

The consensus average price target for the stock is $37.78.

Financial Performance and Key Metrics

An overview of HA Sustainable Infrastructure Capital’s financial standing and market performance indicators.

- Market Capitalization: $3.13 billion

- Price-to-Earnings (P/E) Ratio: 16.61

- PEG Ratio: 0.91

- Beta: 1.62

- 52-Week Range: $21.98 – $36.56

- 50-Day Moving Average: $26.55

- 200-Day Moving Average: $26.93

- Debt-to-Equity Ratio: 1.91

- Current Ratio: 11.04

- Quick Ratio: 11.04

Institutional Investment Analysis

Institutional investors and hedge funds hold a significant portion of the company’s stock, at 96.14%.

Notable Institutional Movements (Q1)

- GAMMA Investing LLC: Increased its holdings by 31.5%, acquiring an additional 1,400 shares.

- Principal Financial Group Inc.: Lifted its stake by 3.1%, adding 17,880 shares to its position.

- GSA Capital Partners LLP: Initiated a new position valued at approximately $880,000.

- Aurora Private Wealth Inc.: Acquired a new stake valued at approximately $675,000.

- Apollon Wealth Management LLC: Established a new position valued at approximately $624,000.

SDGs Addressed in the Article

Analysis of Relevant Sustainable Development Goals

-

SDG 7: Affordable and Clean Energy

This goal is directly addressed as the article states that HA Sustainable Infrastructure Capital, Inc. “engages in the investment of energy efficiency, renewable energy, and sustainable infrastructure markets.” Investments in renewable energy and energy efficiency are central pillars of SDG 7.

-

SDG 9: Industry, Innovation and Infrastructure

The company’s focus on investing in “sustainable infrastructure markets” directly connects to SDG 9, which aims to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation.

-

SDG 11: Sustainable Cities and Communities

While not explicitly mentioned, the development of “sustainable infrastructure” and “energy efficiency” projects are fundamental components for making cities and human settlements inclusive, safe, resilient, and sustainable.

-

SDG 13: Climate Action

The company’s investment activities in “renewable energy” and “energy efficiency” are primary strategies for mitigating climate change, thus directly contributing to the objectives of SDG 13.

Specific SDG Targets Identified

Analysis of Relevant SDG Targets

-

Target 7.2: Increase the share of renewable energy

The article mentions the company’s investment in “renewable energy,” which directly supports the goal of increasing the proportion of renewable energy in the energy mix.

-

Target 7.3: Double the rate of improvement in energy efficiency

The company’s investment in “energy efficiency” aligns with this target, as capital is required to develop and implement technologies and projects that improve energy efficiency.

-

Target 9.1: Develop sustainable and resilient infrastructure

The article explicitly states that the company invests in “sustainable infrastructure markets,” which is the core objective of this target.

-

Target 9.4: Upgrade infrastructure for sustainability

By investing in energy efficiency and sustainable infrastructure, the company facilitates the upgrading of existing infrastructure to make it more sustainable and environmentally sound.

Indicators for Measuring Progress

Analysis of Implied Indicators

The article does not mention official SDG indicators. However, it provides several financial metrics that can be interpreted as proxy indicators for the mobilization of private capital towards sustainable development, which is a key aspect of financing the SDGs.

-

Financial Investment as a Proxy Indicator

The article provides specific financial figures that quantify the scale of investment in a company dedicated to sustainable projects. These can be seen as indicators of progress towards mobilizing finance for the identified targets.

- Market Capitalization: The article states the company has a “market capitalization of $3.13 billion,” indicating a significant amount of capital is allocated to this sustainable investment vehicle.

- Institutional Investments: Specific investments by hedge funds and institutional investors are mentioned, such as GAMMA Investing LLC’s stake valued at “$171,000” and Principal Financial Group Inc.’s stake valued at “$17,318,000.” These figures represent direct financial flows into the sustainable infrastructure sector.

- Company Financial Health Ratios: Metrics like the “debt-to-equity ratio of 1.91” and “price-to-earnings ratio of 16.61” are indicators of the financial viability and attractiveness of sustainable investments to the broader market, implying a capacity to attract further capital.

Summary of Findings

| SDGs | Targets | Indicators (Implied from the article) |

|---|---|---|

| SDG 7: Affordable and Clean Energy |

|

|

| SDG 9: Industry, Innovation and Infrastructure |

|

|

| SDG 13: Climate Action |

|

|

Source: marketbeat.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.jpg?format=1500w#)