State Earned Income Tax Credits Support Families and Workers in 2025 – itep.org

Report on the Earned Income Tax Credit and its Alignment with Sustainable Development Goals

Executive Summary

The Earned Income Tax Credit (EITC) is a critical policy instrument for advancing multiple Sustainable Development Goals (SDGs), particularly SDG 1 (No Poverty), SDG 8 (Decent Work and Economic Growth), and SDG 10 (Reduced Inequalities). Currently, 31 states, the District of Columbia, and Puerto Rico have implemented state-level EITCs, which build upon the federal program. In 2024, the federal EITC, in conjunction with the Child Tax Credit, lifted an estimated 6.8 million people out of poverty, demonstrating its direct impact on SDG 1. State-level credits amplify this effect, providing essential economic security to low-income working families. To maximize alignment with the SDGs, this report recommends that state EITCs be fully refundable, feature a robust matching percentage, and expand eligibility to younger and older workers. Recent legislative momentum, with 17 states and the District of Columbia expanding their credits since the expiration of federal enhancements, indicates a growing recognition of the EITC’s role in fostering equitable and sustainable economic outcomes.

Introduction: The EITC as a Tool for Sustainable Development

The Earned Income Tax Credit (EITC) is a foundational income support mechanism that directly contributes to the achievement of the United Nations Sustainable Development Goals. By boosting the incomes of low-paid workers, the EITC serves as a powerful tool for poverty alleviation, aligning with SDG 1 (No Poverty). Its proven benefits extend to improving health and educational outcomes, thereby supporting SDG 3 (Good Health and Well-being) and SDG 4 (Quality Education). Research indicates that children in families receiving the credit demonstrate higher rates of high school graduation and college attendance. Furthermore, the EITC promotes economic justice by offsetting regressive state and local tax systems and mitigating systemic inequities, which is central to SDG 10 (Reduced Inequalities). It is particularly impactful for communities of color who are disproportionately represented in low-wage sectors due to historical and ongoing discrimination.

The Role of Federal and State EITCs in Advancing SDGs

Federal EITC Impact on Poverty and Economic Stability

The federal EITC has been a cornerstone of U.S. anti-poverty strategy for five decades. In 2024, it delivered approximately $64 billion to 23 million working families, providing a crucial economic lifeline. This direct financial support is a primary driver for achieving SDG 1 (No Poverty), having lifted an estimated 6.8 million people above the poverty line in 2024. The temporary expansion of the EITC under the American Rescue Plan Act in 2021 demonstrated an even greater potential, lifting 9.6 million people out of poverty that year. By supplementing low wages, the EITC makes work more economically viable, contributing to SDG 8 (Decent Work and Economic Growth) by enhancing the financial stability of the workforce.

State-Level EITCs and the Reduction of Inequalities

State EITCs are instrumental in addressing the regressive nature of many state and local tax systems, where low-income households often pay a higher percentage of their income in taxes than the wealthiest households. By providing targeted tax relief, these credits directly advance SDG 10 (Reduced Inequalities).

- Counteracting Regressive Taxes: A refundable state EITC is one of the most effective strategies to counterbalance the disproportionate impact of sales and property taxes on low-income families.

- Ensuring Full Benefit through Refundability: Refundable credits ensure that families receive the full value of the credit, even if it exceeds their income tax liability. This feature is essential for the credit to function as a meaningful income boost and poverty reduction tool, rather than merely a tax offset. Nonrefundable credits, offered by states like Missouri and Ohio, limit the policy’s capacity to achieve SDG 1 and SDG 10.

Analysis of State EITC Implementation and Recent Progress

Current Landscape of State EITCs

Nearly two-thirds of states have adopted their own EITCs, though the generosity and structure vary significantly. Most states calculate their credit as a percentage of the federal credit, creating administrative simplicity. However, the match rates range from over 85% in the District of Columbia to less than 10% in states such as Delaware and Louisiana. This disparity in implementation directly affects the degree to which states can leverage the EITC to meet their sustainable development targets.

Recent Legislative Enhancements

Following the expiration of federal EITC expansions in 2022, a significant number of states have taken action to strengthen their own credits. Since 2021, 17 states and the District of Columbia have enacted or expanded their EITCs, signaling a commitment to supporting low-wage workers and advancing goals related to economic equity.

In 2025, notable expansions included:

- Connecticut: Implemented a $250 boost for households with dependents receiving the EITC.

- Montana: Doubled its refundable EITC from 10% to 20%.

- Virginia: Transitioned to a fully refundable 20% credit for all eligible households.

- Vermont: Increased its credit match from 38% to 100% for workers without dependent children.

Recommendations for Maximizing EITC Efficacy in Alignment with SDGs

Key Policy Enhancements

To maximize the impact of state EITCs on the Sustainable Development Goals, policymakers should adopt the following best practices:

- Ensure Full Refundability: This is the most critical feature for ensuring the credit effectively reduces poverty (SDG 1) and counteracts regressive taxation (SDG 10).

- Implement a Robust Matching Percentage: A higher match rate directly translates to greater income support and poverty reduction.

- Enhance Support for Extremely Low-Income Families: Structuring the credit to provide maximum benefit to those with the lowest earnings, as Washington state has done, strengthens its anti-poverty impact.

- Consider Monthly Payments: Distributing the credit in monthly installments rather than an annual lump sum can help families manage expenses and maintain financial stability throughout the year, contributing to economic resilience under SDG 8.

Expanding Eligibility to Promote Inclusivity

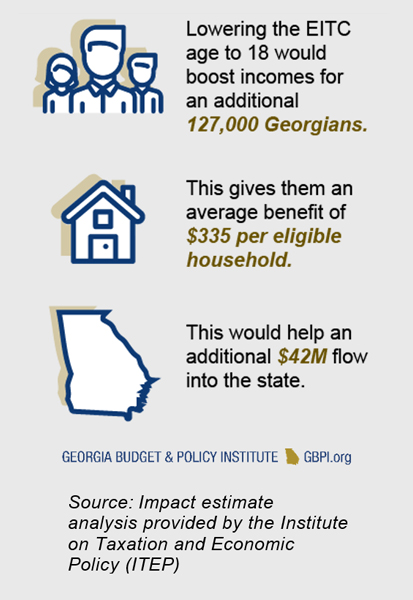

A significant limitation of the federal EITC is its exclusion of workers under 25 and over 64 who do not have dependent children. These restrictions undermine progress on SDG 8 (Decent Work and Economic Growth) and SDG 10 (Reduced Inequalities) by denying support to young workers entering the labor market and older workers who must continue working past retirement age. A growing number of states are decoupling from these federal age restrictions:

- Eight states have expanded eligibility to include younger workers (typically 18-24).

- Three states have expanded access to include older workers (65+).

- Increasing the credit amount for workers without children, as Maryland and Vermont have done, is another crucial step toward ensuring the EITC benefits all low-wage workers, not just those with children.

The Role of Local EITCs in Community-Level Development

Localities can further amplify the benefits of the EITC by establishing their own credits. New York City and Montgomery County, Maryland, provide leading examples of how local EITCs can be layered on top of federal and state credits to provide a substantial income boost. This localized approach allows communities to directly address poverty and inequality at a granular level, accelerating progress toward the SDGs for their residents. State legislation should empower localities to create such programs to bolster the economic security of their communities.

Analysis of SDGs, Targets, and Indicators in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 1: No Poverty

- The article’s central theme is the role of the Earned Income Tax Credit (EITC) in poverty alleviation. It explicitly states that the EITC, along with the Child Tax Credit, “lifted an estimated 6.8 million people out of poverty in 2024” and has “kept millions of Americans above the poverty line since its enactment.” This directly addresses the goal of ending poverty in all its forms.

-

SDG 10: Reduced Inequalities

- The article discusses how the EITC counteracts regressive state and local tax systems where “low-income households also pay a higher share of their incomes in state and local taxes than the richest households.” It also highlights that the credit is “particularly beneficial to Black and Hispanic communities” who are disproportionately affected by economic inequities, and mentions efforts to expand eligibility to different age groups, thereby aiming to reduce income inequality and promote economic inclusion.

-

SDG 3: Good Health and Well-being

- A direct connection to health is made when the article states that the EITC “improves health outcomes and is connected to a reduction in babies born with low birthweights.” This links the financial security provided by the credit to tangible health benefits for vulnerable populations.

-

SDG 4: Quality Education

- The article points to the long-term, intergenerational benefits of the EITC by citing research that “children whose families received the credit are more likely to graduate from high school, go to college, and be employed as adults.” This demonstrates a clear link between the economic support for families and the educational attainment of their children.

-

SDG 8: Decent Work and Economic Growth

- The EITC is a policy designed to support “low-paid workers.” By boosting their incomes, it makes work more financially viable and contributes to the principle of decent work. The article discusses how the credit helps workers “put food on the table, pay their bills, and have more economic stability,” which are fundamental aspects of decent work and economic security.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 1.2: By 2030, reduce at least by half the proportion of men, women and children of all ages living in poverty in all its dimensions according to national definitions.

- The article’s focus on lifting millions of people out of poverty aligns directly with this target of reducing poverty as defined by national standards.

-

Target 1.3: Implement nationally appropriate social protection systems and measures for all… and by 2030 achieve substantial coverage of the poor and the vulnerable.

- The EITC is presented as a key social protection system. The article details its implementation at federal and state levels (“31 states plus the District of Columbia and Puerto Rico”) and discusses expanding its coverage to more vulnerable people, such as younger and older workers.

-

Target 10.4: Adopt policies, especially fiscal, wage and social protection policies, and progressively achieve greater equality.

- The article explicitly frames the EITC as a fiscal policy designed to achieve greater equality by “counteract[ing] inequities in state tax codes” and offsetting “regressive sales and property taxes.”

-

Target 4.1: By 2030, ensure that all girls and boys complete free, equitable and quality primary and secondary education…

- The finding that children in families receiving the EITC are “more likely to graduate from high school” supports this target by showing how economic stability contributes to the completion of secondary education.

-

Target 3.2: By 2030, end preventable deaths of newborns and children under 5 years of age…

- While not a direct measure of mortality, the article’s mention of a “reduction in babies born with low birthweights” is a critical factor in achieving this target, as low birthweight is a leading cause of neonatal mortality.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Number of people lifted out of poverty

- The article explicitly states, “the EITC lifted an estimated 6.8 million people out of poverty in 2024” and “9.6 million people out of poverty in 2021.” This is a direct indicator for measuring progress on Target 1.2.

-

Number of families and individuals receiving benefits

- The article mentions that the federal EITC “delivered about $64 billion to 23 million working families and individuals in 2024.” This serves as an indicator for Target 1.3, measuring the coverage of the social protection system.

-

Tax rate disparity between income groups

- The article provides data that can be used as a baseline indicator for Target 10.4: “The poorest 20 percent of Americans pay 11.4 percent of their incomes in state and local taxes…the wealthiest 1 percent of taxpayers pay just 7.2 percent.” Progress could be measured by the reduction of this gap in states with robust EITCs.

-

Educational attainment rates

- The article implies indicators for Target 4.1 by referencing research showing that children from recipient families are “more likely to graduate from high school” and “go to college.” Measuring these rates among the target population would track progress.

-

Incidence of low birthweight

- The article implies an indicator for Target 3.2 by stating the EITC is “connected to a reduction in babies born with low birthweights.” Tracking the incidence of low birthweight among EITC-eligible populations would measure this health outcome.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 1: No Poverty | 1.2: Reduce at least by half the proportion of people living in poverty according to national definitions. | Number of people lifted above the national poverty line (e.g., “6.8 million people out of poverty in 2024”). |

| SDG 1: No Poverty | 1.3: Implement nationally appropriate social protection systems and achieve substantial coverage of the poor. | Number of working families and individuals receiving EITC benefits (e.g., “23 million working families and individuals in 2024”). |

| SDG 10: Reduced Inequalities | 10.4: Adopt policies, especially fiscal policies, and progressively achieve greater equality. | Disparity in the effective state and local tax rates paid by the poorest vs. wealthiest households (e.g., “poorest 20 percent… pay 11.4 percent… wealthiest 1 percent… pay just 7.2 percent”). |

| SDG 3: Good Health and Well-being | 3.2: End preventable deaths of newborns and children under 5 years of age. | Incidence of low birthweight among babies born to families receiving the EITC (Implied by “reduction in babies born with low birthweights”). |

| SDG 4: Quality Education | 4.1: Ensure all boys and girls complete free, equitable and quality primary and secondary education. | High school graduation rates for children whose families received the EITC (Implied by “more likely to graduate from high school”). |

| SDG 8: Decent Work and Economic Growth | 8.5: Achieve full and productive employment and decent work for all. | Total financial support provided to boost the incomes of low-paid workers (e.g., “delivered about $64 billion”). |

Source: itep.org

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

;Resize=620#)