Water Quality Sensor Market to Hit USD 9.47 Billion by – GlobeNewswire

Water Quality Sensor Market Report 2025-2032: Emphasizing Sustainable Development Goals

Market Overview and Growth Projections

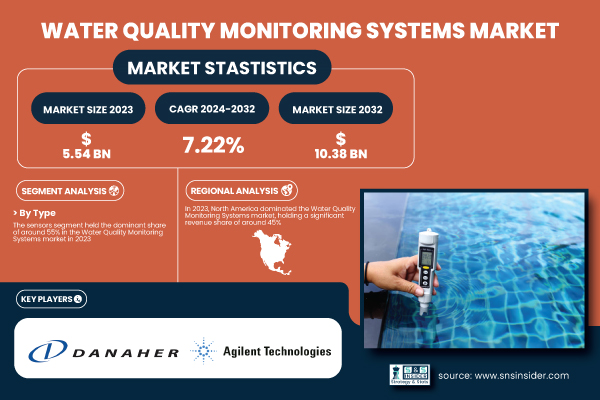

The global water quality sensor market was valued at USD 5.72 billion in 2024 and is projected to reach USD 9.47 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.51% during the forecast period from 2025 to 2032. This growth is primarily driven by the increasing industrial water discharge and frequent contamination incidents, which have accelerated the adoption of advanced sensors for continuous water quality monitoring.

Key contaminants such as heavy metals, pathogens, and chemicals necessitate the use of high-precision sensors including Total Organic Carbon (TOC), pH, and multi-parameter sensors. These technologies align with the United Nations Sustainable Development Goals (SDGs), particularly SDG 6 (Clean Water and Sanitation) and SDG 12 (Responsible Consumption and Production), by promoting sustainable water management and pollution reduction.

Regional Market Insights

-

United States Market

The U.S. water quality sensor market is expected to grow from USD 1.83 billion in 2024 to USD 2.94 billion by 2032, at a CAGR of 6.14%. This growth is propelled by stricter wastewater discharge regulations, increased waterborne illness occurrences demanding real-time detection, and the integration of sensor data with cloud analytics for predictive maintenance and early contamination alerts.

This supports SDG 3 (Good Health and Well-being) and SDG 9 (Industry, Innovation, and Infrastructure) by enhancing public health and fostering innovative water monitoring infrastructure.

-

North America

North America held the largest market share in 2023, accounting for over 42%. Investments in upgrading water infrastructure and monitoring systems, driven by regulatory frameworks such as the Clean Water Act, have encouraged the deployment of advanced sensor networks. These networks monitor parameters including heavy metals, TOC, chlorine, turbidity, and pH, enabling early detection and maintenance.

Federal and state incentive programs further stimulate adoption, contributing to SDG 6 and SDG 11 (Sustainable Cities and Communities) by ensuring safe water and resilient urban infrastructure.

-

Asia Pacific

The Asia Pacific region is the fastest-growing market due to rapid industrialization and urbanization, which have exacerbated water pollution challenges. Countries such as China, India, and Southeast Asian nations face increasing contamination from industrial waste and agricultural runoff.

Governments are implementing extensive water monitoring programs using Internet of Things (IoT)-based sensors to track pH, conductivity, dissolved oxygen, and nutrient levels in rivers, urban areas, and treatment plants. Investments in municipal water treatment infrastructure and local R&D for cost-effective sensors are also driving market expansion.

This growth supports SDG 6, SDG 9, and SDG 13 (Climate Action) by promoting sustainable water management and technological innovation to mitigate environmental impacts.

Market Segmentation

By Sensor Type

- TOC (Total Organic Carbon) Sensors: Leading the market with a 32% share in 2024, TOC sensors measure organic pollution across various water sources including drinking water, industrial effluent, and municipal wastewater. Their real-time, precise reporting capabilities are critical for environmental preservation and regulatory compliance. Compatibility with digital platforms enhances their utility in automated monitoring systems.

By End-Use Industry

- Industrial Sector: Dominating with 36% market share in 2024, the industrial segment includes petrochemical, food and beverage processing, pharmaceutical, and power generation industries. These sectors require accurate water quality data to ensure product safety, improve process efficiency, and comply with environmental regulations. Continuous monitoring addresses challenges related to wastewater discharge, chemical contamination, and water reuse.

Key Market Drivers

- Increasing water pollution necessitates real-time monitoring solutions, supporting SDG 6 (Clean Water and Sanitation).

- Stricter environmental regulations and public health concerns drive demand for advanced sensor technologies, aligning with SDG 3 (Good Health and Well-being) and SDG 12 (Responsible Consumption and Production).

- Integration of sensor data with cloud analytics promotes innovation and infrastructure development, contributing to SDG 9 (Industry, Innovation, and Infrastructure).

- Government incentives and infrastructure investments enhance sustainable water management, supporting SDG 11 (Sustainable Cities and Communities).

Leading Companies in the Water Quality Sensor Market

- Atlas Scientific LLC

- Eksoy Ltd.

- TriOS Mess- und Datentechnik GmbH

- Thermo Fisher Scientific Inc.

- Endress+Hauser Group

- OTT Hydromet (Hach Company)

- Thames Water Utilities Limited

- Libelium Comunicaciones Distribuidas S.L.

- Xylem Inc.

- Honeywell International Inc.

Report Scope and Coverage

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.72 Billion |

| Market Size by 2032 | USD 9.47 Billion |

| CAGR | 6.51% from 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segment Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | Rising water pollution fuels demand for real-time monitoring solutions |

Conclusion

The water quality sensor market is poised for significant growth driven by the urgent need for sustainable water management and pollution control. The adoption of advanced sensor technologies supports multiple Sustainable Development Goals, including SDG 3, SDG 6, SDG 9, SDG 11, SDG 12, and SDG 13, by enhancing water safety, promoting innovation, and fostering environmental stewardship globally.

About SNS Insider

SNS Insider is a leading global market research and consulting agency committed to providing clients with accurate, up-to-date market data, consumer insights, and expert opinions. Utilizing diverse methodologies such as surveys, interviews, and focus groups worldwide, SNS Insider empowers informed decision-making in dynamic market environments.

1. Sustainable Development Goals (SDGs) Addressed or Connected

- SDG 6: Clean Water and Sanitation

- The article focuses on water quality sensors that monitor contaminants, ensuring safe and clean water.

- It highlights the need for real-time monitoring of water pollution and wastewater discharge.

- SDG 9: Industry, Innovation and Infrastructure

- The development and adoption of advanced water quality sensors indicate innovation in industrial processes and infrastructure upgrades.

- Integration of sensor data with cloud analytics for predictive maintenance reflects technological advancement.

- SDG 3: Good Health and Well-being

- Monitoring waterborne illnesses through real-time detection contributes to health and well-being.

- SDG 11: Sustainable Cities and Communities

- Urbanization and pollution control needs in Asia Pacific emphasize sustainable urban development.

- SDG 12: Responsible Consumption and Production

- Industrial water reuse and pollution control relate to sustainable production practices.

2. Specific Targets Under Identified SDGs

- SDG 6: Clean Water and Sanitation

- Target 6.3: Improve water quality by reducing pollution, minimizing release of hazardous chemicals and materials.

- Target 6.5: Implement integrated water resources management at all levels.

- SDG 9: Industry, Innovation and Infrastructure

- Target 9.4: Upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency.

- Target 9.5: Enhance scientific research and upgrade technological capabilities of industrial sectors.

- SDG 3: Good Health and Well-being

- Target 3.3: End epidemics of waterborne diseases by improving water quality monitoring and management.

- SDG 11: Sustainable Cities and Communities

- Target 11.6: Reduce the adverse per capita environmental impact of cities, including air quality and waste management.

- SDG 12: Responsible Consumption and Production

- Target 12.4: Achieve environmentally sound management of chemicals and wastes throughout their life cycle.

3. Indicators Mentioned or Implied to Measure Progress

- Water Quality Parameters as Indicators

- Levels of heavy metals, pathogens, chemicals, Total Organic Carbon (TOC), pH, chlorine, turbidity, conductivity, dissolved oxygen, and nutrient levels are measurable indicators of water quality.

- Market Growth and Adoption Rates

- Market size growth (from USD 5.72 billion in 2024 to USD 9.47 billion by 2032) and CAGR (6.51%) indicate progress in adoption of water quality monitoring technologies.

- Regional adoption rates, such as North America’s 42% market share and Asia Pacific’s fastest growth, reflect implementation progress.

- Regulatory Compliance and Real-Time Monitoring

- Compliance with stricter wastewater discharge regulations and frequency of real-time contamination alerts serve as indicators of effective water quality management.

- Technological Integration

- Integration of sensor data with cloud analytics and IoT-based monitoring systems can be tracked as indicators of innovation and infrastructure development.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 6: Clean Water and Sanitation |

|

|

| SDG 9: Industry, Innovation and Infrastructure |

|

|

| SDG 3: Good Health and Well-being |

|

|

| SDG 11: Sustainable Cities and Communities |

|

|

| SDG 12: Responsible Consumption and Production |

|

|

Source: globenewswire.com