A Lifeline for Global Development Is Under Threat – Foreign Policy

Report on the U.S. Remittance Tax and its Implications for the Sustainable Development Goals (SDGs)

Introduction: A New Threat to Global Development and the SDGs

A new U.S. policy, the “One Big Beautiful Bill Act,” has introduced a 1 percent tax on all cash-based remittances. This report analyzes the policy’s profound and detrimental impact on global development, with a specific focus on its direct contradiction of the United Nations’ Sustainable Development Goals (SDGs). Remittances, a financial lifeline for approximately 800 million people worldwide, are a critical mechanism for achieving these goals. The new tax threatens to reverse progress, increase global instability, and undermine the very objectives it purports to support.

Direct Impact on Human Well-being: Undermining SDGs 1, 3, 4, and 5

Impeding SDG 1: No Poverty

- Remittances are a primary tool for poverty reduction, helping millions of families cope with financial shocks and recover from disasters.

- In 2023, remittances to low and middle-income countries were estimated at $685 billion, significantly outpacing foreign direct investment and overseas development aid.

- Even a 1 percent tax is projected to cause a 1.6 percent decrease in remittance flows, directly reducing the income of the world’s most vulnerable households.

- The impact will be most severe in countries where remittances form a large share of the economy, such as Nicaragua, Honduras, El Salvador, Guatemala, and Haiti.

Jeopardizing SDG 3 (Good Health), SDG 4 (Quality Education), and SDG 11 (Sustainable Communities)

- Remittances function as a critical social safety net, enabling access to essential services.

- In many countries, families rely on these funds to cover major medical expenses and support pensions, directly contributing to SDG 3.

- These financial flows are often used to fund children’s education, a key component of SDG 4.

- Migrant groups often partner with local governments to pool funds for public infrastructure, such as schools and clinics, directly supporting the creation of sustainable communities under SDG 11. An initiative in Somalia, for example, matches diaspora fundraising to finance local infrastructure projects.

Exacerbating Gender Inequality (SDG 5)

- The tax disproportionately affects women, who are more likely than men to be unbanked and lack access to digital financial tools.

- As the policy targets cash-based transfers, it places a heavier burden on women and their families, who often rely on cash as the only means to receive money, thereby undermining progress toward SDG 5.

Economic and Institutional Destabilization: Contradicting SDGs 8, 10, and 16

Threatening Economic Growth and Stability (SDG 8)

- Remittances are crucial for the macroeconomic stability of many nations, a cornerstone of SDG 8.

- These inflows provide foreign currency that helps governments pay for imports, stabilize their currency, improve creditworthiness, and attract investment.

- For 78 countries, remittances constitute at least 3 percent of the economy.

- For more than 29 countries, they represent over 10 percent of GDP.

Widening Inequalities (SDG 10)

- The policy is a regressive “tax on the poor,” targeting low-income migrant workers while the same legislative bill delivers $3.8 trillion in tax cuts skewed toward high-income earners.

- This directly contravenes the goal of reducing inequality within and among countries (SDG 10).

- It ignores the significant tax contributions already made by migrants. In 2022, undocumented immigrants paid almost $97 billion in U.S. taxes, and in 2023, Salvadoran migrants contributed over $223 billion to the U.S. economy.

Undermining Peace, Justice, and Strong Institutions (SDG 16)

- By reducing economic grievances, remittances can lower the risk of civil conflict and ease public discontent, contributing to peaceful and inclusive societies (SDG 16). Undermining this financial flow risks eroding global stability.

- The tax is counterproductive to anti-money laundering efforts. It incentivizes the use of informal and untraceable transfer systems like cryptocurrencies or hawala networks, weakening formal financial oversight and undermining the development of strong institutions.

- This risk is amplified by recent cuts to U.S. programs that supported anti-money laundering training worldwide.

Conclusion: A Counterproductive Policy Inconsistent with Global Partnership for Sustainable Development (SDG 17)

Ineffective and Unjust

- The tax is expected to raise minimal revenue—estimated between $4.6 billion and $10 billion over a decade—while failing to account for increased administrative and enforcement costs.

- The experience of Oklahoma, which imposed a similar 1% tax, demonstrates limited revenue impact, generating just $13 million in fiscal year 2019.

- The policy unfairly burdens families and communities that are already contributing to economic development both in their home countries and in the U.S.

A Detriment to Global Goals

- The remittance tax will inflict significant harm on the world’s poorest populations, damage immigrant communities, and foster economic and political instability.

- It undermines the global partnership for sustainable development (SDG 17) by taxing a key source of international finance that is larger than official development aid.

- Remittances are not a loophole; they are a vital lifeline and a fundamental tool for achieving the Sustainable Development Goals. Taxing these flows makes no one safer or more secure and is fundamentally at odds with the principles of global sustainable development.

Analysis of Sustainable Development Goals (SDGs) in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

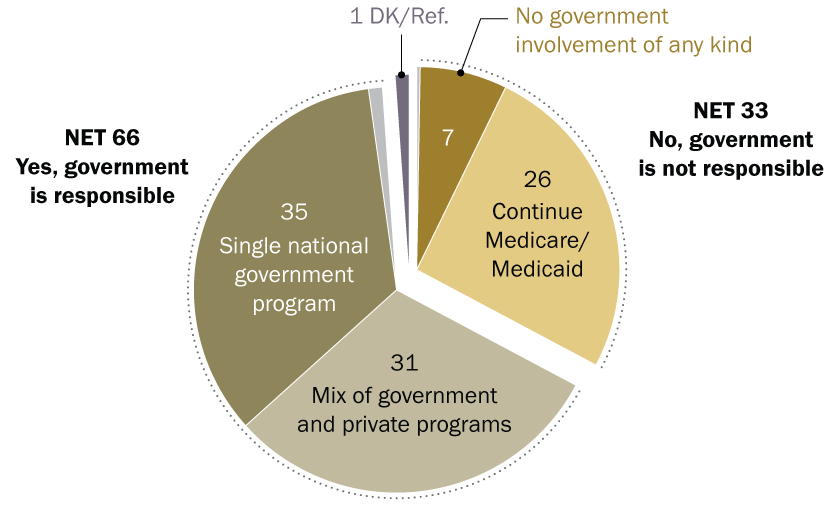

The article on the U.S. remittance tax touches upon several Sustainable Development Goals (SDGs) by discussing the wide-ranging impacts of remittances on global development, poverty, health, education, and economic stability. The following SDGs are directly or indirectly connected to the issues raised:

- SDG 1: No Poverty – The article explicitly states that remittances “have helped millions of families reduce poverty.” The tax threatens this progress by reducing the funds available to the world’s poorest populations.

- SDG 3: Good Health and Well-being – The text highlights that remittances “enable access to health care,” citing that families in Mexico rely on them to pay for “major medical expenses.”

- SDG 4: Quality Education – It is mentioned that remittances contribute to education, as they are used to finance “public services, like schools and clinics.”

- SDG 5: Gender Equality – The article points out a disproportionate impact on women, who are “more likely than men to be unbanked and lack access to digital tools,” making them more reliant on cash-based transfers that are being taxed.

- SDG 8: Decent Work and Economic Growth – The article discusses the macroeconomic importance of remittances, which “make up a large share of the economy and GDP” in many low and middle-income countries and help “stabilize their currency, improve creditworthiness, and attract investment.”

- SDG 10: Reduced Inequalities – The core of the article addresses this goal. The tax is described as a “tax on the poor” that increases inequality by burdening low-income migrants and their families while the same bill provides tax cuts for high-income earners. It directly impacts the cost of sending money, a key issue for reducing inequality among and within countries.

- SDG 11: Sustainable Cities and Communities – The article notes that remittances are used to “pool funds for public infrastructure,” including schools and clinics, particularly through initiatives where migrant groups co-finance community development.

- SDG 16: Peace, Justice, and Strong Institutions – The article argues that the tax could undermine stability by pushing financial flows into informal, untraceable channels, thereby posing challenges for “anti-money laundering efforts.” It also states that remittances can “lower the risk of civil war and conflict” by reducing economic grievances.

- SDG 17: Partnerships for the Goals – The article frames remittances as a critical source of development finance, noting that in low and middle-income countries, they “outpacing both foreign direct investment and overseas development aid.” The tax policy represents a unilateral action that negatively affects global financial partnerships for development.

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the article’s discussion, several specific SDG targets can be identified:

- Target 1.3: Implement nationally appropriate social protection systems and measures for all. The article describes remittances as a “critical social safety net” that helps families “cope with financial shocks, and recover from natural disasters,” effectively serving as an informal social protection system.

- Target 3.8: Achieve universal health coverage, including financial risk protection. The article supports this by stating that remittances are used by families, particularly the “uninsured,” to “pay for major medical expenses.”

- Target 4.a: Build and upgrade education facilities that are child, disability and gender sensitive. The article mentions that remittances directly finance public services like “schools and clinics,” contributing to the infrastructure needed for education.

- Target 5.a: Undertake reforms to give women equal rights to economic resources. The article highlights that the tax will “hit them [women] and their families particularly hard” because women are more likely to be unbanked, which underscores the need to ensure their access to economic and financial resources.

- Target 8.1: Sustain per capita economic growth in accordance with national circumstances. The article warns that the tax will negatively impact economic growth, projecting that El Salvador could lose “0.6 percent of its gross national income.”

- Target 10.c: By 2030, reduce to less than 3 per cent the transaction costs of migrant remittances and eliminate remittance corridors with costs higher than 5 per cent. This target is central to the article. The introduction of a “1 percent tax on all cash-based remittances” directly works against this target by increasing the cost of sending money. The article also notes that companies may “increase fees to offset lost revenue,” further raising costs.

- Target 16.4: By 2030, significantly reduce illicit financial flows. The article warns that taxing formal remittances could lead to an “increased use of cryptocurrencies or informal transfer systems” like hawala networks, which would undermine efforts to combat illicit finance and money laundering.

- Target 17.3: Mobilize additional financial resources for developing countries from multiple sources. The article establishes remittances as a major financial resource for developing countries, estimated at “$685 billion last year” for low and middle-income countries, which is more than foreign direct investment and development aid combined. The tax threatens this crucial flow.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Yes, the article mentions or implies several indicators that can be used to measure progress:

- Indicator 10.c.1: Remittance costs as a proportion of the amount remitted. The entire article is premised on this indicator. The “1 percent tax” is a direct measure of an increase in remittance costs. The potential for companies to “increase fees” also points to this metric.

- Indicator 17.3.2: Volume of remittances (in United States dollars) as a proportion of total GDP. The article provides specific data relevant to this indicator, stating that remittances “make up at least 3 percent of the economy for 78 countries and represent over 10 percent for more than 29 countries.” It also gives the total volume for low and middle-income countries as “$685 billion last year.”

- Indicator 8.1.1: Annual growth rate of real GDP per capita. The article implies a negative impact on this indicator by projecting that El Salvador could “lose 0.6 percent of its gross national income” and that household spending in Mexico could “drop by 25 percent.”

- Indicator 8.10.2: Proportion of adults (15 years and older) with an account at a bank or other financial institution or with a mobile-money-service provider. The article provides data for this indicator, noting that in “sub-Saharan Africa, 51 percent of adults don’t have a bank account” and in “Haiti, 89 percent of adults operate without one.” This data is used to explain why the tax on cash-based transfers is a “tax on the poor.”

- Indicator 16.4.1: Total value of inward and outward illicit financial flows (in current United States dollars). The article implies that this value will increase. It warns that taxing formal channels will lead to “increased use of cryptocurrencies or informal transfer systems,” which are harder to track and contribute to illicit financial flows.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 1: No Poverty | 1.3: Implement social protection systems. | Qualitative description of remittances as a “critical social safety net” that helps families cope with financial shocks and recover from disasters. |

| SDG 3: Good Health and Well-being | 3.8: Achieve universal health coverage. | Remittances are used by the uninsured to pay for “major medical expenses.” |

| SDG 4: Quality Education | 4.a: Build and upgrade education facilities. | Remittances are used to finance public services like “schools and clinics.” |

| SDG 5: Gender Equality | 5.a: Give women equal rights to economic resources. | Women are more likely to be unbanked and will be hit “particularly hard” by the tax on cash transfers. |

| SDG 8: Decent Work and Economic Growth | 8.1: Sustain per capita economic growth. 8.10: Expand access to banking. |

(8.1.1) Projection of a 0.6% loss of gross national income for El Salvador. (8.10.2) Data on the unbanked population: 51% in sub-Saharan Africa and 89% in Haiti do not have a bank account. |

| SDG 10: Reduced Inequalities | 10.c: Reduce remittance transaction costs to less than 3%. | (10.c.1) The introduction of a “1 percent tax on all cash-based remittances” and the potential for remittance companies to “increase fees.” |

| SDG 16: Peace, Justice, and Strong Institutions | 16.4: Reduce illicit financial flows. | (16.4.1) The policy may lead to an “increased use of cryptocurrencies or informal transfer systems,” which would increase illicit financial flows. |

| SDG 17: Partnerships for the Goals | 17.3: Mobilize financial resources for developing countries. | (17.3.2) Total remittance volume to low and middle-income countries was “$685 billion last year,” and remittances make up over 10% of the economy for more than 29 countries. |

Source: foreignpolicy.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.jpg.webp?itok=0ZsAnae9#)