After magnets, China now plants agriculture barrier for India – The Economic Times

Report on China’s Halt of Specialty Fertiliser Shipments to India and Its Implications for Sustainable Development Goals

Introduction

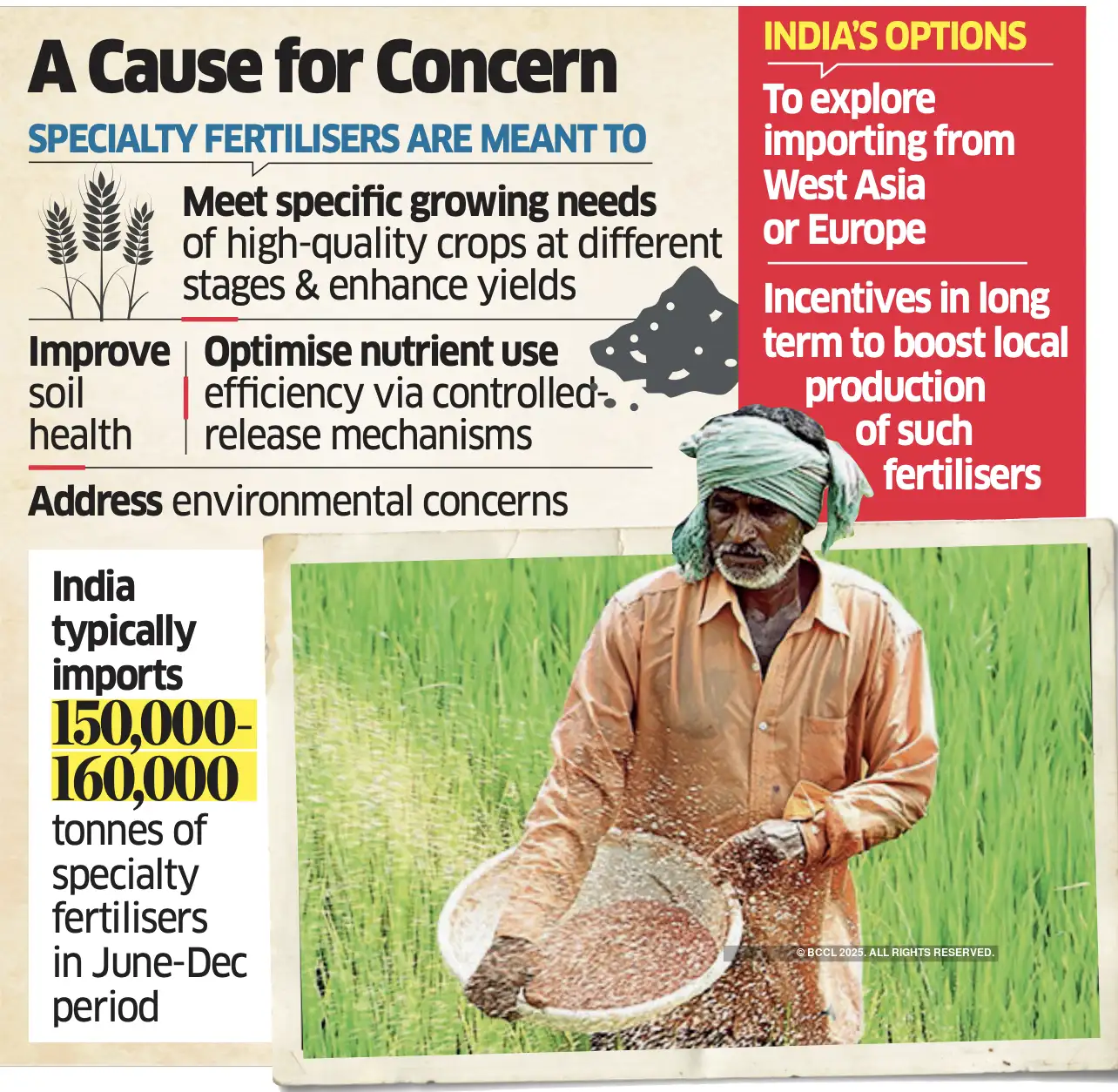

China has ceased shipments of specialty fertilisers to India for the past two months, impacting the supply of critical agricultural inputs used to enhance yields of fruits, vegetables, and other high-value crops. This development comes amid ongoing geopolitical tensions and trade restrictions. India imports approximately 80% of its specialty fertiliser supplies from China, which continues to export these products to other countries.

Background and Current Situation

- China has been restricting specialty fertiliser exports to India for the last four to five years, but the current situation marks a complete halt.

- Shipments from Chinese factories are subject to government inspections, which have increasingly delayed or blocked exports to India without an official ban.

- This trade restriction follows China’s earlier limitations on key raw materials such as rare earth magnets, perceived as retaliation against Indian tariffs and investment curbs.

- India mandates government approval for investments from neighboring countries, particularly China, reflecting heightened border tensions and geopolitical concerns.

Impact on Indian Agriculture and Sustainable Development Goals (SDGs)

Specialty Fertilisers and Their Role

Specialty fertilisers include water-soluble fertilisers (WSFs), liquid fertilisers for foliar and fertigation use, controlled release fertilisers (CRFs), slow-release fertilisers (SRFs), micronutrient fertilisers, fortified fertilisers, customised fertilisers, nano fertilisers, bio-stimulants, organic fertilisers, and other innovative products. These fertilisers:

- Enhance crop yields

- Improve soil health

- Optimize nutrient use efficiency

- Reduce environmental impact compared to traditional fertilisers

Market Size and Growth Projections

- India imports 150,000-160,000 tonnes of specialty fertilisers during the June-December period.

- The micronutrient fertiliser market is projected to exceed $1 billion by 2029, growing at a CAGR of 9.2%.

- The biostimulants market is expected to reach $734 million by 2029, with a CAGR of 15.6%.

- The organic fertiliser market is forecasted to grow to $1.13 billion by 2032, at a CAGR of 7%.

Relevance to Sustainable Development Goals

- SDG 2: Zero Hunger – Specialty fertilisers contribute to increased agricultural productivity and food security by improving crop yields.

- SDG 12: Responsible Consumption and Production – These fertilisers promote efficient nutrient use, reducing waste and environmental degradation.

- SDG 15: Life on Land – Enhanced soil health supports sustainable land management and biodiversity conservation.

- SDG 13: Climate Action – Reduced environmental impact from fertiliser use helps mitigate climate change effects.

Challenges and Strategic Responses

Local Production Constraints

- India currently lacks the technology and scale to produce specialty fertilisers domestically due to historically low demand volumes.

- Rising consumption of specialty fertilisers is encouraging companies to consider establishing local manufacturing facilities.

Alternative Import Options

- India is exploring alternative import sources such as Jordan and Europe.

- Challenges remain in timely delivery and supply chain logistics for these alternatives.

Industry Involvement

- Major Indian fertiliser companies like Deepak Fertilizers, Paradeep Fertilizers, and Nagarjuna Fertilizer Company are active in the specialty fertiliser segment.

- Increased interest in domestic production aligns with the goal of reducing import dependency and enhancing agricultural sustainability.

Conclusion

The halt in specialty fertiliser shipments from China poses significant challenges to India’s agricultural sector and its progress toward multiple Sustainable Development Goals. Addressing these challenges through diversification of import sources, development of domestic manufacturing capabilities, and promotion of sustainable fertiliser use is critical for ensuring food security, environmental sustainability, and economic resilience.

1. Sustainable Development Goals (SDGs) Addressed or Connected

- SDG 2: Zero Hunger

- The article discusses specialty fertilisers that increase crop yields and improve soil health, directly contributing to food security and sustainable agriculture.

- SDG 12: Responsible Consumption and Production

- Use of specialty fertilisers optimizes nutrient use efficiency and reduces environmental impact compared to traditional fertilisers, promoting sustainable production practices.

- SDG 9: Industry, Innovation and Infrastructure

- The article highlights the lack of local technology and manufacturing for specialty fertilisers in India and the interest in developing domestic production facilities, linking to industrial innovation.

- SDG 15: Life on Land

- Improvement of soil health through specialty fertilisers supports sustainable land management and ecosystem health.

2. Specific Targets Under Those SDGs

- SDG 2: Zero Hunger

- Target 2.3: By 2030, double the agricultural productivity and incomes of small-scale food producers through sustainable food production systems.

- Target 2.4: By 2030, ensure sustainable food production systems and implement resilient agricultural practices that increase productivity and production.

- SDG 12: Responsible Consumption and Production

- Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources.

- Target 12.4: By 2020, achieve the environmentally sound management of chemicals and all wastes throughout their life cycle.

- SDG 9: Industry, Innovation and Infrastructure

- Target 9.2: Promote inclusive and sustainable industrialization and, by 2030, raise significantly industry’s share of employment and gross domestic product.

- Target 9.5: Enhance scientific research, upgrade the technological capabilities of industrial sectors.

- SDG 15: Life on Land

- Target 15.3: By 2030, combat desertification, restore degraded land and soil, including land affected by desertification, drought and floods.

3. Indicators Mentioned or Implied to Measure Progress

- Crop Yield and Productivity

- Implied indicator: Increase in crop yields due to use of specialty fertilisers.

- Market Growth and Production Capacity

- Indicators: Market size projections for micronutrient fertilisers, biostimulants, and organic fertilisers (e.g., expected market values and CAGR percentages).

- Number of companies setting up manufacturing units for specialty fertilisers in India.

- Environmental Impact

- Implied indicator: Reduction in environmental impact compared to traditional fertilisers, possibly measured through nutrient use efficiency or soil health metrics.

- Import Dependency

- Indicator: Percentage of specialty fertiliser imports from China and diversification of import sources.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 2: Zero Hunger |

|

|

| SDG 12: Responsible Consumption and Production |

|

|

| SDG 9: Industry, Innovation and Infrastructure |

|

|

| SDG 15: Life on Land |

|

|

Source: m.economictimes.com