Distributional Effects of Selected Provisions of the House and Senate Reconciliation Bills – The Budget Lab at Yale

Report on Changes to Spending and Taxes with Emphasis on Sustainable Development Goals (SDGs)

Changes to Spending

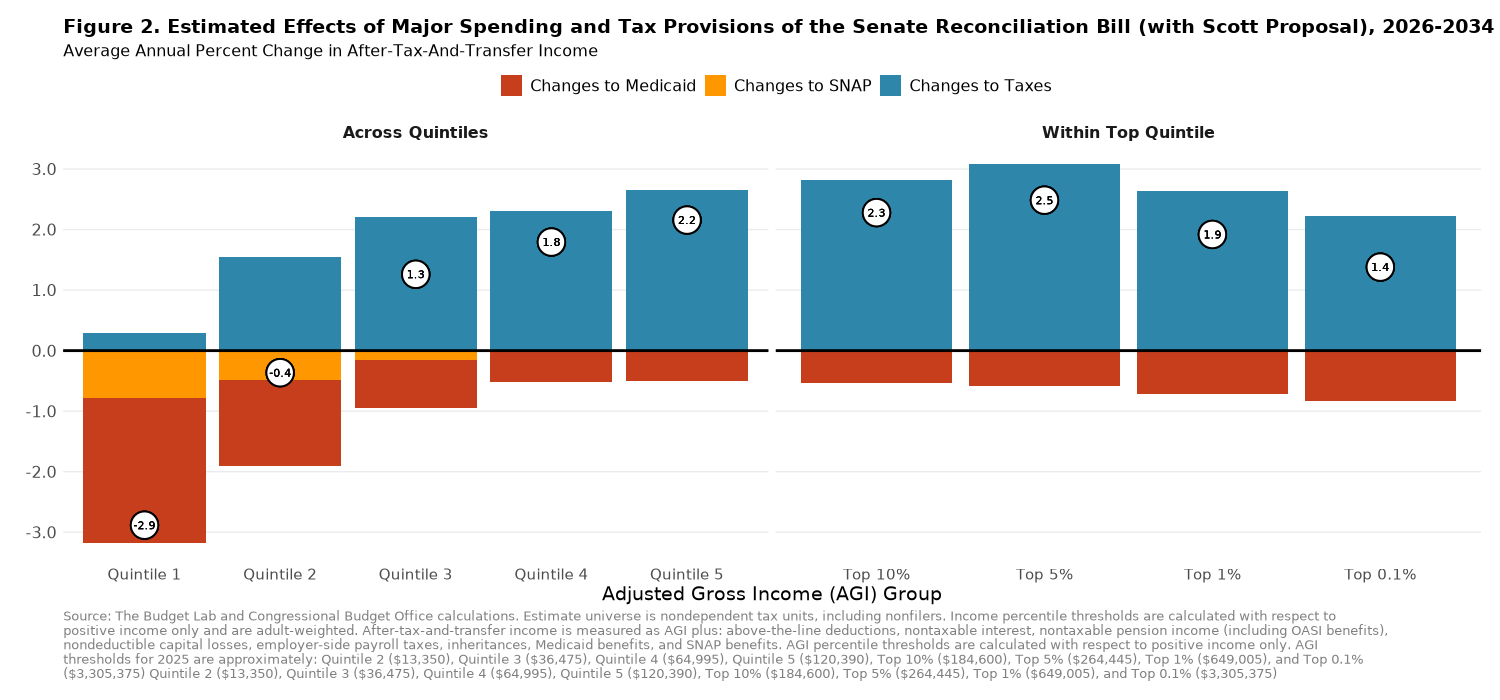

This report analyzes changes to spending on SNAP and Medicaid programs, utilizing self-reported program receipt data from the 2024 Current Population Survey Annual Social and Economic Supplement (ASEC). The methodology aligns with Sustainable Development Goal 1 (No Poverty) and SDG 3 (Good Health and Well-being) by focusing on social protection and healthcare support.

- Data Sources and Estimation:

- SNAP benefits are directly reported in the ASEC.

- Medicaid spending is imputed per individual using the Congressional Budget Office’s (CBO) baseline projections of average Federal spending on benefit payments per enrollee.

- Household Grouping and Income Sorting:

- Individuals are grouped into tax units based on the Census Bureau’s imputed tax-unit ID.

- Tax units are sorted by Adjusted Gross Income (AGI) as imputed by the Census.

- Adjustment for Underreporting:

- Reported SNAP and Medicaid benefit receipt is adjusted to correct underreporting of in-kind benefits in the ASEC.

- Aggregate benefits per income group are scaled to match CBO’s baseline projections, assuming similar income distribution among reported and unreported recipients.

- Methodological Updates:

- 56% of changes to Medicaid spending are assumed to impact providers, with the remainder affecting enrollees, reflecting economic research.

- States are assumed to offset approximately 1% of household resource losses from Federal spending cuts to Medicaid and SNAP during 2026-2034.

These spending adjustments contribute to advancing SDG 10 (Reduced Inequalities) by ensuring targeted support to vulnerable populations.

The computational scripts for these estimates are publicly available here.

Changes to Taxes

The tax changes are evaluated using The Budget Lab’s standard distribution analysis methodology, emphasizing SDG 8 (Decent Work and Economic Growth) and SDG 10 (Reduced Inequalities) by assessing the equitable distribution of tax burdens.

- Income Metric:

- Adjusted Gross Income (AGI) is used as the ranking metric for tax units due to data constraints.

- Included Tax Provisions:

- Ordinary tax rates

- Standard deduction

- Itemized deductions, including Pass-Through Entity Tax (PTET) SALT policy

- Personal exemptions

- Qualified Business Income (QBI) deduction

- Child Tax Credit (CTC) and Child and Dependent Care Tax Credit (CDCTC)

- Alternative Minimum Tax (AMT)

- Exemptions on tips, overtime, and car loan interest

- Senior deduction

- Estate tax

- Bonus depreciation and Research & Development (R&D) expensing

The tax analysis supports SDG 16 (Peace, Justice and Strong Institutions) by promoting transparent and fair tax policies.

The script used for generating tax distribution figures is accessible here. Additional documentation on the tax model is available for further reference.

1. Sustainable Development Goals (SDGs) Addressed or Connected

- SDG 1: No Poverty

- The article discusses SNAP (Supplemental Nutrition Assistance Program) and Medicaid benefits, which are social safety net programs aimed at reducing poverty and improving economic security.

- SDG 3: Good Health and Well-being

- Medicaid spending and enrollment are central to the article, highlighting access to healthcare services for low-income populations.

- SDG 10: Reduced Inequalities

- The analysis of tax changes and distributional effects on different income groups addresses economic inequalities.

- SDG 17: Partnerships for the Goals

- The article references collaboration between government agencies (CBO, Census Bureau) and research institutions (The Budget Lab), which aligns with strengthening data and policy partnerships.

2. Specific Targets Under Those SDGs

- SDG 1: No Poverty

- Target 1.3: Implement nationally appropriate social protection systems and measures for all, including floors, and achieve substantial coverage of the poor and vulnerable.

- SDG 3: Good Health and Well-being

- Target 3.8: Achieve universal health coverage, including financial risk protection and access to quality essential health-care services.

- SDG 10: Reduced Inequalities

- Target 10.2: Empower and promote the social, economic and political inclusion of all, irrespective of income or other status.

- Target 10.4: Adopt policies, especially fiscal, wage and social protection policies, to progressively achieve greater equality.

- SDG 17: Partnerships for the Goals

- Target 17.18: Enhance capacity-building support to developing countries to increase significantly the availability of high-quality, timely and reliable data.

3. Indicators Mentioned or Implied to Measure Progress

- For SDG 1 (No Poverty)

- Indicator 1.3.1: Proportion of population covered by social protection systems, including social safety nets (implied by measuring SNAP and Medicaid receipt).

- Use of self-reported program receipt data from the Current Population Survey ASEC to estimate coverage.

- For SDG 3 (Good Health and Well-being)

- Indicator 3.8.1: Coverage of essential health services (implied through Medicaid enrollment and spending data).

- Federal spending per Medicaid enrollee as a proxy for health service provision.

- For SDG 10 (Reduced Inequalities)

- Indicator 10.4.1: Labour share of GDP and distribution of household income by income deciles (implied through analysis of Adjusted Gross Income and tax distributional effects).

- Distributional analysis of tax changes by income groups using AGI data.

- For SDG 17 (Partnerships for the Goals)

- Indicator 17.18.2: Number of countries that have national statistical legislation that complies with the Fundamental Principles of Official Statistics (implied by use of Census Bureau and CBO data and methodologies).

- Use of publicly available data and open-source scripts to promote transparency and reproducibility.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 1: No Poverty | Target 1.3: Implement social protection systems and achieve coverage of the poor and vulnerable. | Indicator 1.3.1: Proportion of population covered by social protection systems (measured via SNAP and Medicaid receipt data from ASEC). |

| SDG 3: Good Health and Well-being | Target 3.8: Achieve universal health coverage including financial risk protection. | Indicator 3.8.1: Coverage of essential health services (implied by Medicaid enrollment and federal spending per enrollee). |

| SDG 10: Reduced Inequalities |

Target 10.2: Promote social, economic and political inclusion. Target 10.4: Adopt fiscal and social protection policies to reduce inequality. |

Indicator 10.4.1: Labour share of GDP and income distribution (implied by tax distribution analysis using AGI). Distributional effects of tax and benefit changes by income groups. |

| SDG 17: Partnerships for the Goals | Target 17.18: Enhance capacity-building for high-quality, timely and reliable data. |

Indicator 17.18.2: Compliance with statistical principles (implied by use of Census Bureau and CBO data). Use of open data and open-source scripts for transparency. |

Source: budgetlab.yale.edu