Donegal Group’s Strategic Turnaround and Underwriting Discipline: A Path to Sustainable Growth in a Challenging P&C Market – AInvest

Donegal Group Inc.: A Report on Strategic Execution and Alignment with Sustainable Development Goals

Introduction

This report analyzes the strategic repositioning of Donegal Group Inc. (NASDAQ: DG) over the last two years. It assesses the company’s performance in underwriting, systems modernization, and investment management, with a significant focus on how these initiatives align with the United Nations Sustainable Development Goals (SDGs). The analysis indicates that Donegal’s disciplined execution is fostering long-term value and contributing to broader sustainability objectives.

Core Strategic Pillars and Performance

Underwriting Discipline and Risk Management

Donegal’s strategy is founded on rigorous underwriting discipline to ensure sustainable profitability. This approach directly supports community and economic resilience.

- Core Loss Ratio Improvement: The company achieved a 3.5-point decline in its core loss ratio in 2024, with continued improvement into Q2 2025. This was driven by strategic premium rate increases and the reduction of underperforming personal lines business.

- Profitable Growth Strategy: Management has prioritized profitable growth over market share, particularly by slowing new personal lines writings to protect underwriting margins.

- Market Positioning: By leveraging its strong position in middle-market commercial insurance, Donegal has maintained pricing power and avoided margin erosion common among competitors.

Systems Modernization for Operational Excellence

A multi-year systems modernization project is central to Donegal’s strategy, enhancing efficiency and underwriting capabilities.

- Platform Unification: The final deployment of the commercial lines platform in Q2 2025 will complete the transition to a unified, modern technology stack for all middle-market and small business lines by 2026.

- Enhanced Precision: The new system improves the ability to assess risk and develop tailored products for high-margin market segments.

- Expense Ratio Outlook: While the expense ratio increased slightly to 32.2% in Q2 2025 due to one-time project costs, it is projected to decline significantly post-completion, thereby boosting net income.

Prudent Investment and Capital Allocation

Donegal’s conservative investment strategy has preserved capital and generated steady returns, reinforcing its financial stability.

- High-Quality Asset Allocation: As of June 30, 2025, 95.4% of the investment portfolio consisted of high-quality fixed-maturity securities, primarily U.S. Treasuries and corporate bonds.

- Improved Yields: The average investment yield increased from 3.3% in 2024 to 3.5% in Q2 2025.

- Book Value Growth: Book value per share rose from $15.36 in late 2024 to $16.62 by mid-2025, reflecting both net income and unrealized gains in the bond portfolio.

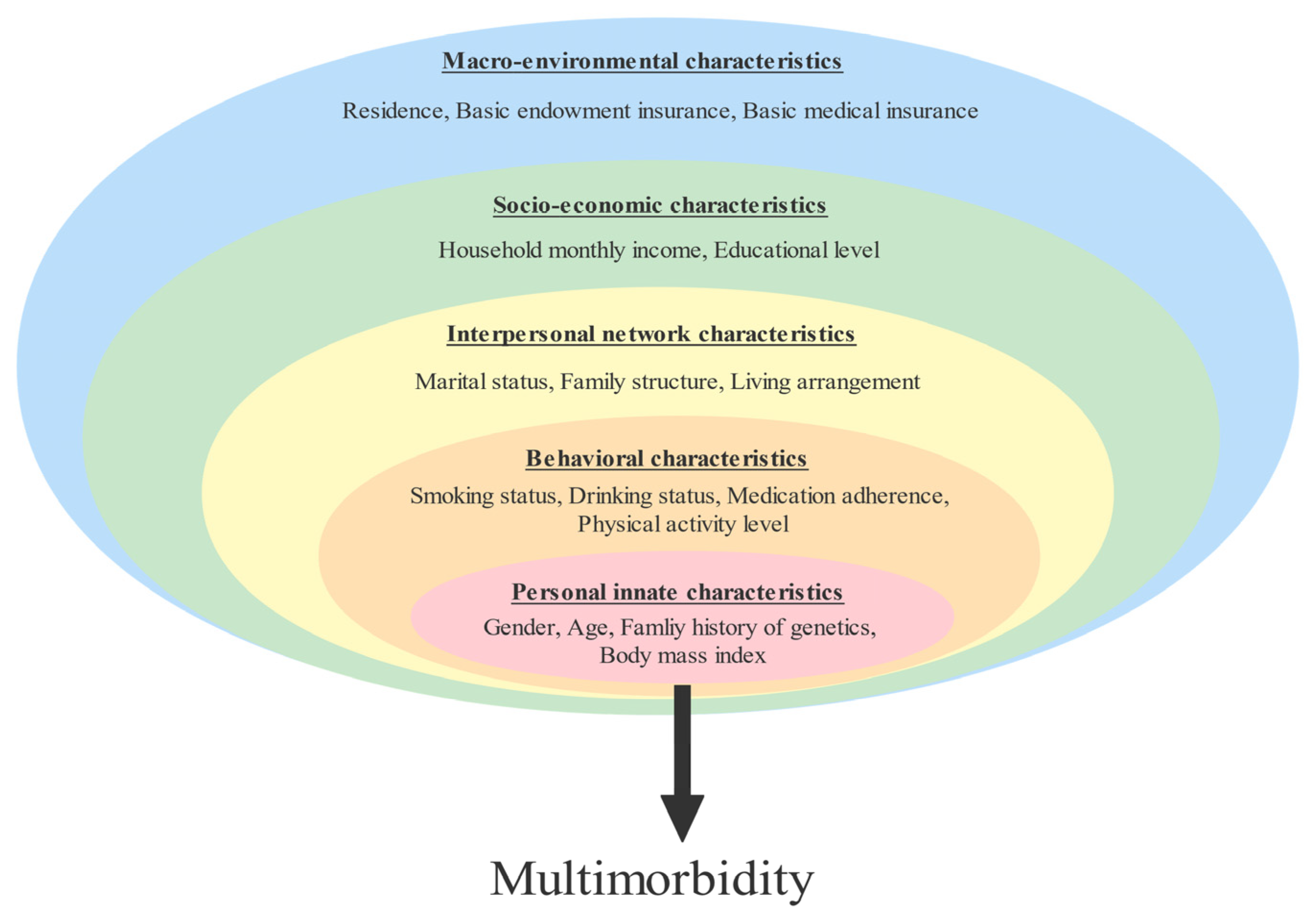

Alignment with Sustainable Development Goals (SDGs)

Donegal’s corporate strategy demonstrates a strong, implicit alignment with several key SDGs through its focus on resilience, innovation, and stable economic contribution.

SDG 8: Decent Work and Economic Growth

The company’s focus on long-term stability directly contributes to sustainable economic growth.

- Promoting Financial Stability: Disciplined underwriting and prudent investment management ensure the company’s long-term viability, allowing it to reliably cover claims and support economic continuity for its clients.

- Supporting Economic Activity: By investing in high-quality corporate and government bonds, Donegal helps finance economic activities and public services.

- Fostering Resilient Enterprises: Providing stable insurance products to middle-market businesses enables them to manage risk, grow, and create jobs.

SDG 9: Industry, Innovation, and Infrastructure

The investment in modern technology represents a significant contribution to building resilient infrastructure within the financial services industry.

- Building Resilient Digital Infrastructure: The systems modernization project creates a robust, efficient, and agile technology platform capable of adapting to future market demands.

- Driving Innovation: The new platform facilitates data-driven underwriting and product innovation, enhancing the quality and precision of insurance services.

- Improving Efficiency: Technological upgrades are set to reduce operational friction and lower long-term expense ratios, reflecting a more sustainable operational model.

SDG 11: Sustainable Cities and Communities

As a property and casualty insurer, Donegal plays a fundamental role in making communities safer and more resilient.

- Mitigating Financial Shocks: The company’s core business of insuring property against catastrophic loss is essential for helping communities and businesses recover from disasters.

- Supporting Local Economies: By focusing on middle-market commercial accounts, Donegal supports the enterprises that form the economic backbone of many communities.

Conclusion and Strategic Outlook

Donegal Group’s strategic turnaround, built on underwriting discipline, technological modernization, and prudent investment, has established a foundation for sustainable growth. This approach not only enhances shareholder value but also aligns with key principles of sustainable development by fostering economic stability, promoting innovation, and building resilient communities.

- Key Metrics: The positive trends in the core loss ratio, expense ratio, and book value per share validate the effectiveness of the current strategy.

- Competitive Advantage: A modernized operational platform and a clear focus on underserved market segments position Donegal to outperform competitors in a fragmented P&C market.

- Investment Implications: The company presents a compelling case for investors seeking exposure to a resilient and disciplined insurer committed to long-term, sustainable value creation.

Analysis of Sustainable Development Goals (SDGs) in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 8: Decent Work and Economic Growth

The article focuses on Donegal Group’s strategy for achieving “sustainable profitability” and “long-term value,” which are fundamental to stable economic growth. It details how the company’s “disciplined execution” and “strategic reinvention” contribute to its own economic health and stability within the insurance sector. The emphasis on “operational excellence” and “technological foresight” to boost “shareholder returns” directly relates to fostering economic productivity.

-

SDG 9: Industry, Innovation, and Infrastructure

This goal is central to the article, which extensively discusses Donegal’s “multi-year systems modernization project.” This project involves creating a “unified, modern technology stack,” which is a form of building resilient technological infrastructure. The article states this modernization is a “catalyst for operational excellence” and enhances “underwriting precision,” directly linking to the themes of innovation and upgrading industrial capabilities.

-

SDG 12: Responsible Consumption and Production

The article highlights Donegal’s “quality over quantity” approach and “underwriting discipline,” which can be interpreted as a form of responsible corporate practice. By “pruning of underperforming personal lines business” and prioritizing “profitable growth” over chasing market share, the company is adopting a sustainable business model that avoids the “costly rate wars” and “short-termism” that plague the sector. This reflects a commitment to sustainable management and efficient use of corporate resources (capital).

-

SDG 13: Climate Action

While not explicitly mentioned, this SDG is relevant because the article discusses “catastrophic losses” as a “perennial threat” for a property and casualty (P&C) insurer. Climate change is a primary driver of increased frequency and severity of such events. Donegal’s strategy of “underwriting discipline” and “risk management” is a direct measure to strengthen its financial resilience and adaptive capacity to these climate-related hazards.

-

SDG 16: Peace, Justice, and Strong Institutions

The article describes a company focused on building a strong, accountable, and effective institution. Phrases like “disciplined execution,” “operational rigor,” “prudent capital allocation,” and management’s emphasis on “cost control” and “organizational alignment” all point to the development of a well-governed and transparent corporate entity. The strategy of prioritizing “long-term value over short-term gains” is a hallmark of responsible institutional management.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation.

The article’s detailed description of the “systems modernization project” directly aligns with this target. The new platform is designed to “enhance underwriting precision” and “reduce operational friction,” which are clear efforts to increase economic productivity through technological upgrading and innovation within the company.

-

Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure…to support economic development.

Donegal’s investment in a “unified, modern technology stack” represents the development of reliable and resilient digital infrastructure. The article explains this is not just a “cost-cutting exercise” but a “strategic investment in agility” that forms the foundation for the company’s future growth and stability, thereby supporting its economic development.

-

Target 12.6: Encourage companies…to adopt sustainable practices and to integrate sustainability information into their reporting cycle.

The entire article is an analysis of Donegal’s sustainable practices, such as “underwriting discipline,” “investment prudence,” and a focus on “long-term value.” The key metrics highlighted for investors—”core loss ratio,” “expense ratio,” and “book value per share”—are examples of how sustainability information (in a business context) is used to measure performance and is integrated into communications with stakeholders.

-

Target 13.1: Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters.

As a P&C insurer, managing risk from “catastrophic losses” is a core function. The article explains how Donegal’s “proactive pricing power” and “underwriting discipline” serve to “stabilize margins” and manage risk. These actions directly build the company’s financial resilience against the impacts of natural disasters, which are increasingly influenced by climate change.

-

Target 16.6: Develop effective, accountable and transparent institutions at all levels.

The article portrays Donegal’s management as creating an effective and accountable institution through “disciplined execution,” “operational rigor,” and “prudent capital allocation.” The focus on transparent metrics like the loss ratio and expense ratio, and the clear strategy of avoiding “short-termism,” demonstrates a commitment to building a strong and well-governed corporate institution.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Core Loss Ratio

This is a direct indicator of underwriting health and risk management. The article states that a “3.5-point decline in its core loss ratio” was achieved in 2024, which measures progress towards Target 13.1 (resilience to hazards) and Target 12.6 (sustainable practices).

-

Expense Ratio

This indicator measures operational efficiency. The article notes the expense ratio was “32.2% in Q2 2025” and is “expected to decline meaningfully” post-modernization. This directly measures progress in resource efficiency related to Target 8.2 (economic productivity) and Target 9.1 (benefits of new infrastructure).

-

Book Value Per Share

This is an indicator of capital preservation and growth, reflecting overall institutional health and prudent investment. The article cites its increase “from $15.36 in late 2024 to $16.62 by mid-2025” as a key measure of success, relevant to Target 16.6 (effective institutions).

-

Investment Yield and Portfolio Composition

The rise in investment yield to “3.5% in Q2 2025” and the allocation of “95.4% of its assets…to high-quality fixed-maturity securities” are specific indicators of the company’s “prudent capital allocation.” This measures the effectiveness of the strategy for sustainable financial management, relevant to Target 12.6 and Target 16.6.

-

Completion of Systems Modernization

The “final deployment of its commercial lines platform in Q2 2025” is a milestone indicator. It marks the successful implementation of the technological upgrade, measuring progress towards Target 9.1 (developing resilient infrastructure) and Target 8.2 (technological upgrading).

SDGs, Targets, and Indicators Summary

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | 8.2: Achieve higher levels of economic productivity through technological upgrading and innovation. |

|

| SDG 9: Industry, Innovation, and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure to support economic development. |

|

| SDG 12: Responsible Consumption and Production | 12.6: Encourage companies to adopt sustainable practices and integrate sustainability information into their reporting cycle. |

|

| SDG 13: Climate Action | 13.1: Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters. |

|

| SDG 16: Peace, Justice, and Strong Institutions | 16.6: Develop effective, accountable and transparent institutions at all levels. |

|

Source: ainvest.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

:focal(2620,1821)/https://media.globalcitizen.org/60/0a/600a77ce-594c-49ce-b428-dd977e3d2328/d4_csdw_thailand_2149_1.jpg?#)