Investors in A-Living Smart City Services (HKG:3319) from five years ago are still down 85%, even after 12% gain this past week – Simply Wall St

Analysis of A-Living Smart City Services Co., Ltd.

It is doubtless a positive to see that the A-Living Smart City Services Co., Ltd. (HKG:3319) share price has gained some 32% in the last three months. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 86% in that time. So we don’t gain too much confidence from the recent recovery. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don’t have to lose the lesson.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let’s see what the fundamentals can tell us.

Overview of A-Living Smart City Services

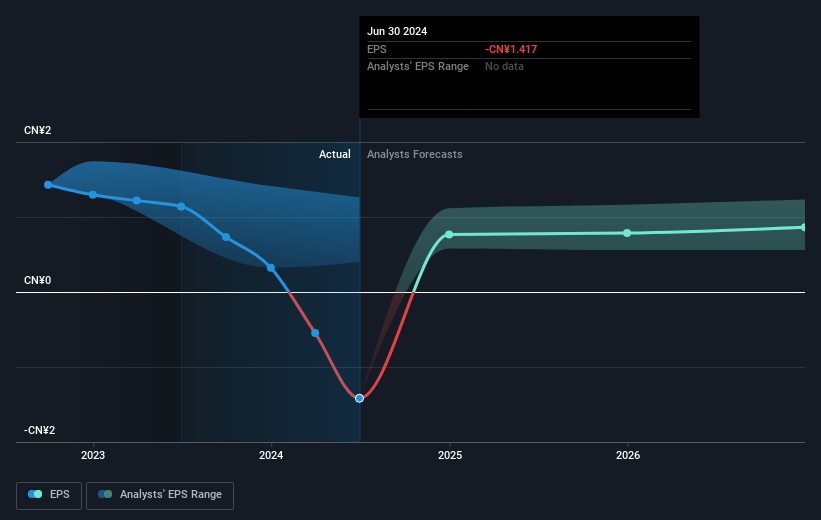

In his essay “The Superinvestors of Graham-and-Doddsville,” Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

In the last half decade, A-Living Smart City Services saw its share price fall as its EPS declined below zero. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss-making position, it’s hard to compare the change in EPS with the share price change. However, we can say we’d expect to see a falling share price in this scenario.

The company’s earnings per share (over time) is depicted in the image below:

It’s probably worth noting that the CEO is paid less than the median at similar-sized companies. It’s always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on A-Living Smart City Services’ earnings, revenue, and cash flow.

A Different Perspective

While the broader market gained around 22% in the last year, A-Living Smart City Services shareholders lost 7.8% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business before getting too interested. Unfortunately, longer-term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We’d need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It’s always interesting to track share price performance over the longer term. But to understand A-Living Smart City Services better, we need to consider many other factors. For example, we’ve discovered 1 warning sign for A-Living Smart City Services that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

- Connect an unlimited number of Portfolios and see your total in one currency

- Be alerted to new Warning Signs or Risks via email or mobile

- Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

SDGs, Targets, and Indicators

-

SDG 8: Decent Work and Economic Growth

- Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading, and innovation

- Indicator 8.2.1: Annual growth rate of real GDP per capita

-

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.2: Promote inclusive and sustainable industrialization and foster innovation

- Indicator 9.2.1: Manufacturing value added as a proportion of GDP and per capita

-

SDG 11: Sustainable Cities and Communities

- Target 11.1: By 2030, ensure access for all to adequate, safe, and affordable housing and basic services and upgrade slums

- Indicator 11.1.1: Proportion of urban population living in slums, informal settlements, or inadequate housing

Analysis

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The issues highlighted in the article are connected to SDG 8 (Decent Work and Economic Growth), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 11 (Sustainable Cities and Communities).

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the article’s content, the specific targets that can be identified are:

- Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading, and innovation

- Target 9.2: Promote inclusive and sustainable industrialization and foster innovation

- Target 11.1: By 2030, ensure access for all to adequate, safe, and affordable housing and basic services and upgrade slums

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Yes, there are indicators mentioned or implied in the article that can be used to measure progress towards the identified targets:

- Indicator 8.2.1: Annual growth rate of real GDP per capita

- Indicator 9.2.1: Manufacturing value added as a proportion of GDP and per capita

- Indicator 11.1.1: Proportion of urban population living in slums, informal settlements, or inadequate housing

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading, and innovation | Indicator 8.2.1: Annual growth rate of real GDP per capita |

| SDG 9: Industry, Innovation, and Infrastructure | Target 9.2: Promote inclusive and sustainable industrialization and foster innovation | Indicator 9.2.1: Manufacturing value added as a proportion of GDP and per capita |

| SDG 11: Sustainable Cities and Communities | Target 11.1: By 2030, ensure access for all to adequate, safe, and affordable housing and basic services and upgrade slums | Indicator 11.1.1: Proportion of urban population living in slums, informal settlements, or inadequate housing |

Source: simplywall.st