Kansas City low-income housing non-profit gets 400% increase in property value assessment, may cut services – KSHB 41 Kansas City

Report on Property Value Assessment Increases and Impact on Sustainable Development Goals in Jackson County

Introduction

Jackson County, Missouri, is experiencing unexpectedly high property value assessments among commercial property owners. This report highlights the recent developments, focusing on the challenges faced by local businesses and non-profit organizations, particularly emphasizing the implications for the United Nations Sustainable Development Goals (SDGs).

Workshop on Appeal Process

On Thursday night, a workshop led by Jackson County Legislator Sean Smith was held to educate commercial property owners about the appeal process for property value assessments. Attendees shared concerns about significant increases in their property valuations.

Case Study: Credit & Homeownership Empowerment Services (CHES Inc.)

CHES Inc., a Hyde Park-based non-profit providing financial housing resources to low- and moderate-income families, reported a 400% increase in property value assessment compared to the previous year.

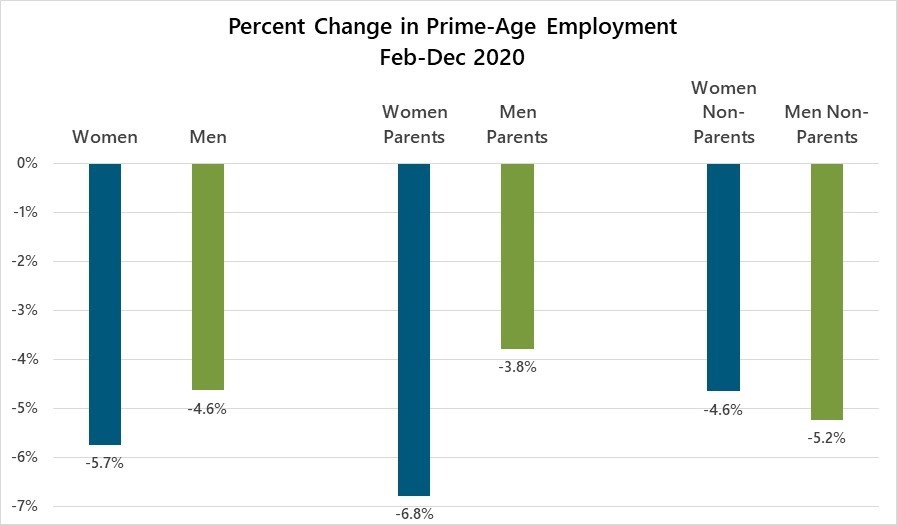

- CHES Inc. provided $17 million in federal rent, utility, and mortgage assistance during the COVID-19 pandemic.

- The organization purchased a dilapidated building in 2013 and has since renovated it to serve as its headquarters.

- CHES Inc. chose not to take non-profit property tax breaks to invest in the sustainability of the organization and neighborhood revitalization.

Property Value Assessment Increase Details

- The 2025 property value assessment for CHES Inc.’s central building increased by $666,600, reaching a market value of $875,400.

- In 2023, the same property was valued at $52,900.

- CHES Inc. owns three additional properties, all experiencing significant assessment increases.

Challenges and Concerns

- CHES Inc. is concerned about sustaining its services to low-income families amid rising property taxes.

- The organization is actively appealing the assessment increases to avoid cutting essential community services.

- Other local businesses and non-profits face similar challenges, risking closure or reduced operations due to increased costs.

Expert Insights on Appeal Process

Stacey Johnson-Cosby, a Kansas City realtor working with Legislator Smith, emphasized the importance of data in the appeal process:

- Property owners must present convincing evidence to challenge inaccurate valuations.

- Incorrect assessments could have devastating ripple effects on community services and local businesses.

Implications for Sustainable Development Goals (SDGs)

The situation in Jackson County intersects with several SDGs, including:

- SDG 1: No Poverty – CHES Inc.’s support for low-income families is critical in reducing poverty and preventing homelessness.

- SDG 11: Sustainable Cities and Communities – The organization’s investment in neighborhood revitalization promotes sustainable urban development.

- SDG 8: Decent Work and Economic Growth – The financial strain on businesses threatens local economic stability and job creation.

- SDG 10: Reduced Inequalities – Rising property taxes disproportionately affect non-profits serving vulnerable populations, exacerbating social inequalities.

Conclusion and Recommendations

- Jackson County authorities should consider phased or gradual property value increases to avoid sudden financial burdens on non-profits and small businesses.

- Enhanced transparency and data accuracy in property assessments are essential to prevent unjustified tax hikes.

- Support mechanisms should be strengthened to ensure organizations contributing to SDGs can continue their vital work without disruption.

- Community stakeholders must be engaged in dialogue to balance fiscal policies with social sustainability goals.

CHES Inc. and other affected entities remain committed to appealing the assessments and advocating for fair treatment to sustain their contributions toward achieving the Sustainable Development Goals in Jackson County.

1. Sustainable Development Goals (SDGs) Addressed or Connected

- SDG 1: No Poverty

- The article discusses a non-profit organization (CHES Inc.) providing financial housing resources and assistance to low and moderate income families, which directly relates to poverty alleviation.

- SDG 10: Reduced Inequalities

- The focus on low-income housing and the impact of increased property taxes on non-profits and small businesses highlights issues of inequality and social inclusion.

- SDG 11: Sustainable Cities and Communities

- The article mentions revitalization and preservation of buildings and neighborhoods, emphasizing sustainable urban development.

- SDG 16: Peace, Justice and Strong Institutions

- The appeal process for property tax assessments and the need for transparent, fair valuation systems relate to access to justice and accountable institutions.

2. Specific Targets Under the Identified SDGs

- SDG 1: No Poverty

- Target 1.2: By 2030, reduce at least by half the proportion of men, women and children living in poverty in all its dimensions according to national definitions.

- Target 1.4: Ensure that all men and women have equal rights to economic resources, as well as access to basic services, ownership and control over property.

- SDG 10: Reduced Inequalities

- Target 10.2: Empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status.

- SDG 11: Sustainable Cities and Communities

- Target 11.1: By 2030, ensure access for all to adequate, safe and affordable housing and basic services and upgrade slums.

- Target 11.3: Enhance inclusive and sustainable urbanization and capacity for participatory, integrated and sustainable human settlement planning and management.

- SDG 16: Peace, Justice and Strong Institutions

- Target 16.6: Develop effective, accountable and transparent institutions at all levels.

- Target 16.7: Ensure responsive, inclusive, participatory and representative decision-making at all levels.

3. Indicators Mentioned or Implied to Measure Progress

- Property Value Assessments and Appeals

- The article implies the use of property value assessment data as an indicator to measure fairness and accuracy in taxation, which affects economic inclusion and sustainability.

- Number and success rate of appeals filed by property owners can serve as an indicator of access to justice and institutional accountability.

- Financial Assistance Distributed

- The $17 million in federal, rent, utility, and mortgage assistance provided by CHES Inc. during the COVID-19 pandemic can be an indicator of support to vulnerable populations.

- Impact on Non-Profit and Business Operations

- Indicators related to the continuity of services by non-profits and the operational status of small businesses can measure the socio-economic impact of property tax increases.

- Urban Revitalization Efforts

- Indicators such as the number of buildings renovated and preserved, and investments in neighborhood revitalization, reflect progress towards sustainable urban development.

4. Table of SDGs, Targets and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 1: No Poverty |

|

|

| SDG 10: Reduced Inequalities |

|

|

| SDG 11: Sustainable Cities and Communities |

|

|

| SDG 16: Peace, Justice and Strong Institutions |

|

|

Source: kshb.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0