US sanctions could cause chaos on Latam farms run on Russian fertilizers – Reuters

Report on the Impact of Potential Fertilizer Sanctions on Latin American Agriculture and Sustainable Development Goals

Executive Summary: Geopolitical Tensions and Threats to Global Food Security

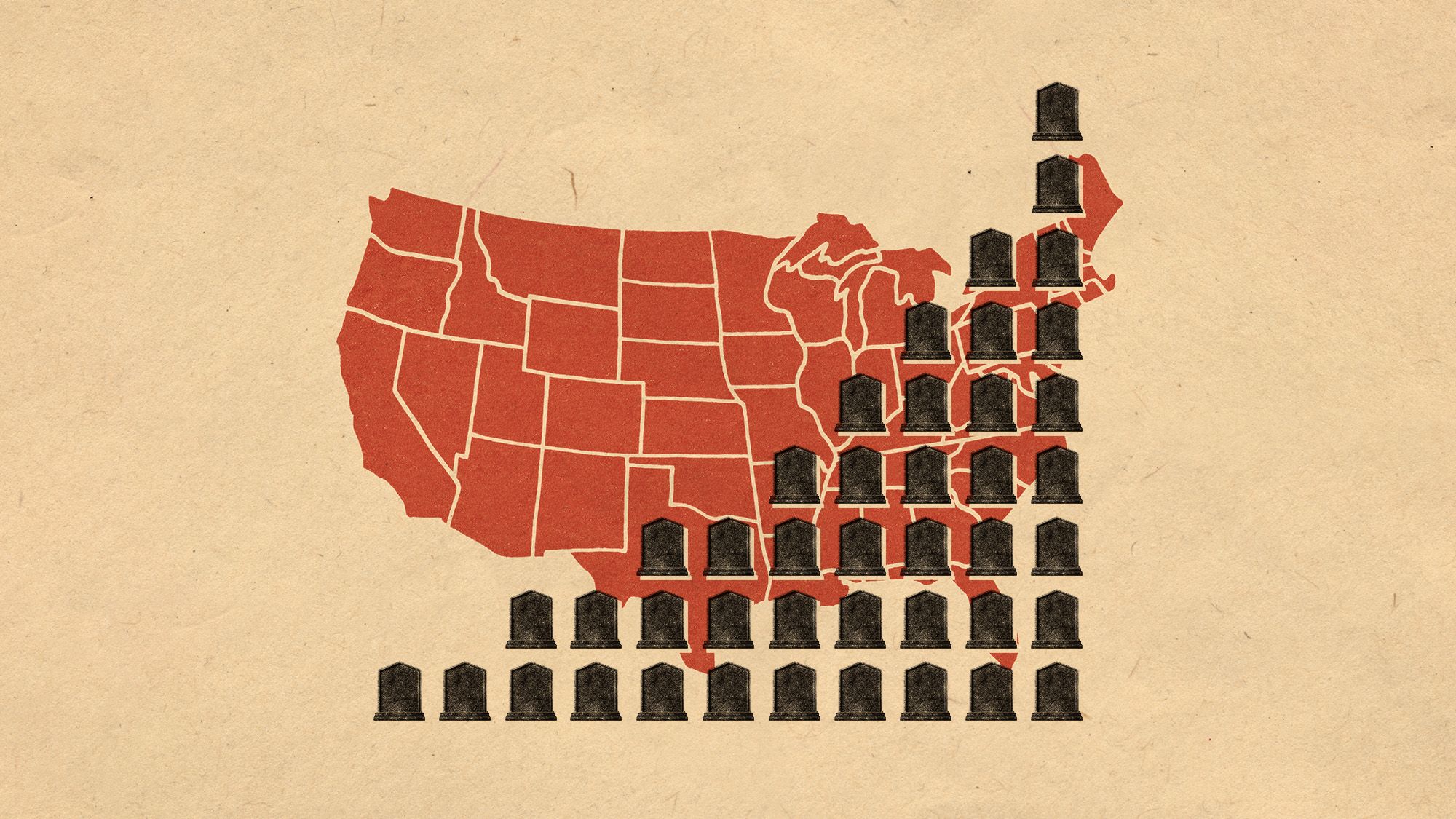

Potential United States secondary sanctions targeting buyers of Russian fertilizer exports pose a significant threat to agricultural stability and food security across Latin America. This geopolitical development directly challenges the achievement of multiple Sustainable Development Goals (SDGs), particularly those concerning poverty, hunger, and economic stability.

- The sanctions risk creating severe disruptions for agricultural powerhouses like Brazil, Mexico, and Colombia, which are heavily dependent on Russian fertilizer imports for their cash crops.

- This dependency places progress on SDG 2 (Zero Hunger) at immediate risk by threatening crop yields and food affordability.

- The economic fallout for the agricultural sector could reverse gains made toward SDG 1 (No Poverty) and SDG 8 (Decent Work and Economic Growth) by jeopardizing farmer livelihoods and national economies.

Direct Implications for Sustainable Development Goal 2 (Zero Hunger)

The availability of fertilizer is a fundamental component of modern agricultural productivity and, by extension, global food security. A disruption in the supply of Russian fertilizers would have immediate and severe consequences for food production, directly undermining the objectives of SDG 2.

- Threatened Crop Production: Key food and export crops, including Brazilian soybeans and corn and Mexican avocados, are reliant on these imports. An agricultural group in Brazil warned that sanctions could render soybean and corn production “inviable.”

- Food Inflation and Accessibility: The World Bank has already identified high fertilizer costs as a primary driver of food inflation in Central America. Further price increases would exacerbate the existing cost-of-living crisis, making food less accessible for vulnerable populations and contributing to regional migration.

- Reduced Food Quality: In Mexico, officials warn that a loss of Russian imports could lead to a drop-off in the quality of available fertilizers, potentially weakening avocado production and affecting food supply chains.

Economic and Social Repercussions: A Challenge to SDG 1 and SDG 8

The agricultural sector is a cornerstone of economic activity and employment in Latin America. The proposed sanctions threaten to destabilize this vital sector, creating significant obstacles to achieving economic and social development goals.

- Jeopardized Livelihoods: A decline in agricultural productivity would directly reduce the income of millions of farmers, increasing poverty rates and hampering progress on SDG 1 (No Poverty).

- Economic Instability: The potential disruption to major agricultural industries threatens national economic growth and stability, conflicting with the aims of SDG 8 (Decent Work and Economic Growth).

- Disrupted Trade Partnerships: The vital avocado trade between Mexico and the United States, a market valued at over $3 billion, is cited as a specific economic partnership at risk.

Country-Specific Vulnerabilities and Dependency

Brazil

- As the world’s largest producer of soybeans, sugar, and coffee, Brazil’s agricultural output has global significance.

- The nation sourced approximately one-third of its fertilizer needs from Russia last year, with imports valued at $3.7 billion.

- Imports from Russia rose nearly 30% in the first half of this year, indicating a deepening dependency.

- Industry experts report there is “virtually no alternative” to fill the supply gap if Russian imports are halted.

Mexico

- Russia is Mexico’s largest supplier of fertilizers, with imports exceeding $580 million last year.

- Russian urea is critical for major crops such as corn, sorghum, wheat, and avocados.

- Sanctions would impact the quality of available fertilizers and could increase consumer prices for key exports to the U.S. market.

Colombia

- Russia supplies approximately a quarter of the nation’s fertilizer imports.

- The nation is a key producer of fruits, flowers, and coffee, much of which is exported to the United States.

National Strategies and Challenges in Achieving SDG 12 (Responsible Consumption and Production)

In response to supply chain vulnerabilities, both Brazil and Mexico have announced plans to boost domestic fertilizer production. These initiatives align with SDG 12 by aiming for more self-sufficient and resilient production patterns, but they face significant hurdles.

- Stated Goals: Brazil aims to nearly halve its reliance on foreign fertilizers, while Mexico intends to increase domestic production to cover 80% of local demand.

- Implementation Challenges: Progress has been slow due to factors including lack of funding, the high cost of natural gas (a key input for nitrogen fertilizers), and the struggle of state-owned companies like Petrobras and Pemex to make fertilizer production profitable.

- Environmental Trade-Offs: A potential solution, the Brazil Potash Corp mining project in the Amazon, highlights a conflict between development goals. While it could enhance food security (SDG 2), it raises significant environmental concerns related to SDG 15 (Life on Land).

Conclusion: Global Interdependence and the Future of Sustainable Agriculture

The potential sanctions on Russian fertilizers underscore the fragility of global supply chains and their profound impact on the 2030 Agenda for Sustainable Development. The situation reveals a critical tension between geopolitical actions and the fundamental requirements for achieving global food security and economic stability.

- Market volatility is already increasing, with geopolitical tensions delaying fertilizer sales to farmers and compromising timely deliveries for critical planting seasons.

- This reliance on a single major supplier for a critical agricultural input demonstrates a lack of resilience that is inconsistent with the principles of SDG 17 (Partnerships for the Goals).

- Meanwhile, Russian producers anticipate increasing their global market share to 25% by 2030, focusing on sales to BRICS nations. This signals a potential realignment of global trade that will continue to shape the landscape for sustainable development.

SDGs Addressed in the Article

-

SDG 2: Zero Hunger

The article extensively discusses the production of essential food and cash crops like soybeans, corn, wheat, and avocados in Latin America. The potential disruption of fertilizer supply directly threatens agricultural productivity and food security, which is the core focus of SDG 2. The article highlights how sanctions could make “soybean and corn production inviable” and affect the quality and price of food, such as avocados.

-

SDG 8: Decent Work and Economic Growth

The agricultural sector is a significant contributor to the economies of Brazil and Mexico. The article mentions Mexico’s avocado exports are a market “worth more than $3 billion last year.” A crisis in this sector, caused by fertilizer shortages, would threaten jobs, income for farmers, and the overall economic growth of these nations, connecting directly to the goals of economic productivity and growth.

-

SDG 12: Responsible Consumption and Production

The article touches upon the heavy reliance of Latin American countries on imported Russian fertilizers. It also details efforts by Brazil and Mexico to become more self-sufficient by boosting domestic production. This shift towards localizing production and reducing dependence on a single foreign source aligns with achieving more sustainable and resilient production patterns for essential agricultural inputs.

-

SDG 17: Partnerships for the Goals

The central theme of the article is international trade, geopolitical tensions, and sanctions. It describes the trade relationship between Russia and Latin American countries (Brazil, Mexico, Colombia) for fertilizers. The threat of “secondary sanctions” disrupting this trade highlights the fragility of global partnerships and supply chains, which is a key concern of SDG 17.

Specific SDG Targets Identified

-

Target 2.c: Adopt measures to ensure the proper functioning of food commodity markets and their derivatives and facilitate timely access to market information, including on food reserves, in order to help limit extreme food price volatility.

The article directly addresses this target by discussing how the war in Ukraine initially caused fertilizer prices to soar and how potential new sanctions could “feed volatility” in pricing. The World Bank is cited as identifying “fertilizer costs as a driver of food inflation,” which directly relates to food price volatility.

-

Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation, including through a focus on high-value added and labour-intensive sectors.

The article shows how the agricultural sectors in Brazil and Mexico are high-value sectors (e.g., soybeans, avocados). The reliance on specific types of imported fertilizers is a key technological component of their productivity. A disruption would negatively impact this productivity, as warned by a former Mexican official who noted a potential “drop-off in the quality of fertilizers available.”

-

Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources.

Fertilizer is a key natural resource for modern agriculture. The article highlights the unsustainable reliance on a single external source. The stated goals of Brazil to “nearly halve its reliance on foreign fertilizers” and Mexico to “boost domestic production from 33% to 80% of local demand” are direct efforts to achieve more sustainable management and efficient use of this resource by localizing the supply chain.

-

Target 17.11: Significantly increase the exports of developing countries.

The article underscores the importance of agricultural exports for countries like Mexico, where the U.S. “accounts for more than 80% of Mexico’s total avocado exports.” Sanctions that disrupt fertilizer supply could weaken production, increase prices, and ultimately threaten the volume and value of these crucial exports from developing nations.

Indicators for Measuring Progress

-

Indicators for SDG 2 (Zero Hunger)

The article implies several indicators. Progress can be measured by tracking:

- Food price inflation: The article explicitly mentions “fertilizer costs as a driver of food inflation.” Monitoring the consumer price index for food would be a relevant indicator.

- Agricultural commodity prices: The text states, “The price of avocados would increase.” Tracking the market price of key crops like avocados, soybeans, and corn is a direct indicator.

- Agricultural productivity/yield: The concern about a “drop-off in the quality of fertilizers” and production becoming “inviable” points to agricultural yield (tons per hectare) as a key metric.

-

Indicators for SDG 8 (Decent Work and Economic Growth)

The article provides data points that can be used as indicators:

- Value of agricultural exports: The article quantifies Mexico’s avocado export market at “more than $3 billion last year.” This figure serves as a baseline indicator for the economic contribution of the sector.

- Contribution of agriculture to national revenue: The fact that Brazil is the “world’s largest producer of soybeans, sugar and coffee” implies that the revenue from these commodities is a key economic indicator.

-

Indicators for SDG 12 (Responsible Consumption and Production)

Specific metrics are mentioned that can track progress towards self-sufficiency:

- Import dependency rate for fertilizers: The article states Brazil covers “about a third of its fertilizer demand” with Russian imports and Russia provides “about a quarter of Colombia’s fertilizer imports.” These percentages are direct indicators of dependency.

- Domestic production as a share of total consumption: Mexico’s goal to increase its share of domestic production from “33% to 80%” provides a clear, measurable indicator of progress.

-

Indicators for SDG 17 (Partnerships for the Goals)

The article contains trade data that can serve as indicators:

- Value of bilateral trade: The article specifies Brazil’s imports from Russia at “$3.7 billion” and Mexico’s at “more than $580 million” for the last year. These figures can be tracked over time.

- Trade concentration/diversification: The fact that Russia is Mexico’s “largest supplier” is an indicator of trade concentration. A reduction in this reliance would indicate diversification.

Summary of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 2: Zero Hunger | 2.c: Adopt measures to ensure the proper functioning of food commodity markets… to help limit extreme food price volatility. |

|

| SDG 8: Decent Work and Economic Growth | 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation… |

|

| SDG 12: Responsible Consumption and Production | 12.2: Achieve the sustainable management and efficient use of natural resources. |

|

| SDG 17: Partnerships for the Goals | 17.11: Significantly increase the exports of developing countries. |

|

Source: finance.yahoo.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.jpg?#)