500 Global Taps UN SDG Architect, Dr. Alaa Murabit, to Launch Firm’s New Offerings in Sustainable Growth – Business Wire

Report on 500 Global’s Strategic Appointment to Advance Sustainable Development Goals

1.0 Introduction: Appointment of Dr. Alaa Murabit

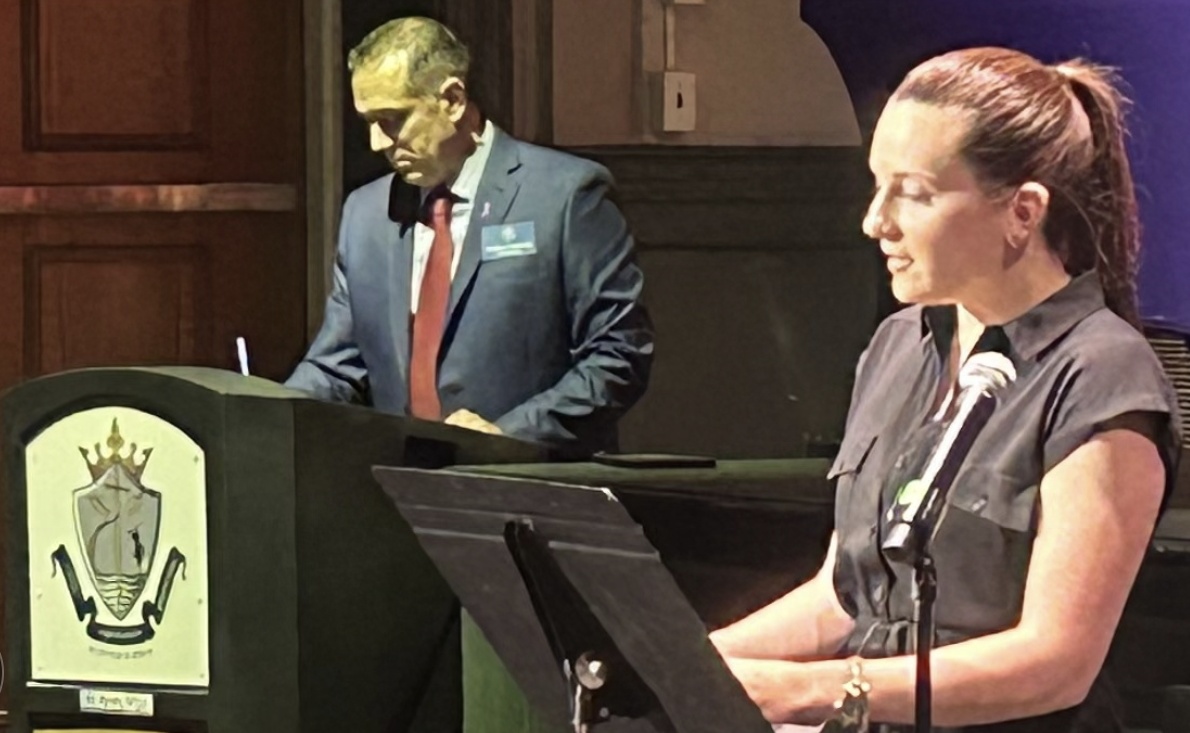

On July 21, 2025, venture capital firm 500 Global announced the appointment of Dr. Alaa Murabit as Managing Partner of Sustainable Growth. This new role oversees the firm’s dedicated Sustainable Growth practice, which is designed to accelerate economic resilience and advance the United Nations Sustainable Development Goals (SDGs) in frontier and emerging markets. Dr. Murabit, a key figure in the creation of the SDGs, will be based in Abu Dhabi, United Arab Emirates, to lead this initiative.

2.0 Mandate of the Sustainable Growth Practice

The Sustainable Growth practice aims to integrate sustainable development into its core investment strategy. The primary objective is to mobilize public, private, and philanthropic capital to achieve tangible economic results that align with global sustainability targets.

2.1 Core Focus Areas and SDG Alignment

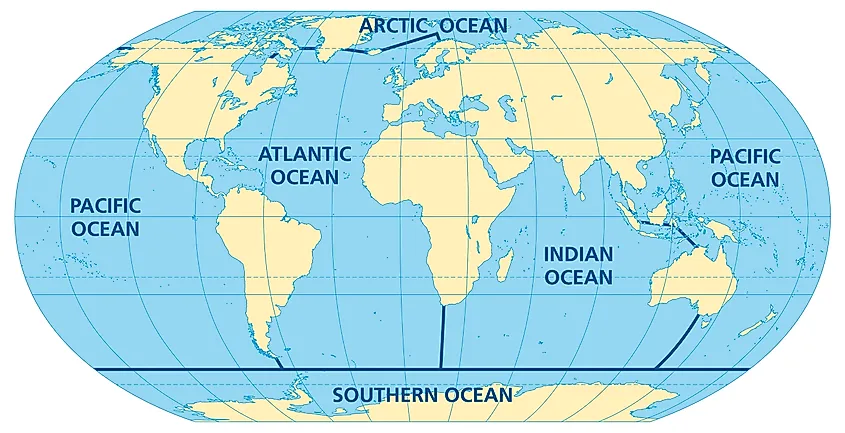

The practice will concentrate on three key pillars, each directly corresponding to several SDGs:

- Climate: Mobilizing capital for climate resilience and mitigation efforts, directly supporting SDG 13 (Climate Action).

- Health: Investing in solutions for global health challenges, including maternal and child health and health security, aligning with SDG 3 (Good Health and Well-being).

- Human Development: Fostering inclusive growth and security, which contributes to SDG 1 (No Poverty), SDG 5 (Gender Equality), SDG 8 (Decent Work and Economic Growth), and SDG 10 (Reduced Inequalities).

2.2 Strategic Initiatives

To achieve these goals, the practice will implement:

- Innovative Financing Strategies: Developing blended finance models to de-risk investments and attract a wider pool of capital.

- Educational and Advisory Platforms: Building capacity and advising governments and stakeholders on supporting entrepreneurial ecosystems.

- Catalytic Initiatives: Launching programs that foster public-private alignment to scale solutions for sustainable development.

3.0 Leadership and Expertise

Dr. Alaa Murabit’s appointment is central to this strategy. Her extensive background provides the necessary expertise to bridge the gap between venture capital and global development agendas.

3.1 Dr. Murabit’s Contributions to Sustainable Development

- Played a pivotal role in the formulation of the United Nations Sustainable Development Goals.

- Mobilized over $25 billion in financing for global health, sustainability, and security initiatives.

- Directed a $300M/year global portfolio at the Gates Foundation, focusing on areas aligned with SDG 3, such as maternal and child health.

- Recognized as a global expert in health, climate, and inclusive security, with experience shaping policies in over 193 countries.

Dr. Murabit’s vision emphasizes redesigning financing systems to prioritize local innovation and align investment with “sustainable, inclusive outcomes,” directly reflecting the ethos of the 2030 Agenda for Sustainable Development.

4.0 500 Global’s Commitment to SDG-Aligned Ecosystem Development

This appointment reinforces 500 Global’s long-term commitment to using venture capital as a tool for national development. The firm’s approach focuses on creating long-term value by aligning with national priorities and the SDGs.

4.1 Strategic Framework

The firm’s strategy is built on several key components that support SDG 17 (Partnerships for the Goals):

- Public-Private Partnerships: Collaborating with governments, sovereign funds, and development finance institutions to co-create localized venture capital infrastructure.

- Blended Finance: Utilizing combined public and private capital to de-risk innovation and scale impact.

- Focus on “Rise Economies”: The 2023 “Rise Report” identified 30 fast-growing economies where targeted venture capital can close funding gaps and accelerate progress toward national development goals, contributing to SDG 8 and SDG 9 (Industry, Innovation and Infrastructure).

According to Courtney Powell, COO & Managing Partner at 500 Global, this strategic direction confirms that venture capital, when aligned with national priorities, can serve as a “catalytic engine for inclusive growth and long-term development impact.”

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 3: Good Health and Well-being

- The article explicitly states that 500 Global’s Sustainable Growth practice will mobilize capital for “health” and “human development.” It also highlights Dr. Alaa Murabit’s background as a “globally recognized expert in health” and her previous role leading “maternal and child health” at the Gates Foundation.

-

SDG 8: Decent Work and Economic Growth

- The central theme of the article is using venture capital as a “catalytic engine for inclusive growth and long-term development impact.” It discusses accelerating “economic resilience,” driving “economic growth and development,” and supporting “entrepreneurial ecosystems” in emerging markets.

-

SDG 10: Reduced Inequalities

- The article identifies “rising inequality” as a major global challenge. The new practice aims to create “resilient, inclusive economic systems” and scale “inclusive economic growth” to ensure that capital reaches communities that are often underserved.

-

SDG 13: Climate Action

- The article mentions that the new practice will mobilize capital for “climate” and addresses the challenge of “climate shocks.” Dr. Murabit’s past work also involved “climate and health security,” linking climate action directly to the firm’s new strategic focus.

-

SDG 17: Partnerships for the Goals

- This goal is a cornerstone of the strategy described. The article repeatedly emphasizes the importance of bringing together “public, private, and philanthropic capital,” using “blended finance,” and forming “public-private partnerships.” It details plans to work with “sovereign funds, governments, development finance institutions, and philanthropies.”

2. What specific targets under those SDGs can be identified based on the article’s content?

-

SDG 3: Good Health and Well-being

- Target 3.1 & 3.2: Reduce global maternal mortality and end preventable deaths of newborns and children under 5. This is directly referenced through Dr. Murabit’s past work at the Gates Foundation, where she directed a “$300M/year global portfolio” that led “maternal and child health.”

-

SDG 8: Decent Work and Economic Growth

- Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation. The article supports this by describing 500 Global’s investment in “fast-growing technology companies” and its focus on “innovation” as a driver of economic growth.

- Target 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation. This is shown by 500 Global’s work advising “governments on how best to support entrepreneurial ecosystems” and “co-creating localized venture capital infrastructure.”

-

SDG 13: Climate Action

- Target 13.a: Implement the commitment to mobilize financial resources for climate action. The article’s focus on creating “financing strategies” and mobilizing “capital” for “climate” in frontier and emerging markets directly aligns with this target.

-

SDG 17: Partnerships for the Goals

- Target 17.3: Mobilize additional financial resources for developing countries from multiple sources. The strategy explicitly aims to “mobilize capital” by bringing together “public, private, and philanthropic capital.”

- Target 17.17: Encourage and promote effective public, public-private and civil society partnerships. The article is built around this concept, highlighting the use of “blended finance,” “public-private alignment,” and collaboration with a wide range of stakeholders including governments and philanthropies.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

- Financial Mobilization for Development: The article mentions that Dr. Murabit has “mobilized over $25 billion in financing for global health, sustainability, and security.” This serves as a direct indicator of financial resource mobilization (relevant to SDG 17).

- Annual Investment in Key Sectors: The mention of a “$300M/year global portfolio” directed by Dr. Murabit for “maternal and child health, climate and health security, and innovation” is a specific indicator of annual financial flows towards SDG 3 and SDG 13.

- Scale of Entrepreneurial Support: The fact that 500 Global has “backed over 5,000 founders representing more than 3,000 companies operating in 80+ countries” is a quantifiable indicator of support for entrepreneurship and innovation (relevant to SDG 8).

- Total Assets Under Management for Sustainable Investment: The firm’s “$2.1B in assets under management” represents the total pool of capital that can be deployed, partly through the new Sustainable Growth practice, to achieve these goals.

- Analysis of Venture Funding Gaps: The “Rise Report,” which “examined potential venture funding gaps” in 30 economies, is an implied indicator or measurement tool used to identify where capital is most needed, guiding progress towards inclusive economic growth (relevant to SDG 8 and SDG 10).

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 3: Good Health and Well-being | 3.1 & 3.2: Reduce maternal mortality and end preventable deaths of newborns and children. | “$300M/year global portfolio” directed at maternal and child health. |

| SDG 8: Decent Work and Economic Growth | 8.2: Achieve higher economic productivity through innovation. 8.3: Promote policies supporting entrepreneurship. |

Backed “over 5,000 founders representing more than 3,000 companies.” The “Rise Report” examining “venture funding gaps.” |

| SDG 10: Reduced Inequalities | Promote inclusive economic systems and growth. | Redesigning financing systems to “share risk more equitably” and serve communities where “global capital reaches communities late — or not at all.” |

| SDG 13: Climate Action | 13.a: Mobilize financial resources for climate action. | Mobilizing capital for “climate” and “climate and health security.” |

| SDG 17: Partnerships for the Goals | 17.3: Mobilize additional financial resources from multiple sources. 17.17: Encourage effective public, public-private and civil society partnerships. |

Mobilized “$25 billion in financing.” Strategy based on “blended finance” and partnerships with “public, private, and philanthropic capital.” |

Source: voiceofalexandria.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0