Assessing HA Sustainable Infrastructure Capital After Recent Clean Energy Investment News and Price Drop – simplywall.st

Executive Summary: HA Sustainable Infrastructure Capital (HASI) and Sustainable Development Goals (SDGs)

This report provides an analysis of HA Sustainable Infrastructure Capital (HASI), a firm whose investment strategy is fundamentally aligned with the United Nations Sustainable Development Goals (SDGs). The company’s focus on financing clean energy and sustainable infrastructure projects directly contributes to SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation, and Infrastructure), SDG 11 (Sustainable Cities and Communities), and SDG 13 (Climate Action). This analysis reviews the company’s recent market performance and valuation through methodologies that assess its financial viability and its role in advancing a sustainable global economy.

Market Performance and SDG Alignment

Recent Stock Performance

The market valuation of HASI has demonstrated recent volatility, which is reflective of the dynamic nature of investment in SDG-related sectors. Key performance indicators include:

- Last Week Performance: -4.2%

- Last Month Performance: -12.1%

- Year-to-Date Performance: +2.1%

This performance occurs within the context of increased investor interest and debate surrounding renewable energy adoption and infrastructure funding, which are central to HASI’s mission.

Core Business Contribution to SDGs

HASI’s strategic investments are integral to achieving key Sustainable Development Goals. The company’s activities create a direct positive impact in the following areas:

- SDG 7 (Affordable and Clean Energy): The company’s primary focus is on financing clean energy projects, which accelerates the transition away from fossil fuels and promotes the adoption of renewable energy sources.

- SDG 9 & 11 (Sustainable Infrastructure & Communities): Through partnerships with municipal agencies and investments in infrastructure, HASI helps build resilient infrastructure and fosters the development of sustainable cities and communities.

- SDG 13 (Climate Action): By channeling capital into green projects, the company plays a crucial role in climate change mitigation and supports broader initiatives for climate action.

Financial Valuation in the Context of Sustainable Investment

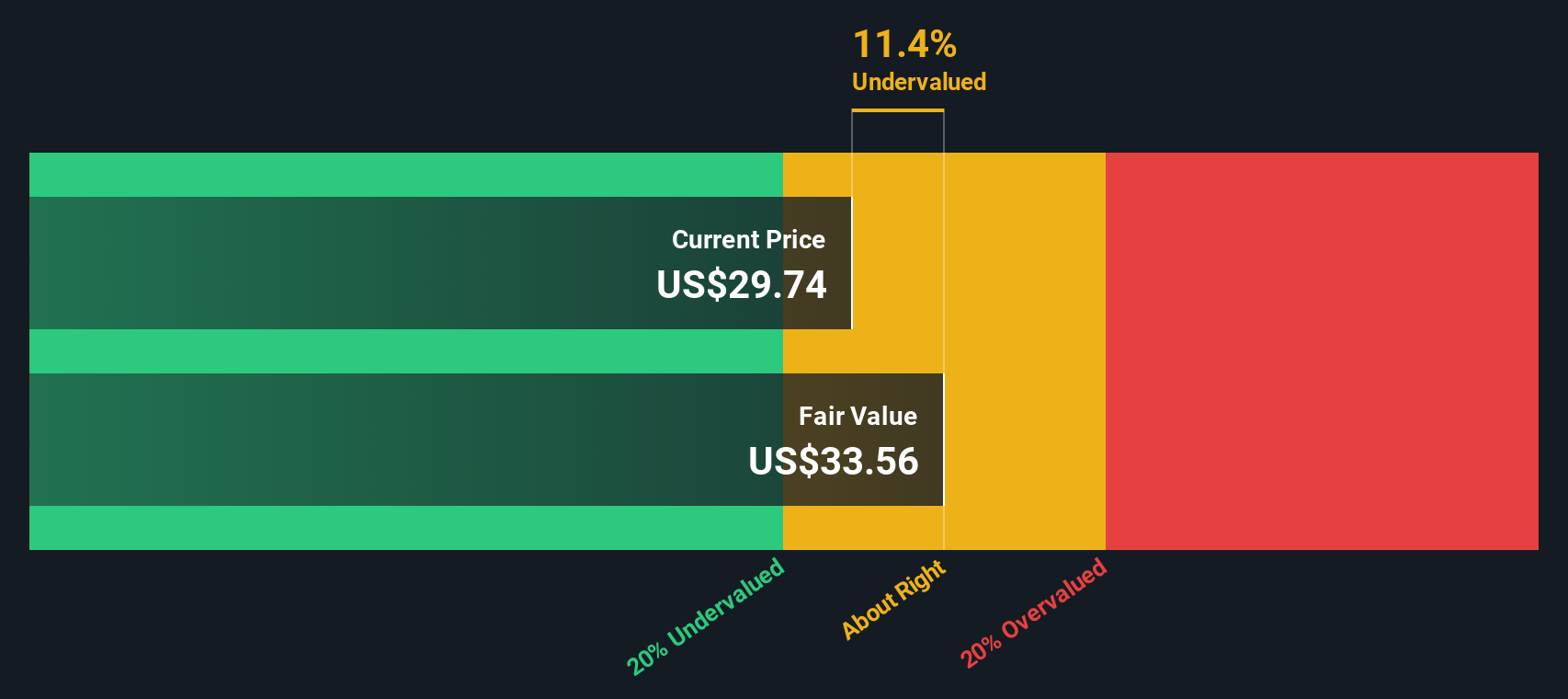

Assessing the value of HASI requires a dual approach that considers traditional financial metrics alongside the company’s significant contributions to sustainable development. Two primary valuation models offer different perspectives on its current market price.

Analysis 1: Excess Returns Model

The Excess Returns model evaluates how efficiently a company utilizes shareholder capital to generate profits beyond its cost of equity. This is a key indicator of sustainable economic performance, aligning with SDG 8 (Decent Work and Economic Growth). The analysis yields the following data points:

- Book Value: $20.39 per share

- Analyst-Expected EPS: $3.05 per share

- Return on Equity: 13.47%

- Valuation Conclusion: UNDERVALUED. The model estimates an intrinsic value 14.9% above the current share price, suggesting that the market may not have fully priced in the long-term value of its SDG-aligned asset portfolio.

Analysis 2: Price-to-Earnings (PE) Ratio

The PE ratio provides a measure of market sentiment by comparing the company’s stock price to its earnings per share. This metric is useful for understanding how investors value the earnings generated from its sustainable infrastructure investments.

- HASI PE Ratio: 16.85x

- Diversified Financial Industry Average PE: 15.12x

- Proprietary “Fair Ratio” Estimate: 14.91x

- Valuation Conclusion: ABOUT RIGHT. The company’s PE ratio is only slightly above the Fair Ratio, suggesting that the market is pricing the stock appropriately based on its current earnings power, which is derived directly from its SDG-focused operations.

Outlook and Investor Perspectives on SDG Impact

Narrative-Based Valuation Scenarios

Investor perspectives on HASI’s future value are closely tied to their outlook on the global transition towards a green economy. Different narratives can be constructed to project the company’s long-term potential based on its alignment with the SDGs.

- Optimistic Scenario: Investors who anticipate accelerated growth in the green energy sector may view HASI as significantly undervalued. This perspective assumes that its contributions to SDG 7 and SDG 13 will drive substantial future returns.

- Conservative Scenario: Investors who are more cautious about market volatility and the inherent risks of large-scale infrastructure projects may see the company as fairly valued. This view acknowledges the challenges associated with achieving SDG 9 on a global scale.

Conclusion

HA Sustainable Infrastructure Capital represents a compelling case study in impact investing, where financial performance is inextricably linked to advancing the Sustainable Development Goals. While valuation models provide mixed signals—ranging from undervalued to fairly priced—they collectively highlight the complex task of quantifying the financial worth of a company dedicated to creating long-term sustainable value. The ultimate valuation depends on an investor’s confidence in the global commitment to achieving a sustainable and resilient future.

Analysis of Sustainable Development Goals (SDGs) in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The article discusses HA Sustainable Infrastructure Capital, a company whose core business is directly linked to several Sustainable Development Goals. The following SDGs are addressed:

- SDG 7: Affordable and Clean Energy – The article explicitly mentions the company’s “ongoing investments in clean energy projects” and “initiatives to accelerate renewable energy adoption.” This directly connects the company’s activities to the goal of ensuring access to affordable, reliable, sustainable, and modern energy for all.

- SDG 9: Industry, Innovation and Infrastructure – The company’s name itself, “HA Sustainable Infrastructure Capital,” and its focus on funding infrastructure projects align with this goal. The article refers to “expanded infrastructure funding,” which supports the development of quality, reliable, sustainable, and resilient infrastructure.

- SDG 11: Sustainable Cities and Communities – The mention of “partnerships with municipal agencies” indicates that the company’s infrastructure projects are implemented at the local and city level, contributing to making cities and human settlements inclusive, safe, resilient, and sustainable.

- SDG 17: Partnerships for the Goals – The entire article, which analyzes a publicly-traded company dedicated to financing sustainable projects, exemplifies the mobilization of private sector finance for sustainable development. The “partnerships with municipal agencies” also represent public-private partnerships crucial for achieving the SDGs.

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the activities described, several specific SDG targets can be identified:

- Under SDG 7 (Affordable and Clean Energy):

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. The article’s reference to “initiatives to accelerate renewable energy adoption” directly supports this target.

- Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology, including renewable energy… and promote investment in energy infrastructure and clean energy technology. The company’s business model of channeling capital into “clean energy projects” is a direct mechanism for achieving this target.

- Under SDG 9 (Industry, Innovation and Infrastructure):

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure… to support economic development and human well-being. The company’s focus on “Sustainable Infrastructure” aligns with this target.

- Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes. The investment in “clean energy projects” is a key component of this target.

- Under SDG 17 (Partnerships for the Goals):

- Target 17.17: Encourage and promote effective public, public-private and civil society partnerships, building on the experience and resourcing strategies of partnerships. The mention of “partnerships with municipal agencies” is a clear example of the public-private partnerships this target aims to foster.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

While the article does not cite official UN SDG indicators, it contains several financial and operational metrics that can serve as proxy indicators for measuring progress:

- Financial Investment as an Indicator: The article’s core subject is the financial valuation of a company making “ongoing investments in clean energy projects” and benefiting from “expanded infrastructure funding.” The amount of capital invested by HA Sustainable Infrastructure Capital in these projects can be used as a direct indicator of financial flows towards sustainable infrastructure, relevant to Target 7.a and Target 9.1.

- Company Financial Health Metrics: Metrics such as “Return on Equity of 13.47%,” “EPS of $3.05 per share,” and the stock’s valuation (PE ratio, intrinsic value) are indicators of the financial viability and sustainability of the business model that funds these SDG-related projects. A healthy financial performance suggests that private capital can be successfully and sustainably mobilized for these goals.

- Partnership Formation as an Indicator: The mention of “partnerships with municipal agencies” is a qualitative indicator of progress towards Target 17.17. The number and scale of such partnerships could be quantified to measure the extent of public-private collaboration.

- Rate of Adoption: The phrase “initiatives to accelerate renewable energy adoption” implies that the rate of adoption is a key performance metric for the company’s projects. This rate would be a direct measure of progress towards Target 7.2.

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators (Mentioned or Implied in the Article) |

|---|---|---|

| SDG 7: Affordable and Clean Energy |

|

|

| SDG 9: Industry, Innovation and Infrastructure |

|

|

| SDG 11: Sustainable Cities and Communities |

|

|

| SDG 17: Partnerships for the Goals |

|

|

Source: simplywall.st

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

;Resize=620#)