China keeps benchmark lending rates steady as economic growth stays strong – CNBC

Economic Stability and Sustainable Development: An Analysis of China’s Monetary Policy Stance

Overview of Central Bank Monetary Policy Decision

The People’s Bank of China (PBOC) has maintained its benchmark lending rates, a decision with significant implications for the nation’s progress towards several Sustainable Development Goals (SDGs). This action seeks to balance economic stability with growth pressures, a core tenet of SDG 8 (Decent Work and Economic Growth).

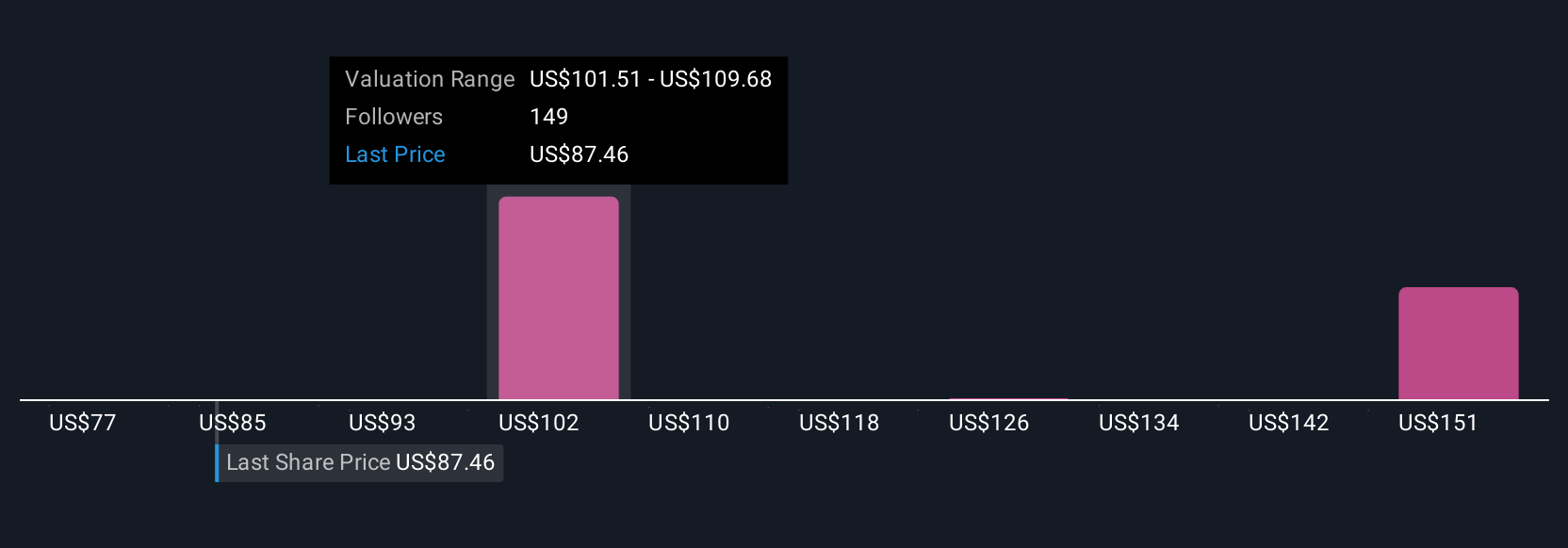

- The 1-year loan prime rate (LPR) was held at 3.0%. This rate is a key determinant for corporate and household loans, directly influencing investment in industry and innovation as outlined in SDG 9 (Industry, Innovation, and Infrastructure).

- The 5-year LPR remains at 3.5%. As the benchmark for mortgage rates, this rate is crucial for the housing market’s stability and affordability, which is central to SDG 11 (Sustainable Cities and Communities).

Current Economic Performance and its Relation to SDG 8

The decision was made against a backdrop of mixed economic signals, which present both opportunities and challenges for achieving the targets of SDG 8.

- Gross Domestic Product (GDP): Second-quarter GDP growth was recorded at 5.2% year-over-year. While this figure is down from the first quarter’s 5.4%, it surpassed the 5.1% forecast, indicating a degree of resilience in the pursuit of sustained economic growth.

- Retail Sales: Growth in retail sales slowed to 4.8% in June from 6.4% in May, falling short of forecasts. This indicates weakening consumer demand, a potential impediment to the inclusive and sustainable economic growth envisioned by SDG 8.

Expert Analysis and Policy Implications for Sustainable Goals

Economic analysis suggests a cautious approach from the PBOC, weighing the effectiveness of monetary tools against other policy options to support long-term sustainable development.

- Limited Urgency for Rate Cuts: With GDP growth currently above the official target, there is a perception that immediate rate cuts are not essential. This reflects a strategy aimed at maintaining long-term financial stability, a prerequisite for sustainable economic progress under SDG 8.

- Effectiveness of Fiscal Measures: It is suggested that fiscal policy may be more effective than further monetary easing in stimulating demand. This highlights the need for a coordinated policy mix to foster investment in infrastructure (SDG 9) and support communities (SDG 11).

- Preservation of Policy Tools: The PBOC may be conserving its monetary policy options (“policy powder”) to counteract future economic shocks, such as the potential impact of U.S. tariffs. This forward-looking stance is vital for ensuring resilience and safeguarding progress towards the SDGs in a volatile global environment, aligning with the principles of SDG 17 (Partnerships for the Goals).

Future Outlook: The ‘Demand Cliff’ and Risks to Sustainable Development

Analysts project significant economic headwinds in the latter half of the year, posing risks to the attainment of multiple SDGs.

- Projected Economic Slowdown: A “demand cliff” is forecast for the second half of the year, with GDP growth expected to drop to 4.0% year-over-year. Such a slowdown would directly challenge the objective of sustained economic growth under SDG 8.

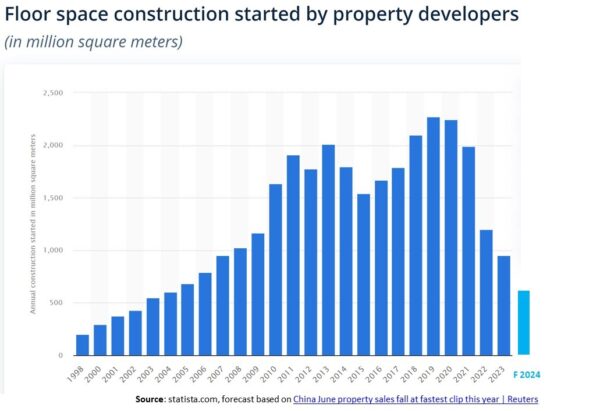

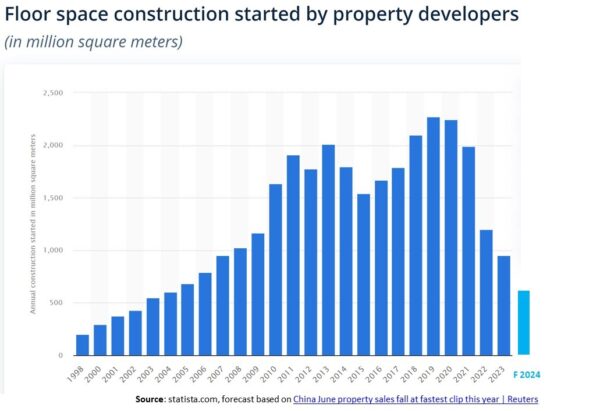

- Contributing Factors: Key drivers of this anticipated slowdown include an export decline linked to international trade policies and a sales contraction in the crucial property sector. These factors threaten not only SDG 8 but also SDG 11 by impacting urban development and housing, and SDG 10 (Reduced Inequalities) by potentially worsening fiscal conditions and affecting employment.

- Anticipated Policy Response: It is expected that Beijing will implement a new round of supportive measures to counteract these negative trends and maintain momentum towards its development goals.

SDGs Addressed in the Article

SDG 8: Decent Work and Economic Growth

- The article’s primary focus is on China’s economic performance, directly aligning with SDG 8, which aims to promote sustained, inclusive, and sustainable economic growth. It discusses key economic metrics such as GDP growth rates, benchmark lending rates, and consumer spending, all of which are central to this goal. The concerns about “softening growth” and a potential “demand cliff” highlight the challenges in maintaining sustained economic activity.

SDG 17: Partnerships for the Goals

- The article touches upon global economic interactions and policies, which are relevant to SDG 17. Specifically, it mentions the “impact of U.S. tariffs on Chinese exports.” This relates to the goal’s emphasis on a universal, rules-based, and non-discriminatory multilateral trading system and the need for global macroeconomic stability, which can be affected by such trade policies.

Identified SDG Targets

SDG 8: Decent Work and Economic Growth

-

Target 8.1: Sustain per capita economic growth.

The article is centered on this target, providing specific figures for China’s economic growth. It states that “GDP growth in the second quarter grew at 5.2% year over year, down from 5.4% in the first quarter” and projects a further drop to “4.0% y-o-y in H2.” This directly addresses the objective of sustaining economic growth. -

Target 8.10: Strengthen the capacity of domestic financial institutions.

The article details the actions and considerations of the People’s Bank of China (PBOC), the country’s central bank. It mentions the PBOC’s decision to hold the “1-year loan prime rate at 3.0% and the 5-year LPR at 3.5%.” This discussion of monetary policy tools and the role of commercial banks in setting the LPR reflects the functioning and capacity of the nation’s domestic financial institutions to manage the economy.

SDG 17: Partnerships for the Goals

-

Target 17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system.

This target is relevant due to the article’s reference to trade barriers. The mention of an “export slowdown resulting from U.S. tariffs” points to a deviation from an open and non-discriminatory trading system, highlighting the negative economic consequences when such principles are not upheld. -

Target 17.13: Enhance global macroeconomic stability.

The article’s entire theme of China grappling with “softening growth,” “weak consumer sentiment,” and potential “disinflationary pressures” speaks to the challenge of maintaining macroeconomic stability. The discussion of external factors like U.S. tariffs and their impact on China’s economy underscores the interconnectedness of national economies and the importance of policy coherence for global stability.

Indicators for Measuring Progress

Indicators for Target 8.1

- Annual growth rate of real GDP: The article explicitly provides this indicator. It states the GDP growth was “5.2% year over year” in Q2, down from “5.4% in the first quarter,” and is projected to fall to “4.0% y-o-y in H2.”

Indicators for Target 8.10

- Benchmark lending rates: The article specifies the “1-year loan prime rate at 3.0% and the 5-year LPR at 3.5%.” These rates are indicators of the central bank’s policy stance and the cost of credit in the economy, reflecting the activity of financial institutions.

- Real interest rates: The article implies this indicator by noting that “real interest rates remain relatively high,” which is a key factor influencing investment and consumption decisions.

Indicators for Target 17.10

- Existence of tariffs: The article directly mentions “U.S. tariffs on Chinese exports” as a negative driver for the economy. The presence of these tariffs serves as a qualitative indicator of trade barriers that are contrary to the goal of an open multilateral trading system.

Indicators for Target 17.13

- Retail sales growth rate: The article provides this data as an indicator of consumer demand and economic health, noting it “slowed to 4.8% from a year earlier, compared with the 6.4% year over year increase in May.”

- Currency exchange rate: The article mentions the currency’s value as an indicator of financial stability, stating “the offshore yuan remained mostly flat, trading at 7.179 against the dollar.”

Summary of Findings

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth |

8.1: Sustain per capita economic growth.

8.10: Strengthen the capacity of domestic financial institutions. |

Annual growth rate of real GDP: Mentioned as 5.2% in Q2, down from 5.4% in Q1, and projected to fall to 4.0%.

Benchmark lending rates: 1-year LPR at 3.0% and 5-year LPR at 3.5%. |

| SDG 17: Partnerships for the Goals |

17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system.

17.13: Enhance global macroeconomic stability. |

Existence of tariffs: “U.S. tariffs on Chinese exports” are cited as a negative economic factor.

Retail sales growth rate: Slowed to 4.8% in June from 6.4% in May. |

Source: cnbc.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0