Crypto Products See 11-Week Green Streak After $2,700,000,000 in Weekly Inflows: CoinShares – The Daily Hodl

Institutional Digital Asset Investment Inflows and Sustainable Development Goals (SDGs) Analysis

Overview of Institutional Digital Asset Inflows

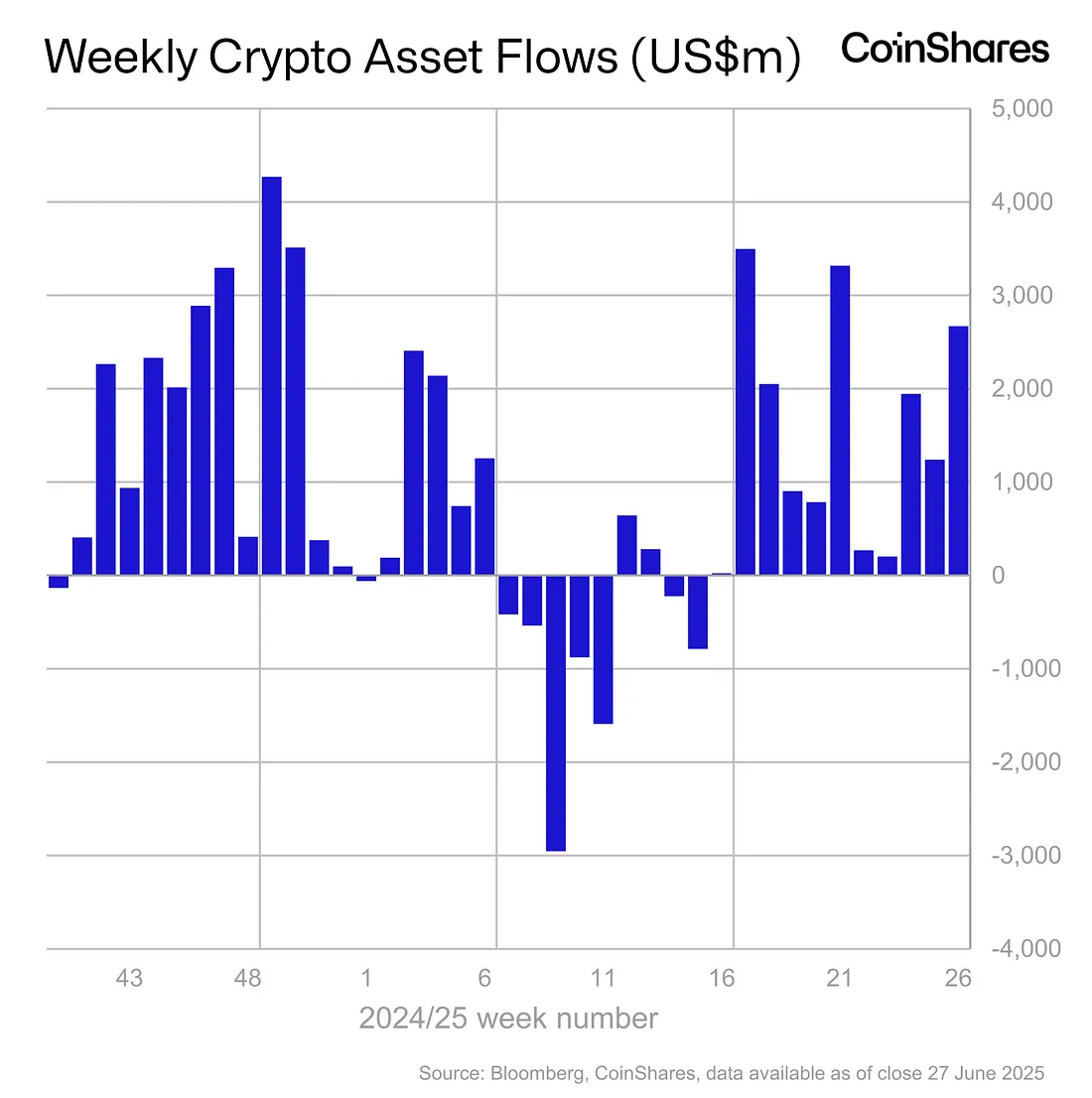

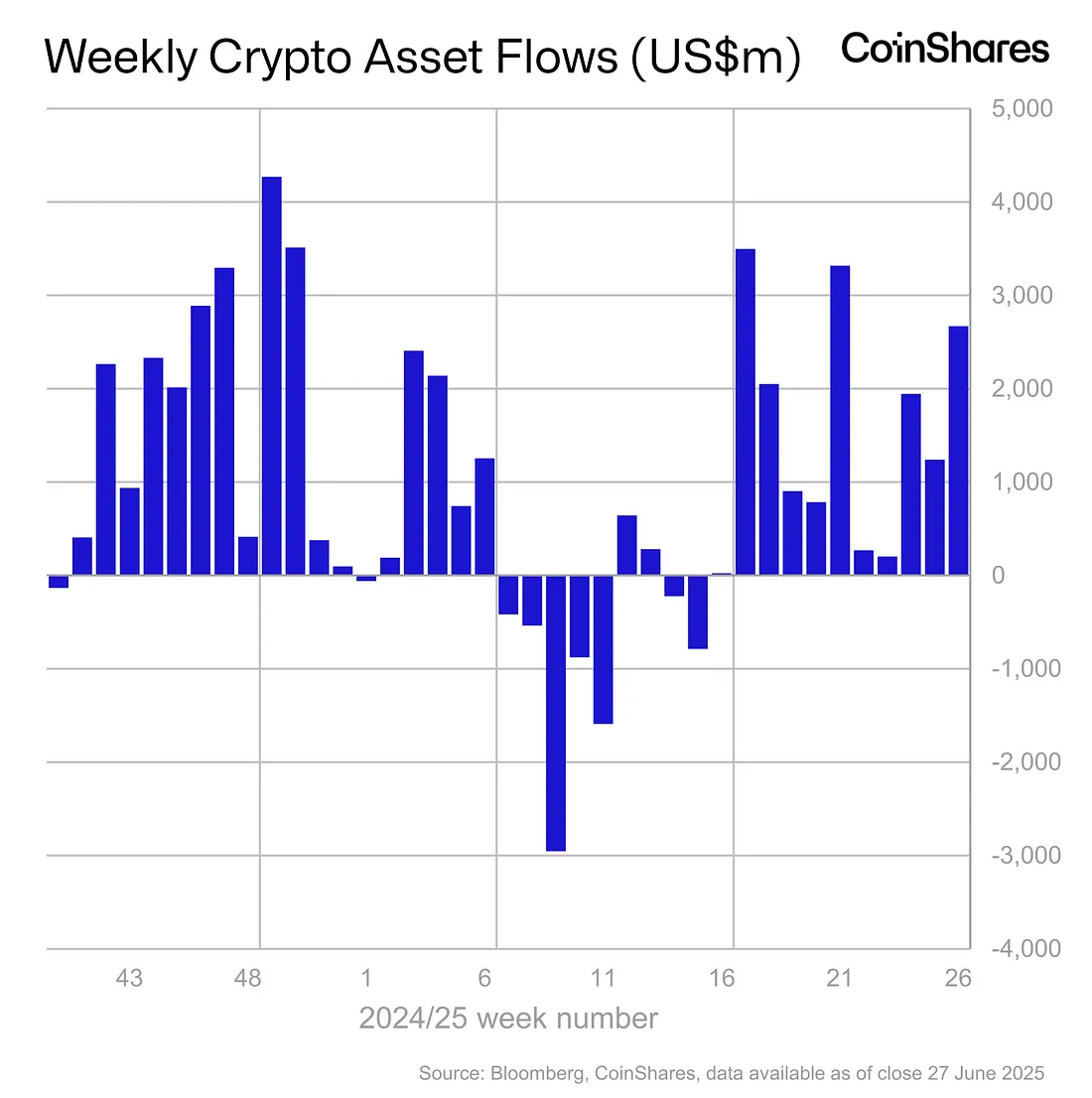

According to crypto asset management firm CoinShares, institutional digital asset investment vehicles have experienced over $16 billion in inflows over the past eleven weeks. The latest Digital Asset Fund Flows Weekly Report highlights that inflows during the first half of 2025 (H1) are slightly below those recorded in the previous year.

“Digital asset investment products saw inflows of US$2.7bn last week, marking the 11th consecutive week of inflows totalling US$16.9bn. Reflecting on the half-year mark, inflows are on a similar track to 2024, where inflows to end-June were at US$18.3bn.

We believe this resilient investor demand has been driven by a combination of factors, primarily heightened geopolitical volatility and uncertainty surrounding the direction of monetary policy.”

Regional Inflow and Outflow Dynamics

- United States: Led inflows with $2.65 billion.

- Switzerland: Contributed $23 million in inflows.

- Germany: Added $19.8 million in inflows.

- Canada: Experienced outflows of $13.6 million.

- Hong Kong: Notable outflows of $2.3 million, including $132 million in June alone.

- Brazil: Saw outflows of $2.4 million.

Asset-Specific Inflows

- Bitcoin (BTC): Dominated inflows, accounting for 83% of total inflows last week with $2.2 billion. Short-Bitcoin products saw outflows of $2.9 million last week, totaling $12 million year-to-date, indicating strong positive sentiment.

- Ethereum (ETH): Continued its inflow streak with $429 million last week.

Emphasis on Sustainable Development Goals (SDGs)

SDG 9: Industry, Innovation, and Infrastructure

The growth in institutional digital asset investments reflects advancements in innovative financial infrastructure. By supporting blockchain technologies and digital assets, these investments contribute to building resilient infrastructure and fostering innovation, aligning with SDG 9.

SDG 8: Decent Work and Economic Growth

Increased inflows into digital assets may stimulate economic growth by creating new financial markets and job opportunities within the fintech and blockchain sectors, supporting SDG 8’s aim for sustained, inclusive economic growth and productive employment.

SDG 16: Peace, Justice, and Strong Institutions

The report notes that geopolitical volatility and monetary policy uncertainties have influenced investor behavior. Transparent and regulated digital asset markets can promote strong institutions and reduce corruption risks, contributing to SDG 16.

SDG 17: Partnerships for the Goals

Cross-border investment flows, as seen in the regional data, highlight the importance of international cooperation and partnerships in financial markets, supporting SDG 17’s objective to strengthen global partnerships for sustainable development.

Conclusion

The sustained inflows into institutional digital asset investment vehicles demonstrate robust investor confidence amid global uncertainties. These trends not only reflect evolving financial landscapes but also intersect with multiple Sustainable Development Goals by promoting innovation, economic growth, institutional strength, and international cooperation.

1. Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 8: Decent Work and Economic Growth

- The article discusses institutional investment inflows into digital assets, reflecting economic activity and financial market development.

- SDG 9: Industry, Innovation, and Infrastructure

- The focus on digital asset investment vehicles and cryptocurrencies like Bitcoin and Ethereum relates to innovation in financial technologies and infrastructure.

- SDG 16: Peace, Justice, and Strong Institutions

- The article mentions geopolitical volatility and monetary policy uncertainty, which are connected to institutional stability and governance.

2. What specific targets under those SDGs can be identified based on the article’s content?

- SDG 8 – Target 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation.

- The growth of digital asset investment vehicles supports entrepreneurship and innovation in the financial sector.

- SDG 8 – Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all.

- Institutional inflows into digital assets indicate expanding access and development of new financial products.

- SDG 9 – Target 9.5: Enhance scientific research, upgrade the technological capabilities of industrial sectors.

- Investment in cryptocurrencies and blockchain technology reflects upgrading technological capabilities.

- SDG 16 – Target 16.6: Develop effective, accountable and transparent institutions at all levels.

- Geopolitical volatility and monetary policy uncertainty highlight the need for strong institutions.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

- Indicator for SDG 8.3 and 8.10: Volume of inflows into institutional digital asset investment vehicles.

- The article provides data on weekly and half-year inflows (e.g., $16.9 billion over 11 weeks, $18.3 billion by end-June 2024), which can be used to track financial market growth and innovation.

- Indicator for SDG 9.5: Adoption and investment levels in innovative technologies such as blockchain and cryptocurrencies.

- The share of inflows into Bitcoin (83%) and Ethereum ($429 million last week) reflects technological adoption and investment trends.

- Indicator for SDG 16.6: Measures of geopolitical volatility and monetary policy uncertainty.

- Though not quantified in the article, the mention of geopolitical volatility and monetary policy uncertainty implies the need for indicators that monitor institutional stability.

4. Table: SDGs, Targets and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth |

|

|

| SDG 9: Industry, Innovation, and Infrastructure |

|

|

| SDG 16: Peace, Justice, and Strong Institutions |

|

|

Source: dailyhodl.com