EIB and Mediobanca join forces to unlock €200M in funding for Italy’s microenterprises and women-led businesses – Silicon Canals

EIB and Mediobanca Partnership to Advance Sustainable Development Goals in Italy

Executive Summary

The European Investment Bank (EIB) and Mediobanca have finalized a €100 million agreement aimed at enhancing credit access for Italian small and medium-sized enterprises (SMEs). This initiative is projected to mobilize up to €200 million in total investment, directly contributing to several United Nations Sustainable Development Goals (SDGs), particularly those concerning economic growth, gender equality, and reduced inequalities.

Strategic Alignment with Sustainable Development Goals (SDGs)

Fostering Decent Work and Economic Growth (SDG 8)

The agreement is structured to bolster Italy’s economic fabric by supporting the enterprises that form its core. This directly addresses SDG 8, which promotes sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all.

- Target 8.3: The initiative promotes development-oriented policies that support productive activities, decent job creation, entrepreneurship, and the growth of micro-, small-, and medium-sized enterprises.

- Microenterprise Focus: A significant 60% of the financing is specifically earmarked for microenterprises with fewer than 10 employees, fostering grassroots economic development and job creation.

- Target 8.10: By expanding access to banking and financial services, the partnership strengthens the capacity of domestic financial institutions to encourage and expand access to credit for all.

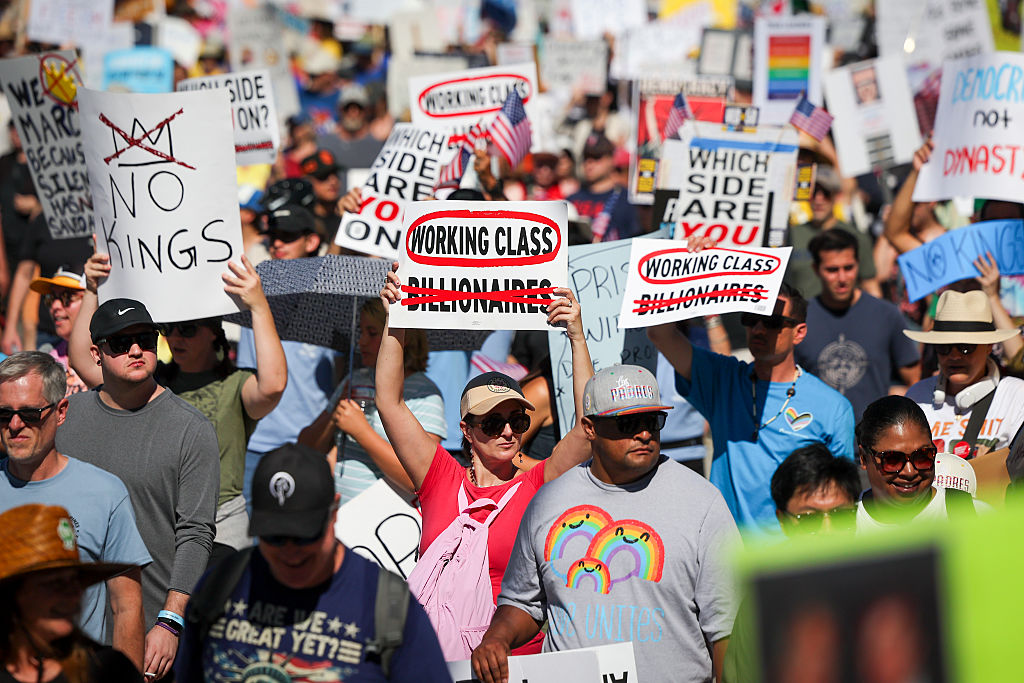

Advancing Gender Equality (SDG 5)

A core component of the financing is dedicated to empowering female entrepreneurs, a key driver for achieving SDG 5, which aims to achieve gender equality and empower all women and girls.

- Target 5.5: 20% of the total funds are allocated to companies led by women or to projects that advance gender equality, ensuring women’s full and effective participation and equal opportunities for leadership.

- Economic Empowerment: This targeted funding provides women with greater access to financial resources, promoting their economic empowerment and enhancing their role in the business community.

Reducing Inequalities (SDG 10)

The initiative includes a geographical focus on cohesion regions, directly contributing to SDG 10, which calls for reducing inequality within and among countries.

- Cohesion Region Support: A portion of the financing is directed toward businesses located in the less developed cohesion regions of central and southern Italy.

- Reducing Disparities: This allocation aims to reduce economic disparities across the nation, promoting inclusive growth and ensuring that development benefits are distributed more equitably, in line with the principles of the EU Cohesion Policy.

Implementation and Financial Allocation

Distribution Mechanism

The funds provided by the EIB will be managed and distributed by Mediobanca through its consumer credit subsidiary, Compass Banca. This established network ensures efficient delivery of new loans to eligible Italian businesses to support their operational and investment strategies.

Allocation Breakdown

- 60% for Microenterprises: To support the smallest businesses, which are vital for local economies.

- 20% for Gender Equality: To finance female-led enterprises and projects promoting gender equality in the workplace.

- Remaining Funds: To be directed towards SMEs, with a specific focus on those operating within designated cohesion regions.

Institutional Commitment to Sustainable Development

European Investment Bank (EIB)

The EIB’s involvement is consistent with its broader mandate to support EU policy objectives through long-term investment. Its operations are fundamentally aligned with sustainable development principles.

- Climate Action (SDG 13): All EIB-supported projects are aligned with the Paris Agreement. The bank is committed to mobilizing €1 trillion in climate and environmental sustainability investments by 2030.

- Partnerships for the Goals (SDG 17): This agreement exemplifies a public-private partnership designed to achieve sustainable development objectives.

- Commitment to Cohesion: Approximately half of all EIB financing within the EU is directed towards cohesion regions, underscoring its commitment to reducing regional inequalities (SDG 10).

Mediobanca

Mediobanca’s participation reflects its strategic goal of promoting the growth of Italian companies through “responsible banking.” The group aims to adapt its services to the needs of a modern economy dominated by SMEs, thereby contributing to a more cohesive, dynamic, and sustainable economic landscape in Italy.

Identified Sustainable Development Goals (SDGs)

- SDG 5: Gender Equality

- SDG 8: Decent Work and Economic Growth

- SDG 9: Industry, Innovation, and Infrastructure

- SDG 10: Reduced Inequalities

- SDG 13: Climate Action

Specific SDG Targets

-

SDG 5: Gender Equality

- Target 5.a: Undertake reforms to give women equal rights to economic resources, as well as access to ownership and control over land and other forms of property, financial services, inheritance and natural resources, in accordance with national laws.

Explanation: The article explicitly states that 20% of the financing will be allocated to “companies led by women or to projects related to gender equality,” directly providing women with access to financial services. - Target 5.5: Ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision-making in political, economic and public life.

Explanation: By specifically earmarking funds for “female-led entrepreneurs,” the initiative supports women’s leadership and participation in the economic sphere.

- Target 5.a: Undertake reforms to give women equal rights to economic resources, as well as access to ownership and control over land and other forms of property, financial services, inheritance and natural resources, in accordance with national laws.

-

SDG 8: Decent Work and Economic Growth

- Target 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation, and encourage the formalization and growth of micro-, small- and medium-sized enterprises, including through access to financial services.

Explanation: The entire agreement is focused on providing a €100M credit line to support “small and medium-sized enterprises (SMEs)” and “microenterprises with fewer than 10 employees” in Italy, fostering their growth and investment plans. - Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all.

Explanation: The partnership between the European Investment Bank (EIB) and the Italian institution Mediobanca is a direct example of strengthening a domestic financial institution to expand credit access for SMEs.

- Target 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation, and encourage the formalization and growth of micro-, small- and medium-sized enterprises, including through access to financial services.

-

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.3: Increase the access of small-scale industrial and other enterprises, in particular in developing countries, to financial services, including affordable credit, and their integration into value chains and markets.

Explanation: The initiative’s core purpose is to “expand credit access for small and medium-sized enterprises (SMEs),” including microenterprises. The focus on “cohesion regions” where economic development is below average aligns with the spirit of supporting enterprises in less developed areas.

- Target 9.3: Increase the access of small-scale industrial and other enterprises, in particular in developing countries, to financial services, including affordable credit, and their integration into value chains and markets.

-

SDG 10: Reduced Inequalities

- Target 10.2: By 2030, empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status.

Explanation: The agreement promotes economic inclusion by specifically targeting “female-led entrepreneurs” and businesses in “cohesion regions,” which are areas with below-average economic development. EIB Vice-President Gelsomina Vigliotti states that a key goal is to prevent the exclusion of “whole regions or segments of the working population.”

- Target 10.2: By 2030, empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status.

-

SDG 13: Climate Action

- Target 13.a: Implement the commitment undertaken by developed-country parties to the United Nations Framework Convention on Climate Change to a goal of mobilizing jointly $100 billion annually by 2020 from all sources to address the needs of developing countries…

Explanation: The article mentions the EIB’s broader commitment to climate action, stating it is “working toward a €1T investment goal in climate and environmental sustainability by 2030.” This represents a significant mobilization of finance for climate-related goals.

- Target 13.a: Implement the commitment undertaken by developed-country parties to the United Nations Framework Convention on Climate Change to a goal of mobilizing jointly $100 billion annually by 2020 from all sources to address the needs of developing countries…

Implied Indicators for Measuring Progress

-

Indicators for SDG 8, 9, and 10

- Total value of financing: The article specifies a “€100M agreement” expected to generate “up to €200M in total credit.” This is a direct quantitative measure of the financial support provided.

- Allocation of funds to microenterprises: A specific indicator is that “60 per cent will go to microenterprises with fewer than 10 employees.”

- Allocation of funds to promote gender equality: The article provides the indicator that “20 per cent will be allocated to companies led by women or to projects related to gender equality.”

- Geographic allocation of funds: The financing is directed toward “businesses located in cohesion regions in central and southern Italy,” which serves as an indicator for measuring support to less developed areas.

-

Indicators for SDG 13

- Financial commitment to climate goals: The EIB’s “€1T investment goal in climate and environmental sustainability by 2030” is a clear indicator of its long-term commitment.

- Alignment with international agreements: The statement that “All supported initiatives align with the Paris Climate Agreement” serves as a qualitative indicator of the nature of the investments.

- Exclusion of fossil fuel financing: The policy that the “Group does not finance fossil fuel investments” is a specific indicator of its commitment to climate action.

Summary of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 5: Gender Equality | 5.a: Equal rights to economic resources and access to financial services. 5.5: Ensure women’s full participation and equal opportunities for leadership. |

20% of financing allocated to female-led entrepreneurs or gender equality projects. |

| SDG 8: Decent Work and Economic Growth | 8.3: Promote policies that support entrepreneurship and the growth of micro-, small- and medium-sized enterprises through access to financial services. 8.10: Strengthen domestic financial institutions to expand access to financial services. |

€100M agreement to provide credit to SMEs. 60% of funds allocated to microenterprises (fewer than 10 employees). |

| SDG 9: Industry, Innovation, and Infrastructure | 9.3: Increase the access of small-scale enterprises to financial services, including affordable credit. | Provision of new loans to support company operations and investment plans for Italian small businesses. |

| SDG 10: Reduced Inequalities | 10.2: Empower and promote the social and economic inclusion of all. | A portion of financing directed to businesses in cohesion regions (less developed areas). Targeting of specific groups like female entrepreneurs. |

| SDG 13: Climate Action | 13.a: Mobilize finance for climate action. | EIB’s €1T investment goal for climate and environmental sustainability by 2030. Policy of not financing fossil fuel investments. |

Source: siliconcanals.com

![]()

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0