LatAm and the Caribbean will need more than 46 GW of energy storage by 2035 – ess-news.com

Report on Energy Storage Deployment in Latin America and the Caribbean for Sustainable Development

Executive Summary

A report by the Latin American Energy Organization (OLADE) outlines the critical role of energy storage in achieving regional Sustainable Development Goals (SDGs), particularly SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). The analysis details the necessary capacity expansion, investment requirements, technological landscape, and policy recommendations to facilitate the integration of renewable energy, enhance grid stability, and build resilient infrastructure (SDG 9) across Latin America and the Caribbean.

Projected Requirements to Meet SDG 7 and SDG 13 Targets

To support the transition to clean energy and meet climate objectives, the region must significantly scale its energy storage capacity. The report projects the following requirements:

- By 2030: An estimated 24 GW of new energy storage capacity is needed, requiring an investment of approximately $24 billion.

- By 2035: The required capacity increases to 46 GW, with a corresponding investment need of $46 billion.

Achieving these targets is fundamental for ensuring the reliability of power systems dominated by intermittent renewable sources, directly contributing to SDG 7. Currently, the project pipeline, including operational, under-construction, and planned facilities, totals approximately 9 GW.

Current Status and Technological Innovation for SDG 9

The development of sustainable and resilient infrastructure (SDG 9) is underway, though at a nascent stage. The current technological landscape is characterized by:

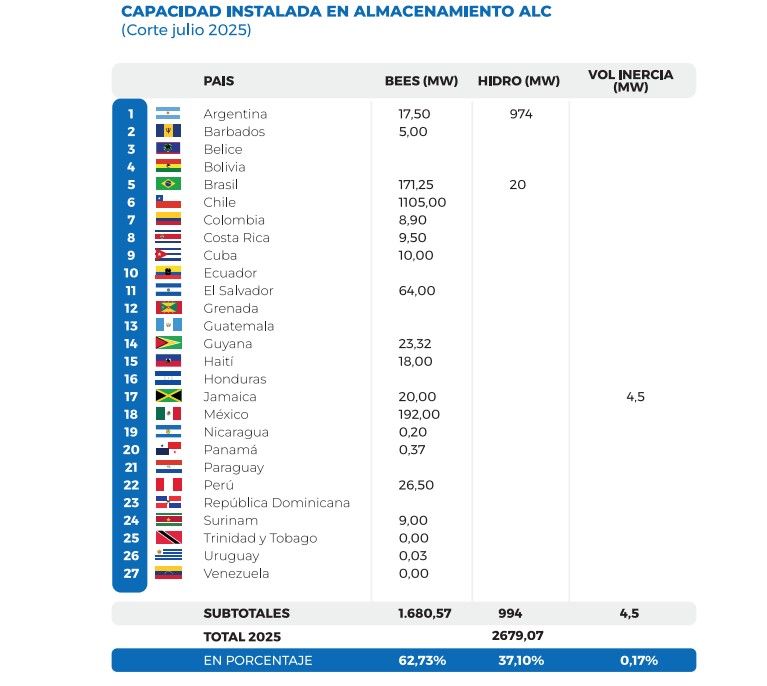

- Operational Capacity: The region currently has 2.5 GW of operational storage, with battery energy storage systems (BESS), primarily lithium-ion, accounting for 1.5 GW.

- Dominant Technologies: Electrochemical systems and pumped hydro storage are the most prevalent technologies, supplemented by industrial thermal backup solutions.

- Future Innovation: Medium-term growth is anticipated in emerging technologies such as flow and sodium-ion batteries, green hydrogen, and distributed storage for residential and commercial use. It is estimated that over 30% of residential solar systems will incorporate battery storage by 2035, advancing SDG 11 (Sustainable Cities and Communities).

National Progress and Regulatory Frameworks

Several nations are pioneering the integration of energy storage, creating models for regional replication:

- Large-Scale Deployment: Chile and Brazil are leading in the implementation of large-scale projects.

- Regulatory Advancement: Mexico, Argentina, and the Dominican Republic are developing legal frameworks to formally recognize energy storage as a key asset within the electricity system.

- Targeted Integration: Honduras and Colombia have launched specific tenders to integrate BESS into their distribution networks, enhancing grid resilience.

Challenges and Strategic Policy Recommendations

Significant barriers hinder the acceleration of energy storage deployment. Overcoming these is essential for progress on the SDGs.

Identified Challenges

- Lack of clear legal and regulatory definitions for the role of energy storage.

- Absence of differentiated tariff structures that properly value storage services.

- Outdated grid interconnection rules that do not accommodate storage technologies.

Policy Recommendations

- Incorporate specific energy storage capacity targets into National Energy Plans to provide clear market signals.

- Establish dedicated auctions and tenders for hybrid renewable projects, such as solar PV combined with BESS (PV + BESS).

Financial Mechanisms and Partnerships for the Goals (SDG 17)

Mobilizing capital is a central challenge. The report highlights the importance of partnerships and innovative financing to fund this critical infrastructure.

Current Financial Landscape

- Primary Funding Sources: International climate funds and public-private partnerships (SDG 17) are the main drivers of current projects.

- Financial Barriers: Key obstacles include a lack of innovative financial instruments, insufficient participation from local banking institutions, and a perception of regulatory instability.

Financial Recommendations

To de-risk investments and attract capital, OLADE recommends the promotion of:

- Green bonds dedicated to energy infrastructure.

- Performance guarantees to secure investor confidence.

- Sovereign wealth funds focused on sustainable energy development.

Conclusion

Energy storage is an indispensable component for building flexible, reliable, and sustainable energy systems in Latin America and the Caribbean. Its deployment is directly linked to the successful achievement of multiple SDGs, including those related to clean energy, climate action, resilient infrastructure, and sustainable communities. Coordinated policies and robust financial partnerships are imperative to attract the necessary investment and accelerate the deployment of energy storage across all levels of the energy value chain.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 7: Affordable and Clean Energy: The entire article focuses on energy storage as a critical component for integrating renewable energy sources into the power grid, which is central to achieving clean and reliable energy for all.

- SDG 9: Industry, Innovation, and Infrastructure: The article discusses the need to build resilient energy infrastructure by incorporating 24 GW of storage capacity by 2030. It highlights technological innovation (BESS, green hydrogen) and the need for updated regulatory frameworks to support this infrastructure development.

- SDG 13: Climate Action: By enabling greater integration of renewable energy, energy storage directly contributes to reducing greenhouse gas emissions from the power sector. The article’s recommendation to incorporate storage targets into national energy plans is a direct climate action measure.

- SDG 17: Partnerships for the Goals: The article explicitly mentions the role of “international climate funds and public-private partnerships” as key sources of financing. It also calls for new financial instruments like green bonds and sovereign wealth funds, which require collaboration between governments, international bodies, and the private sector.

2. What specific targets under those SDGs can be identified based on the article’s content?

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. The article states that energy storage is necessary “to support the integration of renewable energy and enhance the stability of power systems,” directly contributing to this target.

- Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology. The article identifies a need for “$24 billion by 2030” in investments and mentions “international climate funds” as a key source of support.

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure… to support economic development and human well-being. The article emphasizes that energy storage is “essential to increase the reliability and flexibility of electricity grids,” which is a core component of resilient infrastructure.

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. The recommendation that countries should “incorporate energy storage targets into national energy plans” is a direct example of integrating climate-related measures into national policy.

- Target 17.3: Mobilize additional financial resources for developing countries from multiple sources. The article points to the need to overcome financial barriers by promoting “green bonds, performance guarantees, and sovereign wealth funds” in addition to existing “international climate funds and public-private partnerships.”

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

- For Target 7.2: The primary indicator is the amount of energy storage capacity deployed. The article provides clear quantitative goals: “incorporate around 24 GW of energy storage capacity by 2030 and 46 GW by 2035.” Progress can be measured against the current operational capacity of 2.5 GW.

- For Target 7.a: A key indicator is the total investment mobilized for energy storage projects. The article provides a financial target: “investments of approximately $24 billion by 2030.”

- For Target 9.1: An indicator is the adoption rate of distributed storage technologies. The article projects that “by 2035, more than 30% of residential solar systems in the region will be paired with batteries,” which measures the resilience and modernization of infrastructure at the consumer level.

- For Target 13.2: A qualitative indicator is the number of countries with supportive policies. The article mentions that “Mexico, Argentina, and the Dominican Republic are advancing regulatory frameworks,” and “Honduras and Colombia have launched specific tenders.” Tracking the number of countries that implement such policies measures progress.

- For Target 17.3: An indicator is the diversification of funding sources. Progress can be measured by tracking the value of “green bonds” issued or the establishment of “sovereign wealth funds dedicated to energy storage development,” as recommended in the report.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.2: Increase substantially the share of renewable energy in the global energy mix. | Amount of energy storage capacity installed (Goal: 24 GW by 2030). |

| SDG 7: Affordable and Clean Energy | 7.a: Promote investment in energy infrastructure and clean energy technology. | Total investment mobilized for energy storage (Goal: $24 billion by 2030). |

| SDG 9: Industry, Innovation and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure. | Percentage of residential solar systems paired with batteries (Projection: >30% by 2035). |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. | Number of countries incorporating energy storage targets into national energy plans and advancing regulatory frameworks. |

| SDG 17: Partnerships for the Goals | 17.3: Mobilize additional financial resources for developing countries from multiple sources. | Use of diverse financial instruments such as international climate funds, public-private partnerships, green bonds, and sovereign wealth funds. |

Source: ess-news.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0