Interest on Student Loans Is About to Skyrocket for Low-Income Borrowers – Mother Jones

Report on the Termination of the Saving on a Valuable Education (SAVE) Program and its Implications for Sustainable Development Goals

Executive Summary

Recent administrative actions to dismantle the Saving on a Valuable Education (SAVE) student loan repayment program present significant setbacks to the achievement of several United Nations Sustainable Development Goals (SDGs). The termination of interest subsidies and the planned phasing out of the program directly undermine progress on SDG 1 (No Poverty), SDG 4 (Quality Education), SDG 8 (Decent Work and Economic Growth), and SDG 10 (Reduced Inequalities). This report analyzes the policy changes and their adverse effects on millions of borrowers, contextualizing the crisis within the framework of sustainable development.

Impact on Poverty Alleviation and Economic Growth (SDG 1 & SDG 8)

The SAVE program was a critical tool for poverty reduction, directly supporting the objectives of SDG 1 by making debt manageable for low-income individuals. Its removal threatens to push millions of borrowers into financial precarity.

Direct Economic Hardship

- The SAVE plan significantly lowered monthly payments, with some of the lowest-income borrowers paying zero, thereby preventing them from falling into poverty due to educational debt.

- The termination of the 0% interest cap for borrowers in forbearance is projected to add an average of $3,500 in annual interest charges per enrollee, directly reducing disposable income and hindering economic mobility.

- Borrowers report making significant financial sacrifices that impede economic participation and growth, in direct conflict with the principles of SDG 8. These include:

- Inability to afford housing or relocate for better opportunities.

- Postponement of family planning and child-rearing.

- Forgoing consumer spending and ceasing personal hobbies.

- Depletion of savings to cover rising debt obligations.

Case Study: Sarah Letsinger and Lauren Gardner

The experiences of borrowers illustrate the program’s importance. Sarah Letsinger, a mother who left the workforce due to high childcare costs, found the SAVE plan provided essential financial breathing room. Lauren Gardner, a therapist with over $100,000 in debt, faces the potential depletion of her savings within months due to reinstated interest charges. These cases exemplify how unmanageable debt serves as a barrier to decent work and economic security (SDG 8).

Setbacks for Quality Education and Equality (SDG 4 & SDG 10)

The student debt crisis is intrinsically linked to educational access and equity. The dismantling of affordable repayment options exacerbates existing inequalities, undermining SDG 4 (Quality Education) and SDG 10 (Reduced Inequalities).

Erosion of Equitable Access to Education

SDG 4 calls for inclusive and equitable quality education and lifelong learning opportunities for all. However, the prospect of crippling debt acts as a major deterrent to pursuing higher education, particularly for individuals from low-income backgrounds.

- The SAVE plan made the financial outcomes of education more equitable by linking repayment to income.

- Its termination disproportionately harms the most vulnerable borrowers, including those who did not complete their degrees but still hold debt, widening the inequality gap (SDG 10).

- The policy changes also threaten related initiatives like the Public Service Loan Forgiveness (PSLF) program, which incentivizes careers in vital but often lower-paying sectors like education and healthcare. This discourages graduates from contributing to public services, further impacting societal well-being.

Impact on Public Sector Workers

Bryan Riha, a public school teacher, exemplifies the challenges. Despite qualifying for PSLF after 120 months of service, administrative hurdles and the reinstatement of interest on his loans have trapped him in debt. This situation undermines the viability of public service careers, which are essential for strong community infrastructure and achieving broader development goals.

Challenges to Justice and Institutional Integrity (SDG 16)

The handling of the SAVE program’s termination raises concerns related to SDG 16 (Peace, Justice and Strong Institutions), which emphasizes the need for effective, accountable, and transparent institutions.

Policy and Implementation Failures

- The administration’s decision to resume interest charges was described by legal experts as an elective policy choice, not a court mandate, creating unnecessary financial burdens on 7.7 million borrowers.

- The rollout of these changes has been characterized by confusion, anxiety, and a lack of clear communication from the Department of Education and loan servicers.

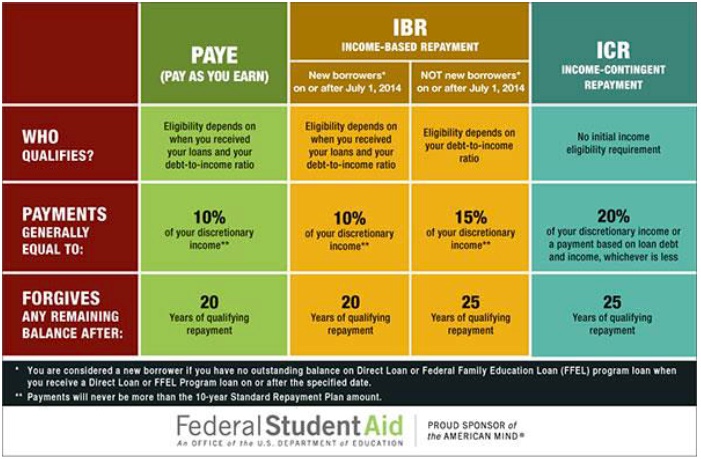

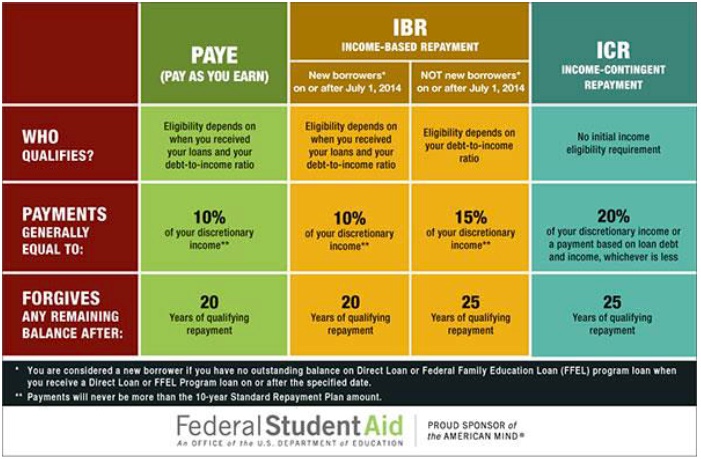

- Borrowers are being pushed toward the Income-Based Repayment (IBR) plan, which offers less favorable terms, higher payments, and a longer path to forgiveness.

- The Department of Education has admitted to a backlog of over 1.5 million applications for income-driven repayment plans and has paused forgiveness processing under IBR, indicating a systemic failure to serve borrowers effectively.

Future Outlook

The planned replacement of existing income-driven plans with a new “Repayment Assistance Plan” by 2028 is expected to result in even higher monthly payments and a 30-year repayment timeline before forgiveness. This long-term policy direction moves further away from the sustainable and equitable principles required to meet the SDGs.

Analysis of Sustainable Development Goals (SDGs) in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 1: No Poverty

The article directly connects student loan debt to financial hardship and the risk of poverty. It describes how borrowers are forced to make significant financial sacrifices, such as returning items to the store to pay bills and depleting savings. The SAVE program, by lowering monthly payments, is presented as a social protection policy aimed at alleviating this financial burden, and its removal threatens to push borrowers closer to poverty. Lauren Gardner explicitly states that the renewed interest charges “would wipe out my savings in about two months,” questioning if she “would be able to survive it.”

-

SDG 4: Quality Education

The core of the article revolves around the accessibility and affordability of tertiary education. The significant debt figures mentioned ($35,000, $90,000, over $100,000) for degrees in various fields demonstrate that higher education is not affordable for many. This financial barrier undermines the goal of ensuring equitable access to quality education. The article also mentions “slashing federal funding for academic research” as another policy change affecting the education system.

-

SDG 5: Gender Equality

The article highlights how student debt can disproportionately affect women. Sarah Letsinger’s story illustrates this: after graduating, her low wages in fashion design, combined with the high cost of childcare, forced her to leave the workforce to become a full-time mother. This shows how debt can intersect with existing gender inequalities in pay and caregiving responsibilities, limiting women’s economic participation and career advancement.

-

SDG 8: Decent Work and Economic Growth

The article demonstrates a disconnect between the cost of education and the wages available in certain professions, which undermines the principle of decent work. A teacher, Bryan Riha, notes he doesn’t “make nearly enough to cover [such enormous debt] over the course of a lifetime.” This debt burden also stifles broader economic activity, as individuals like the Letsingers cannot afford to move, travel, or spend money on hobbies, thereby reducing their economic participation.

-

SDG 10: Reduced Inequalities

The issues discussed are fundamentally about inequality. The SAVE program was specifically designed for “low- and moderate-income borrowers,” and its dismantling is predicted to hit “the lowest-income borrowers… the hardest.” This exacerbates economic inequality within the country. Furthermore, the article mentions policy changes targeting specific groups, such as revamping the Public Service Loan Forgiveness (PSLF) program to exclude work supporting “gender-affirming care” and “diversity, equity, and inclusion,” which is a direct move against reducing inequalities for vulnerable populations.

-

SDG 16: Peace, Justice and Strong Institutions

The article details the failure of governmental institutions to be effective, accountable, and transparent. The policy changes are described as “messy, creating new levels of confusion and anxiety among the millions of borrowers.” The government and loan servicers provide “little clarification,” and there is a backlog of “more than 1.5 million outstanding applications” for repayment plans. This points to institutional dysfunction. The legal challenges, court injunctions, and the administration’s move to dismantle the Department of Education itself are all related to the functioning and justice of public institutions.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 1.4:

“By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership and control over land and other forms of property, inheritance, natural resources, appropriate new technology and financial services, including microfinance.” The article discusses how student loan policies directly impact borrowers’ access to economic resources. The SAVE program is a financial service designed to be more accessible, while its removal restricts financial stability for vulnerable, indebted populations.

-

Target 4.3:

“By 2030, ensure equal access for all women and men to affordable and quality technical, vocational and tertiary education, including university.” The entire premise of the article—the struggle with massive student loan debt—is evidence that tertiary education is not affordable. The existence of various repayment plans is a direct policy response to this lack of affordability.

-

Target 5.4:

“Recognize and value unpaid care and domestic work through the provision of public services, infrastructure and social protection policies…” Sarah Letsinger’s choice to leave the workforce because her salary would just cover childcare costs highlights a failure in social protection policies. Her student debt exacerbates this situation, making it financially impossible for her to both work and manage childcare costs.

-

Target 8.5:

“By 2030, achieve full and productive employment and decent work for all women and men… and equal pay for work of equal value.” The article shows that graduates in essential but lower-paying fields like teaching cannot earn enough to manage their student debt, challenging the “decent work” standard. Sarah Letsinger’s inability to make a living wage in her chosen field of fashion design is another example.

-

Target 10.2:

“By 2030, empower and promote the social, economic and political inclusion of all, irrespective of… economic or other status.” The SAVE program was a tool for the economic inclusion of low-income borrowers. The article also mentions executive orders targeting trans students and DEI initiatives, which directly counter the goal of social inclusion for all.

-

Target 16.6:

“Develop effective, accountable and transparent institutions at all levels.” The article’s description of the “messy” rollout, “confusion and anxiety,” and lack of “clarification from the federal government” directly points to a failure of institutions to be effective and transparent in their operations and communication with the public.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Amount of Student Debt per Borrower:

The article explicitly mentions the debt levels of individuals (e.g., $35,000, $70,000, $90,000). This figure serves as a direct indicator of the affordability of education (Target 4.3) and the financial burden on individuals (Target 1.4).

-

Interest Rates on Federal Loans:

The article contrasts the 0% interest rate under the SAVE forbearance with potential future rates that “could exceed 9 percent per year.” The interest rate is a key indicator of the financial terms offered to borrowers and their ability to manage debt (Target 1.4).

-

Number of Borrowers in Income-Driven Repayment Plans:

The article states that “7.7 million borrowers” are enrolled in the SAVE program. This number is a direct indicator of the scale of policies aimed at reducing inequality and providing financial relief (Target 10.2).

-

Debt-to-Income Ratio:

This is implied through the stories of borrowers. Bryan Riha, a teacher with $90,000 in debt, and Sarah Letsinger, who earned only $16 an hour in her field, illustrate a high debt-to-income ratio. This can be used to measure the viability of “decent work” (Target 8.5) for educated professionals.

-

Application Processing Backlogs:

The mention of “more than 1.5 million outstanding applications” for income-driven repayment plans is a quantifiable indicator of institutional inefficiency and lack of effectiveness (Target 16.6).

-

Number of Borrowers Eligible for Loan Forgiveness:

The article discusses Bryan Riha’s progress toward the 120-payment requirement for Public Service Loan Forgiveness. The number of people who successfully achieve forgiveness is an indicator of the effectiveness of such social protection policies (Targets 1.4, 10.2).

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 1: No Poverty | 1.4: Equal rights to economic resources and access to financial services. | Amount of monthly loan payments; Interest rates on loans; Number of borrowers qualifying for loan forgiveness. |

| SDG 4: Quality Education | 4.3: Equal access to affordable and quality tertiary education. | Total student debt amount per borrower; Federal funding for academic research. |

| SDG 5: Gender Equality | 5.4: Recognize and value unpaid care and domestic work through social protection policies. | (Implied) Female labor force participation rate among indebted graduates; Impact of childcare costs on women’s career choices. |

| SDG 8: Decent Work and Economic Growth | 8.5: Achieve full and productive employment and decent work for all. | (Implied) Debt-to-income ratio for graduates in specific fields (e.g., teaching, creative arts). |

| SDG 10: Reduced Inequalities | 10.2: Empower and promote the social and economic inclusion of all. | Number of borrowers enrolled in income-driven repayment plans (e.g., 7.7 million in SAVE); Policies targeting specific groups (e.g., trans students, DEI initiatives). |

| SDG 16: Peace, Justice and Strong Institutions | 16.6: Develop effective, accountable and transparent institutions. | Backlog of applications for government programs (1.5 million for IDR plans); Clarity and timeliness of government communications to the public. |

Source: motherjones.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0