Battery storage values reach record highs in ERCOT, Pexapark finds – ess-news.com

ERCOT Investment Pivot to Battery Storage Aligns with Sustainable Development Goals Amidst Renewable PPA Challenges

Executive Summary

A significant shift in energy investment is underway within the Electric Reliability Council of Texas (ERCOT) market. Investors are increasingly prioritizing Battery Energy Storage Systems (BESS) over traditional solar and wind Power Purchase Agreements (PPAs). This trend is driven by policy changes and rising project costs for renewables, creating a challenging environment for solar and wind projects. The accelerated adoption of BESS, however, represents a critical advancement for grid stability and the integration of renewable energy, directly supporting key United Nations Sustainable Development Goals (SDGs), particularly SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 13 (Climate Action).

Market Dynamics Driving BESS Investment and SDG 7 Advancement

The growing investor confidence in BESS is underpinned by strong market signals that align with the objectives of SDG 7. By stabilizing the grid, BESS infrastructure enables greater penetration of intermittent renewable sources like solar and wind, making clean energy more reliable and accessible.

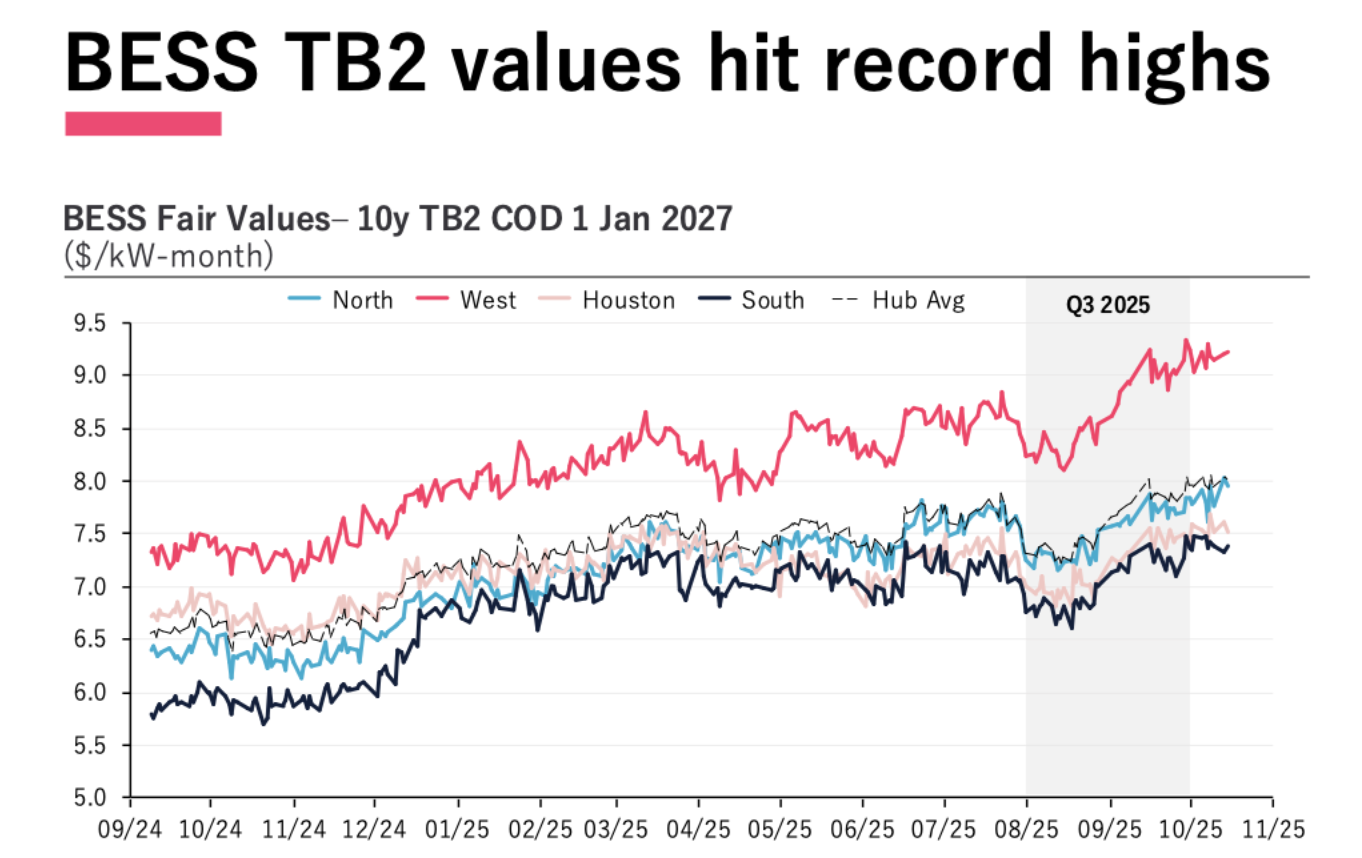

- Record Forward Values: Analytics from Pexapark indicate that forward values for BESS have reached record highs, signaling a bullish long-term outlook.

- Energy Arbitrage Opportunity: The primary revenue stream for BESS in ERCOT, energy arbitrage, has seen its 10-year outlook advance by double digits in most ERCOT hubs. This is fueled by widening intraday price spreads resulting from increased load growth and solar penetration.

- Favorable Dealmaking Environment: A convergence of rising value levels and stable or declining BESS toll offers points to a growing opportunity for investment and dealmaking in this critical clean energy sector.

As noted by Yaniv Yaffe, Pexapark product manager, “Expected load growth coupled with high levels of solar penetration mean that intraday spreads in ERCOT will, in general, get wider… This dynamic strengthens the long-term economic rationale for BESS.” This rationale is fundamental to building the resilient energy systems required by SDG 7 and SDG 11 (Sustainable Cities and Communities).

BESS Deployment: A Milestone in Sustainable Infrastructure (SDG 9)

The rapid buildout of BESS in ERCOT is a tangible contribution to SDG 9, which calls for building resilient, sustainable, and innovative infrastructure. This expansion is crucial for modernizing the energy grid to support climate action goals.

- Record Quarterly Deployment: A record 2 GW of BESS capacity became operational in Q3 2025, the largest single-quarter deployment in the market’s history.

- Substantial Operational Capacity: ERCOT’s total operational battery capacity has now reached 12,052 MW in rated power and 19,442 MWh in energy capacity.

- Sustained Profitability: Despite market volatility, analysis from Modo Energy confirms that well-positioned BESS projects remain profitable and meet investor return thresholds, ensuring the financial sustainability of this vital infrastructure.

Challenges for Solar and Wind PPAs: A Potential Setback for SDG 13

In contrast to the BESS boom, the market for solar and wind PPAs faces significant headwinds that could impede progress toward SDG 13 (Climate Action) by slowing the deployment of new renewable generation capacity.

- Widening Price Gap: In Q3, offer prices for wind and solar PPAs rose by 12% and 13% respectively, significantly outpacing a 7% rise in their fair value. This creates a pricing gap that discourages new agreements.

- Decreased Market Liquidity: The challenging market environment has led to a sharp decline in dealmaking, with only three publicly announced ERCOT PPAs in Q3, less than half the number from the previous year.

- Hostile Regulatory Environment: The One Big Beautiful Bill (OBBBA) is phasing out clean energy tax credits and imposing strict component sourcing restrictions, which strains developers and increases project costs.

Luca Pedretti, COO & co-founder of Pexapark, stated, “The ERCOT market is facing temporary but acute policy-driven shocks that have created a pricing gap between project costs and buyers’ willingness to pay… For wind and solar, the price gap is now significant and is contributing to the shift in focus toward BESS.” This highlights a critical challenge to the broader clean energy transition envisioned by the SDGs.

SDGs Addressed or Connected

Detailed Explanation

- SDG 7: Affordable and Clean Energy: The article’s core subject is the energy market, specifically focusing on clean energy sources like solar and wind, and enabling technologies like Battery Energy Storage Systems (BESS). It discusses the economic viability, investment trends, and policy impacts (the OBBBA) on these clean energy technologies, directly relating to the goal of ensuring access to affordable, reliable, sustainable, and modern energy.

- SDG 9: Industry, Innovation, and Infrastructure: The text highlights the significant buildout of resilient energy infrastructure. The deployment of a “record 2 GW of battery energy storage capacity” in a single quarter and reaching a total of “12,052 MW in rated power” represents a major upgrade to the energy infrastructure, fostering innovation to support a modern and sustainable grid.

- SDG 13: Climate Action: While not explicitly mentioning climate change, the article discusses the technologies and policies central to climate action. The shift between investments in solar/wind and BESS, and the impact of the “OBBBA” policy phasing out clean energy tax credits, are directly linked to the integration of climate change measures into national policies and strategies for decarbonizing the energy sector.

Specific Targets Identified

Detailed Explanation

- Target 7.2: Increase substantially the share of renewable energy in the global energy mix. The article addresses this target by discussing the market conditions for solar and wind power. The challenges they face due to policy changes and rising costs, contrasted with the growth of BESS which is essential for integrating more renewables, are central to achieving a higher share of renewable energy.

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure. The article directly relates to this target by describing the massive expansion of BESS in ERCOT. This development is crucial for creating a more resilient and reliable grid that can handle the “high levels of solar penetration” and manage “intraday spreads,” thereby ensuring the stability of the energy supply.

- Target 9.4: Upgrade infrastructure and retrofit industries to make them sustainable… with greater adoption of clean and environmentally sound technologies. The investment pivot towards BESS is an example of upgrading energy infrastructure to better support clean technologies. BESS makes the grid more efficient and capable of integrating intermittent renewable sources like solar and wind, which is a key aspect of making the energy industry more sustainable.

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. The article provides a clear example of how national policy impacts clean energy development. The “OBBBA” is described as a “policy-driven shock” that phases out clean energy tax credits, directly influencing the investment landscape for solar and wind and thus affecting the country’s strategy for climate action.

Indicators Mentioned or Implied

Detailed Explanation

-

Installed capacity of clean energy and enabling technology: The article provides specific quantitative data that can be used as indicators of infrastructure growth.

- “a record 2 GW of battery energy storage capacity began commercial operations in ERCOT in Q3 2025.”

- “ERCOT’s operational battery capacity has now reached 12,052 MW in rated power and 19,442 MWh in energy capacity.”

-

Investment and market health for renewable energy projects: The article implies progress (or lack thereof) through financial and market-based indicators.

- The number of publicly announced Power Purchase Agreements (PPAs): “only three ERCOT PPAs which were publicly announced in Q3, representing fewer than half the number of deals signed in the same quarter last year.”

- Price changes for renewable energy contracts: “offer prices for such contracts rose… 12% for wind PPAs and 13% for solar PPAs.”

- Market liquidity indicators: The article notes an “increasingly illiquid PPA market” and a “widening bid-offer spread” for solar and wind.

-

Economic viability of energy storage: The article points to indicators that measure the financial attractiveness of BESS.

- “forward values for BESS are hitting record highs.”

- “the arbitrage opportunity over the next ten years advanced by double digits.”

Summary Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.2: Increase the share of renewable energy in the energy mix. |

|

| SDG 9: Industry, Innovation, and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure.

9.4: Upgrade infrastructure… with greater adoption of clean technologies. |

|

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. |

|

Source: ess-news.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

;Resize=620#)