Is America Breaking the Global Economy? – Foreign Affairs

Global Economic Volatility and its Impact on Sustainable Development

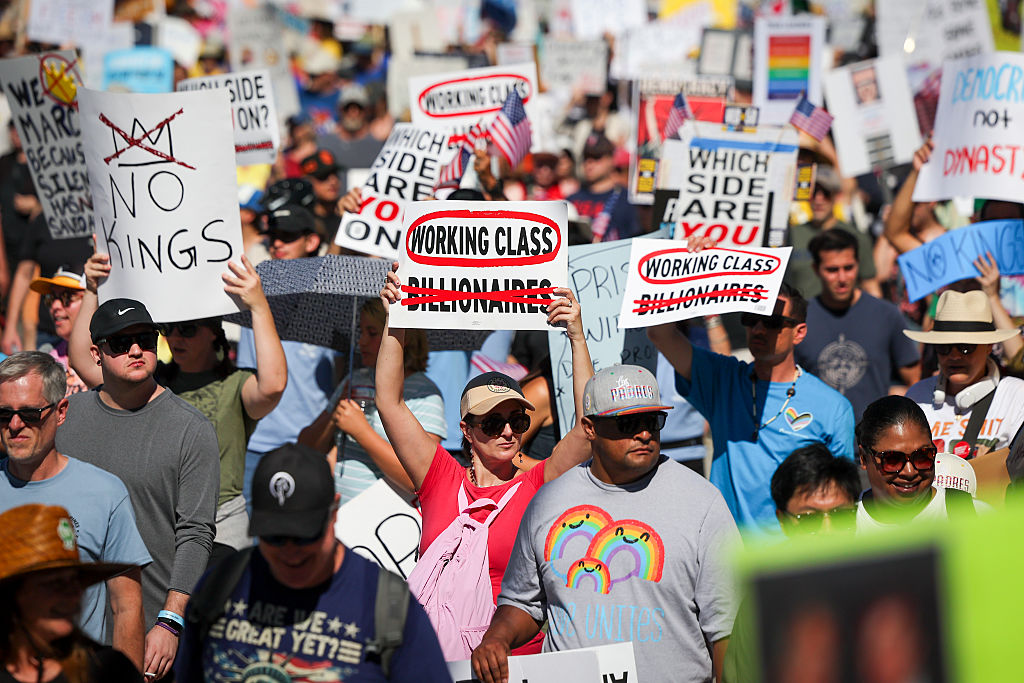

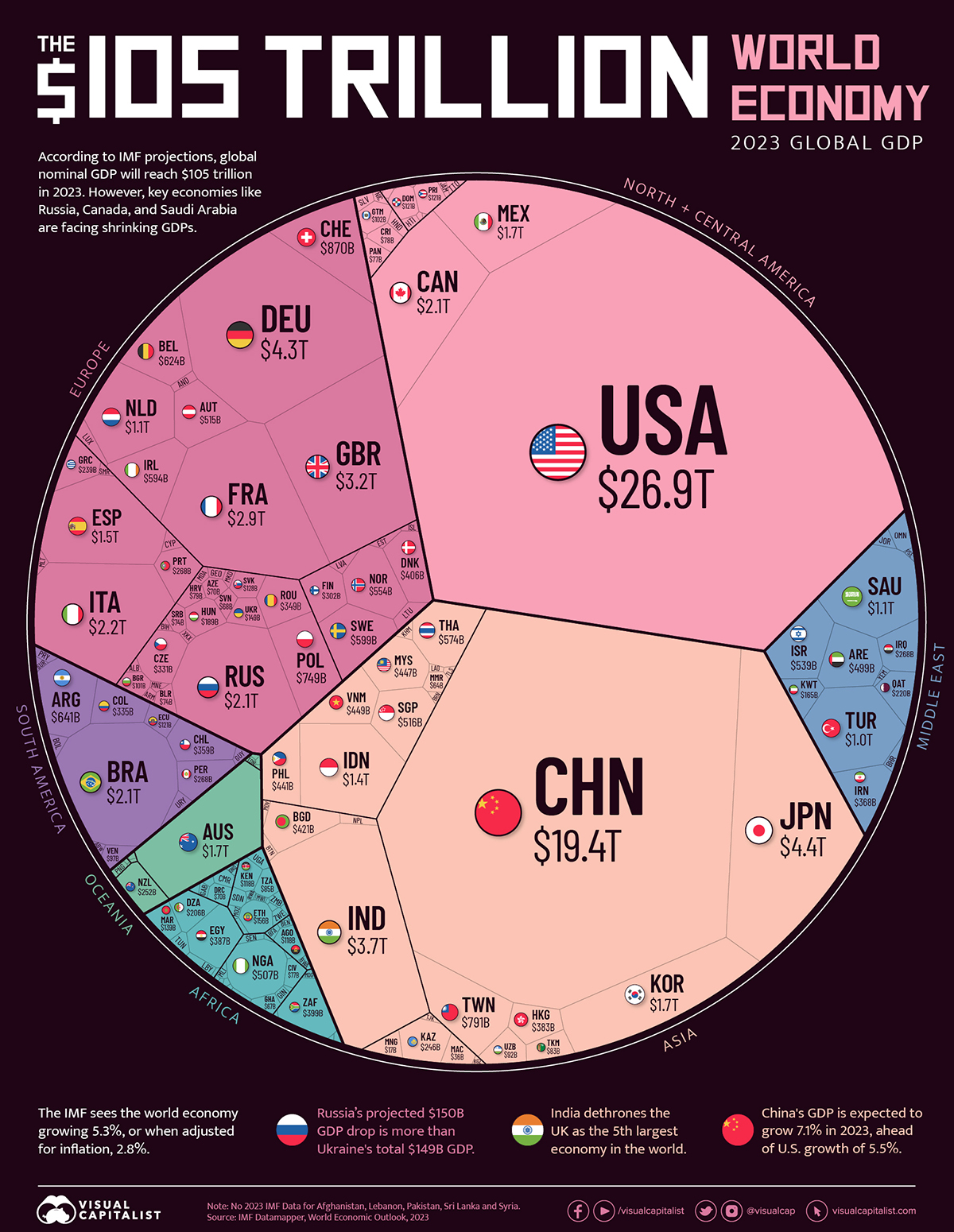

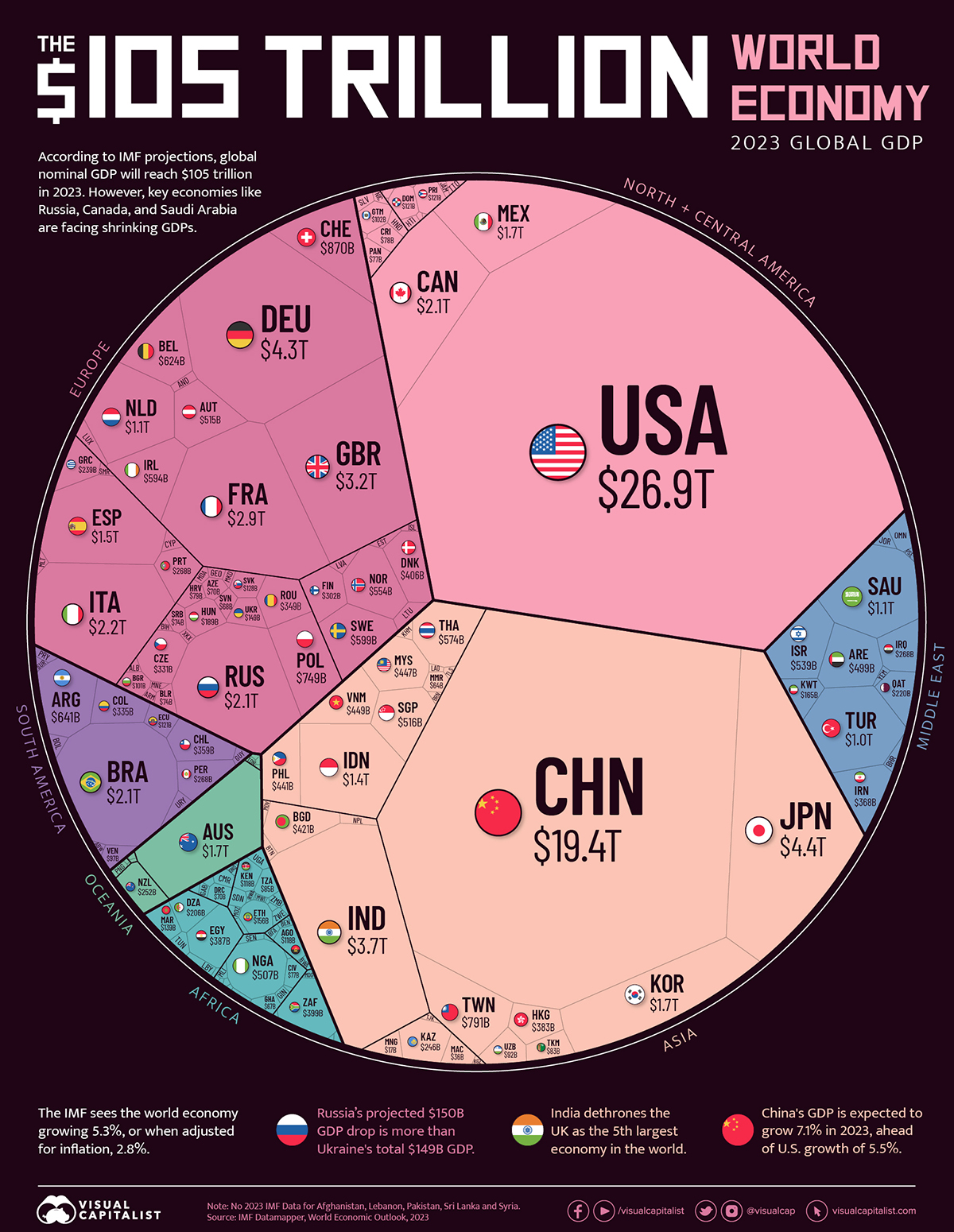

The global economy is experiencing significant flux, driven by geopolitical shocks, technological innovation, and pronounced policy volatility. This instability poses a direct threat to the achievement of the 2030 Agenda for Sustainable Development. The current economic turbulence jeopardizes progress on key Sustainable Development Goals (SDGs), particularly those related to economic growth, inequality, institutional stability, and global partnerships.

The Erosion of Global Stability and its Implications for SDG 16 and SDG 17

Weakening Multilateralism and Institutional Trust (SDG 16)

Recent policy shifts, characterized by sudden tariffs and an unpredictable approach to international agreements, are undermining the foundations of the global order. This erosion of predictability challenges the core tenets of SDG 16 (Peace, Justice, and Strong Institutions), which relies on stable, reliable, and transparent governance. There are growing concerns regarding:

- The independence and credibility of central banks.

- The stability of international financial architecture.

- The adherence to the rule of law in economic policymaking.

This behavior risks creating an environment where capital outflows and investor hesitancy become more common, mirroring conditions that hinder development in less stable nations and undermining the strong institutions needed for sustainable progress.

Challenges to Global Partnerships (SDG 17)

The move away from global policy coordination and the potential fragmentation of the world trading system represent a direct assault on SDG 17 (Partnerships for the Goals). A reliable global framework is essential for mobilizing resources, ensuring fair trade, and tackling shared challenges. The current climate has introduced a daunting list of uncertainties that complicate international cooperation:

- The relationship between disruptions in global trade and global capital flows.

- The potential for tariffs to fuel a sustained inflationary cycle, harming consumers globally.

- The long-term consequences of supply chain disruptions exacerbated by geopolitical tensions.

- The pressure on nations to choose between economic superpowers, fracturing global unity.

Economic Scenarios and their Consequences for SDG 8 and SDG 10

Forecasters envision two primary trajectories for the U.S. economy, each with profound and divergent consequences for sustainable and inclusive global development.

Scenario A: Restructuring for Sustainable Growth

An optimistic outcome involves an economic restructuring that could align with long-term sustainability objectives. This scenario would see the emergence of a more efficient, less debt-encumbered economy capable of leveraging innovation. This could advance several SDGs:

- SDG 9 (Industry, Innovation, and Infrastructure): Unleashing the private sector could accelerate productivity-enhancing innovations in artificial intelligence, life sciences, and robotics.

- SDG 8 (Decent Work and Economic Growth): A more dynamic economy, operating within a fairer global trading system, could foster sustainable growth and create high-quality jobs.

- SDG 17 (Partnerships for the Goals): A reset of the global order could result in a more equitable distribution of costs for providing global public goods.

Scenario B: Stagflation and the Reversal of Development Gains

A pessimistic scenario projects a slide into stagflation and recession, which would severely undermine the 2030 Agenda. This outcome would be characterized by rising costs, weakening demand, and financial instability, with devastating effects:

- SDG 8 (Decent Work and Economic Growth): Households would face diminished purchasing power and job security, leading to a global recession.

- SDG 10 (Reduced Inequalities): A downturn would disproportionately harm a generation already facing high debt and low resilience, exacerbating both domestic and global inequalities.

- SDG 1 (No Poverty) and SDG 13 (Climate Action): A global crisis would divert critical resources and political will away from poverty eradication and climate action, jeopardizing the well-being of current and future generations.

Strategic Responses for a Resilient and Sustainable Future

In this volatile environment, governments, companies, and investors must adopt strategies that build resilience and actively support sustainable development outcomes.

National and Regional Strategies for Resilience

Nations and regional blocs are seeking to insulate themselves from volatility and regain control of their economic destinies. These efforts, if successful, could create new models for sustainable development.

- Europe: Can use the instability as an impetus to pursue reforms that address its innovation and productivity gaps (SDG 9), complete its banking and fiscal unions for greater stability, and build more robust regional capital markets.

- China: Could revamp its growth model by shifting from exports to private domestic consumption, contributing to more balanced and sustainable global growth (SDG 8).

- Major Developing Countries: Nations like Brazil and India can be spurred to enact reforms that drive their economies through the middle-income trap, fostering more inclusive growth.

Corporate and Investor Imperatives for Advancing the SDGs

Private sector actors must move beyond a “stay the course” mentality and fundamentally rethink their strategies to navigate risks and contribute to a sustainable future. Key actions include:

- Build Financial and Operational Resilience: Strengthen balance sheets and increase cash holdings to absorb shocks and maintain the capacity to invest in long-term sustainable initiatives.

- Diversify Supply Chains: Move toward more robust, transparent, and potentially localized supply chains, which can enhance regional economic strength and contribute to SDG 8 and SDG 9 in more diverse locations.

- Invest in Human Capital: Prioritize employee development and reskilling to adapt to technological and economic shifts, directly supporting SDG 4 (Quality Education) and SDG 8.

- Embrace Proactive Scenario Planning: Systematically stress-test strategies against a range of futures to identify vulnerabilities and ensure long-term alignment with sustainability principles.

- Avoid Behavioral Traps: Actively counter cognitive biases like “active inertia” to make the bold, transformative decisions required to shift away from outdated models and toward genuinely sustainable and resilient business practices.

Conclusion: A Call for Bold Action in Pursuit of the 2030 Agenda

The current period of global insecurity presents profound risks to human well-being and the future of the planet. However, it also creates an opportunity for a fundamental reset. The choices made by leaders in government and business in the coming months will have lasting consequences. This is not a time for timidity, but for boldness, creativity, and a willingness to challenge conventional wisdom. By rethinking how economies, businesses, and investments are managed, the global community can not only navigate the storm but emerge stronger, more prosperous, and more firmly on the path to achieving the Sustainable Development Goals.

1. Which SDGs are addressed or connected to the issues highlighted in the article?

SDG 8: Decent Work and Economic Growth

- The article is centered on economic performance, discussing scenarios of economic restructuring, stagflation, recession, and growth. It highlights the importance of productivity and the potential for economic turmoil to undermine job security and purchasing power for households.

SDG 9: Industry, Innovation, and Infrastructure

- The text frequently mentions “transformative technological innovations” such as “artificial intelligence, life sciences, and robotics” as key drivers of productivity and economic leadership. It also points to the need for infrastructure investment in Europe to spur growth.

SDG 10: Reduced Inequalities

- The article touches upon inequality by noting that future generations are set to inherit a world of “high debt, inequality, and climate crises.” It also discusses the need for a “fairer trading system” and ensuring developing countries have a voice, particularly as the U.S. economy shows characteristics of a developing nation.

SDG 12: Responsible Consumption and Production

- The article suggests a shift in economic models, specifically mentioning that “China could also fundamentally revamp its growth model, replacing the traditional engines of exports and state investment with the unleashing of private domestic consumption and private investment,” which relates to changing patterns of consumption and production.

SDG 13: Climate Action

- Although not a central theme, the article explicitly mentions that a potential global recession would be particularly damaging for future generations who are “already due to inherit a world of high debt, inequality, and climate crises.”

SDG 16: Peace, Justice, and Strong Institutions

- A core theme is the erosion of institutional stability. The article highlights concerns about “central bank independence,” the weakening of “trust in institutions,” and the risk to the “rule of law.” It contrasts this with the historical strength of “mature institutions” in the U.S.

SDG 17: Partnerships for the Goals

- The entire article revolves around the breakdown of global partnerships and policy coordination. It details the U.S. pulling back from its role as a “reliable driver of world economic growth,” the imposition of tariffs that threaten the “global trading system,” and the resulting need for “global policy coordination.”

2. What specific targets under those SDGs can be identified based on the article’s content?

SDG 8: Decent Work and Economic Growth

- Target 8.1: Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7 per cent gross domestic product growth per annum in the least developed countries. The article’s discussion of potential recession, stagflation, or high growth directly relates to this target.

- Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation. This is directly supported by the article’s emphasis on “productivity-enhancing innovations in areas where the United States already leads, such as artificial intelligence, the life sciences, robotics.”

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure… to support economic development and human well-being. This is referenced when the article states that Europe could be “Led by a Germany more interested in defense and infrastructure.”

- Target 9.b: Support domestic technology development, research and innovation in developing countries. The article discusses the need for Europe to address its “lack of innovation” and for China to unleash private investment, reflecting the spirit of this target.

SDG 10: Reduced Inequalities

- Target 10.5: Improve the regulation and monitoring of global financial markets and institutions and strengthen the implementation of such regulations. The article’s focus on “financial instability,” a “roller coaster not just for bonds and equities,” and nervous “financial debt markets” points directly to this target.

SDG 12: Responsible Consumption and Production

- Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources. The discussion of China revamping its growth model away from export-led growth towards domestic consumption implies a shift in production and consumption patterns that is relevant to this target.

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. The article’s mention of “climate crises” as an inherited problem for future generations underscores the failure to integrate these measures into the economic and political policies being discussed.

SDG 16: Peace, Justice, and Strong Institutions

- Target 16.6: Develop effective, accountable and transparent institutions at all levels. This is a central theme, with the article citing “concern about central bank independence,” erosion of “trust in institutions,” and a U.S. policy approach that undermines institutional credibility.

SDG 17: Partnerships for the Goals

- Target 17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system. The article directly addresses threats to this target through its discussion of “sudden, high tariffs,” the risk of the “global trading system” fragmenting, and the need for a “fairer trading system.”

- Target 17.13: Enhance global macroeconomic stability, including through policy coordination and policy coherence. The article’s main argument is about the lack of macroeconomic stability caused by “policy volatility emanating from Washington” and the breakdown of “global policy coordination.”

- Target 17.14: Enhance policy coherence for sustainable development. The article critiques the U.S. “swiss cheese approach to concessions” as an example of incoherent policymaking with global repercussions.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

SDG 8: Decent Work and Economic Growth

- Indicator for Target 8.1: Real GDP growth rate. This is implied by the extensive discussion of “recession,” “stagflation,” and economic “growth.”

- Indicator for Target 8.2: Productivity growth. The article explicitly mentions “productivity growth” and “productivity-enhancing innovations” as critical for a positive economic outcome.

SDG 9: Industry, Innovation, and Infrastructure

- Indicator for Target 9.1: Investment in infrastructure. This is mentioned in the context of Germany and Europe needing to increase spending in this area.

- Indicator for Target 9.b: Research and development expenditure. This is implied by the focus on leading in “artificial intelligence, the life sciences, robotics, and (down the road) quantum computing.”

SDG 10: Reduced Inequalities

- Indicator for Target 10.5: Financial market volatility. The article explicitly describes the market as a “roller coaster,” “unstable,” and “nervous,” which are direct measures of volatility.

SDG 16: Peace, Justice, and Strong Institutions

- Indicator for Target 16.6: Public trust in institutions. The article directly states that “Trust in institutions continues to erode.” Another indicator is the perceived independence of the central bank, which is mentioned as a specific “concern.”

SDG 17: Partnerships for the Goals

- Indicator for Target 17.10: Average tariff rates. The article is replete with mentions of “high tariffs,” “manageable tariffs,” and their impact on global trade.

- Indicator for Target 17.13: Exchange rate stability and policy volatility. The “weakening of the dollar” is cited as a key issue, and “policy volatility” is a central theme of the entire article.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth |

8.1: Sustain per capita economic growth. 8.2: Achieve higher levels of economic productivity through innovation. |

Real GDP growth rate (implied by discussion of recession/growth). Productivity growth (explicitly mentioned). |

| SDG 9: Industry, Innovation, and Infrastructure |

9.1: Develop quality, reliable, sustainable and resilient infrastructure. 9.b: Support domestic technology development, research and innovation. |

Investment in infrastructure (mentioned for Europe). Research and development expenditure (implied by focus on AI, life sciences, etc.). |

| SDG 10: Reduced Inequalities | 10.5: Improve the regulation and monitoring of global financial markets. | Financial market volatility (described as a “roller coaster” and “unstable”). |

| SDG 12: Responsible Consumption and Production | 12.2: Achieve the sustainable management and efficient use of natural resources. | Shift in national growth models (implied by China moving from export-led to domestic consumption-led growth). |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. | Mention of “climate crises” as an inherited problem for future generations, indicating a lack of policy integration. |

| SDG 16: Peace, Justice, and Strong Institutions | 16.6: Develop effective, accountable and transparent institutions at all levels. |

Public trust in institutions (explicitly mentioned as eroding). Perceived independence of the central bank (mentioned as a concern). |

| SDG 17: Partnerships for the Goals |

17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system. 17.13: Enhance global macroeconomic stability. 17.14: Enhance policy coherence for sustainable development. |

Average tariff rates (explicitly mentioned). Exchange rate stability (the “weakening of the dollar”). Policy volatility (central theme of the article). |

Source: foreignaffairs.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0