Middle East and Africa Water and Wastewater Treatment Industry Size Share Forecast 2018 2034 – openPR.com

Report on the Middle East & Africa Water and Wastewater Treatment Market and its Alignment with Sustainable Development Goals

Executive Summary

The Middle East & Africa (MEA) Water and Wastewater Treatment Market is projected to experience significant growth through 2034. This expansion is fundamentally linked to the pursuit of several United Nations Sustainable Development Goals (SDGs), particularly SDG 6 (Clean Water and Sanitation). Key drivers include rapid urbanization, industrial development, and acute water scarcity, compelling regional governments and private entities to invest heavily in sustainable water management infrastructure.

Market Drivers and Alignment with Sustainable Development Goals

The market’s growth is propelled by factors that directly correspond with global sustainability targets:

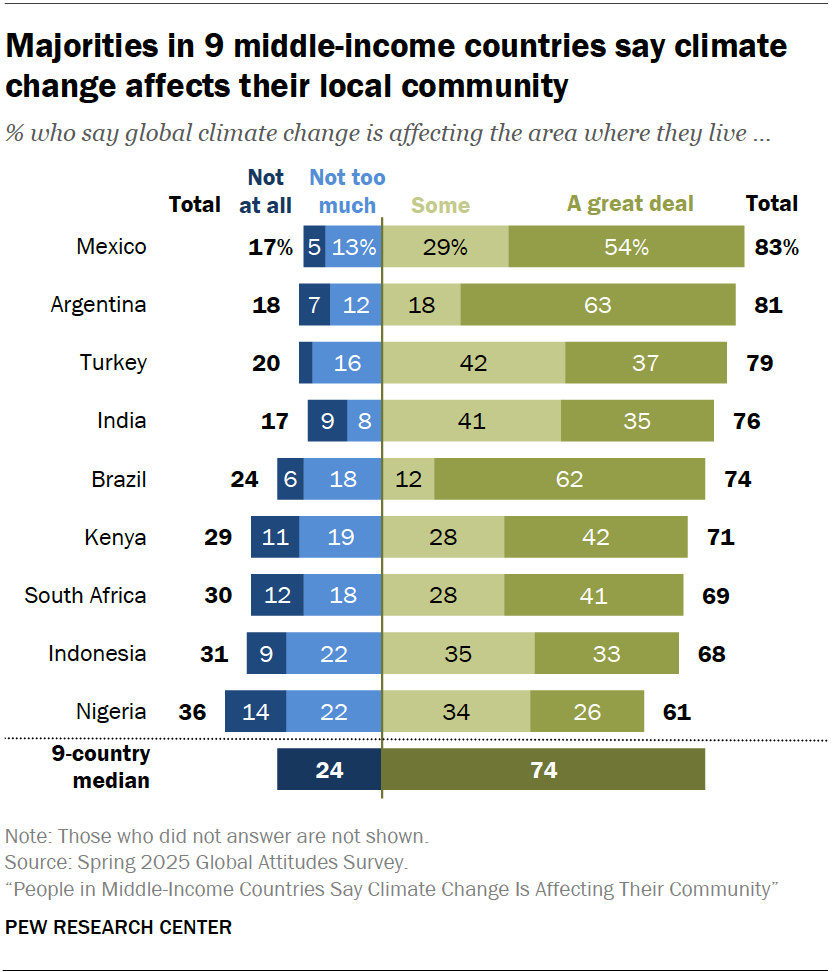

- Water Scarcity and Climate Change: Increasing water stress across the MEA region necessitates advanced treatment and desalination solutions, directly supporting SDG 6 (Clean Water and Sanitation) and SDG 13 (Climate Action) by promoting resilient water infrastructure.

- Urbanization and Population Growth: The rising demand for safe drinking water and effective sanitation in expanding urban centers is a primary driver, aligning with SDG 11 (Sustainable Cities and Communities) and its goal of providing universal access to basic services.

- Industrial Expansion: Growth in sectors like oil & gas, chemicals, and power generation requires specialized wastewater treatment to mitigate environmental impact, contributing to SDG 9 (Industry, Innovation, and Infrastructure) and SDG 12 (Responsible Consumption and Production).

- Regulatory Frameworks and Partnerships: Governments are implementing stricter water quality standards and fostering public-private partnerships (PPPs) to finance infrastructure upgrades. This approach is central to achieving SDG 17 (Partnerships for the Goals).

Market Segmentation and Contribution to SDGs

Applications

- Municipal Sector: This dominant segment focuses on providing safe drinking water and treating sewage, which is fundamental to achieving SDG 6.1 (universal and equitable access to safe drinking water) and SDG 6.2 (access to adequate and equitable sanitation and hygiene).

- Industrial Sector: This rapidly expanding segment addresses the need for specialized water treatment in manufacturing and production. It supports SDG 9.4 by upgrading infrastructure for sustainability and SDG 6.3 by reducing pollution and increasing water recycling and safe reuse.

Treatment Processes and Technologies

The adoption of advanced treatment processes is critical for meeting sustainability objectives:

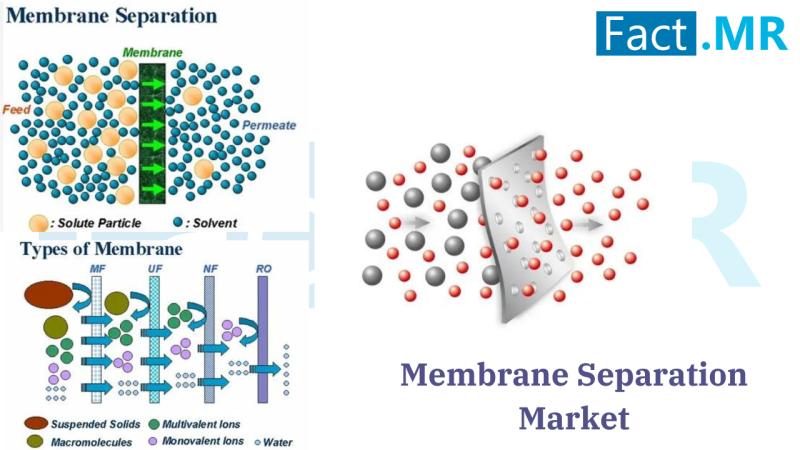

- Primary and Secondary Treatment: Secondary treatment holds a significant market share, as it is essential for removing biological contaminants and forms a baseline for compliance with SDG 6.3.

- Tertiary Treatment: The adoption of tertiary treatment is growing, driven by the need for high-purity water for reuse. This directly supports the principles of a circular economy and the targets of SDG 12.2 on the sustainable management of natural resources.

- Advanced Equipment: Membrane technologies like reverse osmosis (RO) and ultrafiltration (UF) are gaining prominence, especially in desalination and water reuse applications, making them vital tools for achieving water security under SDG 6.

Technological Advancements for Sustainable Water Management

Innovation is enhancing the market’s capacity to meet SDG targets:

- Smart Water Systems: The integration of IoT, automation, and data-driven monitoring (Industry 4.0) improves the operational efficiency of treatment facilities, contributing to SDG 9 by fostering innovation and resilient infrastructure.

- Renewable Energy Integration: The increasing use of renewable energy to power water treatment plants presents a significant growth opportunity, creating a synergy between SDG 6 (Clean Water) and SDG 7 (Affordable and Clean Energy).

Regional Initiatives and Outlook

Strategic focus varies across the MEA region but remains aligned with the SDGs:

- GCC Nations: Heavy investment in large-scale water reuse and desalination projects reflects a commitment to creating a circular water economy, in line with SDG 12.

- African Nations: The focus is on developing basic water and sanitation infrastructure to improve access to potable water, directly addressing the foundational targets of SDG 6.

The market is expected to continue its strong growth trajectory, driven by policy reforms and a collective push towards decentralized and sustainable water treatment solutions. This trend underscores the region’s commitment to achieving a secure and sustainable water future in alignment with global development agendas.

Key Market Players

Leading companies are driving innovation and strengthening regional capacity through local partnerships and sustainable technologies. Key players include:

- Veolia

- SUEZ

- Xylem Inc.

- Aquatech International LLC

- DuPont Water Solutions

- Kurita Water Industries Ltd.

- Grundfos

Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 6: Clean Water and Sanitation

This is the most central SDG in the article. The entire text focuses on the “Water and Wastewater Treatment Market,” which directly relates to ensuring the availability and sustainable management of water and sanitation. The article mentions key issues like the “growing demand for clean water,” “water scarcity,” “sewage treatment,” “water purification,” and “safe drinking water,” all of which are core components of SDG 6.

-

SDG 9: Industry, Innovation, and Infrastructure

The article highlights the importance of infrastructure development, stating that countries are “actively investing in water treatment infrastructure” and upgrading “existing water and wastewater infrastructure.” It also emphasizes innovation through “technological advancements such as smart water systems, automation, and data-driven monitoring tools” and the expansion of the “industrial segment” requiring specialized water treatment, which aligns with building resilient infrastructure and promoting sustainable industrialization.

-

SDG 11: Sustainable Cities and Communities

The article connects water management to urban development by noting that “rising urbanization” is a key driver for the market. It specifies that the “municipal segments dominate due to the growing need for safe drinking water and efficient sewage treatment in urban areas.” This directly addresses the goal of making cities and human settlements inclusive, safe, resilient, and sustainable by providing essential services like water and sanitation.

-

SDG 12: Responsible Consumption and Production

The article discusses the shift towards sustainability through efficient resource management. It mentions the increasing adoption of “water reuse projects,” “urban recycling initiatives,” and the move toward “circular water economy models.” This focus on reducing waste and promoting recycling and reuse aligns with ensuring sustainable consumption and production patterns, particularly for a critical natural resource like water.

-

SDG 13: Climate Action

The article implicitly links its subject to climate action by stating that “climate change are intensifying the need for advanced water management systems.” This acknowledges that climate change exacerbates water scarcity and that robust water treatment and management infrastructure are critical adaptation measures.

-

SDG 17: Partnerships for the Goals

The article emphasizes the role of collaboration in achieving water management goals. It mentions that “Governments are… encouraging public-private partnerships” and that “International aid, funding from development banks, and strategic alliances with global companies are supporting market growth in low-income regions.” This points to the importance of partnerships between governments, the private sector, and international bodies to achieve sustainable development.

What specific targets under those SDGs can be identified based on the article’s content?

-

Target 6.1: Achieve universal and equitable access to safe and affordable drinking water for all.

The article directly supports this target by highlighting efforts to address the “growing need for safe drinking water” and mentioning that African nations are “focusing on building basic infrastructure to improve access to potable water.”

-

Target 6.3: Improve water quality by reducing pollution, …halving the proportion of untreated wastewater and substantially increasing recycling and safe reuse globally.

This is a core theme of the article, which is centered on the “Water and Wastewater Treatment Market.” It discusses technologies for “sewage treatment,” reducing “contamination of freshwater sources,” and promoting “water reuse projects” and “urban recycling initiatives.”

-

Target 6.a: Expand international cooperation and capacity-building support to developing countries in water- and sanitation-related activities and programmes.

The article identifies this by stating that “International aid, funding from development banks, and strategic alliances with global companies are supporting market growth in low-income regions,” particularly for technologies like “desalination” and “wastewater treatment.”

-

Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure.

The article discusses countries “actively investing in water treatment infrastructure” and efforts to “upgrade existing water and wastewater infrastructure,” which is a direct reflection of this target.

-

Target 11.6: Reduce the adverse per capita environmental impact of cities, including by paying special attention to… municipal and other waste management.

The focus on the “municipal” segment for “efficient sewage treatment in urban areas” due to “rising urbanization” directly relates to managing waste within cities to reduce their environmental impact.

-

Target 12.5: Substantially reduce waste generation through prevention, reduction, recycling and reuse.

The article points to this target through its emphasis on “water reuse projects,” “reuse applications,” and the adoption of “circular water economy models,” which are all methods to reduce water waste and promote recycling.

-

Target 17.17: Encourage and promote effective public, public-private and civil society partnerships.

This target is explicitly mentioned in the article, which states that “Governments are implementing stringent regulations for water quality and encouraging public-private partnerships to upgrade existing water and wastewater infrastructure.”

Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Implied Indicator for Target 6.1: Proportion of population using safely managed drinking water services.

The article implies this indicator through its focus on the “growing need for safe drinking water” and projects to “improve access to potable water.” Market growth in this segment would suggest an increase in this proportion.

-

Implied Indicator for Target 6.3: Proportion of domestic and industrial wastewater safely treated.

The entire article, which analyzes the “Water and Wastewater Treatment Market” for both “municipal and industrial applications,” serves as a proxy for this indicator. Market expansion in “sewage treatment” and “industrial… treatment solutions” directly correlates with progress on treating wastewater.

-

Implied Indicator for Target 9.1 & 17.17: Investment in water infrastructure and value of public-private partnerships.

The article’s discussion of countries “actively investing in water treatment infrastructure” and the encouragement of “public-private partnerships” implies that the financial value of these investments and partnerships is a key metric for measuring progress.

-

Implied Indicator for Target 12.5: Water recycling/reuse rate.

The mention of “water reuse projects,” “tertiary treatment… for achieving high-purity standards in water reuse,” and the growth of “reuse applications” suggests that the volume or percentage of water being recycled and reused is a critical measure of success.

Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators (Identified or Implied in the Article) |

|---|---|---|

| SDG 6: Clean Water and Sanitation | 6.1: Achieve universal and equitable access to safe and affordable drinking water for all. | Proportion of population with access to potable/safe drinking water. |

| SDG 6: Clean Water and Sanitation | 6.3: Improve water quality by reducing pollution, halving untreated wastewater, and increasing recycling and reuse. | Proportion of municipal and industrial wastewater safely treated; Rate of water recycling and reuse. |

| SDG 6: Clean Water and Sanitation | 6.a: Expand international cooperation and capacity-building support to developing countries. | Amount of international aid, funding, and strategic alliances for water projects in low-income regions. |

| SDG 9: Industry, Innovation, and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure. | Level of investment in new and upgraded water and wastewater infrastructure. |

| SDG 11: Sustainable Cities and Communities | 11.6: Reduce the adverse per capita environmental impact of cities, including waste management. | Rate of efficient sewage treatment in urban areas. |

| SDG 12: Responsible Consumption and Production | 12.5: Substantially reduce waste generation through reduction, recycling and reuse. | Adoption rate of water reuse projects and circular water economy models. |

| SDG 13: Climate Action | Strengthen resilience and adaptive capacity to climate-related hazards. | Investment in and deployment of advanced water management systems to combat climate-induced water scarcity. |

| SDG 17: Partnerships for the Goals | 17.17: Encourage and promote effective public, public-private and civil society partnerships. | Number and value of public-private partnerships for upgrading water infrastructure. |

Source: openpr.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0