Portland General Electric’s Dividend: A Model for Sustainable Growth in the Clean Energy Era – AInvest

Report on Portland General Electric’s Strategy for Sustainable Growth and SDG Alignment

Executive Summary

This report analyzes the strategic direction of Portland General Electric (POR), focusing on its recent dividend declaration as an indicator of a broader corporate strategy that integrates financial discipline with a robust commitment to the United Nations Sustainable Development Goals (SDGs). The company’s capital allocation, clean energy transition, and operational performance demonstrate a comprehensive model for creating long-term value by aligning shareholder returns with critical environmental and social objectives.

Financial Framework and Capital Discipline

Dividend Sustainability and Payout Ratio

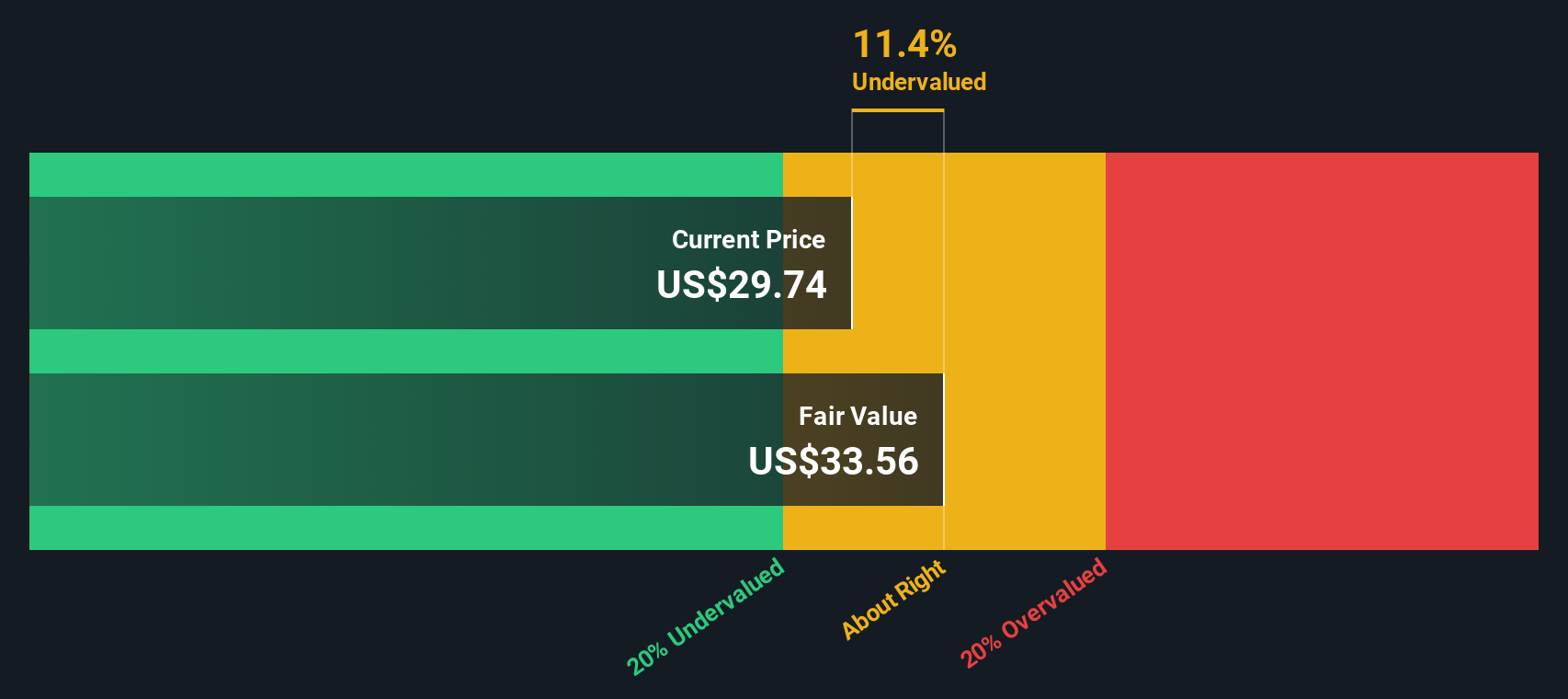

POR’s declaration of a $0.525 quarterly dividend is underpinned by a disciplined financial policy. The resulting annualized dividend of $2.10 per share represents a payout ratio of approximately 67% based on 2024 non-GAAP EPS of $3.14. This performance aligns with the company’s stated target of a 60–70% payout ratio, ensuring a balance between providing consistent shareholder returns and retaining sufficient capital for strategic reinvestment. This approach supports SDG 8 (Decent Work and Economic Growth) by fostering a stable investment environment.

Strategic Capital Allocation

In 2024, POR executed a capital investment plan of $1.26 billion. These funds were strategically directed toward initiatives that enhance long-term resilience and advance sustainability targets. Key investment areas include:

- Grid modernization to improve efficiency and reliability.

- Integration of renewable energy sources.

- Wildfire mitigation infrastructure to protect communities and assets.

This capital deployment is fundamental to achieving the company’s clean energy goals and directly supports SDG 9 (Industry, Innovation, and Infrastructure).

Commitment to Sustainable Development Goals (SDGs)

SDG 7: Affordable and Clean Energy

POR’s core business strategy is intrinsically linked to SDG 7. The company is actively transitioning its energy portfolio through significant investments and clear targets.

- Emission Reduction Targets: A commitment to reduce retail power supply emissions by 80% by 2030 and achieve net-zero emissions by 2040, directly addressing SDG 13 (Climate Action).

- Renewable Asset Integration: The operationalization of the Clearwater Wind Energy Center and associated battery storage systems has increased non-emitting resources to 45% of POR’s total energy mix.

- Future Procurement: The company’s Clean Energy Plan outlines the procurement of 375–500 MW of renewables and 375 MW of non-emitting capacity, further advancing its transition away from fossil fuels.

SDG 9: Industry, Innovation, and Infrastructure

POR’s investment in resilient and sustainable infrastructure is a cornerstone of its strategy. This focus not only enhances operational stability but also prepares the grid for future demands, such as the electrification of transportation and buildings. This modernization is critical for building resilient infrastructure as outlined in SDG 9.

Broader Contributions to SDGs

POR’s ESG initiatives demonstrate a holistic commitment to sustainability that extends across multiple goals.

- SDG 11 (Sustainable Cities and Communities): By investing in grid resilience and wildfire mitigation, POR helps create safer and more sustainable communities. Its focus on electrification supports the transition to cleaner urban transportation.

- SDG 15 (Life on Land): Environmental stewardship is evidenced by record fish returns on the Clackamas and Deschutes Rivers, including the highest steelhead return to Round Butte Dam since the 1960s, showcasing a commitment to protecting biodiversity.

- SDG 4 (Quality Education): The company contributed to social equity by awarding 55 scholarships to support underrepresented students in their educational pursuits.

- SDG 17 (Partnerships for the Goals): POR utilizes innovative financing mechanisms, such as issuing $150 million in green bonds for the Wheatridge Renewable Energy Facility, demonstrating a partnership-based approach to funding sustainable development.

Investment Implications and Market Position

ESG Alignment as a Value Driver

POR’s proactive alignment with SDG and ESG criteria positions it favorably within a market increasingly focused on sustainability. This strategy mitigates long-term regulatory risks associated with carbon emissions and enhances its appeal to a growing pool of ESG-focused investors. The company’s top ranking in the Forrester U.S. Customer Experience Index further solidifies its reputation for operational excellence.

Future Outlook

The combination of a stable dividend, significant investments in clean energy infrastructure, and a comprehensive ESG strategy provides a strong foundation for future growth. By embedding the SDGs into its core business model, POR is not only addressing global challenges but is also future-proofing its revenue streams and enhancing its long-term valuation potential in a decarbonizing global economy.

1. Which SDGs are addressed or connected to the issues highlighted in the article?

SDG 7: Affordable and Clean Energy

The article extensively discusses Portland General Electric’s (POR) investments in clean energy. It highlights the company’s strategy to increase its reliance on renewable sources, as evidenced by the statement that “the Clearwater Wind Energy Center and battery storage systems have elevated non-emitting resources to 45% of POR’s energy mix.” This directly aligns with the goal of ensuring access to affordable, reliable, sustainable, and modern energy for all.

SDG 9: Industry, Innovation, and Infrastructure

The article details significant investments in infrastructure. It states, “In 2024, the company invested $1.26 billion in grid modernization, renewable integration, and wildfire mitigation.” This focus on upgrading infrastructure to be more resilient, reliable, and sustainable is a core component of SDG 9, which aims to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation.

SDG 11: Sustainable Cities and Communities

POR’s efforts contribute to making communities more sustainable and resilient. The focus on “electrification in transportation and buildings” and “wildfire mitigation” directly addresses challenges faced by urban and community areas. These actions support SDG 11’s goal of making cities and human settlements inclusive, safe, resilient, and sustainable.

SDG 13: Climate Action

The article explicitly states POR’s climate action goals: “The company aims to reduce retail power supply emissions by 80% by 2030 and achieve net-zero by 2040.” This commitment to combat climate change and its impacts by reducing greenhouse gas emissions is the central theme of SDG 13.

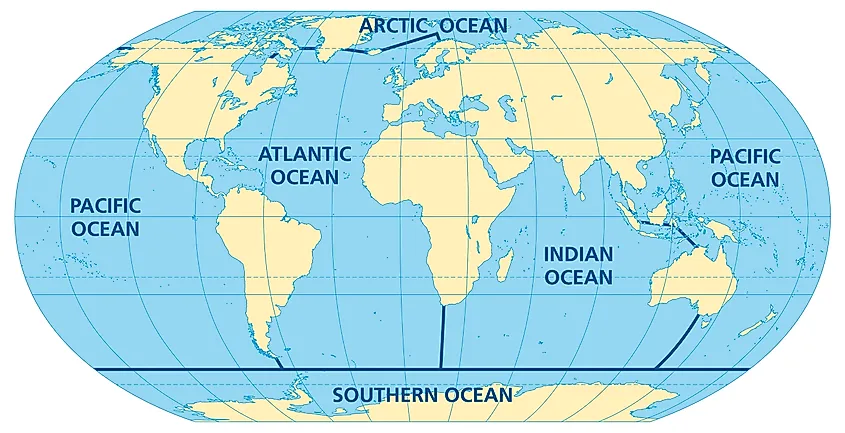

SDG 14: Life Below Water

The article provides a specific example of positive environmental impact on aquatic ecosystems. It notes that POR’s “hydroelectric facilities recorded record fish returns on the Clackamas and Deschutes Rivers, including the highest steelhead return to Round Butte Dam since the 1960s.” This demonstrates a commitment to conserving and sustainably using the oceans, seas, and marine resources, which extends to the freshwater ecosystems that support them.

SDG 4: Quality Education

The social component of POR’s ESG strategy includes educational support. The article mentions that the company “awarded 55 scholarships for underrepresented students.” This action directly contributes to SDG 4, which aims to ensure inclusive and equitable quality education and promote lifelong learning opportunities for all.

2. What specific targets under those SDGs can be identified based on the article’s content?

SDG 7: Affordable and Clean Energy

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. The article supports this by stating that non-emitting resources now constitute 45% of POR’s energy mix and that the company is procuring “375–500 MW of renewables.”

- Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology. This is demonstrated by POR’s “$1.26 billion” investment in “renewable integration” and its use of “green bonds for the Wheatridge Renewable Energy Facility.”

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure. The article highlights POR’s investment in “grid modernization” and “wildfire mitigation” to “enhance grid reliability.”

- Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable… with greater adoption of clean and environmentally sound technologies. POR’s investment in the “Clearwater Wind Energy Center and battery storage systems” is a direct example of this target.

SDG 11: Sustainable Cities and Communities

- Target 11.6: By 2030, reduce the adverse per capita environmental impact of cities. POR’s plan to “reduce retail power supply emissions by 80% by 2030” and promote “electrification in transportation” directly contributes to this target by improving air quality and reducing the carbon footprint of the community it serves.

- Target 11.b: …adopt and implement integrated policies and plans towards… resilience to disasters. The company’s investment in “wildfire mitigation” is a clear implementation of a plan to increase community resilience to climate-related disasters.

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. POR’s “Clean Energy Plan and Integrated Resource Plan,” which aims for an “80% reduction by 2030 and net-zero by 2040,” represents the integration of climate measures at the corporate and regional planning level.

SDG 14: Life Below Water

- Target 14.2: By 2020, sustainably manage and protect marine and coastal ecosystems… The article’s mention of “record fish returns on the Clackamas and Deschutes Rivers” as a result of its hydroelectric facility management demonstrates actions to protect and restore vital freshwater ecosystems that connect to marine environments.

SDG 4: Quality Education

- Target 4.3: By 2030, ensure equal access for all women and men to affordable and quality technical, vocational and tertiary education, including university. The provision of “55 scholarships for underrepresented students” is a direct contribution to this target.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

SDG 7: Affordable and Clean Energy

- Indicator for Target 7.2: The share of renewable energy. The article provides a specific figure: “non-emitting resources to 45% of POR’s energy mix.”

- Indicator for Target 7.a: Financial investment in clean energy. The article quantifies this with figures like “$1.26 billion in… renewable integration” and “$150 million in green bonds.”

SDG 9: Industry, Innovation, and Infrastructure

- Indicator for Target 9.1: Investment in infrastructure development and resilience. The article mentions the “$1.26 billion” investment in “grid modernization” and “wildfire mitigation.”

SDG 11: Sustainable Cities and Communities

- Indicator for Target 11.6: Greenhouse gas emissions reduction. The goal to “reduce retail power supply emissions by 80% by 2030” serves as a direct indicator.

SDG 13: Climate Action

- Indicator for Target 13.2: Reduction in greenhouse gas emissions. The article provides clear metrics: “reduce retail power supply emissions by 80% by 2030 and achieve net-zero by 2040.”

SDG 14: Life Below Water

- Indicator for Target 14.2: Measures of ecosystem health. The article provides a qualitative and quantitative indicator: “record fish returns” and the “highest steelhead return to Round Butte Dam since the 1960s.”

SDG 4: Quality Education

- Indicator for Target 4.3: Number of scholarships provided to specific groups. The article states a precise number: “55 scholarships for underrepresented students.”

4. Create a table with three columns titled ‘SDGs, Targets and Indicators” to present the findings from analyzing the article.

| SDGs, Targets and Indicators | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.2: Increase substantially the share of renewable energy in the energy mix. | Share of non-emitting resources in the energy mix (45%); Procurement of new renewables (375-500 MW). |

| SDG 9: Industry, Innovation, and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure. | Investment in grid modernization and wildfire mitigation ($1.26 billion). |

| SDG 11: Sustainable Cities and Communities | 11.6: Reduce the adverse per capita environmental impact of cities. | Commitment to reduce retail power supply emissions by 80% by 2030. |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into policies, strategies and planning. | Emission reduction goals (80% by 2030, net-zero by 2040) outlined in the Clean Energy Plan. |

| SDG 14: Life Below Water | 14.2: Sustainably manage and protect marine and coastal ecosystems. | Record fish returns, including the highest steelhead return since the 1960s. |

| SDG 4: Quality Education | 4.3: Ensure equal access for all to affordable and quality tertiary education. | Number of scholarships awarded to underrepresented students (55). |

Source: ainvest.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0