Rising Floodwaters: Navigating Climate Risk and Seizing Infrastructure Opportunities – AInvest

The Escalating Threat of Climate-Induced Flooding to Sustainable Development

Report on Economic Risks and Strategic Opportunities Aligned with Global Goals

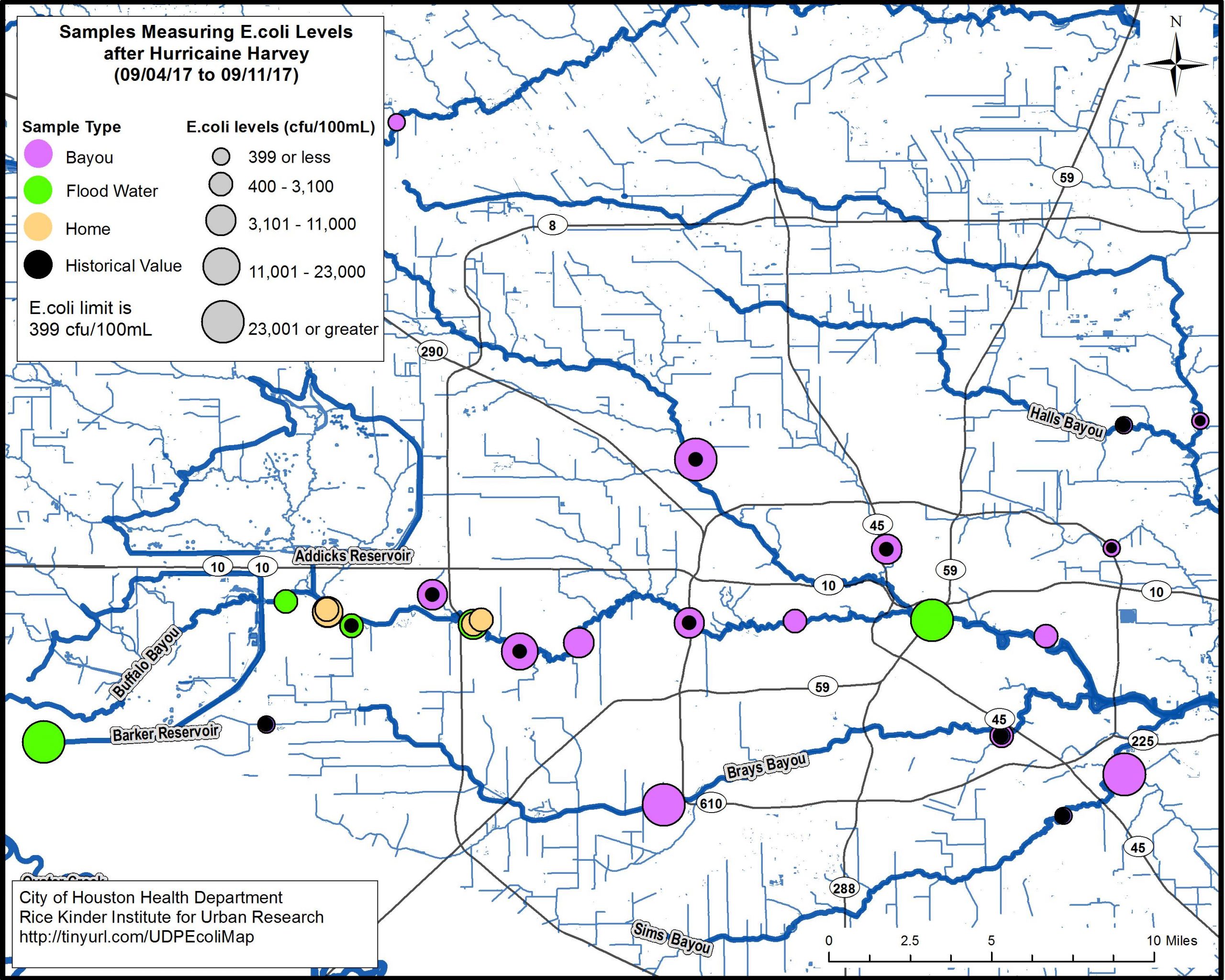

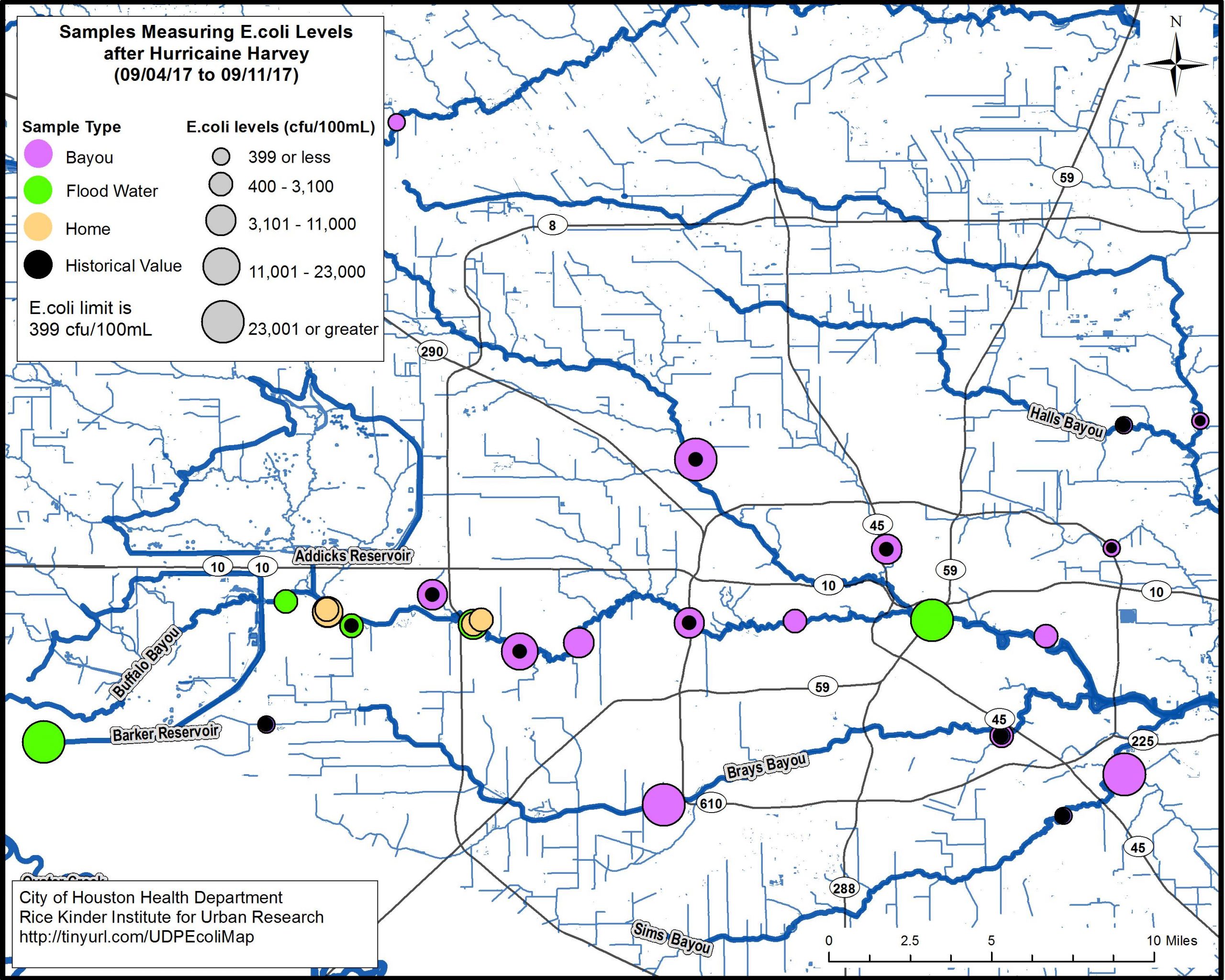

The increasing frequency and intensity of climate-related flooding present a significant impediment to achieving the Sustainable Development Goals (SDGs). Projections indicate that by 2030, a 1.5°C warming scenario will increase the number of people exposed to flood risk by 24%. This crisis directly threatens progress on multiple fronts, including **SDG 1 (No Poverty)**, **SDG 8 (Decent Work and Economic Growth)**, **SDG 9 (Industry, Innovation and Infrastructure)**, **SDG 11 (Sustainable Cities and Communities)**, and **SDG 13 (Climate Action)**. However, strategic investments in resilient infrastructure and adaptive financial mechanisms offer a pathway to mitigate these risks while advancing the 2030 Agenda.

Economic and Sectoral Impacts on Global SDG Progress

Undermining SDG 8: Decent Work and Economic Growth

Recent climate events demonstrate the severe economic repercussions of flooding, which directly undermine national economic stability and growth targets central to SDG 8.

- The 2023 floods in Slovenia resulted in damages estimated at €10 billion, equivalent to 16% of the nation’s GDP.

- Hurricane Otis in Mexico caused approximately $16 billion in losses, primarily impacting coastal tourism infrastructure.

- By 2035, climate-related hazards are projected to cost listed companies between $560–$610 billion annually.

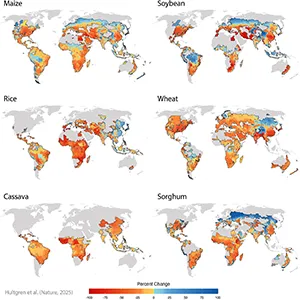

Sectoral Disparities and Implications for SDG 9: Industry, Innovation and Infrastructure

The impact of flooding is not uniform across sectors, creating complex challenges for industrial development and infrastructure resilience as outlined in SDG 9.

- Manufacturing and trade sectors experience immediate supply chain disruptions and output shocks.

- Utilities, telecommunications, and travel sectors face potential EBITA declines exceeding 20%.

- Middle-income regions, where an estimated 40% of flood defenses are in disrepair, are at risk of permanent declines in industrial output, jeopardizing long-term infrastructure goals.

Strategic Mitigation Framework Aligned with the Sustainable Development Goals

Advancing SDG 9 and SDG 11 Through Adaptive Infrastructure

Investing in resilient infrastructure is a cornerstone of achieving SDG 9 and SDG 11. Such investments not only protect communities and assets but also offer significant economic returns.

- Studies show that every $1 invested in flood defenses can yield between $2 and $19 in economic benefits.

- Increasing adaptation spending to 1% of GDP can reduce flood frequency by as much as 44.9% over a five-year period.

- Key growth areas include firms specializing in flood-resistant engineering and advanced materials like waterproof composites.

Strengthening SDG 1 and SDG 10 via Innovative Insurance Mechanisms

Financial instruments are crucial for building resilience, protecting vulnerable populations (**SDG 1**), and reducing inequalities (**SDG 10**).

- A significant protection gap exists, with only 25% of European flood damages currently insured, leaving small and medium-sized enterprises (SMEs) exposed.

- Proposed solutions like an EU catastrophe bond system and parametric insurance could mobilize an estimated $127 billion annually for adaptation efforts.

- Investment opportunities exist within insurers and risk modeling platforms that offer climate-linked parametric products.

Leveraging ESG Capital for SDG 12 and SDG 17

Aligning capital allocation with Environmental, Social, and Governance (ESG) criteria is essential for promoting **SDG 12 (Responsible Consumption and Production)** and fostering **SDG 17 (Partnerships for the Goals)**.

- Investors are increasingly demanding that companies in high-risk regions channel capital into resilient supply chains.

- The use of green bonds to finance the construction and maintenance of flood defenses is a critical mechanism for directing private finance toward sustainable outcomes.

Investment Opportunities in a Climate-Resilient Economy

Capital Deployment for Future-Proofing Assets and Achieving SDGs

- Resilient Infrastructure (SDG 9 & SDG 11): This includes civil engineering firms designing permeable pavements and elevated critical infrastructure, as well as technology companies developing smart urban systems for real-time flood monitoring.

- Insurance and Risk Management (SDG 1, SDG 10 & SDG 17): Opportunities lie with firms pioneering parametric insurance products and index-based flood coverage, which provide rapid payouts and enhance financial stability for affected communities.

- ESG-Driven Equity (SDG 12 & SDG 13): Companies in critical sectors like utilities and telecommunications that proactively invest in flood-hardened infrastructure are positioned to outperform peers, demonstrating a tangible commitment to climate action and responsible production.

Implementation Risks and Challenges to Equitable Adaptation

- Time Lag: The benefits of large-scale infrastructure projects are not immediate, typically requiring 2–5 years for construction and realization, demanding a long-term investment horizon.

- Maintenance Costs: The failure to maintain existing infrastructure, as seen with thousands of “very poor” rated defenses in England, can erode returns and undermine resilience efforts, posing a challenge to the sustainability aspect of SDG 9.

- Regional Disparities: There is a significant risk that adaptation will be concentrated in high-income regions, leaving low-income and vulnerable areas further exposed and exacerbating global inequalities, directly contradicting the core principle of **SDG 10 (Reduced Inequalities)**.

Conclusion: The Imperative for Integrating Climate Resilience into SDG Frameworks

Addressing climate-induced flood risk is inseparable from the pursuit of the Sustainable Development Goals. Businesses and investors that prioritize adaptive infrastructure, innovative insurance solutions, and ESG-aligned capital allocation are not only mitigating risk but are also capitalizing on the emerging climate economy. Failure to act risks creating stranded assets and economic exclusion, while proactive investment builds a resilient and sustainable future for all.

SDGs Addressed in the Article

- SDG 13: Climate Action: The entire article is framed around the consequences of climate change, specifically the “escalating threat of climate-related flooding” due to global warming. It focuses on adaptation and resilience as direct responses to climate impacts.

- SDG 9: Industry, Innovation and Infrastructure: A core theme is the need for investment in “resilient infrastructure” and “adaptive infrastructure.” The article highlights opportunities for infrastructure firms, civil engineering, and technological innovation (e.g., real-time flood monitoring systems) to mitigate flood risks.

- SDG 11: Sustainable Cities and Communities: The article discusses the impact of floods on urban and coastal areas, such as the destruction of “$16 billion in coastal tourism infrastructure” in Mexico. It advocates for strategies like “permeable pavements, elevated data centers, and floating neighborhoods” to make settlements more resilient to disasters.

- SDG 8: Decent Work and Economic Growth: The text extensively details the economic devastation caused by floods, which directly threatens economic growth. It cites examples like the Slovenian floods causing damages equivalent to “16% of its GDP” and predicts that climate hazards could cost listed companies “$560–610 billion annually.”

- SDG 1: No Poverty: The article touches upon the disproportionate impact on vulnerable populations and regions. It notes that “regional disparities” will leave “low-income areas exposed” and that the insurance gap leaves small and medium-sized enterprises (SMEs) vulnerable, which relates to building the resilience of the poor and vulnerable.

- SDG 17: Partnerships for the Goals: The article calls for a multi-stakeholder approach involving businesses, investors, and public bodies. It highlights the role of “ESG-aligned capital allocation,” public-private financing mechanisms like the proposed “EU catastrophe bond system,” and collaboration between insurers and businesses.

Identified SDG Targets

SDG 13: Climate Action

- Target 13.1: Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries.

Explanation: The article’s central argument is the “imperative to build resilience.” It advocates for “adaptive infrastructure,” “insurance innovation,” and “ESG-aligned capital allocation” as key strategies to strengthen adaptive capacity against the increasing risk of floods.

SDG 9: Industry, Innovation and Infrastructure

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure… to support economic development and human well-being.

Explanation: The article explicitly identifies “Resilient Infrastructure” as a key investment area and a “new safe asset.” It calls for building “flood-resistant engineering” and “flood-hardened infrastructure” to prevent supply chain disruptions and asset damage, thereby supporting economic stability.

SDG 11: Sustainable Cities and Communities

- Target 11.5: By 2030, significantly reduce… the direct economic losses relative to global gross domestic product caused by disasters, including water-related disasters, with a focus on protecting the poor and people in vulnerable situations.

Explanation: The article directly addresses this target by quantifying the economic losses from floods, such as the “€10 billion in damages” in Slovenia and the “$16 billion” loss in Mexico. Its proposed solutions are aimed at reducing these financial impacts. - Target 11.b: By 2020, substantially increase the number of cities and human settlements adopting and implementing integrated policies and plans towards… adaptation to climate change, resilience to disasters…

Explanation: The call for businesses and regions to adopt a “tripartite approach” of adaptive infrastructure, insurance, and strategic capital allocation is a direct call for implementing integrated plans for disaster resilience, as mentioned in this target.

SDG 1: No Poverty

- Target 1.5: By 2030, build the resilience of the poor and those in vulnerable situations and reduce their exposure and vulnerability to climate-related extreme events…

Explanation: The article highlights that “regional disparities” and neglected infrastructure in “middle-income regions” and “low-income areas” increase their vulnerability. The discussion on the insurance “protection gap” where “Only 25% of European flood damages are insured” also points to the financial vulnerability of populations and SMEs.

Indicators for Measuring Progress

Economic and Population Impact Indicators

- Direct Economic Loss: The article provides concrete data points that can be used as indicators of economic loss, such as “€10 billion in damages” (Slovenia), “$16 billion in coastal tourism infrastructure” (Mexico), and projected annual costs of “$560–610 billion” for listed companies.

- Population Exposure: The statistic that “24% more people will face flood exposure by 2030” is a direct indicator of human vulnerability to climate-related disasters.

- Insurance Protection Gap: The figure that “Only 25% of European flood damages are insured” serves as a key indicator of financial resilience. A decrease in this gap would signify progress.

Infrastructure and Investment Indicators

- Investment in Adaptation: The proposal of “raising adaptation spending to 1% of GDP” is a measurable input indicator for tracking commitment to building resilience.

- Condition of Infrastructure: The article implies that the state of existing defenses is a critical indicator, citing that “40% of flood defenses are in disrepair” in middle-income regions and “over 4,000 English flood defenses are ‘very poor’.”

- Effectiveness of Interventions: Progress can be measured by the outcomes of investments. The article suggests indicators such as a reduction in “flood frequency by up to 44.9% over five years” and the financial return on investment, where “Every $1 invested in flood defenses yields $2–$19 in returns.”

Summary Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 13: Climate Action | 13.1: Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters. |

|

| SDG 9: Industry, Innovation and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure. |

|

| SDG 11: Sustainable Cities and Communities | 11.5: Significantly reduce direct economic losses from disasters. |

|

| SDG 1: No Poverty | 1.5: Build the resilience of the poor and those in vulnerable situations. |

|

| SDG 8: Decent Work and Economic Growth | 8.1: Sustain per capita economic growth. |

|

Source: ainvest.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

![Lancaster homeowner’s energy-efficient renovation sparks clash over historic preservation [Lancaster Watchdog] – LancasterOnline](https://bloximages.newyork1.vip.townnews.com/lancasteronline.com/content/tncms/assets/v3/editorial/9/ed/9ed03d32-c902-44d2-a461-78ad888eec38/69050b156baeb.image.png?resize=150,75#)