Small Business Optimism Holds Steady In June, But Tax Worries Climb To Top Concern – CU Today

Report on Small Business Conditions and Alignment with Sustainable Development Goals (June)

Executive Summary: Economic Sentiment and SDG 8

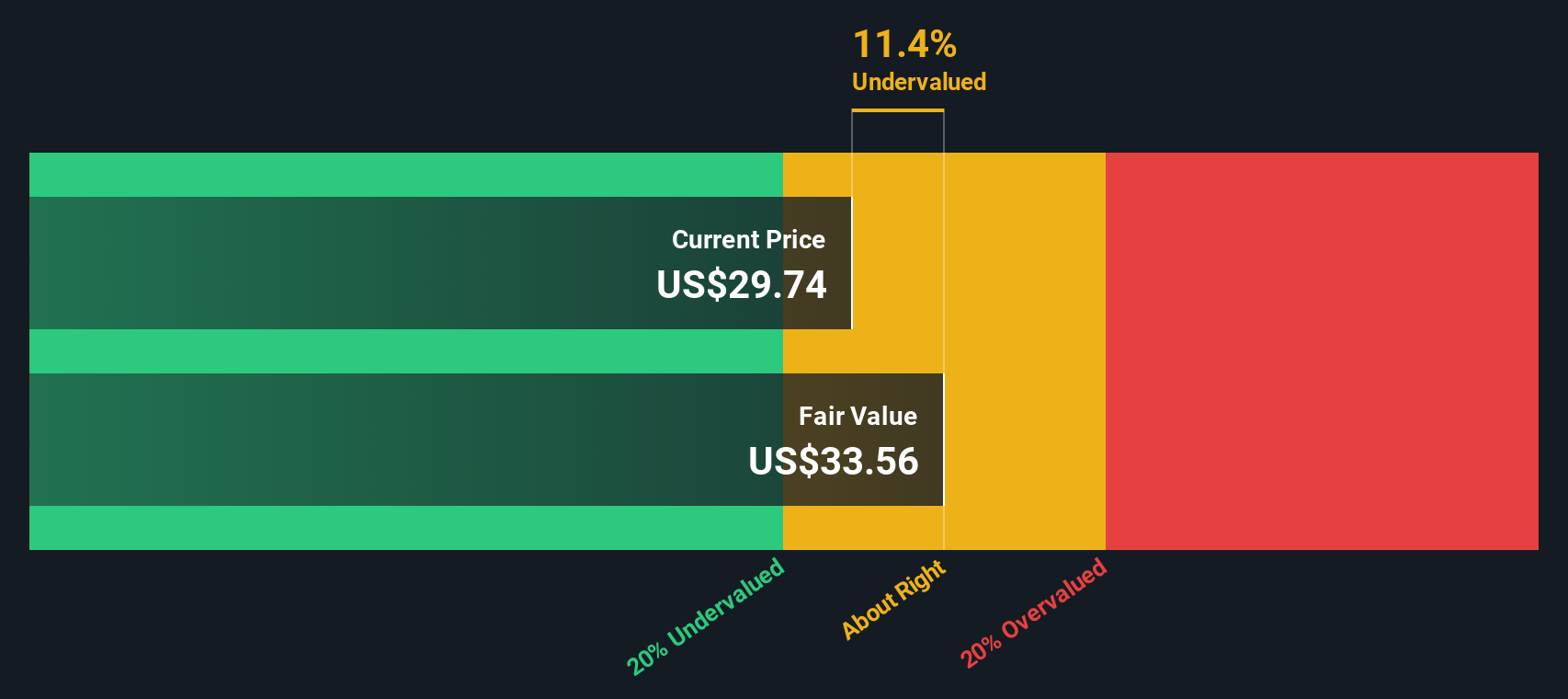

A June assessment of the small business sector indicates a period of stability, though with underlying challenges that impact progress toward key Sustainable Development Goals (SDGs). The National Federation of Independent Business (NFIB) Small Business Optimism Index registered at 98.6, a marginal decrease of 0.2 points. While this figure remains slightly above the historical average, it reflects persistent obstacles for small enterprises, which are critical drivers for SDG 8: Decent Work and Economic Growth. A notable five-point decrease in the Uncertainty Index to 89 suggests a slight clarification of the economic landscape, yet significant hurdles to achieving sustained, inclusive, and sustainable economic growth remain.

Key Challenges to Sustainable Economic Progress

Several factors were identified as primary impediments to the growth and sustainability of small businesses, directly affecting their capacity to contribute to national development objectives.

- Fiscal Burdens: Taxes were cited as the single most important problem by 19% of owners. This fiscal pressure can limit the ability of enterprises to reinvest in operations, innovate, and create the decent work opportunities central to SDG 8.

- Labor Market Pressures: Concerns over labor quality were the top problem for 16% of businesses, while high labor costs were also a significant issue. These challenges directly impact the “decent work” component of SDG 8, highlighting a gap between workforce skills and business needs that can stifle productivity and growth.

- Inflationary Environment: Although concern over inflation as the primary business problem fell to 11%, its persistence continues to affect operational viability. This can disproportionately impact smaller enterprises, potentially widening economic disparities and working against SDG 10: Reduced Inequalities.

Analysis of Operational Indicators and SDG Impact

Specific operational metrics from the report reveal trends with direct implications for sustainability and long-term economic health.

- Inventory Management and SDG 12: A net negative 5% of owners viewed inventory stocks as “too low,” a six-point drop from May. This was driven by an increase in respondents reporting inventories as “too high” (from 7% to 12%). This trend toward excess inventory signals potential inefficiencies in supply chains and points to challenges in aligning with SDG 12: Responsible Consumption and Production, which encourages minimizing waste and optimizing resource use.

- Future Investment and SDGs 8 & 9: Forward-looking indicators showed signs of caution. The net percent of owners expecting better business conditions fell by three points to 22%, and those expecting higher real sales volumes also fell three points to a net 7%. Furthermore, planned capital outlays in the next six months declined to 21%. This hesitancy to invest directly impacts progress on SDG 9: Industry, Innovation, and Infrastructure, as reduced capital expenditure can slow technological adoption and infrastructure improvements. It also tempers the outlook for job creation under SDG 8.

- Overall Business Health and Economic Resilience: A substantial deterioration was reported in the overall health of businesses. The percentage of owners rating their business as “excellent” or “good” fell by six points each, while those rating it “fair” or “poor” increased. The declining health of these enterprises, which form the backbone of local economies, poses a direct risk to the resilience and stability envisioned in SDG 8.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 8: Decent Work and Economic Growth

- The entire article is dedicated to the economic health, challenges, and outlook of small businesses, which are fundamental drivers of economic growth and job creation. It discusses key factors like business optimism, sales expectations, investment plans (capital outlays), and major operational problems (taxes, labor quality, inflation), all of which are central to the performance of an economy and the creation of decent work.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation, and encourage the formalization and growth of micro-, small- and medium-sized enterprises, including through access to financial services.

- The article directly addresses the state of small enterprises by reporting on the NFIB Small Business Optimism Index. It highlights the primary challenges they face, such as taxes being the “single most important problem,” along with concerns about labor quality and costs. This information is crucial for shaping development-oriented policies aimed at supporting the growth and sustainability of these businesses.

-

Target 8.1: Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7 per cent gross domestic product growth per annum in the least developed countries.

- While not mentioning GDP directly, the article provides several proxy measures for economic growth. The “net percent of owners expecting better business conditions” and the “net percent of owners expecting higher real sales volumes” are forward-looking indicators of economic activity. Furthermore, the data on planned “capital outlays” reflects business investment, a key component of economic growth.

-

Target 8.5: By 2030, achieve full and productive employment and decent work for all women and men, including for young people and persons with disabilities, and equal pay for work of equal value.

- The article touches upon the labor market from the employer’s perspective. The finding that “labor quality” remains a significant problem for 16% of small business owners points to challenges in achieving productive employment, suggesting a potential mismatch between the skills of the available workforce and the needs of businesses.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Indicators for Target 8.3 (Support for Small Enterprises):

- NFIB Small Business Optimism Index score: The index itself (at 98.6) serves as a composite indicator of the overall health and sentiment of small businesses.

- Percentage of owners reporting specific operational problems: The article specifies that 19% of owners cite taxes as their top problem, 16% cite labor quality, and 11% cite inflation. These figures can be used as indicators to track the most significant barriers to small business growth.

- Owner assessment of business health: The percentages of owners reporting their business as “excellent” (8%), “good” (49%), “fair” (35%), or “poor” (7%) provide a direct measure of the perceived viability of these enterprises.

-

Indicators for Target 8.1 (Economic Growth):

- Net percent of owners expecting better business conditions: The article states this is a “net 22%,” which serves as a forward-looking indicator of economic sentiment and potential growth.

- Net percent of owners expecting higher real sales volumes: The reported “net 7%” is a direct indicator of expected economic output from the small business sector.

- Percentage of owners planning capital outlays: The figure of 21% planning investments is an indicator of future economic activity and productivity enhancements.

-

Indicators for Target 8.5 (Productive Employment):

- Percentage of owners reporting labor quality as the single most important problem: The reported 16% serves as an indicator of challenges in the labor market and the difficulty businesses face in finding suitably skilled employees for productive roles.

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | Target 8.3: Promote policies to support small- and medium-sized enterprises. |

|

| SDG 8: Decent Work and Economic Growth | Target 8.1: Sustain per capita economic growth. |

|

| SDG 8: Decent Work and Economic Growth | Target 8.5: Achieve full and productive employment. |

|

Source: cutoday.info

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0