Analyzing the impact of export tax rebates and energy conservation on sustainable industrial growth in China – Nature

Report on the Impact of Export Tax Rebates on Sustainable Industrial Growth in China

Executive Summary

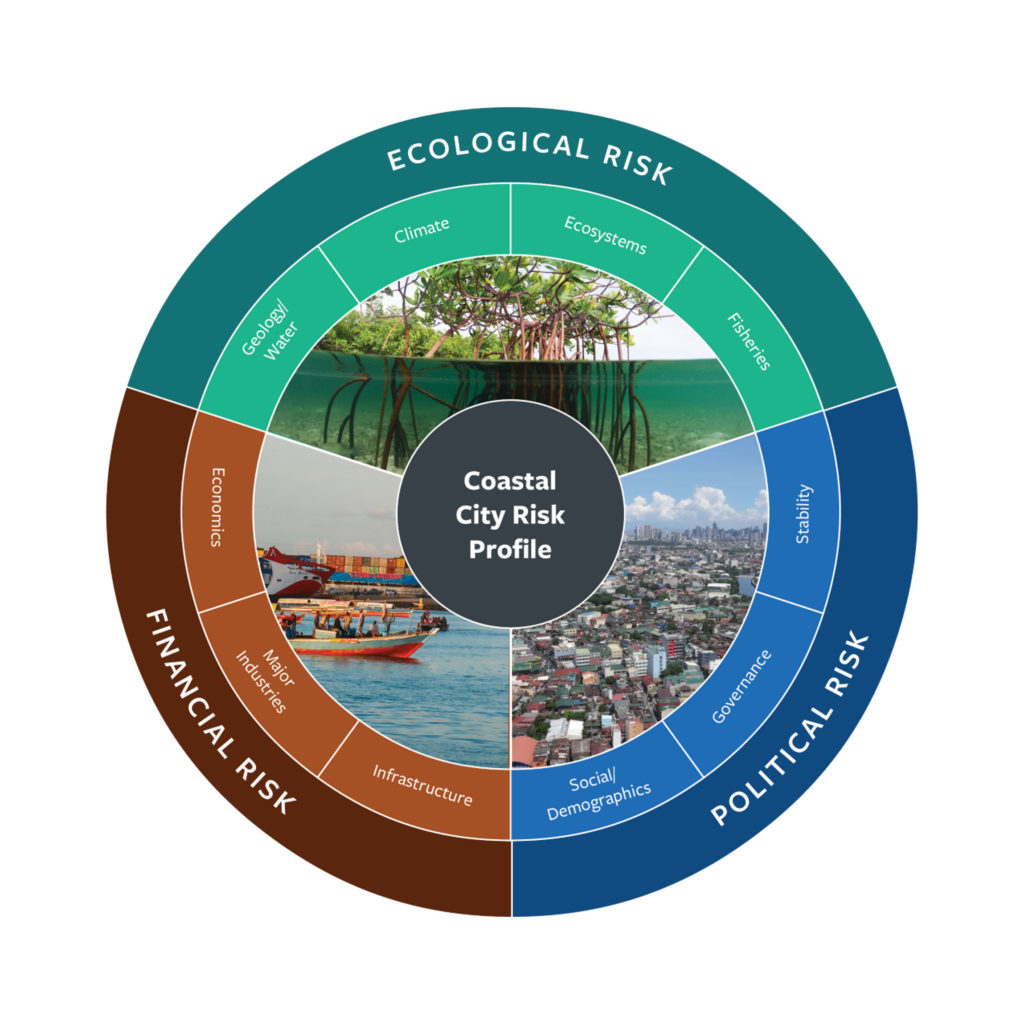

This report analyzes the relationship between China’s export tax rebate policy, initiated in 1985, and the subsequent five-fold increase in industrial energy consumption. The study investigates the complex interplay between industrial energy demand (IED), export tax rebates (ETR), exports, industrial output, Gross Domestic Product (GDP), Foreign Direct Investment (FDI), and carbon dioxide (CO2) emissions. The findings reveal that policies designed to promote economic growth have had significant adverse effects on environmental sustainability, creating a conflict with several Sustainable Development Goals (SDGs). Specifically, the export tax rebate policy, while supporting SDG 8 (Decent Work and Economic Growth), has driven up energy consumption and emissions, undermining SDG 7 (Affordable and Clean Energy), SDG 12 (Responsible Consumption and Production), and SDG 13 (Climate Action). Empirical analysis confirms a long-term positive relationship between export tax rebates and industrial energy consumption. Conversely, Foreign Direct Investment (FDI) was found to reduce industrial energy needs, suggesting it may introduce more efficient technologies in line with SDG 9 (Industry, Innovation, and Infrastructure). The report concludes with policy recommendations to realign China’s industrial and trade policies with its sustainability commitments by restructuring the export tax rebate system to incentivize energy efficiency and low-carbon production.

Introduction: Aligning Industrial Policy with Sustainable Development Goals

Since the implementation of its trade openness policy in 1978 and the export tax rebate policy in 1985, China has experienced unprecedented industrial and economic growth. However, this expansion has been powered by a massive increase in energy consumption, making China the world’s largest energy consumer and CO2 emitter. The industrial sector is the primary consumer, accounting for 64.5% of total energy use in 2022. This trajectory presents a direct challenge to achieving key Sustainable Development Goals.

The Challenge of Balancing Economic Growth and Environmental Stewardship

The core conflict lies between achieving SDG 8 (Decent Work and Economic Growth) through export-led industrialization and upholding commitments to SDG 13 (Climate Action). China’s national action plan aims to reduce CO2 emissions per unit of GDP by over 65% by 2030 compared to 2005 levels. This study examines whether the export tax rebate policy, a key driver of economic growth, is compatible with this environmental objective and the broader goal of promoting SDG 12 (Responsible Consumption and Production).

Research Objectives in the Context of SDGs

This research aims to fill a critical gap in the literature by directly investigating the link between the export tax rebate policy and industrial energy demand. The primary objectives are:

- To analyze the impact of export tax rebates on industrial energy consumption, thereby assessing its alignment with SDG 7 (Affordable and Clean Energy).

- To understand how economic variables like exports, industrial output, and FDI influence energy demand and contribute to or detract from SDG 9 (Industry, Innovation, and Infrastructure).

- To provide evidence-based policy recommendations that can help decouple economic growth from environmental degradation, a central tenet of the 2030 Agenda for Sustainable Development.

Analytical Framework and Methodology

To assess the impact of export tax rebates on industrial energy consumption in China, an econometric analysis was conducted using time-series data from 1985 to 2022. The data was sourced from the China Energy Statistical Yearbook, the Statistical Yearbook of China, and the World Bank’s World Development Indicators.

Econometric Model and Variables

The study utilized a model where Industrial Energy Demand (E) is a function of several key variables:

- Export Tax Rebate (ETR)

- Gross Industrial Output (Y)

- Gross Domestic Product (GDP)

- Foreign Direct Investment (FDI)

- Exports (EXP)

- Carbon Dioxide Emissions (CO2)

Estimation Procedure

A multi-step econometric procedure was employed to ensure the robustness of the findings:

- Unit Root Test: The Augmented Dickey-Fuller (ADF) test was used to check the stationarity of the time-series data. Results indicated a mix of I(0) and I(1) variables, making the ARDL model appropriate.

- ARDL Bound Testing: The Autoregressive-Distributed Lag (ARDL) bounds testing approach was applied to examine the long-run and short-run cointegration relationships among the variables.

- VECM Granger Causality Test: This test was used to determine the direction of causality between the variables, identifying key policy levers.

- Diagnostic and Stability Tests: A series of diagnostic tests, including heteroscedasticity tests and CUSUM tests, were conducted to confirm the model’s stability and reliability.

Key Findings and Implications for Sustainable Development

The empirical results demonstrate a significant and complex relationship between China’s economic policies and its environmental performance, with direct implications for the SDGs.

Long-Term Relationships and Cointegration

The ARDL bounds test confirmed a stable, long-run cointegration relationship among all variables. This indicates that the export tax rebate policy has lasting and predictable effects on industrial energy consumption and related environmental outcomes.

Impact of Economic Policies on SDG 7 and SDG 13

The analysis revealed that several economic drivers have a positive and statistically significant impact on industrial energy demand, working against the principles of SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action).

- Export Tax Rebates (ETR): The ETR policy is positively correlated with industrial energy consumption in both the short and long run. By making exports cheaper, it stimulates energy-intensive industrial production, leading to higher energy demand and associated CO2 emissions.

- Exports and Industrial Output: As expected, growth in exports and industrial output directly increases the need for energy. This highlights the urgent need to decouple economic activity from fossil fuel consumption, as targeted by SDG 8.4.

- Carbon Dioxide (CO2) Emissions: The model confirms a strong positive link between CO2 emissions and industrial energy use, reinforcing that the current industrial model is a primary driver of climate change.

The Role of FDI in Promoting SDG 9 (Sustainable Industry)

A significant finding is that Foreign Direct Investment (FDI) has a negative correlation with industrial energy demand. This suggests that FDI may be contributing to the goals of SDG 9.4 by introducing more advanced, energy-efficient technologies and management practices into China’s industrial sector. This “pollution halo” effect presents a potential pathway for sustainable industrial upgrading.

Causal Relationships and Policy Levers

The VECM Granger Causality test identified a clear causal pathway:

- A unidirectional causality runs from Export Tax Rebates to Gross Industrial Output.

- A unidirectional causality runs from Gross Industrial Output to Industrial Energy Demand.

This chain of causality establishes the export tax rebate policy as a critical upstream intervention point. Modifying this policy can have cascading effects on industrial production patterns and, ultimately, on national energy consumption and emissions.

Conclusion and Policy Recommendations for SDG Alignment

Summary of Findings

This report concludes that China’s export tax rebate policy, while successful in promoting exports and economic growth (SDG 8), has created significant environmental externalities. It has stimulated energy-intensive industrial production, leading to increased energy consumption and CO2 emissions, thereby conflicting with the objectives of SDG 7 (Affordable and Clean Energy), SDG 12 (Responsible Consumption and Production), and SDG 13 (Climate Action). To achieve its dual carbon goals and align with the 2030 Agenda, China must reform this policy to integrate environmental and sustainability criteria.

Strategic Policy Recommendations

To transform the export tax rebate from an obstacle into a tool for sustainable development, the following policy actions are recommended:

- Restructure the Export Tax Rebate Policy: The government should link rebate eligibility and rates to the environmental performance of firms and products. Industries that are highly polluting or energy-intensive should receive lower or no rebates, while those utilizing clean technologies should be rewarded. This directly supports SDG 12 and SDG 13.

- Incentivize Green Innovation (SDG 9): Earmark a portion of rebate funds or offer enhanced rebates for industries that demonstrate significant investment in research and development for energy efficiency, pollution control, and circular economy practices.

- Promote Renewable Energy in Manufacturing (SDG 7): Introduce a tiered rebate system that provides higher returns for products manufactured using a verified share of renewable energy. This would create a market-based incentive for industries to transition away from fossil fuels.

- Implement a Carbon-Intensity Classification System: Develop a transparent system to classify industries based on their carbon footprint. High-carbon sectors should face stricter eligibility criteria for rebates, while low-carbon and green-tech industries could receive preferential treatment.

- Enhance Transparency and Corporate Accountability (SDG 12.6): Make rebate eligibility conditional on the public disclosure of annual energy audits, sustainability reports, and progress toward emission reduction targets. This would foster greater corporate responsibility and provide valuable data for policy evaluation.

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 7: Affordable and Clean Energy

- The article’s primary focus is on “industrial energy demand (IED)” and “rising energy use in the industrial sector” in China. It explicitly states that “industrial energy consumption increased by more than five times” since 1985, directly addressing the theme of energy consumption patterns.

-

SDG 8: Decent Work and Economic Growth

- The study examines the relationship between economic indicators like “GDP,” “exports,” and “the value of industrial output” and their impact on energy consumption and emissions. This connects to the goal of decoupling economic growth from environmental degradation.

-

SDG 9: Industry, Innovation, and Infrastructure

- The research centers on China’s “industrial sector,” its energy consumption, and the environmental impact of its production processes. It suggests policy measures to “curb China’s rising energy use in the industrial sector,” aligning with the goal of promoting sustainable industrialization.

-

SDG 12: Responsible Consumption and Production

- The article analyzes how policies like the “exports tax rebate” stimulate the production of goods for export, leading to increased energy consumption and CO2 emissions. This directly relates to achieving sustainable management and efficient use of natural resources (energy) in production cycles.

-

SDG 13: Climate Action

- A key variable in the study is “carbon dioxide (CO2)” emissions, which are directly linked to industrial energy use. The article mentions China’s status as the “world’s largest source of carbon dioxide emissions” and its national plans for “emission reduction,” making climate action a central theme.

-

SDG 17: Partnerships for the Goals

- The article’s core analysis revolves around how a national policy—the “exports tax rebate policy”—impacts environmental and energy goals. This examination of policy coherence for sustainable development is a key aspect of SDG 17. The conclusion calls for a revision of this policy to align trade incentives with environmental objectives.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 7.3: By 2030, double the global rate of improvement in energy efficiency.

- The article’s objective to find “policy measures to curb China’s rising energy use in the industrial sector” and its focus on “industrial energy demand” directly relate to improving energy efficiency. The mention of China’s plan to reduce “energy consumption and emission reduction to GDP” is a national effort towards this target.

-

Target 8.4: Improve progressively, through 2030, global resource efficiency in consumption and production and endeavour to decouple economic growth from environmental degradation.

- The study empirically investigates the link between “economic growth (GDP),” “industrial output,” and “industrial energy consumption.” The finding that export-led growth increases energy demand highlights the challenge of decoupling, which is the central theme of this target.

-

Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes.

- The article’s conclusion suggests that the government should provide “rebates to the industrial sector with high investment in research and development on energy efficiency improvements and emission reductions.” This directly supports the retrofitting of industries with cleaner and more efficient technologies.

-

Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources.

- The research analyzes how China’s industrial sector consumes energy (“a natural resource”) to produce goods for export. The entire study is an assessment of the efficiency of this resource use, driven by trade policies.

-

Target 13.2: Integrate climate change measures into national policies, strategies and planning.

- The article explicitly analyzes the “exports tax rebate policy,” a national trade policy, and its impact on CO2 emissions. The recommendation to revise this policy to “help reduce pollution” is a direct call to integrate climate change measures into national economic planning. The article also mentions China’s “national action plan for reducing energy consumption and emission reduction.”

-

Target 17.14: Enhance policy coherence for sustainable development.

- The study demonstrates a lack of policy coherence, where a trade policy (export tax rebate) inadvertently undermines environmental goals by stimulating energy consumption and emissions. The paper’s purpose is to analyze this conflict and suggest “more effective legal or administrative regulations and policy measures” to create coherence.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Indicator 7.3.1: Energy intensity measured in terms of primary energy and GDP.

- The article explicitly analyzes “industrial energy demand (IED),” “GDP,” and “the value of industrial output.” It mentions China’s plan to reduce “energy consumption and emission reduction to GDP as of 2030,” which is a direct application of this indicator.

-

Indicator 8.4.2 / 12.2.2: Domestic material consumption, domestic material consumption per capita, and domestic material consumption per GDP.

- While not using the term “material consumption,” the article’s use of “industrial energy consumption” as a key variable measured against “GDP” and “industrial output” serves as a proxy for this indicator, measuring the energy resource consumption per unit of economic output.

-

Indicator 9.4.1: CO2 emission per unit of value added.

- The study models the relationship between “carbon dioxide (CO2)” emissions and the “value of industrial output.” This directly reflects the measurement of CO2 emissions from the industrial sector relative to its economic contribution.

-

Indicator 13.2.1: Number of countries that have communicated the establishment or operationalization of an integrated policy/strategy/plan…

- The article references China’s “national action plan for reducing energy consumption and emission reduction to GDP as of 2030” and analyzes the “exports tax rebate policy” as a key national strategy. The research itself is an evaluation of how this policy can be better integrated with climate goals.

-

Indicator 17.14.1: Number of countries with mechanisms in place to enhance policy coherence for sustainable development.

- The entire research paper acts as a mechanism for assessing policy coherence. It evaluates how China’s “exports tax rebate policy” (a trade and economic policy) interacts with its environmental and energy conservation goals, highlighting the need for better alignment and coherence.

4. Summary of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.3: Double the global rate of improvement in energy efficiency. | 7.3.1: Energy intensity measured in terms of primary energy and GDP (analyzed as industrial energy consumption vs. GDP). |

| SDG 8: Decent Work and Economic Growth | 8.4: Improve resource efficiency and decouple economic growth from environmental degradation. | 8.4.2: Domestic material consumption per GDP (proxied by industrial energy consumption per GDP/industrial output). |

| SDG 9: Industry, Innovation, and Infrastructure | 9.4: Upgrade industries to make them sustainable with increased resource-use efficiency and adoption of clean technologies. | 9.4.1: CO2 emission per unit of value added (analyzed as CO2 emissions vs. industrial output). |

| SDG 12: Responsible Consumption and Production | 12.2: Achieve the sustainable management and efficient use of natural resources. | 12.2.2: Domestic material consumption per GDP (proxied by industrial energy consumption per GDP). |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. | 13.2.1: Establishment of integrated policies (e.g., China’s national action plan for emission reduction and the analysis of the export tax rebate policy). |

| SDG 17: Partnerships for the Goals | 17.14: Enhance policy coherence for sustainable development. | 17.14.1: Mechanisms to enhance policy coherence (the study itself serves as an assessment mechanism for the coherence between trade and environmental policies). |

Source: nature.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

-1920w.png?#)

;Resize=805#)

.jpg?#)