Energy Security Market to Reach USD 39.26 Billion by 2032, – GlobeNewswire

Global Energy Security Market Report: 2025-2032

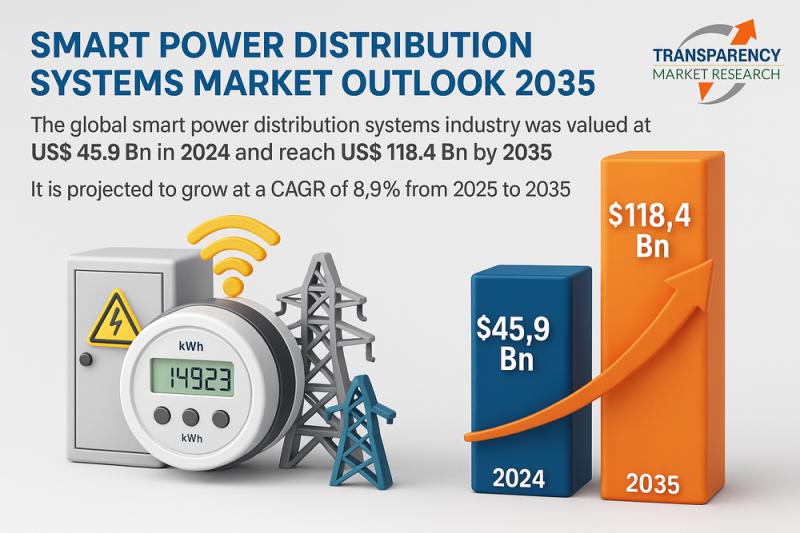

Market Projections and Growth

The global Energy Security Market is on a significant growth trajectory, reflecting a global commitment to building resilient and sustainable infrastructure. The market, valued at USD 19.64 billion in 2024, is projected to expand to USD 39.26 billion by 2032, demonstrating a Compound Annual Growth Rate (CAGR) of 9.17%.

- Base Year Value (2024): USD 19.64 Billion

- Projected Value (2032): USD 39.26 Billion

- CAGR (2025-2032): 9.17%

This expansion is intrinsically linked to the pursuit of the United Nations Sustainable Development Goals (SDGs), particularly SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 13 (Climate Action).

Core Drivers and Link to Sustainable Development Goals

Market growth is propelled by several critical factors that underscore the importance of secure energy systems for sustainable development.

- Safeguarding Critical Infrastructure: Rising geopolitical tensions and the increasing frequency of cyberattacks necessitate robust security measures to protect energy infrastructure. This directly supports SDG 9 by ensuring the resilience of essential services and SDG 11 (Sustainable Cities and Communities) by guaranteeing reliable energy for urban populations.

- Digitalization and Smart Grids: The global shift towards digitalized energy systems and smart grids requires advanced security solutions. This technological advancement is crucial for efficiently managing and distributing energy, a key component of SDG 9.

- Transition to Renewable Energy: The integration of renewable energy sources is a primary driver for the market. Securing these decentralized and often variable power sources is essential for the successful implementation of SDG 7 and for mitigating climate change as outlined in SDG 13.

Market Segmentation Analysis and SDG Alignment

Analysis by Power Plant Type

The market’s composition by power plant type reveals a critical transition period in the global energy landscape. While fossil fuel plants commanded the largest market share (38.94%) in 2024 due to legacy infrastructure, the most rapid growth is forecast in the renewable energy sector.

- Fossil Fuel Plants: Securing these assets remains vital for short-term energy stability as the global transition progresses.

- Renewable Energy Plants: This segment is projected to grow at the fastest CAGR of 10.36%. This growth is a direct indicator of the global effort to achieve SDG 7 (Affordable and Clean Energy). Investments in securing wind, solar, and hydroelectric infrastructure are paramount to ensuring the reliability and long-term viability of clean energy systems, thereby advancing SDG 13 (Climate Action).

Analysis by Security Type

The dominance of the long-term security segment, which captured 66.71% of the market in 2024, highlights a strategic focus on sustainable and resilient infrastructure. This approach involves investing in comprehensive cybersecurity and physical protection systems designed for sustained defense, aligning perfectly with the long-term objectives of SDG 9 and SDG 11.

Analysis by Offering

In 2024, the solutions segment led the market with a 52.28% share. The high adoption rate of integrated security platforms, surveillance, and intrusion detection systems demonstrates a proactive approach to protecting energy assets. These comprehensive solutions are foundational to building the resilient infrastructure required to meet the targets of SDG 9.

Regional Analysis and Contribution to Global Goals

North America

North America led the market in 2024 with a 35.79% revenue share. The region’s focus on grid modernization and stringent regulatory frameworks for infrastructure protection showcases a mature commitment to SDG 9. The U.S. market, valued at USD 5.14 billion in 2024, is a key contributor to this leadership.

Asia Pacific

The Asia Pacific region is projected to experience the fastest growth, with a CAGR of 10.63% from 2025 to 2032. This growth is driven by rapid industrialization and significant investments in new energy infrastructure. By integrating advanced security into developing energy grids, the region has a unique opportunity to build systems that are inherently aligned with SDG 7 and SDG 9, fostering sustainable economic growth.

Corporate Initiatives and Sustainable Development

Recent Developments

Corporate actions within the energy sector are increasingly reflecting a commitment to sustainable development.

- Equinor (October 2024): The implementation of advanced carbon capture and storage (CCS) solutions is a direct contribution to SDG 13 (Climate Action) by mitigating emissions from energy production.

- Marathon (November 2024): New investments in renewable energy, including biofuel projects, demonstrate a strategic pivot towards diversifying energy portfolios in line with SDG 7 (Affordable and Clean Energy).

Market Segmentation Summary

- By Offering:

- Services

- Solutions

- By Security Type:

- Long-Term Security

- Short-Term Security

- By Power Plant Type:

- Fossil Fuel Plants

- Geothermal Plants

- Nuclear Power Plants

- Renewable Energy Plants

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The article on the Energy Security Market discusses issues that are directly and indirectly connected to several Sustainable Development Goals. The analysis identifies the following relevant SDGs:

- SDG 7: Affordable and Clean Energy: The article’s core theme is securing energy infrastructure, which is fundamental to providing reliable energy. It also emphasizes the growing segment of renewable energy and the need to protect it.

- SDG 9: Industry, Innovation and Infrastructure: A major focus of the article is the protection and resilience of “critical energy infrastructure” through technological solutions like smart grids, cybersecurity, and AI-enabled monitoring.

- SDG 11: Sustainable Cities and Communities: Ensuring the reliability and resilience of energy infrastructure is a prerequisite for creating sustainable and resilient cities and communities. The article’s emphasis on “infrastructure resilience” and “operational continuity” supports this goal.

- SDG 13: Climate Action: The article mentions corporate initiatives aimed at climate change mitigation, such as investments in renewable energy, biofuels, and carbon capture and storage (CCS) technologies as part of their energy security strategy.

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the article’s content, the following specific SDG targets can be identified:

-

SDG 7: Affordable and Clean Energy

- Target 7.1: By 2030, ensure universal access to affordable, reliable and modern energy services. The article’s focus on “energy resilience and reliability” and “safeguarding critical energy assets” directly contributes to ensuring that energy services are reliable and continuously available.

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. The article highlights the “integration of renewable energy sources” and notes that the “renewable energy plants security segment is expected to grow at the fastest CAGR,” reflecting the increasing share of renewables.

- Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology. The article details significant global investment in security for clean energy, mentioning the deployment of “AI- and IoT-enabled monitoring systems” to protect “wind, solar, and hydroelectric power” infrastructure.

-

SDG 9: Industry, Innovation and Infrastructure

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure… to support economic development and human well-being. The entire premise of the energy security market, as described in the article, is to make energy infrastructure resilient. It highlights “rising investments in resilient infrastructure” and the need for “long-term infrastructure stability.”

-

SDG 11: Sustainable Cities and Communities

- Target 11.b: By 2030, substantially increase the number of cities and human settlements adopting and implementing integrated policies and plans towards… resilience to disasters… The article’s discussion of ensuring “long-term infrastructure stability” and “operational continuity” against threats is a foundational element for building disaster-resilient communities.

-

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. The article provides examples of companies integrating climate action into their business strategies. It cites Equinor’s “implementation of advanced carbon capture and storage (CCS) solutions” and Marathon’s “investments in renewable energy initiatives, including biofuel projects” as part of their efforts to enhance energy security.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

The article provides several quantitative and qualitative indicators that can be used to measure progress towards the identified targets:

-

Indicators for SDG 7 (Affordable and Clean Energy)

- Investment in energy reliability (Target 7.1): The overall market size for energy security, “valued at USD 19.64 billion in 2024,” serves as a financial indicator of the investment being made to ensure the reliability of energy services.

- Growth in the renewable energy sector (Target 7.2): The projected growth rate for the “renewable energy plants security segment” at a “CAGR of 10.36%” is a direct indicator of the expanding share and importance of renewable energy.

- Investment in clean energy technology (Target 7.a): The article mentions the deployment of “AI- and IoT-enabled monitoring systems” and “advanced cybersecurity” for renewable energy plants, which are indicators of investment in clean energy technology.

-

Indicators for SDG 9 (Industry, Innovation and Infrastructure)

- Investment in resilient infrastructure (Target 9.1): The projected growth of the energy security market to “USD 39.26 billion by 2032” is a primary quantitative indicator of the global financial commitment to developing resilient energy infrastructure.

-

Indicators for SDG 11 (Sustainable Cities and Communities)

- Adoption of resilience solutions (Target 11.b): The article’s mention of the market dominance of the “long-term security segment” with “66.71% revenue share” implies a focus on sustained, long-term solutions for infrastructure stability, a key component of urban resilience.

-

Indicators for SDG 13 (Climate Action)

- Corporate climate actions (Target 13.2): The article provides specific, qualitative examples of corporate actions that serve as indicators. These include “Equinor announced the implementation of advanced carbon capture and storage (CCS) solutions” and “Marathon revealed new investments in renewable energy initiatives, including biofuel projects.”

4. Summary Table of SDGs, Targets, and Indicators

| SDGs, Targets and Indicators | Corresponding Targets | Specific Indicators Identified in the Article |

|---|---|---|

| SDG 7: Affordable and Clean Energy |

7.1: Ensure universal access to affordable, reliable and modern energy services.

7.2: Increase substantially the share of renewable energy in the global energy mix. 7.a: Promote investment in energy infrastructure and clean energy technology. |

– Total market value of energy security (USD 19.64 billion in 2024) as an investment in reliability.

– Projected CAGR of 10.36% for the renewable energy plants security segment. – Deployment of AI- and IoT-enabled monitoring systems for clean energy infrastructure. |

| SDG 9: Industry, Innovation and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure. |

– Projected market size of USD 39.26 billion by 2032 as a measure of investment in resilient infrastructure. – Market share of the “long-term security segment” (66.71%) indicating a focus on sustained resilience. |

| SDG 11: Sustainable Cities and Communities | 11.b: Adopt and implement integrated policies and plans towards… resilience to disasters. | – Investment in security solutions for “long-term infrastructure stability” and “operational continuity,” which are foundational for urban resilience. |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. | – Specific corporate actions: Equinor’s implementation of carbon capture and storage (CCS) and Marathon’s investments in renewable energy and biofuels. |

Source: globenewswire.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

-1920w.png?#)

;Resize=805#)

.jpg?#)