ENPH Q2 Deep Dive: Product Innovation and Channel Strategies Amid Tariff and Market Shifts – Yahoo Finance

Enphase (ENPH) Q2 CY2025 Performance Report: Advancing Sustainable Development Goals

Executive Summary

Home energy technology company Enphase announced its financial results for the second quarter of CY2025, demonstrating continued progress in advancing United Nations Sustainable Development Goal 7 (SDG 7: Affordable and Clean Energy) and SDG 13 (Climate Action). The company reported strong year-on-year revenue growth, reflecting increased adoption of its clean energy solutions. However, a cautious outlook and operational challenges highlight the complexities of scaling renewable energy infrastructure. This report analyzes Enphase’s performance, strategic initiatives, and future outlook, with a significant emphasis on its contributions to the Sustainable Development Goals.

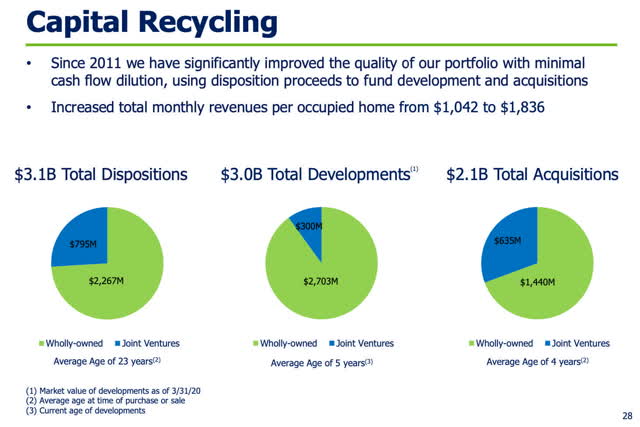

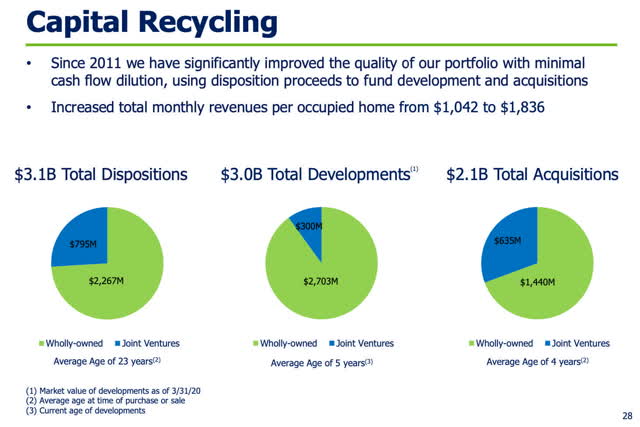

Q2 CY2025 Financial and Operational Highlights

Enphase’s performance indicates a growing market for technologies that support SDG 7, though near-term headwinds persist. The following key metrics were reported:

- Revenue: $363.2 million, a 19.7% year-on-year increase, surpassing analyst estimates. This growth underscores rising consumer demand for decentralized clean energy systems.

- Adjusted EPS: $0.69, beating consensus estimates by 10.8%.

- Adjusted EBITDA: $77.19 million, with a 21.3% margin.

- Revenue Guidance for Q3 CY2025: A midpoint of $350 million, below analyst expectations, reflecting anticipated market shifts.

- Operating Margin: 10.2%, a significant improvement from 0.6% in the prior-year quarter, indicating enhanced operational efficiency in delivering clean energy solutions.

- Sales Volumes: A 9.1% year-on-year increase, demonstrating sustained momentum in product deployment.

Strategic Analysis in the Context of Sustainable Development

Driving SDG 9: Industry, Innovation, and Infrastructure

Enphase’s strategy is heavily reliant on technological advancement to build resilient and sustainable energy infrastructure. This directly supports the targets of SDG 9.

- Product Innovation: The company is advancing its battery technology roadmap with a focus on reducing installation costs and increasing scale. The launch of its fourth-generation battery, which offers 30% higher energy density, and the planned fifth-generation battery are critical innovations aimed at making energy storage more accessible and affordable.

- Cost and Compliance: The upcoming IQ9 microinverter is designed to improve the cost structure and support compliance with evolving trade regulations, including domestic content requirements. This enhances the sustainability and resilience of the clean energy supply chain.

- Installer Platform Expansion: By investing in its Solargraf design platform and SolarLeadFactory, Enphase is building a comprehensive ecosystem that improves operational efficiency for installers, thereby strengthening the entire clean energy industry’s infrastructure.

Promoting SDG 7 (Affordable and Clean Energy) and SDG 11 (Sustainable Cities and Communities)

Enphase is navigating a dynamic policy environment to ensure the continued adoption of solar energy, which is fundamental to creating sustainable communities.

- Market Adaptation: In anticipation of expiring U.S. homeowner tax credits, Enphase is strategically shifting focus to support lease and Power Purchase Agreement (PPA) models. By partnering with third-party owners, the company aims to maintain market access for clean energy, ensuring it remains affordable for a broader customer base.

- International Market Development: Expansion in Europe (Netherlands, France), Australia, and Asia contributes to the global proliferation of clean energy. Regulatory changes and new rebates in these markets are accelerating the transition to battery adoption, making communities more resilient and less reliant on centralized fossil fuel grids.

- Supply Chain Management: The company is actively managing the impact of tariffs through supply chain diversification. While tariffs presented a 2% gross margin impact, proactive management mitigated a larger potential effect, demonstrating a commitment to maintaining the affordability of its clean energy products.

Future Outlook and Key Monitoring Points for SDG Impact

Enphase’s forward-looking strategy is centered on navigating policy changes and market transitions through innovation and operational efficiency. The company’s ability to execute on these plans will determine its future impact on global sustainability targets.

Areas for Future Assessment

- Pace of Innovation: The market introduction timeline for the fifth-generation battery and IQ9 microinverter will be a key indicator of the company’s ability to lower costs and drive progress on SDG 7 and SDG 9.

- Channel Inventory Management: The effectiveness of managing microinverter inventory levels amid policy-driven demand shifts will be crucial for maintaining a stable and efficient supply chain.

- Financing Model Success: The successful expansion of lease and PPA financing options will be vital for sustaining market momentum and ensuring equitable access to clean energy, in line with the principles of SDG 7 and SDG 11.

- Global Climate Action (SDG 13): Continued progress in international markets will be a primary measure of the company’s contribution to global climate change mitigation efforts.

Analysis of Sustainable Development Goals (SDGs) in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 7: Affordable and Clean Energy

The article is centered on Enphase, a “home energy technology company” that produces “microinverters and battery systems.” This directly relates to providing access to clean and modern energy from solar power.

-

SDG 8: Decent Work and Economic Growth

The article discusses Enphase’s financial performance, including revenue growth, profitability, and market capitalization. It also mentions the company is “hiring equity analyst and marketing roles,” which contributes to job creation and economic growth.

-

SDG 9: Industry, Innovation, and Infrastructure

Enphase’s focus on “product innovation,” its “technology road map,” and the development of new products like the “fifth-generation battery and IQ9 microinverter” highlight advancements in sustainable technology and industry.

-

SDG 13: Climate Action

By producing and selling solar energy components, Enphase’s core business helps in the transition to renewable energy, which is a key strategy for mitigating climate change. The article also mentions policy mechanisms like “homeowner tax credits” designed to combat climate change.

-

SDG 17: Partnerships for the Goals

The article details how Enphase is “partnering with third-party owners to broaden financing access” and working with installers. It also discusses the impact of international trade policies and tariffs, which are elements of global partnerships and trade systems.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

SDG 7: Affordable and Clean Energy

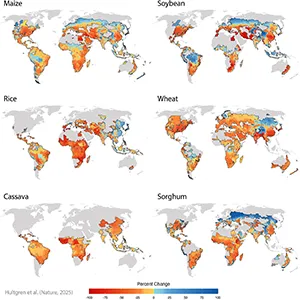

- Target 7.2: “By 2030, increase substantially the share of renewable energy in the global energy mix.” Enphase’s business of selling microinverters and battery systems for solar installations directly contributes to increasing the share of renewable energy. The article notes “robust sales of both microinverters and battery systems.”

- Target 7.3: “By 2030, double the global rate of improvement in energy efficiency.” The company’s innovation aims at improving efficiency. The “fourth-generation battery… delivers 30% higher energy density,” and the upcoming fifth-generation battery aims to “further increase energy density and lower costs.”

- Target 7.a: “By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology.” Enphase’s expansion into international markets like “Europe, Australia, and Asia” and its focus on an advancing “battery technology road map” align with this target.

-

SDG 8: Decent Work and Economic Growth

- Target 8.2: “Achieve higher levels of economic productivity through diversification, technological upgrading and innovation.” Enphase’s strategy is based on “product innovation progress” and technological advancement to drive its “19.7% year-on-year revenue increase.”

- Target 8.5: “By 2030, achieve full and productive employment and decent work for all…” The article explicitly states that “StockStory is growing and hiring equity analyst and marketing roles,” indicating direct job creation.

-

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.4: “By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies…” Enphase’s products, such as high-density batteries and microinverters, are clean technologies designed to upgrade residential energy infrastructure.

- Target 9.5: “Enhance scientific research, upgrade the technological capabilities of industrial sectors… encouraging innovation…” The company’s focus on its “technology road map,” “product innovation,” and the development of the “fifth-generation battery and IQ9 microinverter” directly supports this target.

-

SDG 13: Climate Action

- Target 13.2: “Integrate climate change measures into national policies, strategies and planning.” The article discusses how Enphase’s business is influenced by climate-related policies such as “homeowner tax credits” and “changing regulatory incentives,” showing an interplay between corporate strategy and national climate action.

-

SDG 17: Partnerships for the Goals

- Target 17.10: “Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system…” The article highlights the impact of the global trading system, noting a “2% gross margin impact from tariffs” and the need to manage “ongoing trade policy changes.”

- Target 17.17: “Encourage and promote effective public, public-private and civil society partnerships…” Enphase is “partnering with third-party owners to broaden financing access” and expanding its “installer services platform,” which are forms of private-sector partnerships to achieve common goals.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

For SDG 7 (Affordable and Clean Energy)

- Indicator for Target 7.2 (Renewable energy share): The “Sales Volumes” of solar components, which “rose 9.1% year on year,” serve as a proxy for the installation of new renewable energy capacity.

- Indicator for Target 7.3 (Energy efficiency): The “30% higher energy density” of the fourth-generation battery is a direct measure of improved energy efficiency and technological progress.

-

For SDG 8 (Decent Work and Economic Growth)

- Indicator for Target 8.2 (Economic productivity): Company financial metrics such as “Revenue: $363.2 million” (19.7% year-on-year growth) and “Operating Margin: 10.2%” indicate economic productivity at the firm level.

- Indicator for Target 8.5 (Employment): The statement that the company is “hiring equity analyst and marketing roles” is a direct indicator of job creation.

-

For SDG 9 (Industry, Innovation, and Infrastructure)

- Indicator for Target 9.5 (Research and innovation): The development and launch of new products like the “fifth-generation battery and IQ9 microinverter” are tangible outcomes of investment in research and innovation.

-

For SDG 13 (Climate Action)

- Indicator for Target 13.2 (Integration of climate policies): The mention of “expiring tax credits” and “new battery rebates” in Australia are indicators of national policies being implemented to promote climate action.

-

For SDG 17 (Partnerships for the Goals)

- Indicator for Target 17.10 (Trade system): The “2% gross margin impact from tariffs” is a quantifiable indicator of the effect of international trade policies on the clean energy industry.

- Indicator for Target 17.17 (Partnerships): The strategy of “partnering with third-party owners” and expanding the “Solargraf design platform” for installers are indicators of partnership formation.

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy |

7.2: Increase share of renewable energy. 7.3: Improve energy efficiency. 7.a: Promote access to clean energy technology. |

Sales volumes of microinverters and batteries rose 9.1% year on year. New battery delivers 30% higher energy density. International market expansion in Europe, Australia, and Asia. |

| SDG 8: Decent Work and Economic Growth |

8.2: Achieve higher economic productivity through innovation. 8.5: Achieve full and productive employment. |

Revenue growth of 19.7% year on year. Company is actively “hiring equity analyst and marketing roles.” |

| SDG 9: Industry, Innovation, and Infrastructure |

9.4: Upgrade infrastructure with clean technologies. 9.5: Enhance scientific research and innovation. |

Sales of home energy systems (microinverters, batteries). Development of “fifth-generation battery and IQ9 microinverter.” |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies. | Company adapting to “homeowner tax credits” and “changing regulatory incentives.” |

| SDG 17: Partnerships for the Goals |

17.10: Promote a universal, rules-based trading system. 17.17: Encourage effective public-private and civil society partnerships. |

“2% gross margin impact from tariffs.” “Partnering with third-party owners” and expanding installer platforms. |

Source: finance.yahoo.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

![Lancaster homeowner’s energy-efficient renovation sparks clash over historic preservation [Lancaster Watchdog] – LancasterOnline](https://bloximages.newyork1.vip.townnews.com/lancasteronline.com/content/tncms/assets/v3/editorial/9/ed/9ed03d32-c902-44d2-a461-78ad888eec38/69050b156baeb.image.png?resize=150,75#)

![Governing Health -Compensation Considerations for Health System Innovation Activities [Podcast] – The National Law Review](https://natlawreview.com/sites/default/files/styles/article_image/public/2025-10/Health AI Security Privacy Data Cyber Medical Doctor-309772690.jpg.webp?itok=i51uHMDx#)