Innovative company announces unconventional approach to Bitcoin mining: ‘Provides an offset’ – The Cool Down

SolarBank Unveils Strategic Initiative Linking Renewable Energy Revenue to Digital Asset Investment

SolarBank (NASDAQ: SUUN), a developer of renewable energy and battery storage projects, has announced a novel treasury strategy to convert revenues from its solar energy operations into Bitcoin. This initiative positions the company at the intersection of clean energy and digital finance, creating a model that directly supports several United Nations Sustainable Development Goals (SDGs).

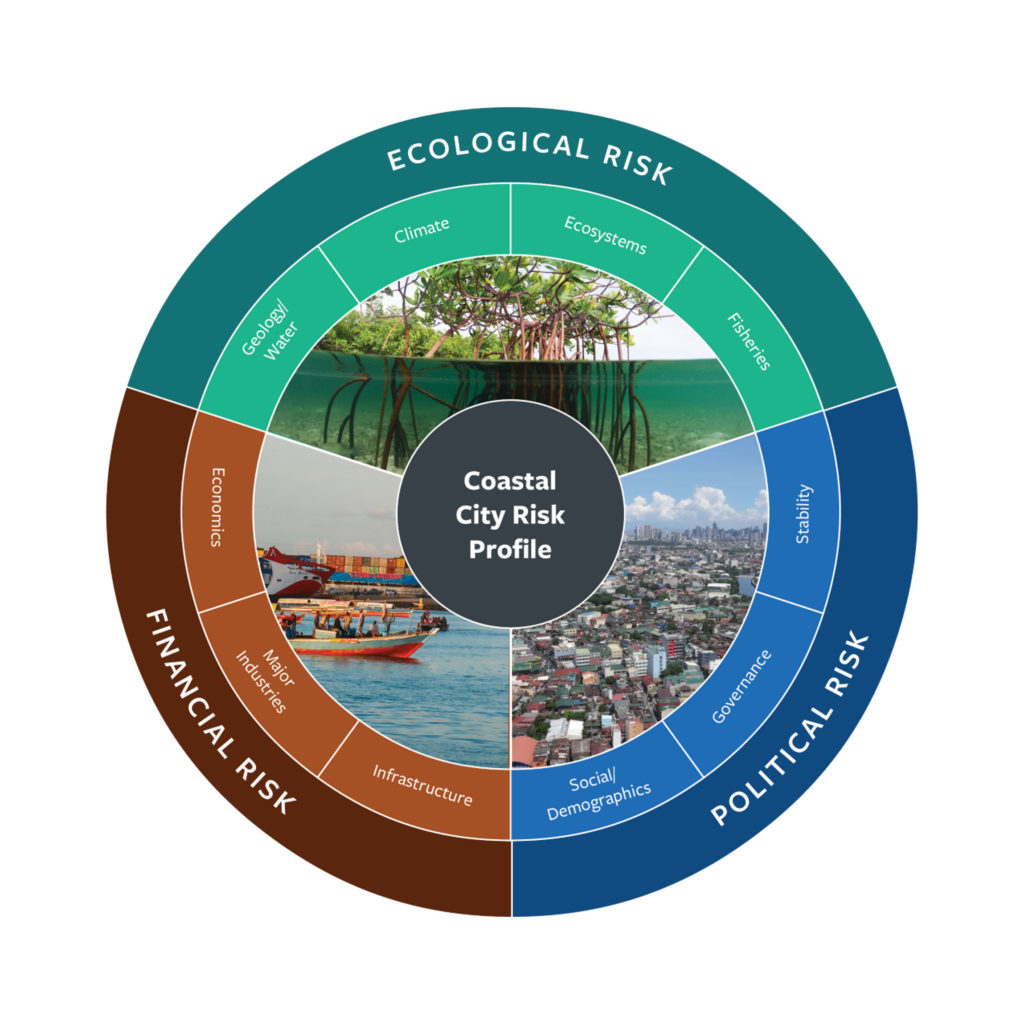

Strategic Alignment with Sustainable Development Goals (SDGs)

SolarBank’s strategy is intrinsically linked to advancing global sustainability targets. The initiative provides a framework for responsible investment while actively contributing to key environmental and economic goals.

SDG 7: Affordable and Clean Energy

The foundation of this strategy is the generation of clean, pollution-free electricity from solar power projects. By expanding its portfolio of renewable energy assets, SolarBank directly increases the share of clean energy in the power grid, a primary target of SDG 7.

SDG 13: Climate Action

The company explicitly states that the renewable energy generated by its projects provides an offset against the emissions associated with the broader Bitcoin network. This approach takes urgent action to combat climate change by ensuring that its financial strategy is underpinned by a carbon-negative or neutral energy source.

SDG 9: Industry, Innovation, and Infrastructure

This initiative represents a significant innovation in corporate finance and infrastructure development. By creating a financial model that leverages sustainable infrastructure (solar and battery storage projects) to invest in a modern digital asset, SolarBank is pioneering new industrial and financial processes that promote sustainability.

SDG 8: Decent Work and Economic Growth

The strategy aims to generate dual value streams: stable revenue from energy sales and potential growth from digital asset holdings. This approach is designed to hedge against inflation and currency devaluation, fostering sustained and sustainable economic growth for the company and its stakeholders.

A Novel Approach to Cryptocurrency Engagement

SolarBank’s model diverges significantly from traditional cryptocurrency mining, which has faced criticism for its high energy consumption, often sourced from fossil fuels.

Distinction from Green Mining

While the crypto industry is increasingly shifting towards sustainable power sources—with recent studies indicating over 52% of Bitcoin mining is powered by renewables—SolarBank’s method is different. Rather than using its generated solar power for the energy-intensive mining process, the company will:

- Generate and sell clean electricity to the grid.

- Utilize the net cash revenues from these sales to purchase Bitcoin.

This method decouples the company’s digital asset acquisition from direct energy consumption, aligning with the principles of SDG 12: Responsible Consumption and Production by promoting resource efficiency.

Implementation and Outlook

Pilot Project and Financial Strategy

The first implementation of this strategy involves the 3.79-megawatt Geddes Solar Power Project in New York. Revenues generated from this project will be allocated to the purchase of Bitcoin, establishing a recurring investment cycle funded by clean energy production.

Risks and Opportunities

The company acknowledges potential risks associated with the strategy, including:

- Volatility in Bitcoin’s market price.

- Evolving regulatory landscapes for both cryptocurrency and clean energy.

However, the approach presents a compelling opportunity to leverage the parallel growth of the clean energy and digital finance sectors. As stated by SolarBank President and CEO Richard Lu, the company aims to deliver “renewable energy solutions and recurring revenues, now combined with all of the benefits of holding Bitcoin” to address the complexities of modern energy demand and corporate treasury management.

Which SDGs are addressed or connected to the issues highlighted in the article?

SDG 7: Affordable and Clean Energy

- The article’s central theme is the generation of “pollution-free electricity” through solar energy projects developed by SolarBank. This directly aligns with the goal of ensuring access to affordable, reliable, sustainable, and modern energy. The company’s business is developing “renewable energy and battery storage projects,” specifically mentioning a “3.79-megawatt Geddes Solar Power Project.”

SDG 9: Industry, Innovation, and Infrastructure

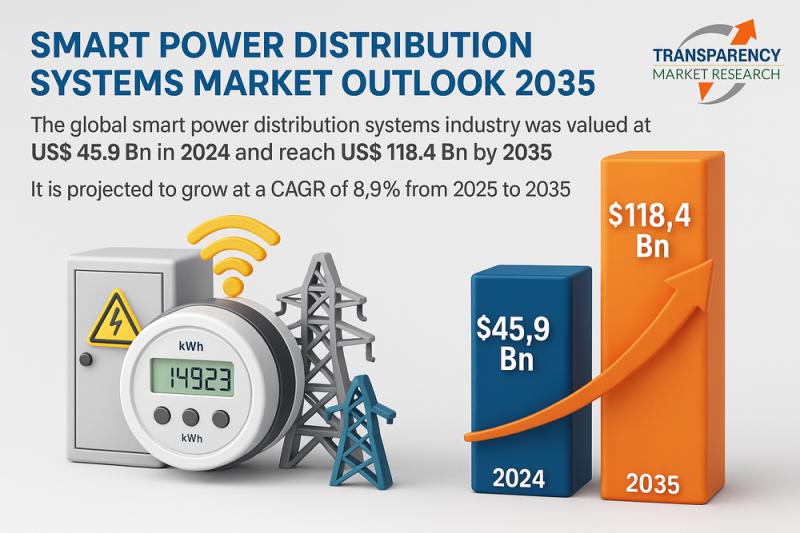

- SolarBank’s strategy of converting solar energy revenues into Bitcoin is described as an “intriguing way to leverage investment” and an innovative business model. This connects to building resilient infrastructure, promoting inclusive and sustainable industrialization, and fostering innovation. The approach combines clean energy infrastructure with digital finance, representing an innovation in how sustainable projects are financed and how their value is stored.

SDG 13: Climate Action

- The article explicitly addresses climate action by discussing how renewable energy can mitigate the environmental impact of energy-intensive industries like Bitcoin mining. It notes that traditional mining creates “a large amount of pollution that contributes to… increases global temperatures.” SolarBank’s strategy is presented as a way to “offset against the emissions generated from the energy used to generate Bitcoin,” directly contributing to climate change mitigation efforts.

SDG 8: Decent Work and Economic Growth

- The company’s strategy aims to create “dual value streams: stable energy revenue and digital asset holdings.” This focus on generating revenue and creating value through a new business model contributes to economic growth. By investing in Bitcoin as a “hedge against inflation,” the company is also pursuing a strategy for sustained economic value, which is a component of this SDG.

What specific targets under those SDGs can be identified based on the article’s content?

SDG 7: Affordable and Clean Energy

-

Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix.

- SolarBank’s core business is developing solar power projects, such as the 3.79-megawatt Geddes project. This directly contributes to increasing the share of renewable energy. The article also mentions a broader trend, stating that “52.4% of the power behind Bitcoin mining now comes from sustainable energy sources,” which reflects progress toward this target within a specific industry.

-

Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology.

- SolarBank’s model is an innovative financial strategy to “promote investment in energy infrastructure.” By creating a new revenue and investment stream linked to crypto, it provides a novel way to fund and leverage clean energy technology.

SDG 9: Industry, Innovation, and Infrastructure

-

Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes.

- The article highlights that the “crypto industry has increasingly explored energy-efficient processes.” The shift to using sustainable sources for Bitcoin mining is a direct example of retrofitting an industry to make it more sustainable and adopting cleaner technologies. SolarBank’s model supports this by linking clean energy generation to the crypto ecosystem.

SDG 13: Climate Action

-

Target 13.2: Integrate climate change measures into national policies, strategies and planning.

- On a corporate level, SolarBank is integrating climate change measures (developing renewable energy) directly into its financial and treasury strategy (“Bitcoin Treasury Strategy”). This demonstrates how climate action can be embedded into business planning.

Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

For Target 7.2

- Indicator 7.2.1 (Renewable energy share in the total final energy consumption): The article provides two specific data points that serve as indicators. First, the capacity of a new renewable energy project is mentioned: the “3.79-megawatt Geddes Solar Power Project.” This is a direct measure of new renewable capacity. Second, a statistic is provided for the crypto industry: “52.4% of the power behind Bitcoin mining now comes from sustainable energy sources,” which measures the renewable energy share within that sector.

For Target 9.4

- Indicator 9.4.1 (CO2 emission per unit of value added): While not providing a specific value, the article’s entire premise implies this indicator. The statement that renewable energy “provides an offset against the emissions generated from the energy used to generate Bitcoin” directly addresses the concept of reducing the carbon intensity of the value created (Bitcoin holdings). The goal is to decouple value creation from CO2 emissions.

SDGs, Targets, and Indicators Analysis

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.2: Increase substantially the share of renewable energy in the global energy mix. | The capacity of new renewable energy projects (e.g., “3.79-megawatt Geddes Solar Power Project”). The share of renewable energy in a specific industry (e.g., “52.4% of the power behind Bitcoin mining now comes from sustainable energy sources”). |

| SDG 9: Industry, Innovation, and Infrastructure | 9.4: Upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies. | Implied reduction in CO2 emissions per unit of value added by offsetting emissions from Bitcoin generation with clean energy revenue. The adoption of “energy-efficient processes” by the crypto industry. |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. | The integration of renewable energy generation as a core component of a corporate financial strategy (“Bitcoin Treasury Strategy”). |

| SDG 8: Decent Work and Economic Growth | 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation. | Creation of “dual value streams: stable energy revenue and digital asset holdings” as a measure of economic diversification and innovation. |

Source: thecooldown.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

-1920w.png?#)

;Resize=805#)