Rental Housing: The Next Gold Mine as Urbanization and Affordability Crises Drive Demand – AInvest

Report on Global Urbanization and Investment in Rental Housing

A Strategic Alignment with Sustainable Development Goals

This report analyzes the intersection of global urbanization, housing affordability, and the Build-to-Rent (BTR) real estate sector. The findings are framed within the context of the United Nations Sustainable Development Goals (SDGs), with a primary focus on SDG 11 (Sustainable Cities and Communities) and its target of ensuring access to adequate, safe, and affordable housing for all.

Urbanization as a Driver for SDG 11 Challenges and Opportunities

The accelerating rate of global urbanization presents a significant challenge to achieving SDG 11. Projections indicate that 68% of the world’s population will reside in urban centers by 2050. This demographic shift intensifies the pressure on urban infrastructure and housing supply, making the provision of adequate housing a critical component of sustainable development.

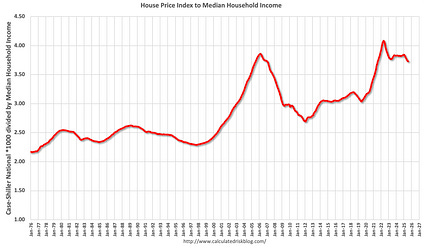

The Declining Viability of Homeownership and Its Impact on SDG 10

A notable trend, particularly in developed economies, is the decreasing rate of homeownership. In the United States, the homeownership rate has fallen to a five-year low of 65.1%, with a more pronounced decline among younger demographics. This shift is driven by economic factors that exacerbate inequality, a key concern of SDG 10 (Reduced Inequalities). Key metrics include:

- A price-to-income ratio for homes reaching 116.2 in 2024, indicating a 16% decline in affordability since 2015.

- Sustained increases in median home prices and mortgage rates, rendering ownership inaccessible for a growing portion of the population.

This affordability crisis necessitates a pivot towards robust, high-quality rental markets to ensure equitable access to housing, thereby supporting the objectives of both SDG 10 and SDG 11.

The Build-to-Rent Sector: A Market-Based Solution for Sustainable Housing

The Build-to-Rent (BTR) sector is emerging as a critical mechanism for addressing the urban housing deficit. As an institutional-grade asset class, BTR developments can be designed and managed to meet the standards of sustainable and inclusive communities outlined in SDG 11.

Contribution to SDG 11: Sustainable Cities and Communities

BTR developments contribute directly to SDG Target 11.1 by increasing the supply of professionally managed, high-quality rental housing. These projects often feature amenities that enhance quality of life and community resilience, such as reliable high-speed internet, integrated smart home technology, and shared community spaces. The model’s focus on long-term tenancy and professional management ensures a higher standard of maintenance and safety compared to fragmented private landlord markets.

Market Growth and Investment Potential

The BTR market in the United States is valued at approximately $2.5 trillion and is expanding rapidly. This growth signifies a substantial opportunity for private sector investment to contribute to public policy goals, aligning with SDG 17 (Partnerships for the Goals).

- National BTR supply has increased by 55% since 2023.

- Vacancy rates have decreased from 13.3% to 8.8% over the past two years, indicating strong and sustained demand.

- BTR units demonstrate higher occupancy rates (e.g., 9.7% higher in Austin) than traditional rental properties, underscoring their appeal to modern renters.

Strategic Analysis for Investment Aligned with Sustainable Development

Directing capital toward markets with the greatest need and growth potential can maximize both financial returns and positive social impact. This approach treats investment as a tool for achieving sustainable development outcomes.

High-Priority Markets for SDG-Aligned Investment

- Austin, TX: Strong, tech-driven job growth and a high conversion rate of new housing to rentals signal a critical need for structured rental solutions to support its expanding workforce, directly contributing to SDG 8 (Decent Work and Economic Growth) and SDG 11.

- Charlotte, NC: A doubling of BTR supply since 2023 reflects the market’s response to rapid growth. Investment here supports the development of sustainable urban infrastructure in a key economic hub.

- Nashville, TN: With population growth of 30% since 2020, this market requires significant investment in housing to maintain affordability and livability, making it a prime target for contributing to SDG 11.

Markets Requiring Cautious Assessment

- Shrinking Markets (e.g., Rust Belt cities): Investment in new large-scale housing may not align with principles of sustainable development in areas with declining populations and economic bases.

- Overbuilt Markets (e.g., Tampa, FL): A spike in vacancy rates to 12.9% suggests a supply-demand imbalance, where further investment may not be sustainable or address the most pressing housing needs.

Investment Vehicles for Driving Sustainable Housing

Investors can engage with the BTR sector through various channels that facilitate the development of sustainable communities, in line with SDG 17.

- BTR-focused Real Estate Investment Trusts (REITs): Entities such as Camden Property Trust (CPT) and Mid-America Apartment Communities (MAA).

- Development Corporations: Firms like Lendlease (LLNK) and Brookfield Property Partners (BPY) are actively scaling their BTR portfolios.

Conclusion: Integrating BTR Investment with the 2030 Agenda

The confluence of urbanization, demographic shifts, and housing affordability challenges has created a clear and urgent need for scalable rental housing solutions. The Build-to-Rent sector represents a significant financial opportunity that is intrinsically aligned with the objectives of the Sustainable Development Goals, particularly SDG 11. By providing professionally managed, high-quality, and resilient housing, investment in BTR can play a pivotal role in building the sustainable and inclusive cities of the future.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 11: Sustainable Cities and Communities

This is the most prominent SDG in the article. The text is centered on the theme of rapid urbanization, housing demand, and the development of residential infrastructure in cities. It discusses the projection that “by 2050, over two-thirds of humanity will live in cities” and analyzes the housing market’s response, particularly the rise of Build-to-Rent (BTR) properties. The focus on housing affordability, occupancy rates, and urban population growth directly connects to the goal of making cities inclusive, safe, resilient, and sustainable.

-

SDG 8: Decent Work and Economic Growth

The article connects urbanization and housing development to economic opportunities and growth. It frames the BTR sector as a “$2.5 trillion industry in the U.S. alone” and highlights specific cities like Austin, TX, for their “tech-driven job growth (47% decade growth projected).” This discussion of industry growth, investment opportunities (REITs, developers), and job creation in growing urban centers aligns with the objectives of promoting sustained, inclusive, and sustainable economic growth.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 11.1: Ensure access for all to adequate, safe and affordable housing and basic services.

The article directly addresses this target by focusing on the global housing demand driven by urbanization. It highlights the “affordability crisis” in homeownership, citing the high “price-to-income ratio” and rising mortgage rates. The promotion of BTR is presented as a solution to provide housing. The description of BTR units as “Class A apartments with top-notch management” and amenities like “high-speed Wi-Fi, smart homes” points toward the provision of “adequate” housing.

-

Target 11.3: Enhance inclusive and sustainable urbanization and capacity for… sustainable human settlement planning and management.

The article’s entire premise is based on managing the impacts of rapid urbanization. It states that the global urban population will hit “68% by 2050.” The analysis of which cities are successfully absorbing this growth (e.g., Austin, Charlotte) versus those that are not (e.g., Rust Belt cities) is a discussion about human settlement planning. The surge in BTR supply (“55% since 2023”) is presented as a planned response to population shifts and housing needs in these growing urban areas.

-

Target 8.1: Sustain per capita economic growth in accordance with national circumstances.

While the article does not discuss national GDP, it provides data on significant economic activity within a major sector. The valuation of the BTR industry at “$2.5 trillion” and its rapid growth (“supply has surged 55% since 2023”) are indicators of substantial economic expansion. Furthermore, the mention of “tech-driven job growth” in cities like Austin directly relates to sustaining local economic growth.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Indicators for Target 11.1 (Affordable and Adequate Housing):

- Housing Affordability Ratios: The article explicitly mentions the “price-to-income ratio for homes hit 116.2 in 2024” and that in Portugal, “home prices are 147% of income.” These are direct indicators used to measure housing affordability.

- Homeownership Rate: The article cites the U.S. homeownership rate cratering to “65.1%” and the rate for under-35s at “36.6%.” This data indicates the proportion of the population with access to one type of housing, and its decline suggests a rising need for alternatives like rentals.

- Rental and Vacancy Rates: The mention of median rents rising “1.8% in 2024” and national vacancy rates for BTR dropping from “13.3% to 8.8%” are indicators of housing availability and cost in the rental market.

-

Indicators for Target 11.3 (Sustainable Urbanization):

- Rate of Urbanization: The projection that “68% by 2050” of the global population will be urbanized is a key indicator of the pace and scale of urbanization that requires management.

- Population Growth in Cities: Specific data, such as Nashville’s “30% population growth since 2020,” serves as a direct indicator of urban population change.

- Rate of Housing Supply Growth: The article provides metrics on the expansion of housing stock to meet population growth, such as the “doubling of BTR supply” in Charlotte since 2023 and the overall “55% surge” in BTR supply.

-

Indicators for Target 8.1 (Economic Growth):

- Sector-Specific Economic Value: The valuation of the BTR industry at “$2.5 trillion in the U.S. alone” is an indicator of its contribution to the economy.

- Job Growth Projections: The forecast of “47% decade growth projected” for jobs in Austin is a direct indicator of local economic growth and employment opportunities.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 11: Sustainable Cities and Communities | 11.1: Ensure access for all to adequate, safe and affordable housing and basic services. |

|

| SDG 11: Sustainable Cities and Communities | 11.3: Enhance inclusive and sustainable urbanization and capacity for… sustainable human settlement planning and management. |

|

| SDG 8: Decent Work and Economic Growth | 8.1: Sustain per capita economic growth in accordance with national circumstances. |

|

Source: ainvest.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0