Utilities may speed renewable projects under new tax credit timeline: Jefferies – ESG Dive

Report on the Impact of New U.S. Legislation on Renewable Energy Development and Sustainable Development Goals

Executive Summary

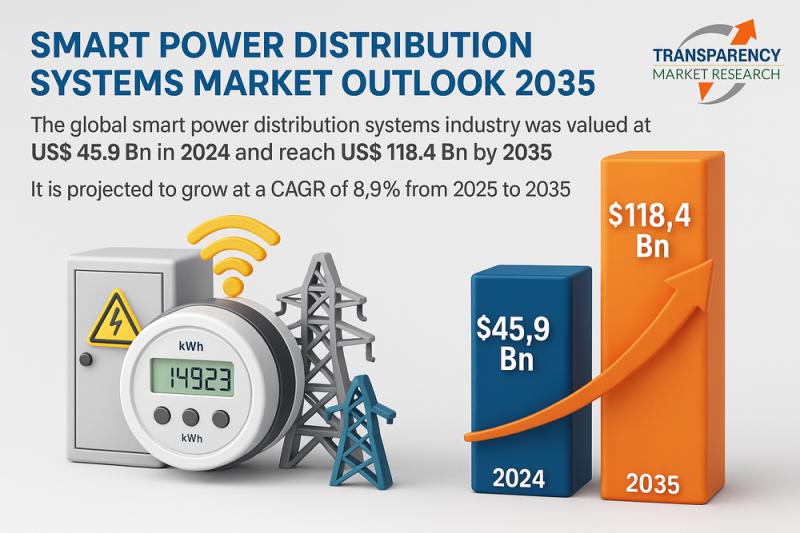

Recent U.S. legislation has established a new one-year safe harbor period for renewable energy projects to qualify for Inflation Reduction Act (IRA) tax credits. This policy change is compelling utility companies to significantly accelerate their development timelines for wind and solar projects. This report analyzes the implications of this legislative shift, focusing on its direct contributions to achieving key United Nations Sustainable Development Goals (SDGs), particularly SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action).

Accelerated Timelines in Pursuit of SDG 7

A July 10 report from investment bank Jefferies indicates that the new legislation will catalyze a rapid increase in clean energy deployment. This acceleration is a critical driver for advancing SDG 7, which aims to ensure access to affordable, reliable, sustainable, and modern energy for all.

- Project Acceleration: Utilities with significant renewable energy plans are expected to advance projects originally scheduled for 2030–2031 into the 2027–2028 timeframe.

- Key Industry Players: Companies identified as leading this acceleration include:

- Xcel Energy

- WEC Energy Group

- CMS Energy

- Ameren

- Commitment to Clean Energy: Xcel Energy affirmed its ability to leverage the new provisions to continue delivering “new, affordable, clean energy,” directly aligning with the core targets of SDG 7. The company’s planning process is designed to manage policy changes while pursuing state energy goals and maintaining customer affordability.

Policy Framework and Contribution to Climate Action (SDG 13)

The Republican budget megabill, signed into law on July 4, mandates stringent deadlines that intensify the urgency for climate action. By forcing a faster transition to renewables, the policy inadvertently strengthens efforts toward SDG 13 (Climate Action).

- Construction Deadline: Wind and solar projects must commence construction within one year of the law’s enactment to qualify for clean electricity tax credits.

- Service Deadline: Alternatively, projects must be “placed in service” by the end of 2027 to be eligible for the credits.

- Regulatory Oversight: A subsequent executive order issued on July 7 instructs the Treasury Department to publish guidance ensuring that the “beginning of construction” requirements are not circumvented. This measure aims to guarantee that the accelerated timelines result in tangible contributions to national climate and energy objectives.

Industry Response and Sustainable Infrastructure (SDG 9 & SDG 11)

The utility sector’s response highlights a strategic realignment to meet the new regulatory landscape, underscoring the importance of resilient infrastructure and partnerships, which are central to SDG 9 (Industry, Innovation, and Infrastructure) and SDG 11 (Sustainable Cities and Communities).

- Xcel Energy: Stated its focus on an “all-of-the-above” approach to meet rising energy demand and support economic growth, emphasizing the need for “strengthened infrastructure” as a foundation for sustainable development.

- WEC Energy Group: Is focused on executing its current capital plan and collaborating with regulators and stakeholders, reflecting the multi-stakeholder partnerships essential for SDG 17 (Partnerships for the Goals).

- CMS Energy: Is actively reviewing the legislation to determine its impact on the company’s long-term clean energy strategy, which is vital for building sustainable communities.

Economic Implications and Market Realignment toward SDG 8

The legislative changes are creating significant market shifts, with economic consequences that align with SDG 8 (Decent Work and Economic Growth). The accelerated pace of development is expected to stimulate investment and job creation in the green economy.

- Investment Surge: Jefferies anticipates that companies will “scramble to ensure their projects are as safe harbored as possible,” leading to a substantial increase in equipment orders within the next quarter.

- Economic Stimulus: This surge in investment and construction activity directly supports economic growth and creates employment opportunities in the renewable energy sector, contributing to the objectives of SDG 8.

- Investor Focus: The market is shifting its focus from potential capital reductions to identifying companies that are actively accelerating sustainable investments, signaling a positive trend toward financing the clean energy transition.

1. Which SDGs are addressed or connected to the issues highlighted in the article?

SDG 7: Affordable and Clean Energy

- The article’s central theme is the acceleration of renewable energy projects, specifically wind and solar, driven by legislative changes to tax credits. This directly aligns with the goal of increasing the share of clean energy. The text explicitly mentions utilities aiming to deliver “new, affordable, clean energy to our customers.”

SDG 9: Industry, Innovation and Infrastructure

- The development of renewable energy projects involves significant investment in new infrastructure. The article mentions the need for “strengthened infrastructure” to meet energy demand and highlights that utilities are accelerating their “capital plan” and “spend” on these projects. This relates to building resilient and sustainable infrastructure.

SDG 13: Climate Action

- The promotion of wind and solar energy through policies like the Inflation Reduction Act (IRA) tax credits is a primary strategy for climate change mitigation. The article discusses the legislative framework (“Republican megabill,” “executive order”) that directly impacts the development of clean energy, which is a key component of national climate action plans.

2. What specific targets under those SDGs can be identified based on the article’s content?

SDG 7: Affordable and Clean Energy

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. The article directly addresses this by describing how utilities are set to “accelerate the development of their renewable energy projects” and have “renewables-heavy plans.”

- Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology, including renewable energy… and promote investment in energy infrastructure and clean energy technology. The article discusses national policies (IRA tax credits, the new megabill) designed to “promote investment” in clean energy technology like wind and solar.

- Target 7.b: By 2030, expand infrastructure and upgrade technology for supplying modern and sustainable energy services for all… The article references the need for “strengthened infrastructure” and the execution of capital plans that include new renewable energy projects.

SDG 9: Industry, Innovation and Infrastructure

- Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes… The article’s focus on accelerating wind and solar projects represents a direct effort to upgrade energy infrastructure with “clean and environmentally sound technologies.”

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. The article is centered on the impact of national policies—the “Republican megabill,” the IRA tax credits, and a presidential “executive order”—on the clean energy sector. These policies are a direct example of integrating climate-related measures into national strategy and legislation.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Indicators for SDG 7 Targets

- Indicator for Target 7.2: The primary implied indicator is the rate of development of renewable energy projects. The article states that Jefferies anticipates utilities “to accelerate projects originally slated for 2030–31 into 2027–28.” This acceleration can be measured in terms of megawatts (MW) of new capacity added or the number of projects started.

- Indicator for Target 7.a: An indicator is the level of investment in clean energy. The article mentions that investors are focused on “potential capital pullbacks” versus “who’s actually accelerating spend.” This “spend” on new projects and “meaningful quantums of renewed equipment orders” serves as a direct financial indicator.

- Indicator for Target 7.b: The article implies the affordability of energy as an indicator. It notes that “affordability concerns linger” and that Xcel Energy is “keeping bills as low as possible for our customers,” suggesting that energy prices for consumers are a key metric of success.

Indicators for SDG 9 & 13 Targets

- Indicator for Target 9.4: The amount of capital investment in sustainable infrastructure is a key indicator. The article refers to utilities’ “capital plan” and the acceleration of “spend,” which can be tracked to measure progress in upgrading infrastructure.

- Indicator for Target 13.2: The existence and implementation of national policies and regulations supporting climate action is an indicator. The article details several such policies: the “Republican budget megabill,” the “Inflation Reduction Act’s clean electricity production and investment tax credits,” and the presidential “executive order” instructing the Treasury on implementation. The enactment and enforcement of these policies are measurable actions.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 7: Affordable and Clean Energy |

7.2: Increase substantially the share of renewable energy.

7.a: Promote investment in energy infrastructure and clean energy technology. 7.b: Expand infrastructure and upgrade technology for sustainable energy. |

– Rate of acceleration of renewable energy projects (e.g., moving projects from “2030-31 into 2027-28”). – Amount of capital “spend” and investment in renewable projects. – Volume of “renewed equipment orders” for wind and solar. – Affordability of energy for customers (“keeping bills as low as possible”). |

| SDG 9: Industry, Innovation and Infrastructure | 9.4: Upgrade infrastructure and retrofit industries to make them sustainable… with greater adoption of clean… technologies. |

– Execution of utilities’ “current capital plan” for new projects. – Investment in “strengthened infrastructure” for energy delivery. |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. |

– Enactment and implementation of national legislation (“Republican megabill,” “Inflation Reduction Act tax credits”). – Issuance of government directives (“executive order”) related to clean energy policy. |

Source: esgdive.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

-1920w.png?#)

;Resize=805#)