Suzhou Shijing Environmental Technology Co.,Ltd. (SZSE:301030) Stock Rockets 27% But Many Are Still Ignoring The Company

Suzhou Shijing Environmental Technology Co.,Ltd. Share Price Shows Signs of Recovery

Shareholders of Suzhou Shijing Environmental Technology Co.,Ltd. (SZSE:301030) would be pleased to see that the share price has experienced a significant gain of 27% in the past month, recovering from previous weakness. However, the share price is still down by a disappointing 20% over the last twelve months.

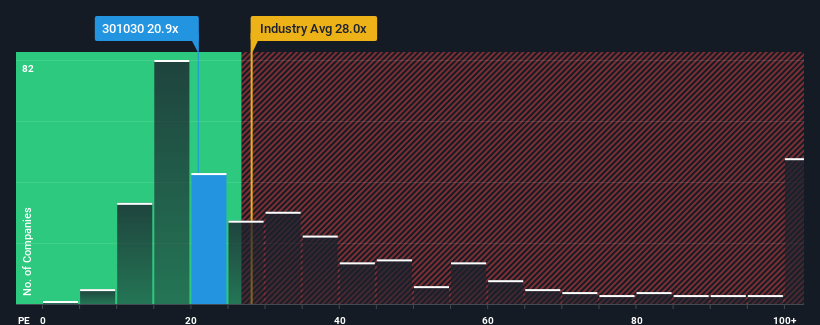

Despite the recent surge in price, Suzhou Shijing Environmental Technology Co.,Ltd. remains an attractive investment with a price-to-earnings ratio (P/E) of 20.9x, considering that approximately half of the companies in China have P/E ratios above 29x. It is important to note that the P/E ratio should not be taken at face value, as there may be underlying reasons for its limitation.

Suzhou Shijing Environmental Technology Co.,Ltd. has been performing well recently, with positive earnings growth compared to the declining earnings of most other companies. However, it is possible that many expect the strong earnings performance to deteriorate significantly, which has led to the suppression of the P/E ratio. Investors who believe in the company’s potential may see this as an opportunity to acquire stocks while they are undervalued.

See our latest analysis for Suzhou Shijing Environmental Technology Co.,Ltd.

If you’d like to see what analysts are forecasting for Suzhou Shijing Environmental Technology Co.,Ltd. in the future, you should check out our free report on Suzhou Shijing Environmental Technology Co.,Ltd.

How Is Suzhou Shijing Environmental Technology Co.,Ltd.’s Growth Trending?

In order to justify its P/E ratio, Suzhou Shijing Environmental Technology Co.,Ltd. would need to demonstrate sluggish growth that lags behind the market.

Looking back, the company achieved an impressive 43% growth in earnings per share last year. Over the past three years, it has been able to grow EPS by a total of 77%. Therefore, it is fair to say that the company has experienced superb earnings growth recently.

Looking ahead, estimates from the one analyst covering the company suggest that earnings should grow by 112% each year over the next three years. This is significantly higher than the forecasted 19% annual growth for the broader market.

Despite the positive growth outlook, it is peculiar that Suzhou Shijing Environmental Technology Co.,Ltd.’s P/E ratio is lower than that of most other companies. This indicates that many investors are skeptical about the company’s ability to achieve future growth expectations.

The Key Takeaway

Although Suzhou Shijing Environmental Technology Co.,Ltd.’s shares have shown signs of recovery, its P/E ratio still lags behind that of most other companies. While using the P/E ratio alone to make investment decisions is not advisable, it can provide insight into the company’s future prospects.

Considering the lower-than-expected P/E ratio and the forecasted higher-than-market growth, it appears that potential risks are placing significant pressure on the P/E ratio. Many investors anticipate earnings instability, which would normally boost the share price.

It is important to consider other risk factors as well. We have identified 4 warning signs for Suzhou Shijing Environmental Technology Co.,Ltd. (3 of which should not be ignored) that you should be aware of before making an investment decision.

If you are interested in P/E ratios, you may also want to explore our collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We have created the ultimate portfolio companion for stock investors, and it’s free.

- Connect an unlimited number of Portfolios and see your total in one currency

- Be alerted to new Warning Signs or Risks via email or mobile

- Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

SDGs, Targets, and Indicators Analysis

1. Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 8: Decent Work and Economic Growth

- SDG 9: Industry, Innovation, and Infrastructure

- SDG 11: Sustainable Cities and Communities

The article discusses the performance and potential investment attractiveness of Suzhou Shijing Environmental TechnologyLtd, which operates in the environmental technology industry. This industry contributes to economic growth (SDG 8) through job creation and innovation (SDG 9). Additionally, the company’s operations in the environmental technology sector align with the goal of creating sustainable cities and communities (SDG 11).

2. What specific targets under those SDGs can be identified based on the article’s content?

- SDG 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading, and innovation.

- SDG 9.2: Promote inclusive and sustainable industrialization and foster innovation.

- SDG 11.6: Reduce the adverse per capita environmental impact of cities, including by paying special attention to air quality and municipal and other waste management.

The article highlights the company’s positive earnings growth and potential for future growth, indicating its contribution to economic productivity and innovation (SDG 8.2 and SDG 9.2). Furthermore, as an environmental technology company, Suzhou Shijing Environmental TechnologyLtd plays a role in addressing environmental issues in cities, such as waste management and air quality (SDG 11.6).

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

- Earnings per share growth

- Price-to-earnings ratio (P/E ratio)

The article mentions the company’s earnings per share growth, indicating its performance in achieving higher economic productivity and innovation. The P/E ratio is also discussed, which can be used as an indicator of market perception and investor confidence in the company’s future growth prospects.

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading, and innovation. | Earnings per share growth |

| SDG 9: Industry, Innovation, and Infrastructure | 9.2: Promote inclusive and sustainable industrialization and foster innovation. | Earnings per share growth |

| SDG 11: Sustainable Cities and Communities | 11.6: Reduce the adverse per capita environmental impact of cities, including by paying special attention to air quality and municipal and other waste management. | Price-to-earnings ratio (P/E ratio) |

Source: simplywall.st