Devex Invested: The climate insurance lottery low-income countries can’t afford – Devex

Report on Development Finance and Sustainable Development Goal (SDG) Implementation

Introduction

This report analyzes current trends and challenges in development finance, with a specific focus on their alignment with the Sustainable Development Goals (SDGs). Key areas of examination include climate finance mechanisms, outcomes from the Fourth International Conference on Financing for Development, the role of carbon markets, and progress in social development programs. The analysis underscores the critical importance of innovative financing and robust international partnerships (SDG 17) to achieve the 2030 Agenda, particularly in the context of escalating climate change (SDG 13) and economic pressures on vulnerable nations.

Climate Action (SDG 13) and Innovative Financing Mechanisms

The Role of Climate Insurance in Achieving SDG 13

In response to rising global temperatures and increasing climate-related risks, insurance mechanisms are being promoted as a tool to unlock private capital for climate adaptation and resilience, directly supporting SDG 13 (Climate Action) and SDG 11 (Sustainable Cities and Communities). Proponents argue that climate-friendly insurance creates a necessary safety net to de-risk investments in vulnerable regions. The Bridgetown Initiative, in collaboration with the Insurance Development Forum, is advancing products like parametric insurance, which links payouts to predefined thresholds such as wind speed or rainfall levels. This model aims to expedite financial relief and reduce administrative costs following a climate disaster, thereby strengthening partnerships for the goals (SDG 17).

Challenges and Criticisms of Parametric Insurance Models

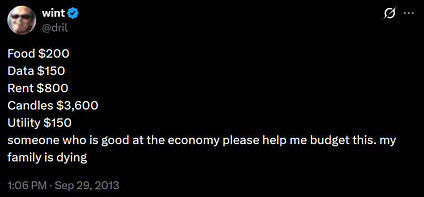

Despite their potential, parametric insurance models have faced significant criticism for failing to protect vulnerable nations, potentially undermining SDG 1 (No Poverty) and SDG 10 (Reduced Inequalities). Critics contend these instruments place an unfair financial burden on countries least responsible for the climate crisis. Furthermore, the effectiveness of these models is in question due to real-world failures.

- Puerto Rico: Following Hurricane María, a parametric insurance policy tied to wind speed did not pay out because the primary damage was caused by flooding.

- Jamaica: A catastrophe bond failed to trigger after Hurricane Beryl because the required air pressure threshold was not met, leaving the country without financial support.

Economists, including Professor Ilan Noy of Te Herenga Waka–Victoria University of Wellington, argue that inadequate risk modeling turns these insurance products into a “lottery ticket” for low-income countries, representing a gamble rather than reliable protection.

Financing the 2030 Agenda: Post-Conference on Financing for Development Analysis

Key Themes for Advancing SDG 17 (Partnerships for the Goals)

Discussions at the Fourth International Conference on Financing for Development have shaped the agenda for the next decade. Experts identified several key themes crucial for financing the SDGs.

- Debt Restructuring and Architecture: The global debt crisis has been acknowledged as a major impediment to achieving SDG 1 (No Poverty) and SDG 8 (Decent Work and Economic Growth). There is a new commitment to establish an intergovernmental process for creating a more effective debt architecture and strengthening regional institutions.

- Regionalism and Self-Reliance: A renewed focus on regionalism is emerging, with entities like the African Union and ASEAN expected to play a larger role in driving development. This shift towards self-reliance is seen as a necessary adaptation to changing economic conditions and shrinking official aid budgets, reinforcing SDG 17.

- Offensive Blended Finance: To achieve SDG 9 (Industry, Innovation and Infrastructure), countries must proactively foster growth. Blended finance is identified as an “entry point” to mobilize domestic capital for infrastructure and economic development. Insurance companies are positioned to act as advisors in these transactions.

Defining Blended Finance for Development Outcomes

Blended finance is the strategic use of public or philanthropic capital to mobilize private investment for development. It utilizes a layered structure where a risk-tolerant “junior tranche” of concessional finance absorbs initial losses, making the “senior tranche” safer and more attractive to commercial investors. Research indicates that minimizing the junior tranche while maximizing the senior one can attract more private capital and reduce the need for public subsidies. However, accurately calculating the optimal structure is complex. The objective is to establish a “good enough” model through negotiation that attracts private investment without providing excessive subsidies, thereby maximizing the impact of development funding.

Challenges to International Development Cooperation (SDG 17)

U.S. Millennium Challenge Corporation Program Review

The U.S. Millennium Challenge Corporation (MCC) is facing significant program cancellations, which could impact the achievement of SDG 16 (Peace, Justice and Strong Institutions) and SDG 17 in partner countries. While the agency will continue to operate, programs in nations including Kenya, the Philippines, Indonesia, Zambia, and Malawi are slated for termination. The agency has stated its remaining work will align with an “America First” approach. Critics warn these cuts could diminish U.S. influence and create a vacuum that other global powers may fill. The final decision on the fate of these programs is pending a board meeting.

Leveraging Carbon Markets for National Climate Plans (SDG 13)

Voluntary Carbon Markets Integrity Initiative (VCMI) Toolkit

The VCMI has released a toolkit to assist governments in using international carbon markets to finance their national climate plans, a key strategy for implementing SDG 13 (Climate Action). The resource provides guidance on engaging with voluntary carbon markets, building strong institutional frameworks, and ensuring environmental and social integrity. This initiative is timely as countries prepare to update their emission-reduction targets under the Paris Agreement. A significant area of potential integration is with agriculture, a sector contributing substantially to emissions. The toolkit could help governments enable farmers to access carbon market financing for implementing climate-smart practices, contributing to SDG 15 (Life on Land).

Progress in Social Development Goals: School Meals Programs

National Leadership in Advancing SDG 2 (Zero Hunger) and SDG 4 (Quality Education)

Governments are increasingly leading the expansion of school meal programs, a critical intervention for achieving SDG 2 (Zero Hunger), SDG 3 (Good Health and Well-being), and SDG 4 (Quality Education). According to the School Meals Coalition, 418 million children received school meals globally in 2022, an increase of 30 million since 2020, supported by a $5 billion rise in investment. This progress is driven by national leadership and innovative strategies.

- Innovative Financing: Mechanisms such as debt swaps and taxes on products like soda and cigarettes are being used to fund these programs.

- Local Sourcing and Climate-Smart Menus: Programs are increasingly sourcing food locally, boosting local economies in line with SDG 8 (Decent Work and Economic Growth), and utilizing technology like the World Food Programme’s School Meal Planner Plus app to optimize menus for nutrition, cost, and local availability.

- Rapid Expansion: Countries like Ethiopia have demonstrated significant progress, expanding program coverage from 1.6 million to 7.5 million children since 2021.

1. SDGs Addressed in the Article

SDG 2: Zero Hunger

- The article discusses the expansion of school meal programs globally, which directly addresses the goal of ending hunger and improving nutrition, especially for children. It highlights how governments are using innovative financing and local food sourcing to “improve child nutrition and stimulate local economies.”

SDG 7: Affordable and Clean Energy

- The article mentions Africa’s vast clean energy potential, specifically its “40% of the world’s solar potential.” It points out that “structural barriers in finance keep its clean energy and agriculture ventures trapped at subscale,” connecting the issue of financing to the goal of ensuring access to affordable and clean energy.

SDG 13: Climate Action

- This is a central theme of the article. It begins by discussing rising global temperatures and the associated risks for climate-vulnerable markets. The core of the discussion revolves around climate adaptation, resilience, and financing mechanisms like climate insurance and carbon markets, which are key components of taking action on climate change.

SDG 17: Partnerships for the Goals

- The article extensively covers the means of implementation for development goals, which is the focus of SDG 17. It details various financial partnerships and mechanisms, including “blended finance,” the role of Multilateral Development Banks (MDBs), private capital mobilization, debt architecture, and international cooperation through initiatives like the VCMI toolkit for carbon markets.

2. Specific Targets Identified

Under SDG 2: Zero Hunger

-

Target 2.1: By 2030, end hunger and ensure access by all people… to safe, nutritious and sufficient food all year round.

- The article’s section on “Meal deals” directly relates to this target by describing the expansion of school meal programs. It states that “418 million children received school meals globally” and highlights efforts to optimize menus based on “local production, nutrition, and cost.”

-

Target 2.4: By 2030, ensure sustainable food production systems and implement resilient agricultural practices…

- The article implies this target by discussing the push to “integrate carbon markets with agriculture.” This integration would help “farmers and land managers… tap carbon markets to fund climate-smart practices,” which are essential for sustainable and resilient agriculture in the face of climate change.

Under SDG 7: Affordable and Clean Energy

-

Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology.

- The article highlights the gap in achieving this target by noting that despite Africa’s vast solar potential, “structural barriers in finance keep its clean energy… ventures trapped at subscale.” This points to the critical need for increased investment and financial mechanisms to unlock this potential.

Under SDG 13: Climate Action

-

Target 13.1: Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries.

- The discussion on climate insurance, particularly “parametric insurance” and “catastrophe bonds,” is directly aimed at this target. These tools are presented as a way to “unlock billions in private capital for climate adaptation” and create a “safety net” for climate-vulnerable countries facing disasters like hurricanes.

Under SDG 17: Partnerships for the Goals

-

Target 17.3: Mobilize additional financial resources for developing countries from multiple sources.

- This target is addressed throughout the article. The concept of “blended finance” is described as the “strategic use of public or philanthropic capital to mobilize private investment.” The article also mentions MDBs making “$150 billion in loan commitments” and innovative funding like “debt swaps and taxes on public ‘bads’ such as soda and cigarettes” to boost resources for development programs.

-

Target 17.9: Enhance international support for implementing effective and targeted capacity-building in developing countries…

- The Voluntary Carbon Markets Integrity Initiative’s (VCMI) launch of a “toolkit to help governments navigate international carbon market rules” is a direct example of capacity-building. The toolkit aims to help countries “build strong institutional frameworks” to use these markets to finance their climate plans.

3. Indicators Mentioned or Implied

For SDG 2 Targets

- Number of children receiving school meals: The article explicitly states that “418 million children received school meals globally, up 30 million since early 2020,” providing a clear metric for progress on Target 2.1.

- Investment in school meal programs: The text mentions a “$5 billion rise in investment” for school meals, which serves as a financial indicator of commitment to the goal.

For SDG 13 Targets

- Payout success rate of climate insurance mechanisms: The article implies this indicator by highlighting failures. It notes that Puerto Rico’s parametric insurance “didn’t pay out” after Hurricane María, and a “catastrophe bond” in Jamaica also “didn’t trigger.” The success or failure of these payouts is a measure of their effectiveness in building resilience (Target 13.1).

- Amount of private capital unlocked for climate adaptation: The article states that advocates believe climate-friendly insurance is needed to “unlock billions in private capital for climate adaptation,” suggesting this mobilized capital is a key measure of success.

For SDG 17 Targets

- Volume of mobilized private investment through blended finance: The article discusses using public capital to “attract more private investors.” The amount of private capital successfully mobilized is a direct indicator of the effectiveness of these partnership models (Target 17.3).

- Value of MDB loan commitments: The article provides a specific figure, stating that last year “MDBs… made more than $150 billion in loan commitments,” which is a direct indicator of financial flows from international institutions.

For SDG 7 Targets

- Investment in Africa’s clean energy ventures: The article implies this indicator by stating that financial barriers keep these ventures “trapped at subscale.” An increase in investment flowing into these projects would be a measure of progress toward Target 7.a.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 2: Zero Hunger |

2.1: End hunger and ensure access to nutritious food.

2.4: Ensure sustainable food production systems and resilient agricultural practices. |

– Number of children receiving school meals (stated as 418 million globally). – Total investment in school meal programs (a $5 billion rise mentioned). – Number of farmers/land managers using carbon markets to fund climate-smart practices (implied). |

| SDG 7: Affordable and Clean Energy | 7.a: Enhance international cooperation and promote investment in clean energy. | – Amount of investment in Africa’s clean energy ventures (implied by the mention of ventures being “trapped at subscale” due to financial barriers). |

| SDG 13: Climate Action | 13.1: Strengthen resilience and adaptive capacity to climate-related hazards. |

– Payout success rate of climate insurance mechanisms (implied by examples of failures in Puerto Rico and Jamaica). – Amount of private capital mobilized for climate adaptation (implied by the goal to “unlock billions”). |

| SDG 17: Partnerships for the Goals |

17.3: Mobilize additional financial resources for developing countries.

17.9: Enhance international support for capacity-building. |

– Volume of private investment mobilized through blended finance. – Value of MDB loan commitments (stated as over $150 billion). – Adoption and use of capacity-building resources like the VCMI toolkit by governments (implied). |

Source: devex.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

:focal(1500,1000)/https://media.globalcitizen.org/a6/9a/a69a4720-d8a1-4715-b596-18738d03c05c/rotary_polio_hero_image.jpg?#)

/countries/sri-lanka/photo-credit---dmc-sri-lanka.tmb-1200v.jpg?sfvrsn=dc298bcc_1#)