Water and Waste Water Treatment Technologies Market Size – Market.us

Global Water and Wastewater Treatment Technologies Market: A Report on Contributions to Sustainable Development Goals

Executive Summary: Market Dynamics and SDG Alignment

The Global Water and Wastewater Treatment Technologies Market is on a significant growth trajectory, projected to expand from USD 71.3 billion in 2024 to USD 131.3 billion by 2034, at a Compound Annual Growth Rate (CAGR) of 6.3%. This expansion is intrinsically linked to the global pursuit of the United Nations Sustainable Development Goals (SDGs), particularly SDG 6 (Clean Water and Sanitation). The market’s growth reflects escalating investments in infrastructure and technology aimed at ensuring the availability and sustainable management of water and sanitation for all. Technologies encompassing physical, chemical, and biological treatment processes are fundamental to achieving targets under SDG 6, as well as contributing to SDG 3 (Good Health and Well-being), SDG 11 (Sustainable Cities and Communities), and SDG 14 (Life Below Water) by mitigating pollution and enhancing public health.

Market Performance and Linkage to Sustainability Targets

Key Findings in the Context of Global Goals

- Market Growth Projection: The projected market value of USD 131.3 billion by 2034 signifies a substantial global investment commitment towards achieving SDG 6.

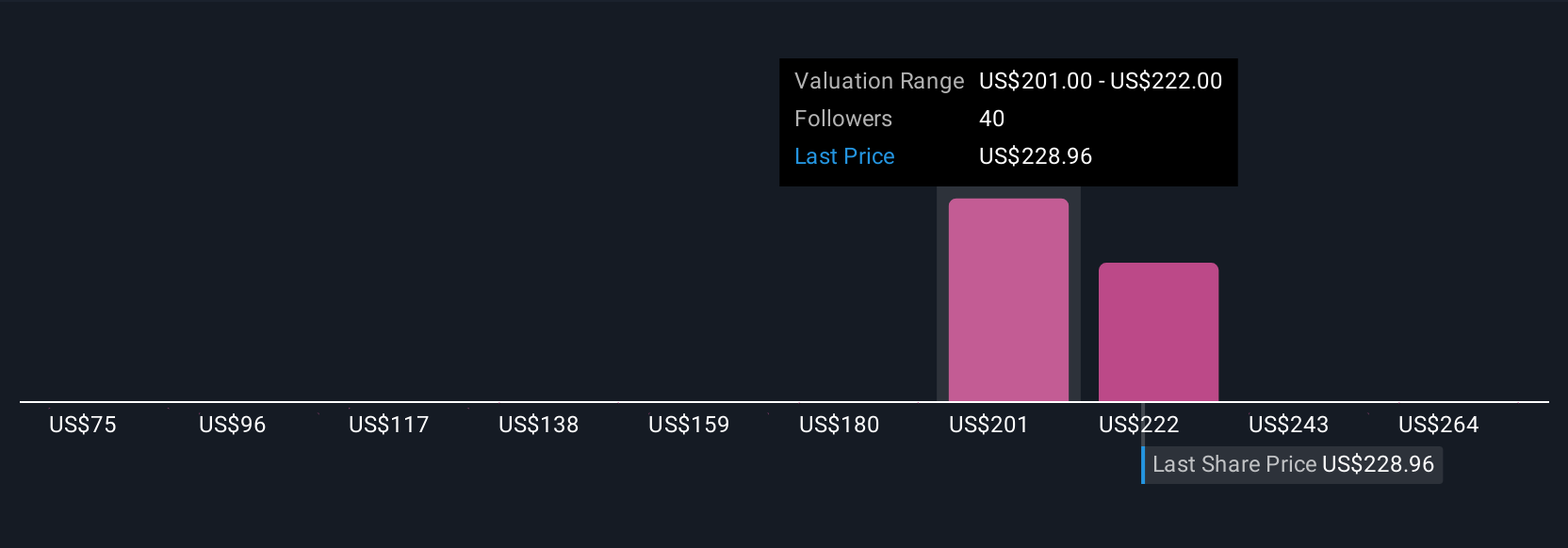

- Suspended Solids Removal: This segment’s 38.2% market share underscores its foundational role in primary water treatment, a critical first step for providing safe water as outlined in SDG 6.1.

- Secondary Treatment Dominance: Holding a 39.4% share, secondary treatment processes are vital for reducing pollution from wastewater, directly supporting SDG 6.3 (halving the proportion of untreated wastewater).

- Municipal Sector Leadership: The municipal sector’s 67.9% share highlights the central role of public infrastructure in creating sustainable urban environments, aligning with SDG 11.

- Asia-Pacific’s Contribution: The region’s market value of USD 29.8 billion is driven by infrastructure development aimed at meeting the pressing water and sanitation needs of its rapidly urbanizing populations, a core challenge of SDG 6 and SDG 11.

Market Segmentation Analysis and SDG Impact

Analysis by Technology Type

The Suspended Solids Removal segment commanded a 38.2% market share in 2024. This technology is indispensable for the initial stages of water and wastewater treatment, removing particulate matter to improve water quality. Its prevalence in both municipal and industrial applications is crucial for meeting the basic sanitation and water safety standards required by SDG 6. Effective solids removal protects downstream processes and ensures that discharged water does not harm aquatic ecosystems, contributing to SDG 14.

Analysis by Process Stage

Secondary treatment processes accounted for 39.4% of the market share. These biological methods are essential for removing dissolved organic matter from wastewater. The widespread adoption of secondary treatment is a direct response to regulatory pressures to improve effluent quality, which is a key component of SDG 6.3. By effectively treating municipal and industrial wastewater, these processes reduce environmental pollution and support the creation of healthier communities (SDG 3).

Analysis by End-User

The Municipal sector dominated the market with a 67.9% share, driven by urbanization and the need to upgrade aging infrastructure. Investments in municipal treatment facilities are fundamental to achieving SDG 6.1 (universal access to safe drinking water) and SDG 6.2 (access to adequate sanitation). Furthermore, these efforts are integral to building resilient and sustainable cities as envisioned in SDG 11.

Market Drivers, Restraints, and Opportunities in the SDG Framework

Driving Factors

Increasing global water pollution is a primary driver for the market. Industrial discharge, agricultural runoff, and urban sewage degrade water sources, posing a direct threat to human health and ecosystems. The demand for advanced treatment technologies is a critical response to this challenge, aligning with the objective of SDG 6.3 to improve water quality by reducing pollution and substantially increasing recycling and safe reuse globally.

Restraining Factors

The high installation and operational costs of advanced treatment systems present a significant barrier, particularly for developing nations. This financial constraint impedes progress towards universal access to clean water and sanitation, highlighting a major challenge in achieving SDG 6. Overcoming this requires innovative financing models and international cooperation, as called for in SDG 17 (Partnerships for the Goals).

Growth Opportunities

The integration of smart technologies, such as IoT sensors and data analytics, offers a significant opportunity to enhance treatment efficiency and sustainability. This aligns with SDG 9 (Industry, Innovation, and Infrastructure) by fostering innovation in the water sector. Smart water management can optimize resource use, reduce operational costs, and improve system reliability, thereby accelerating progress towards SDG 6 and SDG 12 (Responsible Consumption and Production).

Emerging Trends

The rise of decentralized treatment units represents a key trend, offering flexible and scalable solutions for remote or underserved communities. These systems support localized water reuse and reduce the burden on centralized infrastructure. This trend directly contributes to making cities and human settlements more inclusive and sustainable (SDG 11) while providing tailored solutions to meet the sanitation needs of diverse populations (SDG 6).

Regional Analysis: Progress Towards Water-Related SDGs

In 2024, the Asia-Pacific region led the market with a 41.8% share, valued at USD 29.8 billion. This dominance reflects massive investments in water infrastructure to address the challenges of rapid industrialization and population growth, directly tackling the targets of SDG 6 and SDG 9. North America and Europe show mature markets driven by stringent regulations and a focus on advanced treatment and water reuse, contributing to SDG 12. The Middle East & Africa and Latin America are focusing on upgrading infrastructure to combat water scarcity and improve public health, marking steady progress towards SDG 3 and SDG 6.

Key Regions and Countries

- North America: USA, Canada, Mexico

- Europe: Germany, France, UK, Spain, Italy, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Rest of APAC

- Latin America: Brazil, Mexico, Rest of Latin America

- Middle East & Africa: GCC, South Africa, Rest of MEA

Key Player Contributions to Sustainable Development

Leading companies in the market are actively contributing to the SDGs through their technological innovations and project implementations.

- AECOM: Focuses on delivering sustainable and resilient infrastructure projects, directly supporting SDG 9 and SDG 11.

- Aquatech International LLC: Specializes in industrial water treatment, including Zero Liquid Discharge (ZLD) systems that promote water reuse and align with SDG 12.

- Black & Veatch Holding Company: Develops municipal water systems and guidance for removing contaminants like PFAS, contributing to SDG 3 and SDG 6.

- Doosan Heavy Industries and Construction: Constructs large-scale desalination and treatment plants, addressing water scarcity and enhancing water security in line with SDG 6.

Recent Developments and Future Outlook

Recent activities underscore the industry’s commitment to advancing sustainable water management.

- April 2025: AECOM’s acquisition of Allen Gordon LLP aims to strengthen its water advisory services, aligning with regional investment plans to bolster water and energy infrastructure, a key component of SDG 9.

- January 2025: Black & Veatch’s development of national guidance for PFAS treatment will help utilities implement reliable removal methods, a critical step for ensuring safe drinking water and protecting public health (SDG 3 and SDG 6).

Analysis of Sustainable Development Goals (SDGs) in the Water and Wastewater Treatment Technologies Market

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 6: Clean Water and Sanitation

This is the most central SDG addressed. The entire article focuses on technologies for water and wastewater treatment, which are fundamental to ensuring the availability and sustainable management of water and sanitation for all. It discusses purifying drinking water, treating sewage and industrial effluent, and improving water quality by removing contaminants.

-

SDG 9: Industry, Innovation, and Infrastructure

The article highlights the market for water treatment technologies as a key industrial sector. It emphasizes the need for “strong infrastructure investments,” upgrading “aging infrastructure,” and the role of innovation through “smart technologies” and “advanced treatment technologies” to create resilient and sustainable systems.

-

SDG 11: Sustainable Cities and Communities

The article points to the “Municipal” sector as the dominant end-user (67.9% share), driven by “increasing urban population” and the need for centralized water and sewage systems in cities. This directly relates to making cities inclusive, safe, resilient, and sustainable by managing urban wastewater and providing essential services.

-

SDG 12: Responsible Consumption and Production

The article discusses the need for industrial sectors (like food and beverage, chemicals, and oil and gas) to manage their effluent. It also highlights technologies and trends like “water recycling,” “water reuse,” and “zero liquid discharge (ZLD) systems,” which are core principles of ensuring sustainable consumption and production patterns by reducing waste and promoting a circular economy for water.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 6.1: By 2030, achieve universal and equitable access to safe and affordable drinking water for all.

The article connects to this target by highlighting the “rising demand for clean drinking water” as a key driver for the municipal sector’s investment in treatment technologies.

-

Target 6.3: By 2030, improve water quality by reducing pollution, eliminating dumping and minimizing release of hazardous chemicals and materials, halving the proportion of untreated wastewater and substantially increasing recycling and safe reuse globally.

This is a primary focus. The article details technologies for “Suspended Solids Removal,” “Secondary treatment processes” to remove organic matter, and the management of pollutants like “chemicals, sewage, heavy metals, and microplastics.” The goal of ensuring “safe discharge of treated effluent” is mentioned repeatedly.

-

Target 6.4: By 2030, substantially increase water-use efficiency across all sectors and ensure sustainable withdrawals and supply of freshwater to address water scarcity.

The article directly addresses this through its discussion of “increasing global water scarcity,” the “heightened need for water reuse in water-scarce regions,” and the trend towards “decentralized treatment” that enables local water reclamation and reuse.

-

Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure, including regional and transborder infrastructure, to support economic development and human well-being.

The report is centered on the market for water treatment infrastructure. It explicitly mentions “Strong infrastructure investments,” the need to upgrade “aging water infrastructure,” and a focus on “sustainable and resilient infrastructure” by key players like AECOM.

-

Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes.

The article describes how industrial sectors are adopting treatment technologies to “minimize the environmental footprint.” It also points to the growth opportunity in “smart technologies” that make treatment “more efficient and less expensive to run,” which aligns with upgrading industrial processes.

-

Target 11.6: By 2030, reduce the adverse per capita environmental impact of cities, including by paying special attention to air quality and municipal and other waste management.

The dominance of the “Municipal” sector in the market reflects the effort of cities to manage their wastewater. The article notes that “Municipal bodies across urban areas are prioritizing secondary processes to ensure that treated effluent meets stringent environmental regulations before being discharged or reused.”

-

Target 12.4: By 2020, achieve the environmentally sound management of chemicals and all wastes throughout their life cycle… and significantly reduce their release to air, water and soil to minimize their adverse impacts on human health and the environment.

The article’s discussion of removing “chemicals, sewage, heavy metals, and microplastics” from water and the need for “industrial effluent management” directly supports the goal of managing chemical waste and preventing its release into water bodies.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Financial Investment as an Indicator:

The article provides multiple financial figures that serve as indicators of the level of investment and commitment towards water infrastructure and technology.

- Global Market Size: Expected to grow from USD 71.3 billion in 2024 to USD 131.3 billion by 2034.

- Regional Investment: Asia-Pacific’s market value reached USD 29.8 billion.

- Specific Funding: Mentions of “€73 million… to support wastewater infrastructure improvements” and a “£42 million funding round” for water treatment initiatives.

-

Technology Adoption and Treatment Level as an Indicator:

The market share of different treatment processes indicates the level of wastewater treatment being implemented, which is relevant to Target 6.3.

- “Secondary treatment processes account for 39.4%, emphasizing biological and chemical stages in wastewater purification.”

- “Suspended solids removal holds a 38.2% share,” indicating a focus on primary treatment stages.

-

Sectoral Focus as an Indicator:

The dominance of the municipal sector indicates progress in urban sanitation (Target 11.6).

- “Municipal sector drives demand with 67.9% strong dominance.”

-

Qualitative Trend Indicators:

The article describes several trends that are qualitative indicators of progress.

- Increased focus on “water reuse, conservation, and sustainable resource management” (for Target 6.4).

- The emergence of “Decentralized treatment units” for remote and localized solutions (for Target 6.b).

- The rising use of “smart technologies” like sensors and automation to improve efficiency (for Target 9.4).

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 6: Clean Water and Sanitation |

6.1: Access to safe drinking water.

6.3: Improve water quality and increase wastewater treatment. 6.4: Increase water-use efficiency and address water scarcity. |

– Rising demand for clean drinking water driving municipal investment. – Market share of treatment types: “Secondary treatment processes account for 39.4%.” – Focus on removing pollutants like “chemicals, sewage, heavy metals.” – Trends toward “water recycling,” “water reuse,” and “zero liquid discharge (ZLD) systems.” |

| SDG 9: Industry, Innovation, and Infrastructure |

9.1: Develop quality, reliable, sustainable and resilient infrastructure.

9.4: Upgrade infrastructure and industries with clean and sustainable technologies. |

– Market value as a proxy for infrastructure investment: “USD 71.3 billion in 2024.” – Specific investments mentioned: “€73 million” and “£42 million.” – Growth in “smart technologies” (sensors, automation) to improve efficiency. – Industrial adoption of treatment to “minimize the environmental footprint.” |

| SDG 11: Sustainable Cities and Communities | 11.6: Reduce the adverse per capita environmental impact of cities, including waste management. |

– Dominant market share of the municipal sector: “Municipal sector drives demand with 67.9% strong dominance.” – Investment in centralized systems for “urban areas” to manage sewage and meet “stringent environmental regulations.” |

| SDG 12: Responsible Consumption and Production | 12.4: Environmentally sound management of chemicals and all wastes. |

– Focus on “industrial effluent management” for sectors like chemicals and oil & gas. – Technologies designed to remove “harmful pollutants” and “hazardous chemicals” from water. |

Source: market.us

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0