Bill Gates Backs Stealth Startup with $91M for Hydrogen Revolution

Bill Gates Backs Stealth Startup with $91M for Hydrogen Revolution CarbonCredits.com

Natural Hydrogen: The Next Global Gold Rush?

The knowledge of the existence of naturally occuring hydrogen has been around for centuries but is not well understood. With the recent revelation by Koloma, this could be about to change.

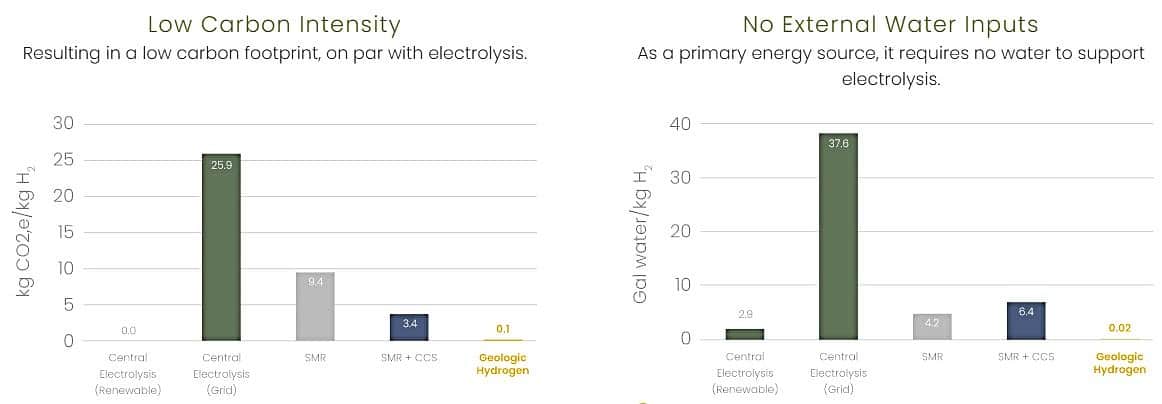

Natural hydrogen, also called gold or white hydrogen, has made headlines as a potential new renewable energy source. It differs from other types of hydrogen in that it’s a primary source of energy like fossil fuels but carbon-free.

Koloma’s Geologic Hydrogen Production

Highlighting these facts about carbon-free hydrogen production, Koloma’s co-founder and CTO, Tom Darrah, said that:

“It’s [Hydrogen] on every continent… The scale of how much there is, is profound.”

Darrah is an Earth sciences professor and an expert in extracting hydrogen who has 16 patents involving H2 extraction. One of them includes the use of AI-assisted laser imaging and satellites to assess sites potentially storing natural hydrogen.

The hydrogen startup analyzes samples from its Midwestern wells in Darrah’s laboratory at the Ohio State University. The tests will help reveal the sites with the best H2 volume and purity.

From Secret Mode to Revolutionary Revelation

Koloma, founded in 2021, has been operating in stealth or secret mode but revealed itself in an interview with Forbes magazine.

The $91 million investment made Koloma the most-funded company in the space. It got the funds from Bill Gates’ Breakthrough Energy Ventures and other big climate investors Energy Impact Partners, Evōk Innovations, Prelude Ventures, and Piva Capital.

The startup didn’t say how much of the funds came from the Microsoft founder Bill Gates. The billionaire himself is a promoter of hydrogen, believing that it is the ‘Swiss Army knife’ of renewable sources.

The $1 Trillion Market by 2050

Currently, the global hydrogen market is worth over $120 billion, with 100 million metric tons in annual consumption volume. Industry experts think that naturally-occuring geologic hydrogen can potentially ditch fossil fuels.

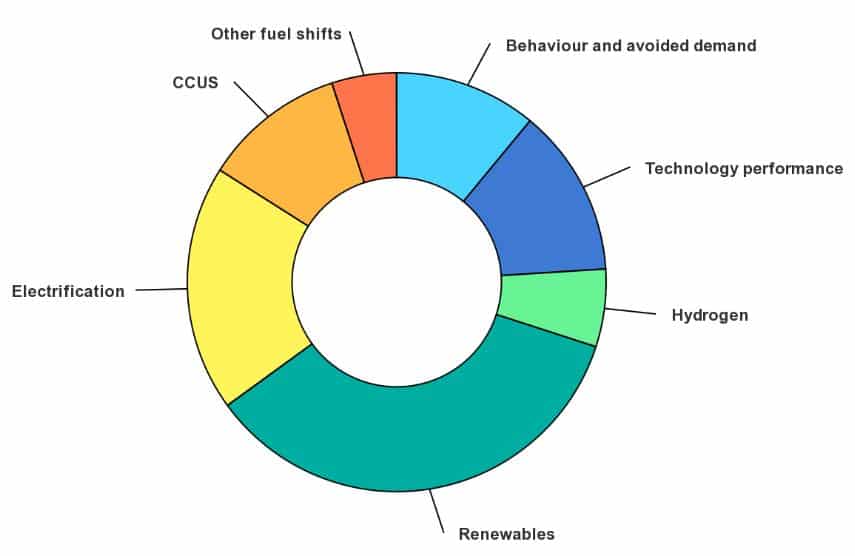

According to Goldman Sachs, the market will more than double to $250 billion by 2030 and worth $1 trillion by 2050. This is crucial as hydrogen is becoming an increasingly important piece of the net zero emissions by 2050 puzzle.

According to the International Energy Agency, strong hydrogen demand growth and the adoption of cleaner technologies for its production will enable H2 and H2-based fuels to have a significant contribution in its Net Zero Emissions Scenario.

Green hydrogen is dubbed as the energy of the future and it begins this 2023 as subsidies start pouring in.

In the U.S., the government allocated over $9 billion for clean hydrogen projects in the 2021 Bipartisan Infrastructure Law. Plus, President Biden’s Inflation Reduction Act provides a tax credit of $3/kilo for zero-carbon fuel which geologic hydrogen meets. Koloma will apply for subsidies under both programs.

The EU’s Carbon Contracts for Difference (CCfD) also subsidizes green hydrogen through its Innovation Fund. The UK also has a similar CfD subsidy scheme for clean hydrogen production.

Germany, Canada, and India also have their own programs to make hydrogen a viable sector of the clean energy market.

The Bill Gates-backed startup said it will start commercial operations when demand for hydrogen ramps up. And this seems to be near starting this year. Through its geologic hydrogen production, Koloma sets the stage for a sustainable future where drilling clean hydrogen is as common as drilling dirty fossil fuels.

SDGs, Targets, and Indicators

SDGs Addressed or Connected to the Issues Highlighted in the Article:

- SDG 7: Affordable and Clean Energy

- SDG 9: Industry, Innovation, and Infrastructure

- SDG 13: Climate Action

Specific Targets Under Those SDGs Based on the Article’s Content:

- SDG 7.2: Increase substantially the share of renewable energy in the global energy mix

- SDG 9.4: Upgrade infrastructure and retrofit industries to make them sustainable

- SDG 13.2: Integrate climate change measures into national policies, strategies, and planning

Indicators Mentioned or Implied in the Article to Measure Progress Towards the Identified Targets:

- Share of renewable energy in the global energy mix

- Investment in upgrading infrastructure and retrofitting industries

- Inclusion of climate change measures in national policies, strategies, and planning

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | Increase substantially the share of renewable energy in the global energy mix (Target 7.2) | Share of renewable energy in the global energy mix |

| SDG 9: Industry, Innovation, and Infrastructure | Upgrade infrastructure and retrofit industries to make them sustainable (Target 9.4) | Investment in upgrading infrastructure and retrofitting industries |

| SDG 13: Climate Action | Integrate climate change measures into national policies, strategies, and planning (Target 13.2) | Inclusion of climate change measures in national policies, strategies, and planning |

Explanation:

1. The issues highlighted in the article are connected to SDG 7 (Affordable and Clean Energy) because the article discusses the potential of natural hydrogen as a renewable energy source. This aligns with the goal of increasing the share of renewable energy in the global energy mix.

2. The specific target under SDG 7 that can be identified is Target 7.2, which aims to increase substantially the share of renewable energy in the global energy mix.

3. The indicator mentioned in the article to measure progress towards this target is the share of renewable energy in the global energy mix.

4. The issues highlighted in the article are also connected to SDG 9 (Industry, Innovation, and Infrastructure) because the article discusses the potential for upgrading infrastructure and retrofitting industries to make them sustainable in the context of natural hydrogen production.

5. The specific target under SDG 9 that can be identified is Target 9.4, which aims to upgrade infrastructure and retrofit industries to make them sustainable.

6. The indicator mentioned in the article to measure progress towards this target is investment in upgrading infrastructure and retrofitting industries.

7. Additionally, the issues highlighted in the article are connected to SDG 13 (Climate Action) because the article discusses the potential of natural hydrogen as a carbon-free fuel and its contribution to reducing greenhouse gas emissions.

8. The specific target under SDG 13 that can be identified is Target 13.2, which aims to integrate climate change measures into national policies, strategies, and planning.

9. The indicator mentioned in the article to measure progress towards this target is the inclusion of climate change measures in national policies, strategies, and planning.

Behold! This splendid article springs forth from the wellspring of knowledge, shaped by a wondrous proprietary AI technology that delved into a vast ocean of data, illuminating the path towards the Sustainable Development Goals. Remember that all rights are reserved by SDG Investors LLC, empowering us to champion progress together.

Source: carboncredits.com

Join us, as fellow seekers of change, on a transformative journey at https://sdgtalks.ai/welcome, where you can become a member and actively contribute to shaping a brighter future.