Integrating biodiversity considerations into infrastructure

Integrating biodiversity considerations into infrastructure PRI

Summary of Investor Roundtables on Integrating Biodiversity Considerations into Infrastructure

This report provides a summary of the key discussion points from two investor roundtables held earlier this year on how to embed biodiversity-related risks and opportunities into the infrastructure investment process. The roundtables, held in collaboration with the Global Infrastructure Investment Association, brought together over 200 participants, including infrastructure investors, biodiversity consultants, and data providers. The discussions were held under the Chatham House Rule.

Key Takeaways

- Why biodiversity considerations matter

- Getting started: climate and biodiversity are deeply interlinked

- Data: challenges and solutions

- Unlocking value through integrating biodiversity

- Defining terms: should projects be called “nature positive”?

Why Biodiversity Considerations Matter

“Biodiversity is defined as the variability among living organisms, including diversity within [and] between species, and of ecosystems…it is an essential characteristic of nature, which captures not only this diversity of living organisms but also their interactions with the wider environment.”

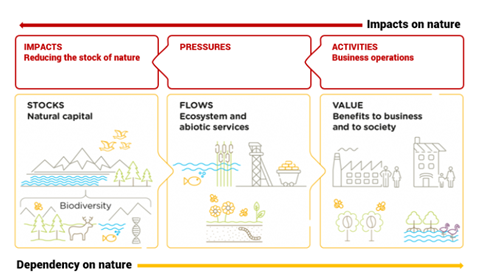

The discussion started by looking at why infrastructure investors should integrate biodiversity considerations into their investments, and the risks of not doing so. Participants discussed the ecosystem services and value that nature provides our economies and societies (see Figure 1) and how this applies to infrastructure, citing examples such as the mangroves which protect coastal infrastructure from floods and storms, the loss of which creates a physical risk. They also acknowledged that infrastructure is closely linked to the drivers of biodiversity loss, such as land and sea-use change, overexploitation of natural resources, pollution, climate change, and invasive species.

Figure 1: Impacts and dependencies in the context of natural capital stocks, flows, and values. Source: Capitals Coalition and Cambridge Conservation Initiative (2020)

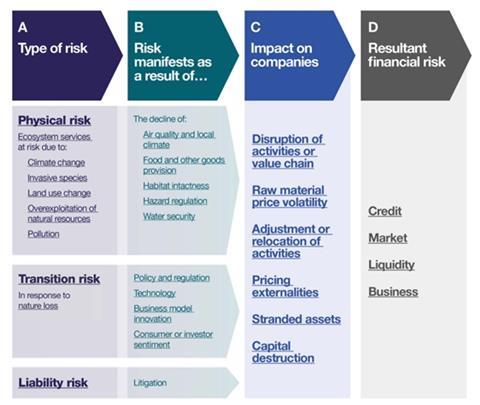

Infrastructure investors are also likely to face a range of risks (see Figure 2), including transition risks that may lead to stranded assets, as policy makers, businesses and consumers look to address environmental change. It was noted that transition risks are likely to accelerate in the near term, given the adoption of the Kunming-Montreal Global Biodiversity Framework by 196 countries at the UN Biodiversity Conference COP15 in December 2022. Governments are now expected to translate the framework into national plans and policies over the next two years, with an overarching target to halt and reverse biodiversity loss by 2030. Finally, the group also touched on how biodiversity-related risks can contribute to systemic risk – the risk that the entire financial system collapses because of contagion from localized losses and institutional failures.

Figure 2: Framework for identifying nature-related financial risks. Source: Cambridge Institute for Sustainability Leadership (2021)

SDGs, Targets, and Indicators

SDGs, Targets, and Indicators

-

SDG 15: Life on Land

- Target 15.1: By 2020, ensure the conservation, restoration, and sustainable use of terrestrial and inland freshwater ecosystems and their services, in particular forests, wetlands, mountains, and drylands, in line with obligations under international agreements.

- Indicator 15.1.1: Forest area as a proportion of total land area.

- Indicator 15.2.1: Progress towards sustainable forest management.

- Indicator 15.4.2: Mountain Green Cover Index.

-

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies, and planning.

- Indicator 13.2.1: Number of countries that have communicated the strengthening of institutional, systemic, and individual capacity-building to implement adaptation, mitigation, and technology transfer.

-

SDG 12: Responsible Consumption and Production

- Target 12.6: Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle.

- Indicator 12.6.1: Number of companies publishing sustainability reports.

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 15: Life on Land | Target 15.1: By 2020, ensure the conservation, restoration, and sustainable use of terrestrial and inland freshwater ecosystems and their services, in particular forests, wetlands, mountains, and drylands, in line with obligations under international agreements. | Indicator 15.1.1: Forest area as a proportion of total land area. |

| SDG 15: Life on Land | Target 15.2: By 2020, promote the implementation of sustainable management of all types of forests, halt deforestation, restore degraded forests, and substantially increase afforestation and reforestation globally. | Indicator 15.2.1: Progress towards sustainable forest management. |

| SDG 15: Life on Land | Target 15.4: By 2030, ensure the conservation of mountain ecosystems, including their biodiversity, in order to enhance their capacity to provide benefits that are essential for sustainable development. | Indicator 15.4.2: Mountain Green Cover Index. |

| SDG 13: Climate Action | Target 13.2: Integrate climate change measures into national policies, strategies, and planning. | Indicator 13.2.1: Number of countries that have communicated the strengthening of institutional, systemic, and individual capacity-building to implement adaptation, mitigation, and technology transfer. |

| SDG 12: Responsible Consumption and Production | Target 12.6: Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle. | Indicator 12.6.1: Number of companies publishing sustainability reports. |

Behold! This splendid article springs forth from the wellspring of knowledge, shaped by a wondrous proprietary AI technology that delved into a vast ocean of data, illuminating the path towards the Sustainable Development Goals. Remember that all rights are reserved by SDG Investors LLC, empowering us to champion progress together.

Source: unpri.org

Join us, as fellow seekers of change, on a transformative journey at https://sdgtalks.ai/welcome, where you can become a member and actively contribute to shaping a brighter future.