Global Economy Remains Resilient Despite Uneven Growth, Challenges Ahead

Global Economy Remains Resilient Despite Uneven Growth, Challenges Ahead International Monetary FundUS economy: IMF raises growth forecast and urges caution on rate cuts CNNThe “Tepid Twenties”: IMF projects slow global growth this decade Axios

Global Economy Shows Resilience Amidst Challenges

Despite gloomy predictions, the global economy remains remarkably resilient, with steady growth and inflation slowing almost as quickly as it rose. The journey has been eventful, starting with supply-chain disruptions in the aftermath of the pandemic, an energy and food crisis triggered by Russia’s war on Ukraine, a considerable surge in inflation, followed by a globally synchronized monetary policy tightening.

Global Growth and Inflation Projections

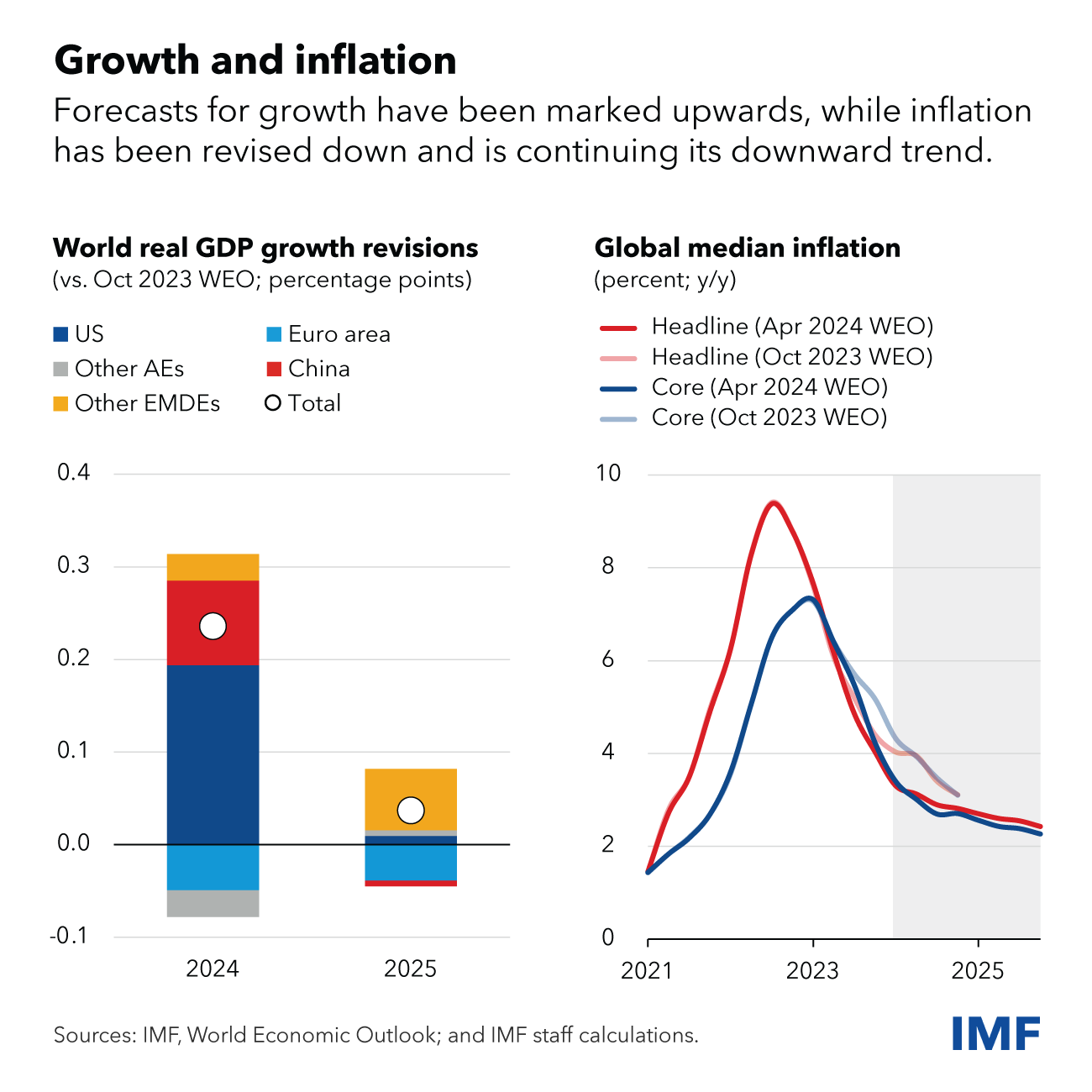

- Global growth bottomed out at the end of 2022, at 2.3 percent, shortly after median headline inflation peaked at 9.4 percent.

- Growth this year and next will hold steady at 3.2 percent, with median headline inflation declining from 2.8 percent at the end of 2024 to 2.4 percent at the end of 2025.

- Most indicators continue to point to a soft landing.

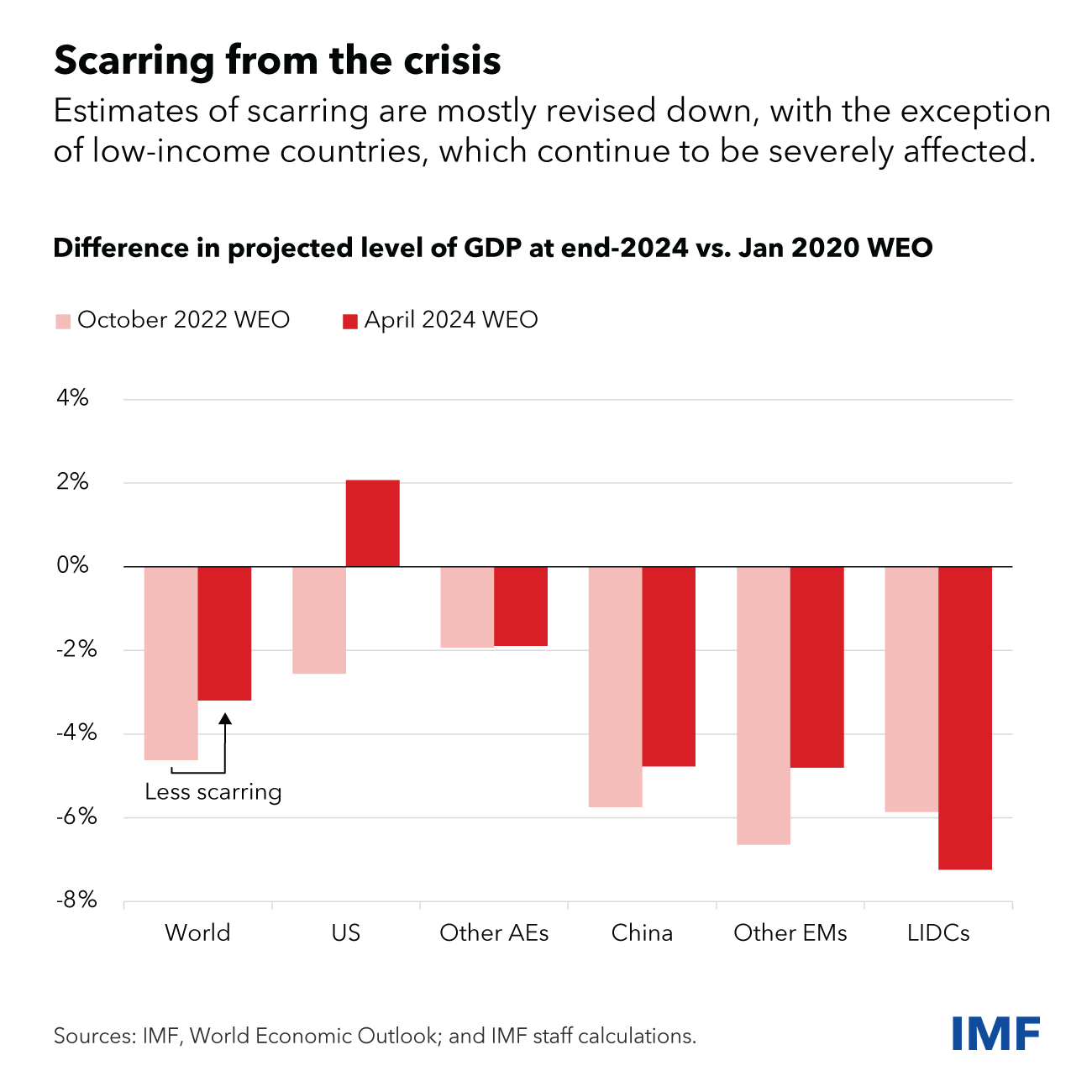

We also project less economic scarring from the crises of the past four years, although estimates vary across countries. The US economy has already surged past its prepandemic trend. But we now estimate that there will be more scarring for low-income developing countries, many of which are still struggling to turn the page from the pandemic and cost-of-living crises.

Resilient Growth and Inflation Trends

Resilient growth and rapid disinflation point toward favorable supply developments, including the fading of energy price shocks, and a striking rebound in labor supply supported by strong immigration in many advanced economies. Monetary policy actions have helped anchor inflation expectations even if its transmission may have been more muted, as fixed-rate mortgages became more prevalent.

Despite these welcome developments, numerous challenges remain, and decisive actions are needed.

Inflation Risks Remain

Bringing inflation back to target should remain the priority. While inflation trends are encouraging, we are not there yet. Somewhat worryingly, progress toward inflation targets has somewhat stalled since the beginning of the year. This could be a temporary setback, but there are reasons to remain vigilant. Most of the good news on inflation came from the decline in energy prices and in goods inflation. The latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices. But oil prices have been rising recently in part due to geopolitical tensions and services inflation remains stubbornly high. Further trade restrictions on Chinese exports could also push up goods inflation.

Economic Divergences Widen

The resilient global economy also masks stark divergence across countries.

The strong recent performance of the United States reflects robust productivity and employment growth, but also strong demand in an economy that remains overheated. This calls for a cautious and gradual approach to easing by the Federal Reserve. The fiscal stance, out of line with long-term fiscal sustainability, is of particular concern. It raises short-term risks to the disinflation process, as well as longer-term fiscal and financial stability risks for the global economy. Something will have to give.

Growth in the euro area will rebound but from very low levels, as past shocks, and tight monetary policy weigh on activity. Continued high wage growth and persistent services inflation could delay the return of inflation to target. However, unlike in the United States, there is little evidence of overheating, and the European Central Bank will need to carefully calibrate the pivot toward monetary easing to avoid an inflation undershoot. While labor markets appear strong, that strength could prove illusory if European firms have been hoarding labor in anticipation of a pickup in activity that does not materialize.

China’s economy remains affected by the downturn in its property sector. Credit booms and busts never resolve themselves quickly, and this one is no exception. Domestic demand will remain lackluster unless strong measures address the root cause. With depressed domestic demand, external surpluses could well rise. The risk is that this will further exacerbate trade tensions in an already fraught geopolitical environment.

Many other large emerging market economies are performing strongly, sometimes benefiting from a reconfiguration of global supply chains and rising trade tensions between China and the US. These countries’ footprint on the global economy is increasing.

Policy Path

Going forward, policymakers should prioritize measures that help preserve or even enhance the resilience of the global economy.

Rebuild Fiscal Buffers

The first such priority is to rebuild fiscal buffers. Even as inflation recedes, real interest rates remain high and sovereign debt dynamics have become less favorable. Credible fiscal consolidations can help lower funding costs, improve fiscal headroom and financial stability. Unfortunately, fiscal plans so far are insufficient and could be derailed further given the record number of elections this year.

Reverse the Decline in Medium Term Growth Prospects

The second priority is to reverse the decline in medium-term growth prospects. Some of that decline comes from increased misallocation of capital and labor within sectors and countries. Facilitating faster and more efficient resource allocation will boost growth. For low-income countries, structural reforms to promote domestic and foreign direct investment, and to strengthen domestic resource mobilization, will help lower borrowing costs and reduce funding needs. These countries also must improve the human capital of their large young populations, especially as the rest of the world is aging rapidly.

Artificial intelligence also gives hope for boosting productivity. It may do so, but the potential for serious disruptions in labor and financial markets is high. Harnessing the potential of AI for all will require that countries improve their digital infrastructure, invest in human capital, and coordinate on global rules of the road.

SDGs, Targets, and Indicators

-

SDG 8: Decent Work and Economic Growth

- Target 8.1: Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7 percent gross domestic product growth per annum in the least developed countries

- Indicator: Gross domestic product (GDP) growth rate

-

SDG 10: Reduced Inequalities

- Target 10.4: Adopt policies, especially fiscal, wage and social protection policies, and progressively achieve greater equality

- Indicator: Gini coefficient (measure of income inequality)

-

SDG 12: Responsible Consumption and Production

- Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources

- Indicator: Domestic material consumption per capita

-

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies and planning

- Indicator: Greenhouse gas emissions

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | Target 8.1: Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7 percent gross domestic product growth per annum in the least developed countries | Gross domestic product (GDP) growth rate |

| SDG 10: Reduced Inequalities | Target 10.4: Adopt policies, especially fiscal, wage and social protection policies, and progressively achieve greater equality | Gini coefficient (measure of income inequality) |

| SDG 12: Responsible Consumption and Production | Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources | Domestic material consumption per capita |

| SDG 13: Climate Action | Target 13.2: Integrate climate change measures into national policies, strategies and planning | Greenhouse gas emissions |

Analysis

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The issues highlighted in the article are connected to the following SDGs:

- SDG 8: Decent Work and Economic Growth

- SDG 10: Reduced Inequalities

- SDG 12: Responsible Consumption and Production

- SDG 13: Climate Action

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the article’s content, the following specific targets can be identified:

- Target 8.1: Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7 percent gross domestic product growth per annum in the least developed countries

- Target 10.4: Adopt policies, especially fiscal, wage and social protection policies, and progressively achieve greater equality

- Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources

- Target 13.2: Integrate climate change measures into national policies, strategies and planning

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

The article mentions or implies the following indicators that can be used to measure progress towards the identified targets:

- Gross domestic product (GDP) growth rate (Indicator for Target 8.1)

- Gini coefficient (measure of income inequality) (Indicator for Target 10.4)

- Domestic material consumption per capita (Indicator for Target 12.2)

- Greenhouse gas emissions (Indicator for Target 13.2)

Behold! This splendid article springs forth from the wellspring of knowledge, shaped by a wondrous proprietary AI technology that delved into a vast ocean of data, illuminating the path towards the Sustainable Development Goals. Remember that all rights are reserved by SDG Investors LLC, empowering us to champion progress together.

Source: imf.org

Join us, as fellow seekers of change, on a transformative journey at https://sdgtalks.ai/welcome, where you can become a member and actively contribute to shaping a brighter future.