Responsible AI in Fintech: Building Trust Through Ethical and Inclusive Innovation – Elets BFSI

Report on Responsible Artificial Intelligence in Financial Services and its Alignment with Sustainable Development Goals (SDGs)

1.0 Introduction: AI in Finance as a Catalyst for Sustainable Development

The proliferation of Artificial Intelligence (AI) within the financial technology (fintech) sector presents a dual potential: to significantly advance or severely undermine the United Nations Sustainable Development Goals (SDGs). While AI-driven innovations in credit scoring, fraud detection, and personalized financial services promise to enhance economic efficiency, their implementation necessitates a robust governance framework centered on ethical principles. This report analyzes the critical role of responsible AI in ensuring that technological advancement in finance contributes positively to global sustainability targets, particularly those concerning poverty, inequality, and institutional strength.

2.0 The Intersection of AI in Fintech and Key SDGs

The deployment of AI in financial services directly impacts several SDGs. A responsible approach can accelerate progress, whereas an unethical one can create significant setbacks.

2.1 Supporting Economic Growth and Reducing Poverty (SDG 1 & SDG 8)

AI has the potential to broaden financial inclusion, providing access to credit for underserved populations and thereby stimulating economic activity and helping to eradicate poverty.

- AI-driven models can assess creditworthiness for individuals lacking traditional financial histories, promoting entrepreneurship and economic growth.

- Efficient and personalized financial services can empower individuals to manage their finances better, contributing to financial stability.

2.2 Addressing Inequalities (SDG 5 & SDG 10)

A primary challenge of AI is its potential to perpetuate and amplify existing biases, directly contravening the goals of achieving gender equality and reducing inequalities.

- AI models trained on biased data can systematically disadvantage specific demographics, such as women or rural populations, who may have different digital footprints.

- Unfair denial of financial services based on biased algorithms deepens social and economic divides, hindering progress toward SDG 10.

2.3 Fostering Innovation and Strong Institutions (SDG 9 & SDG 16)

Responsible AI is foundational to building resilient infrastructure, promoting inclusive and sustainable industrialization, and fostering innovation (SDG 9). This requires transparent, accountable, and just institutional practices (SDG 16).

- Ethical AI governance frameworks are a form of institutional strengthening, ensuring that technological innovation serves society responsibly.

- Transparency and explainability in AI decisions uphold principles of justice and accountability, building trust in financial institutions.

3.0 Core Principles for an SDG-Aligned AI Governance Framework

To mitigate risks and harness the benefits of AI for sustainable development, a comprehensive governance framework must be established. This framework should be built on principles of accountability, transparency, and inclusivity.

3.1 Governance and Leadership Accountability (SDG 16)

Effective governance must be driven by senior leadership and embedded within the corporate structure to ensure compliance and ethical oversight.

- Establish clear lines of responsibility, including roles such as a Chief Privacy Officer, to enforce data protection regulations like the DPDP Act and GDPR.

- Mandate senior leadership oversight for all AI development and deployment to ensure alignment with ethical standards and sustainability objectives.

3.2 Data Minimization and Privacy (SDG 10 & SDG 16)

The principle of data minimization is crucial for protecting individuals and preventing the discriminatory profiling that exacerbates inequality.

- Collect only data that is strictly necessary and relevant for the intended purpose, avoiding intrusive sources like personal messages or broad social media analysis.

- Implement robust security protocols, including encryption of personally identifiable information (PII) and clear consent management systems, to uphold the right to privacy.

3.3 Algorithmic Transparency and Bias Mitigation (SDG 5 & SDG 10)

To ensure fairness and combat exclusion, AI models must be interpretable, and their outputs explainable.

- Develop mechanisms to explain AI-driven decisions to customers, particularly in cases of loan rejection, to ensure fairness and provide recourse.

- Rigorously audit datasets and models for biases related to gender, socioeconomic status, and regional disparities to ensure equitable outcomes.

- Avoid reliance on pre-trained models with unknown data provenance unless sufficient guardrails and bias-detection systems are in place.

4.0 Strategic Recommendations for the Path Forward

The fintech industry must proactively adopt responsible practices to ensure its innovations contribute positively to the 2030 Agenda for Sustainable Development.

4.1 Continuous Monitoring and Improvement

AI systems are not static; they require continuous evaluation to remain fair, accurate, and compliant.

- Implement ongoing monitoring systems to detect model drift, emergent biases, and performance degradation.

- Establish feedback loops that allow for the continual refinement of models based on real-world outcomes and user feedback.

4.2 Industry Collaboration and Self-Regulation (SDG 17)

Achieving responsible AI at scale requires collective action and the establishment of shared standards.

- Foster industry-wide collaboration to develop and adhere to a common code of conduct for responsible AI in finance.

- Engage in partnerships between private sector entities, regulators, and civil society to create a regulatory environment that supports both innovation and ethical imperatives.

5.0 Conclusion: An Ethical Imperative for Sustainable Finance

The integration of AI into financial services is a defining feature of modern innovation. However, for this innovation to be sustainable, it must be guided by a deep commitment to ethical principles that align with the Sustainable Development Goals. By prioritizing fairness, transparency, and inclusivity, fintech companies can build trust, comply with evolving regulations, and create long-term value for all stakeholders. Responsible AI is not merely a technical consideration but a business imperative for contributing to a more equitable and sustainable global economy.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 5: Gender Equality: The article directly addresses gender equality by highlighting how AI models in lending can create bias against women. It points out that “women borrowers might lack sufficient digital history, risking unjust denial of services if models rely solely on such data,” which connects to the goal of ensuring women’s equal access to economic resources.

- SDG 8: Decent Work and Economic Growth: The article discusses the transformation of financial services, including credit and lending, through AI. This relates to improving access to financial services, which is a key component of fostering sustained and inclusive economic growth.

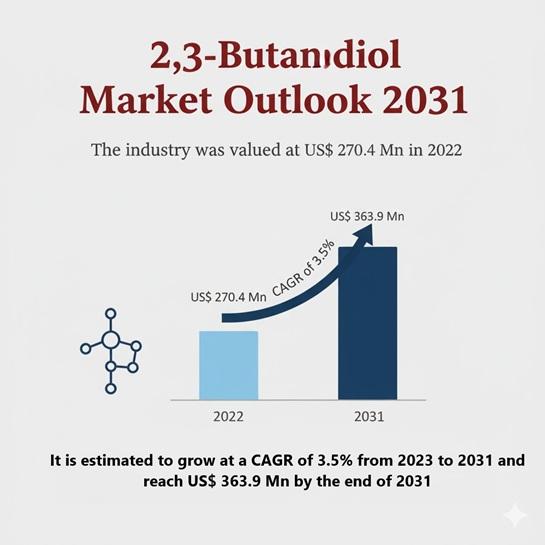

- SDG 9: Industry, Innovation, and Infrastructure: The entire article is centered on technological innovation (AI) within the financial industry (fintech). It discusses the rapid growth of AI, the need for responsible development, and the importance of building resilient and ethical technological solutions.

- SDG 10: Reduced Inequalities: A central theme of the article is the risk of AI models perpetuating and amplifying existing inequalities. It warns against “unfair exclusions—particularly in a diverse country like India where digital footprints vary significantly across demographic groups” and calls for inclusive model design to prevent discrimination.

- SDG 16: Peace, Justice, and Strong Institutions: The article heavily emphasizes the need for strong governance, regulatory compliance, and accountability. It calls for “well-defined AI governance framework,” transparency, adherence to data protection laws (like DPDP and GDPR), and the protection of customer rights, all of which are fundamental to building effective and accountable institutions.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

SDG 5: Gender Equality

- Target 5.b: Enhance the use of enabling technology, in particular information and communications technology, to promote the empowerment of women. The article discusses the risk of technology causing “unjust denial of services” for women and implicitly calls for designing AI that empowers rather than excludes them from financial services.

-

SDG 8: Decent Work and Economic Growth

- Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all. The article explores how AI is used for “credit scoring and lending to personalized financial advice,” which directly relates to expanding access to financial services.

-

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.5: Enhance scientific research, upgrade the technological capabilities of industrial sectors in all countries, in particular developing countries, including, by 2030, encouraging innovation. The article’s focus on embedding “responsible AI governance” and promoting “industry-wide collaboration” to establish shared standards aligns with upgrading technological capabilities responsibly.

-

SDG 10: Reduced Inequalities

- Target 10.2: By 2030, empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status. The article directly addresses this by advocating for “ensuring inclusivity” in AI models to account for “socioeconomic and regional disparities” and prevent unfair exclusion.

- Target 10.3: Ensure equal opportunity and reduce inequalities of outcome, including by eliminating discriminatory laws, policies and practices and promoting appropriate legislation, policies and action in this regard. The call to ensure data is “free from biases and discriminatory indicators” and to mitigate bias in algorithms directly supports this target.

-

SDG 16: Peace, Justice, and Strong Institutions

- Target 16.6: Develop effective, accountable and transparent institutions at all levels. The article’s demand for “Algorithmic Interpretability and Transparency” and a “well-defined AI governance framework” where lenders cannot “hide behind the guise of proprietary algorithms” is a direct call for accountability and transparency.

- Target 16.10: Ensure public access to information and protect fundamental freedoms, in accordance with national legislation and international agreements. The emphasis on data minimization, secure data handling, consent management under laws like the DPDP Act, and respecting that “data owners have control over their information” aligns with protecting fundamental freedoms related to privacy.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

- Bias and Fairness Metrics: The article implies the use of specific metrics to track fairness. It mentions the need for “mechanisms to detect bias, measure fairness, and explain decisions” as essential for continuous evaluation of AI systems. This serves as a direct indicator for progress on Target 10.3.

- Implementation of Governance Frameworks: The establishment of formal governance structures is a key indicator. The article points to the need for a “well-defined AI governance framework,” the appointment of “designated roles like Chief Privacy Officers,” and conducting “regular audits, documentation, and model validation.” This can measure progress towards Target 16.6.

- Transparency and Explainability in AI Models: The ability of a model to provide clear explanations for its decisions is a measurable outcome. The article states that “feedback mechanisms and clear disclosures must be standard practice” and that customers deserve an answer that is “both clear and fair,” which can be audited and tracked as an indicator for Target 16.6.

- Adherence to Data Minimization and Privacy Protocols: Progress can be measured by how well companies adhere to data minimization principles. The article suggests tracking whether “only the data necessary for a specific purpose” is collected and if “secure data handling, audit trails, and consent management” are in place, which are indicators for Target 16.10.

- Inclusive Access to Financial Services: An indicator for Targets 5.b, 8.10, and 10.2 would be the rate of access to and approval for financial services across different demographic groups. The article implies this by highlighting the risk of “unjust denial of services” for groups like women, suggesting that tracking and improving these approval rates is a measure of success.

4. SDGs, Targets, and Indicators Summary

| SDGs | Targets | Indicators (Mentioned or Implied in the Article) |

|---|---|---|

| SDG 5: Gender Equality | 5.b: Enhance the use of enabling technology to promote the empowerment of women. | Tracking loan approval rates for women to ensure AI models do not lead to “unjust denial of services.” |

| SDG 8: Decent Work and Economic Growth | 8.10: Strengthen the capacity of domestic financial institutions to expand access to financial services for all. | The rate of adoption of AI for credit scoring and personalized financial advice to broaden financial inclusion. |

| SDG 9: Industry, Innovation, and Infrastructure | 9.5: Enhance scientific research and upgrade technological capabilities. | Adoption of responsible AI governance frameworks; investment in ethical AI research and development. |

| SDG 10: Reduced Inequalities | 10.2 & 10.3: Promote social and economic inclusion and ensure equal opportunity. | Use of “mechanisms to detect bias” and “measure fairness” in AI models; ensuring models account for “socioeconomic and regional disparities.” |

| SDG 16: Peace, Justice, and Strong Institutions | 16.6: Develop effective, accountable and transparent institutions. | Implementation of “Algorithmic Interpretability and Transparency”; establishment of AI governance frameworks and Chief Privacy Officer roles. |

| SDG 16: Peace, Justice, and Strong Institutions | 16.10: Ensure public access to information and protect fundamental freedoms. | Implementation of data minimization principles; establishment of robust “consent management” systems; adherence to data protection laws like DPDP and GDPR. |

Source: bfsi.eletsonline.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0