Market Cool On Zhejiang Tengy Environmental Technology Co., Ltd’s (HKG:1527) Earnings

Market Cool On Zhejiang Tengy Environmental Technology Co., Ltd's (HKG:1527) Earnings Simply Wall St

Analysis of Zhejiang Tengy Environmental Technology Co., Ltd (HKG:1527)

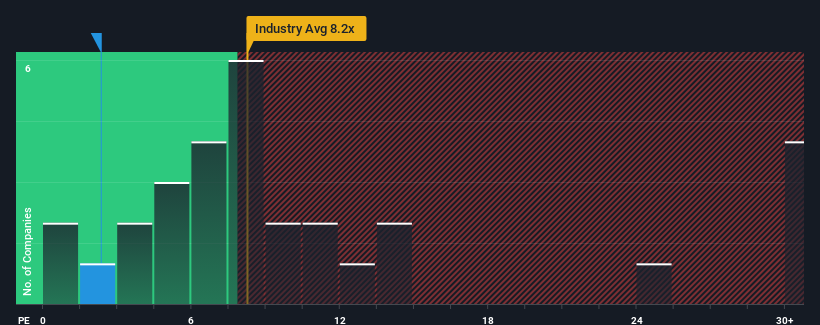

With a price-to-earnings (P/E) ratio of 2.3x, Zhejiang Tengy Environmental Technology Co., Ltd (HKG:1527) stands out in the Hong Kong market. This low P/E ratio may indicate bullish signals, as most companies in Hong Kong have P/E ratios greater than 10x. However, further investigation is required to determine if this low P/E ratio is justified.

Zhejiang Tengy Environmental Technology’s financial performance has been poor lately, with declining earnings. This may have caused the low P/E ratio, as investors expect the disappointing earnings performance to continue or worsen. However, if the company can turn its earnings around, existing shareholders may be optimistic about the future direction of the share price.

View our latest analysis for Zhejiang Tengy Environmental Technology

Although there are no analyst estimates available for Zhejiang Tengy Environmental Technology, you can refer to this free data-rich visualization to see how the company performs in terms of earnings, revenue, and cash flow.

Is There Any Growth For Zhejiang Tengy Environmental Technology?

Zhejiang Tengy Environmental Technology’s low P/E ratio suggests that the company is expected to deliver poor growth or even falling earnings, performing worse than the market. However, despite a recent decline in profits, the company has shown impressive growth in earnings over the past three years, with a total increase of 851%. This indicates that the company has generally done well in growing its earnings, despite some setbacks.

Comparing the recent medium-term earnings trajectory with the market’s one-year forecast for expansion of 20%, Zhejiang Tengy Environmental Technology appears more attractive on an annualized basis. It is puzzling that the company is trading at a lower P/E ratio than the market, suggesting that investors are not convinced it can maintain its recent growth rates.

The Bottom Line On Zhejiang Tengy Environmental Technology’s P/E

While the price-to-earnings ratio can provide insights into a company’s overall health, it is important to consider other factors. Zhejiang Tengy Environmental Technology’s low P/E ratio may be due to unobserved threats to earnings, preventing it from matching its positive performance. Investors may anticipate earnings instability, which would normally boost the share price in similar conditions.

It is always necessary to consider investment risks. We have identified 2 warning signs with Zhejiang Tengy Environmental Technology, which should be part of your investment process. Additionally, you may find a better stock than Zhejiang Tengy Environmental Technology, so you might want to explore this collection of other companies with reasonable P/E ratios and strong earnings growth.

Valuation is complex, but we’re helping make it simple.

Find out whether Zhejiang Tengy Environmental Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions, and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

SDGs, Targets, and Indicators Analysis

1. Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 8: Decent Work and Economic Growth

- SDG 9: Industry, Innovation, and Infrastructure

- SDG 12: Responsible Consumption and Production

2. What specific targets under those SDGs can be identified based on the article’s content?

- SDG 8.5: By 2030, achieve full and productive employment and decent work for all women and men, including for young people and persons with disabilities, and equal pay for work of equal value.

- SDG 9.2: Promote inclusive and sustainable industrialization and, by 2030, significantly raise industry’s share of employment and gross domestic product, in line with national circumstances, and double its share in least developed countries.

- SDG 12.2: By 2030, achieve the sustainable management and efficient use of natural resources.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

- Indicator for SDG 8.5: Employment rate, gender pay gap

- Indicator for SDG 9.2: Industry’s share of employment and GDP

- Indicator for SDG 12.2: Resource efficiency measures

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | 8.5: By 2030, achieve full and productive employment and decent work for all women and men, including for young people and persons with disabilities, and equal pay for work of equal value. | – Employment rate – Gender pay gap |

| SDG 9: Industry, Innovation, and Infrastructure | 9.2: Promote inclusive and sustainable industrialization and, by 2030, significantly raise industry’s share of employment and gross domestic product, in line with national circumstances, and double its share in least developed countries. | – Industry’s share of employment and GDP |

| SDG 12: Responsible Consumption and Production | 12.2: By 2030, achieve the sustainable management and efficient use of natural resources. | – Resource efficiency measures |

Behold! This splendid article springs forth from the wellspring of knowledge, shaped by a wondrous proprietary AI technology that delved into a vast ocean of data, illuminating the path towards the Sustainable Development Goals. Remember that all rights are reserved by SDG Investors LLC, empowering us to champion progress together.

Source: simplywall.st

Join us, as fellow seekers of change, on a transformative journey at https://sdgtalks.ai/welcome, where you can become a member and actively contribute to shaping a brighter future.