National Agricultural Development’s (TADAWUL:6010) earnings growth rate lags the 14% CAGR delivered to shareholders

National Agricultural Development's (TADAWUL:6010) earnings growth rate lags the 14% CAGR delivered to shareholders Simply Wall St

Stock Pickers Seek Sustainable Growth

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the National Agricultural Development share price has climbed 97% in five years, easily topping the market return of 27% (ignoring dividends). However, more recent returns haven’t been as impressive as that, with the stock returning just 64% in the last year.

Although National Agricultural Development has shed ر.س300m from its market cap this week, let’s take a look at its longer-term fundamental trends and see if they’ve driven returns.

Exploring National Agricultural Development

Check out our latest analysis for National Agricultural Development

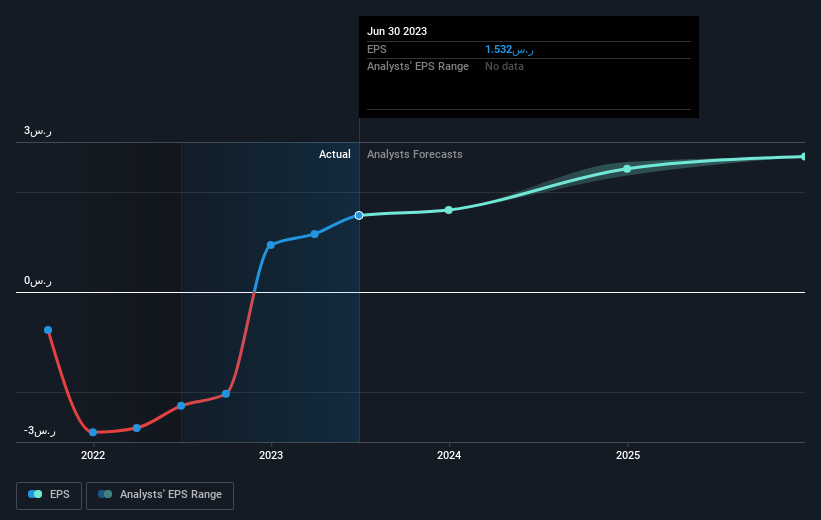

To quote Buffett, ‘Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace…’ One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Positive Shift in National Agricultural Development

During the five years of share price growth, National Agricultural Development moved from a loss to profitability. That would generally be considered a positive, so we’d expect the share price to be up.

We know that National Agricultural Development has improved its bottom line lately, but is it going to grow revenue? If you’re interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It’s nice to see that National Agricultural Development shareholders have received a total shareholder return of 64% over the last year. That’s better than the annualized return of 14% over half a decade, implying that the company is doing better recently. In the best-case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It’s always interesting to track share price performance over the longer term. But to understand National Agricultural Development better, we need to consider many other factors. Consider, for instance, the ever-present specter of investment risk. We’ve identified 3 warning signs with National Agricultural Development, and understanding them should be part of your investment process.

But note: National Agricultural Development may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is Complex, but We’re Helping Make it Simple

Find out whether National Agricultural Development is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions, and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

SDGs, Targets, and Indicators

-

SDG 8: Decent Work and Economic Growth

- Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading, and innovation.

- Indicator 8.2.1: Annual growth rate of real GDP per capita.

-

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.2: Promote inclusive and sustainable industrialization and foster innovation.

- Indicator 9.2.1: Manufacturing value added as a proportion of GDP and per capita.

-

SDG 12: Responsible Consumption and Production

- Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources.

- Indicator 12.2.1: Material footprint, material footprint per capita, and material footprint per GDP.

Analysis

The article discusses the stock performance of National Agricultural Development and provides insights into the company’s fundamental trends. Based on the content, the following SDGs, targets, and indicators can be identified:

1. SDG 8: Decent Work and Economic Growth

The article highlights the company’s share price growth and its impact on wealth. This aligns with SDG 8, which aims to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all. The target and indicator relevant to the article are:

- Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading, and innovation.

- Indicator 8.2.1: Annual growth rate of real GDP per capita.

The article discusses the company’s profitability and its potential for revenue growth, indicating positive economic trends.

2. SDG 9: Industry, Innovation, and Infrastructure

The article mentions the market perception of the company and its change in earnings per share (EPS) in relation to the share price movement. This relates to SDG 9, which aims to promote inclusive and sustainable industrialization and foster innovation. The target and indicator relevant to the article are:

- Target 9.2: Promote inclusive and sustainable industrialization and foster innovation.

- Indicator 9.2.1: Manufacturing value added as a proportion of GDP and per capita.

The article suggests that the company’s shift from a loss to profitability indicates positive industrial and innovative trends.

3. SDG 12: Responsible Consumption and Production

The article briefly mentions the need to consider investment risks and warns readers about the stock’s suitability for investment. This relates to SDG 12, which aims to ensure sustainable consumption and production patterns. The target and indicator relevant to the article are:

- Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources.

- Indicator 12.2.1: Material footprint, material footprint per capita, and material footprint per GDP.

The article indirectly highlights the importance of responsible consumption and production by cautioning investors about potential risks associated with the company.

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading, and innovation. | Indicator 8.2.1: Annual growth rate of real GDP per capita. |

| SDG 9: Industry, Innovation, and Infrastructure | Target 9.2: Promote inclusive and sustainable industrialization and foster innovation. | Indicator 9.2.1: Manufacturing value added as a proportion of GDP and per capita. |

| SDG 12: Responsible Consumption and Production | Target 12.2: By 2030, achieve the sustainable management and efficient use of natural resources. | Indicator 12.2.1: Material footprint, material footprint per capita, and material footprint per GDP. |

Behold! This splendid article springs forth from the wellspring of knowledge, shaped by a wondrous proprietary AI technology that delved into a vast ocean of data, illuminating the path towards the Sustainable Development Goals. Remember that all rights are reserved by SDG Investors LLC, empowering us to champion progress together.

Source: simplywall.st

Join us, as fellow seekers of change, on a transformative journey at https://sdgtalks.ai/welcome, where you can become a member and actively contribute to shaping a brighter future.