American Farmers Fight Back After Losing Top Crop Export Crown

American Farmers Fight Back After Losing Top Crop Export Crown Yahoo Finance

US Farmers Aim to Maximize Production to Regain Export Dominance

After the US lost its status as the world’s top exporter of crops over the past decade, its farmers are ready to fight back. The strategy: maximizing production.

The Commodity Classic and the Push for Sustainable Development Goals (SDGs)

That’s the message from participants at the Commodity Classic in Houston, one of the world’s largest farming shows that saw record attendance of more than 11,500 people two weeks ago. The thought is that even with abundant stockpiles, and corn and soy futures languishing near three-year lows, farmers have little choice but to raise the biggest crops possible.

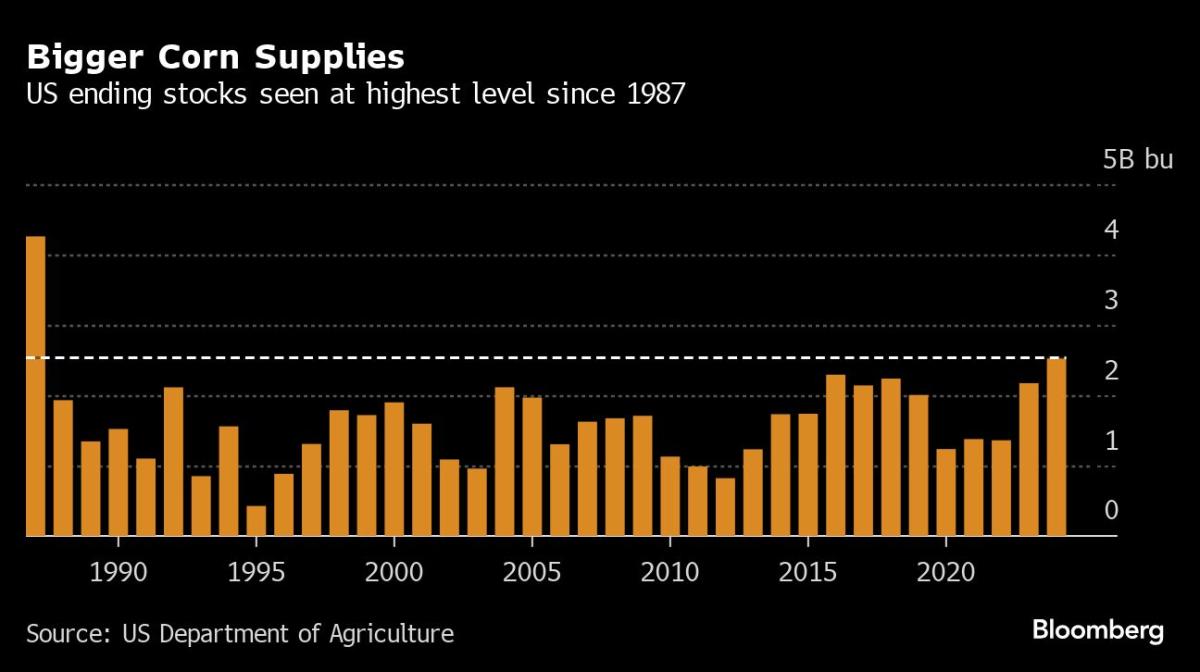

The US Department of Agriculture projections show farmers are set to maintain elevated planting, which could result in one of the biggest supply expansions ever. While that is expected to send net farm income tumbling 26% this year, it could also help the US regain some ground in the export market.

“You just build stocks and get really cheap corn, so that you force the buyers’ hand to go here because we have very competitively priced corn,” Stephen Nicholson, vice president of grain and oilseeds at farm lender Rabobank, said at the trade show. That “would set us up to be prepared to move more corn offshore.”

The US handed the corn-exporting crown to Brazil last August after dominating the international market for more than half a century. It had already relinquished the top spots in both soybean and wheat exports over the past decade — to Brazil and Russia, respectively.

Support from Machinery Companies and Seed Suppliers

Lining up to help farmers at the Commodity Classic were machinery companies including Deere & Co., as well as seed and chemical suppliers. As attendees sampled free soy lattes and popcorn, the companies tweaked their marketing plans with appeals to improve efficiency and reign in costs in a slumping farm economy.

“It’s an excellent opportunity for end users to get stocked up,” said Stan Nelson, a farmer in southeastern Iowa who serves as president of the Iowa Corn Promotion Board. He has no plans to pare back plantings, even though he’s already feeling the “burdensome supply.”

To spur the agriculture markets — and its own revenue — Deere has introduced a starter bundle to attract farmers who may not be ready to buy its top-of-the-line machines. For $2,000, farmers can get Deere’s latest computer display, modem and satellite receiver with the option to pay for additional automation features that give more control over tractors.

“What we’re finding is the lower upfront costs attract customers that we haven’t interacted with ever, or within the last decade,” said Than Hartsock, Deere’s vice president of precision upgrades. That includes Hartsock’s father, an Ohio farmer who added the bundle to a Deere model from 1977. “This was just an easy way for him to get back up to speed.”

Kurt Coffey, of Deere rival CNH Industrial NV, says farmers aren’t as concerned about which of the top brands they are buying.

“We hear this a lot from customers: there’s less brand loyalty, and they’re more focused on how does this keep me in the black,” said Coffey, who is North America vice president of CNH’s Case IH brand.

Focus on Sustainability and Financial Support

Other companies at the show focused on helping farmers become more sustainable. US startup Indigo Ag Inc. is paying farmers carbon credits for planting cover crops and reducing tillage — practices that improve soil health and eventually boost yields. It’s also introducing 30 new biological crop additives to bolster harvests.

“I know how much of a difference the razor-thin margins are that farms operate on, so when I see commodity prices coming down, I cringe for the farmers,” said Indigo Ag Chief Executive Officer Dean Banks. “What I hope is that the value proposition of our biological products, ultimately, pay for themselves in yield.”

Meanwhile, Farmers Business Network is offering 0% financing for growers who purchase from its network of warehouses in the US and Canada.

Farmers are limiting loans from traditional lenders in hopes interest rates go down. “So that makes the 0% even more helpful for borrowers,” according to Charles Baron, co-founder and chief marketing officer of the startup.

Political Push for Agricultural Trade

The efforts come as the agriculture industry also presses for government action. Industry groups in November backed a proposal for the President’s Export Council, an advisory committee on international trade, to bolster American agriculture’s global standing. The proposal included calls to diversify agricultural supply chains, eliminate trade barriers and enforce existing trade agreements.

At the Commodity Classic, the focus was on the farmers, helping them become more efficient and increase output.

“The fastest way to cut the cost of production is to raise yields,” said Matt Bennett, an Illinois farmer and analyst at AgMarket.net.

–With assistance from Dominic Carey.

References:

Most Read from Bloomberg Businessweek

- Article 1

- Article 2

- Article 3

©2024 Bloomberg L.P.

SDGs, Targets, and Indicators in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 2: Zero Hunger – The article discusses the strategy of maximizing crop production to regain ground in the export market, which is directly related to addressing hunger and ensuring food security.

- SDG 8: Decent Work and Economic Growth – The article mentions the slumping farm economy and the efforts of companies to improve efficiency and reduce costs, which are relevant to promoting economic growth and decent work.

- SDG 12: Responsible Consumption and Production – The article highlights efforts by companies to help farmers become more sustainable through practices that improve soil health and reduce tillage, aligning with the goal of responsible consumption and production.

- SDG 13: Climate Action – The article mentions the payment of carbon credits to farmers for planting cover crops and reducing tillage, indicating a focus on climate action and reducing greenhouse gas emissions.

2. What specific targets under those SDGs can be identified based on the article’s content?

- SDG 2.4: By 2030, ensure sustainable food production systems and implement resilient agricultural practices that increase productivity and production, that help maintain ecosystems, that strengthen capacity for adaptation to climate change, extreme weather, drought, flooding, and other disasters, and that progressively improve land and soil quality.

- SDG 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity, and innovation, and encourage the formalization and growth of micro-, small-, and medium-sized enterprises.

- SDG 12.3: By 2030, halve per capita global food waste at the retail and consumer levels and reduce food losses along production and supply chains, including post-harvest losses.

- SDG 13.3: Improve education, awareness-raising, and human and institutional capacity on climate change mitigation, adaptation, impact reduction, and early warning.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

- Indicator 2.4.1: Proportion of agricultural area under productive and sustainable agriculture.

- Indicator 8.3.1: Proportion of informal employment in non-agriculture employment, by sex.

- Indicator 12.3.1: Global food loss index.

- Indicator 13.3.1: Number of countries that have integrated mitigation, adaptation, impact reduction, and early warning measures into primary, secondary, and tertiary curricula.

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 2: Zero Hunger | 2.4: By 2030, ensure sustainable food production systems and implement resilient agricultural practices that increase productivity and production, that help maintain ecosystems, that strengthen capacity for adaptation to climate change, extreme weather, drought, flooding, and other disasters, and that progressively improve land and soil quality. | Indicator 2.4.1: Proportion of agricultural area under productive and sustainable agriculture. |

| SDG 8: Decent Work and Economic Growth | 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity, and innovation, and encourage the formalization and growth of micro-, small-, and medium-sized enterprises. | Indicator 8.3.1: Proportion of informal employment in non-agriculture employment, by sex. |

| SDG 12: Responsible Consumption and Production | 12.3: By 2030, halve per capita global food waste at the retail and consumer levels and reduce food losses along production and supply chains, including post-harvest losses. | Indicator 12.3.1: Global food loss index. |

| SDG 13: Climate Action | 13.3: Improve education, awareness-raising, and human and institutional capacity on climate change mitigation, adaptation, impact reduction, and early warning. | Indicator 13.3.1: Number of countries that have integrated mitigation, adaptation, impact reduction, and early warning measures into primary, secondary, and tertiary curricula. |

Behold! This splendid article springs forth from the wellspring of knowledge, shaped by a wondrous proprietary AI technology that delved into a vast ocean of data, illuminating the path towards the Sustainable Development Goals. Remember that all rights are reserved by SDG Investors LLC, empowering us to champion progress together.

Source: finance.yahoo.com

Join us, as fellow seekers of change, on a transformative journey at https://sdgtalks.ai/welcome, where you can become a member and actively contribute to shaping a brighter future.