Recent Tax Cuts Have Expanded Inequality in the States

Recent Tax Cuts Have Expanded Inequality in the States Just Taxes Blog

March 11, 2024

Some states have improved tax equity by raising new revenue from the well-off and creating or expanding refundable tax credits for low- and moderate-income families in recent years. Others, however, have gone the opposite direction, pushing through deep and damaging tax cuts that disproportionately help the rich.

Many of these negative developments are quantified in the appendices of our recent Who Pays? report, where we created alternative analyses to show the distribution of state tax systems before and after certain policy changes.

The ongoing push for tax cuts in the states has real consequences for tax fairness, and for families and communities, as the examples below illustrate.

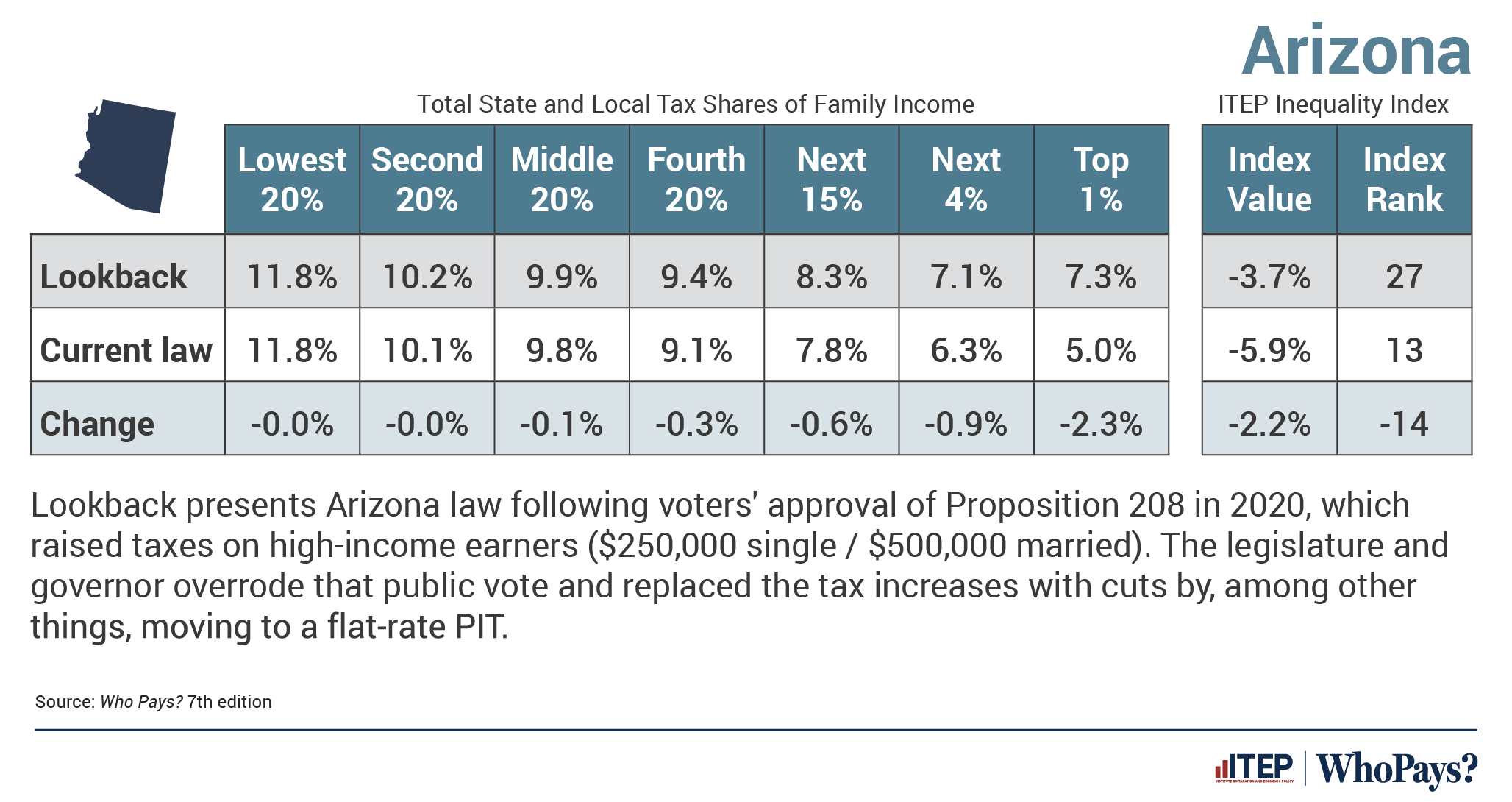

Arizona

Tax changes made in Arizona since 2020 led the state to drop 14 spots in ITEP’s Tax Inequality Index to No. 13 most regressive tax code, the biggest negative change of all the states. This decline was a result of lawmakers’ decision to thwart the will of the people by overriding 2020’s Proposition 208, which raised income taxes on the most well-off residents to fund education. Lawmakers reversed what citizens had done and then passed further top-heavy tax cuts that included a flat personal income tax. Without these changes, Arizona would have been near the middle of the pack relative to other states, with the No. 27 most regressive tax system in the country.

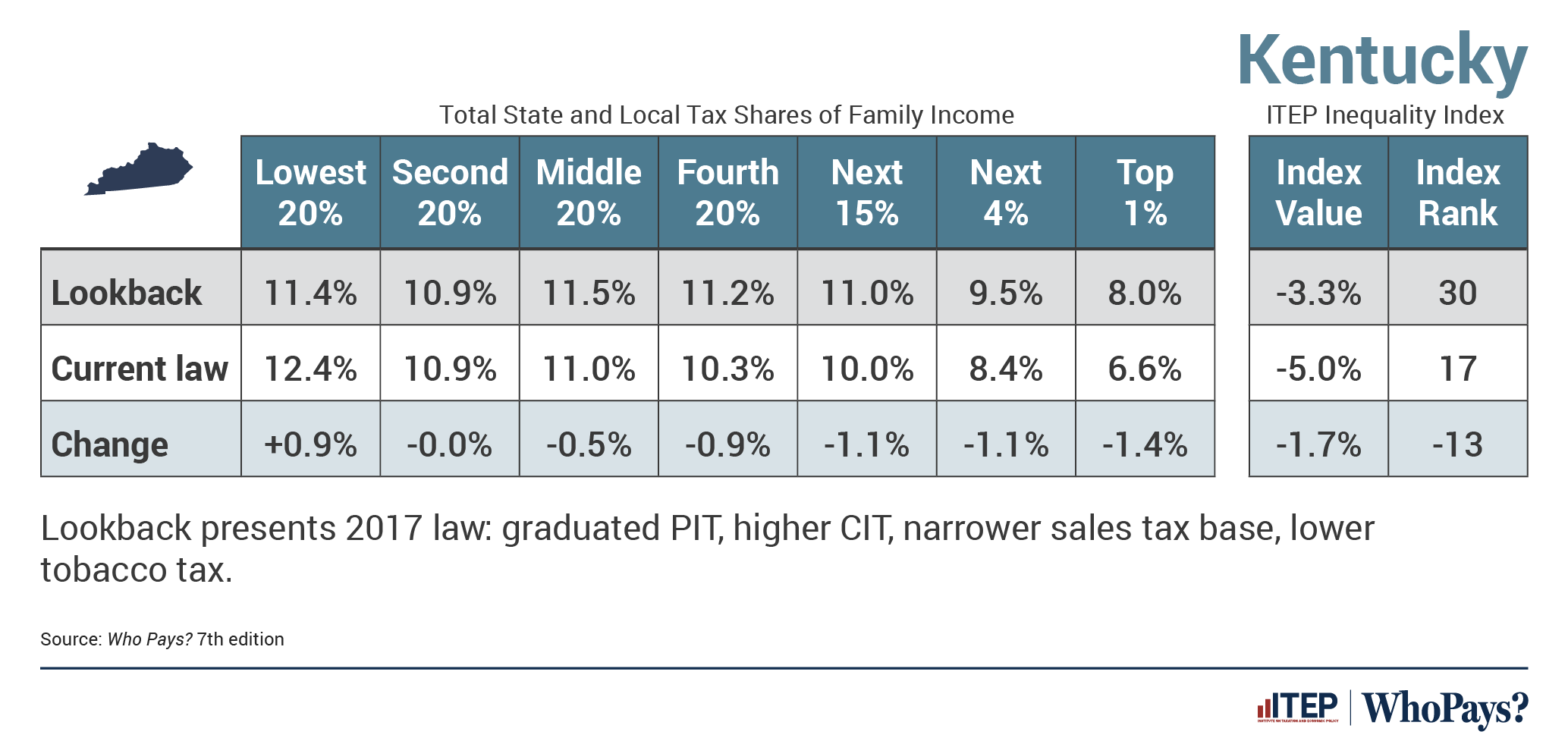

Kentucky

Tax changes made in Kentucky since 2017 led the state to drop 13 spots in ITEP’s Tax Inequality Index, leaving it with the nation’s No. 17 most regressive tax system. These policy changes included switching from a graduated income tax to a flat tax and raising sales and excise taxes. Without all these changes, Kentucky would currently have the No. 30 most regressive tax code in the country. Things will get even worse in the Bluegrass State, however: if Kentucky continues on a path toward full elimination of its income tax as it will under recently passed law, the state would come to have the No. 8 most regressive tax code in the nation.

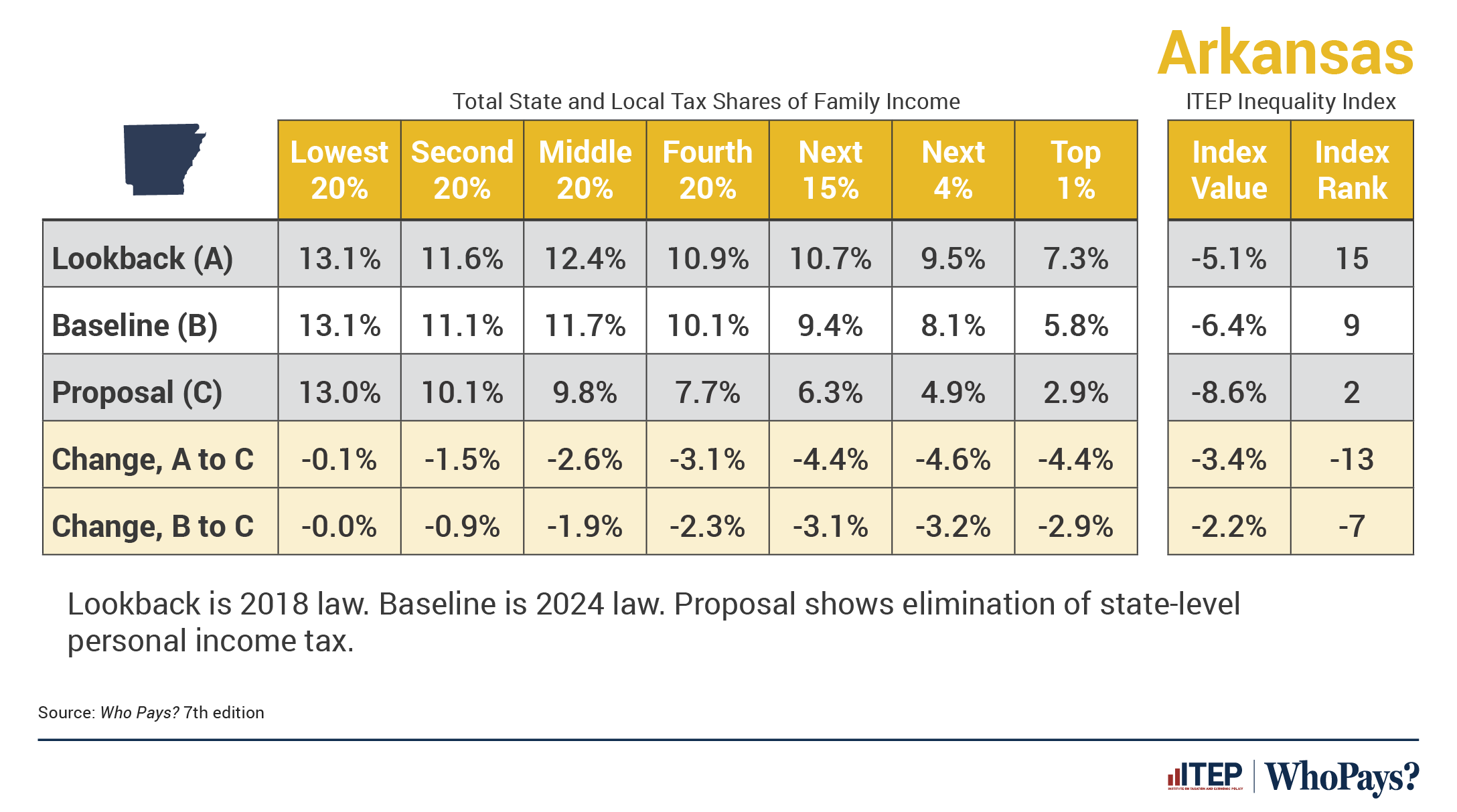

Arkansas

Tax changes made in Arkansas since 2018 led the state to drop six spots in ITEP’s Tax Inequality Index to the No. 9 most regressive tax code. These policy changes included cutting the corporate and personal income tax, and eliminating one set of personal income tax brackets. Without these and other changes made since 2018, Arkansas would currently have the No. 15 most regressive tax system in the country. As in Kentucky, things could get worse in Arkansas. If lawmakers eliminate the personal income tax, as the governor has proposed, the state would drop another seven spots in the Index to the second-most regressive tax system in the nation. This would leave the lowest-income 20 percent of Arkansans paying an average state and local tax rate that is 348 percent higher than the top 1 percent of households.

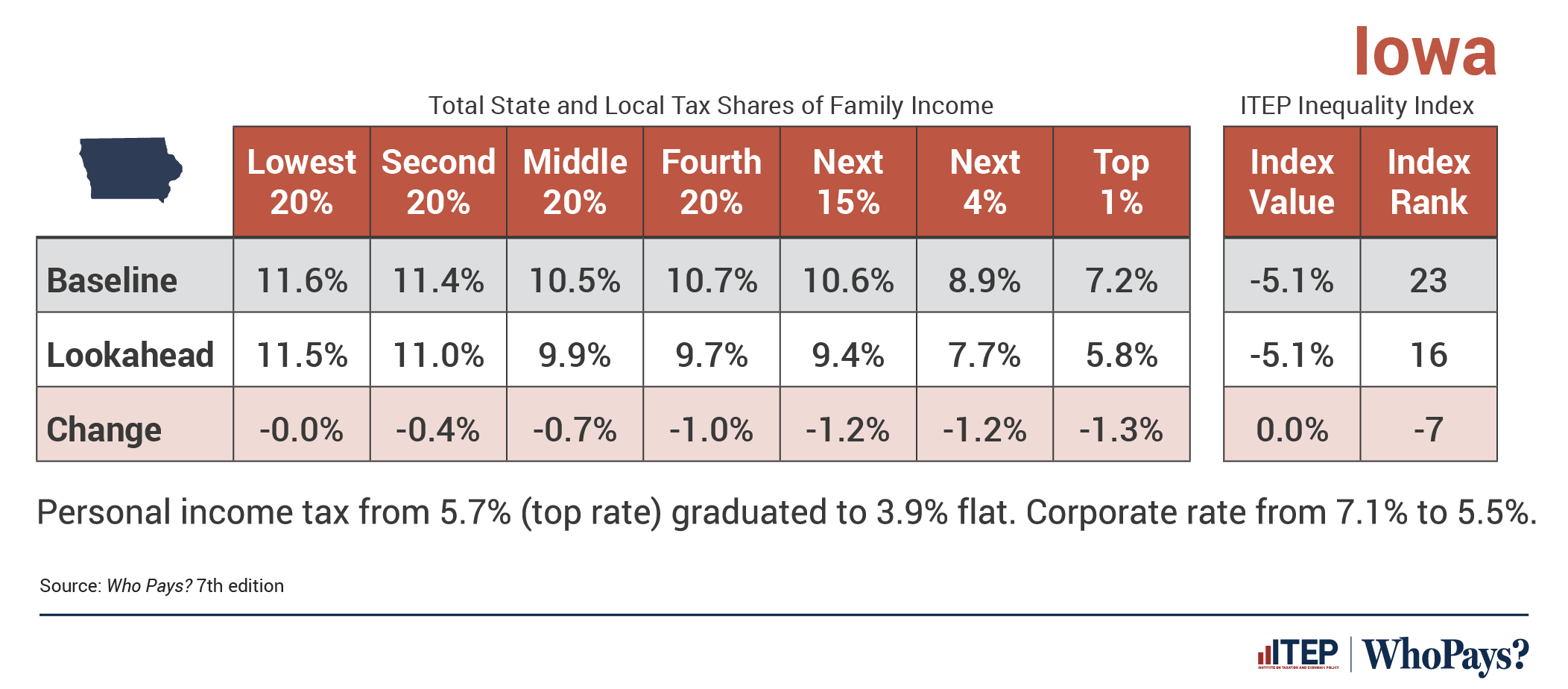

Iowa

Tax cuts that have been enacted but not yet implemented in Iowa will lead that state to drop seven spots in ITEP’s Tax Inequality Index to No. 16 most regressive tax code by 2026. These tax cuts include the double whammy of reducing the graduated personal income tax by 32 percent and making it a flat tax, as well as a 23 percent cut to the corporate tax rate. Without these cuts that are coming down the line, Iowa is currently right in the middle of the pack, with the No. 23 most regressive tax system in the nation. And lawmakers in Iowa aren’t done pushing for tax cuts, either. The governor has called for eliminating the personal income tax, and lawmakers have been advocating for further reductions in the rate (as well as for a constitutional amendment to require supermajority votes to increase personal or corporate income taxes and ban a graduated rate income tax).

The ramifications of these deep tax cuts in these states and others are serious and widespread. As we quantify above, they exacerbate economic inequality by making the tax code less fair. And they also make it harder for lawmakers to fund public services like schools, health care, and environmental protection. In the end, states that choose this path are asking the wealthiest to pay even less in taxes while asking the rest of us to foot the bill.

SDGs, Targets, and Indicators Analysis:

1. Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 1: No Poverty

- SDG 4: Quality Education

- SDG 5: Gender Equality

- SDG 10: Reduced Inequalities

- SDG 16: Peace, Justice, and Strong Institutions

The article discusses tax cuts and changes in various states that have led to increased inequality and regressive tax systems. These issues are directly connected to SDG 1 (No Poverty), as they exacerbate economic inequality. The article also mentions the impact on education funding, which relates to SDG 4 (Quality Education). Additionally, the article highlights the disproportionate impact on low- and moderate-income families, which is relevant to SDG 5 (Gender Equality) and SDG 10 (Reduced Inequalities). Finally, the article mentions the role of lawmakers in making these policy changes, which relates to SDG 16 (Peace, Justice, and Strong Institutions).

2. What specific targets under those SDGs can be identified based on the article’s content?

- Target 1.4: By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership, and control over land and other forms of property.

- Target 4.5: By 2030, eliminate gender disparities in education and ensure equal access to all levels of education and vocational training for the vulnerable, including persons with disabilities, indigenous peoples, and children in vulnerable situations.

- Target 10.4: Adopt policies, especially fiscal, wage, and social protection policies, and progressively achieve greater equality.

- Target 16.6: Develop effective, accountable, and transparent institutions at all levels.

Based on the article’s content, the specific targets that can be identified are related to ensuring equal rights to economic resources (Target 1.4), eliminating gender disparities in education (Target 4.5), achieving greater equality through fiscal policies (Target 10.4), and developing effective and transparent institutions (Target 16.6).

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

- Income tax rates for different income brackets

- Corporate tax rates

- Sales and excise tax rates

- Tax inequality index

The article mentions specific indicators that can be used to measure progress towards the identified targets. These indicators include income tax rates for different income brackets, corporate tax rates, sales and excise tax rates, and the tax inequality index.

Table: SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 1: No Poverty | Target 1.4: By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership, and control over land and other forms of property. | – Tax inequality index – Income tax rates for different income brackets |

| SDG 4: Quality Education | Target 4.5: By 2030, eliminate gender disparities in education and ensure equal access to all levels of education and vocational training for the vulnerable, including persons with disabilities, indigenous peoples, and children in vulnerable situations. | – Funding for education – Impact on education quality |

| SDG 5: Gender Equality | Target 5.4: Recognize and value unpaid care and domestic work through the provision of public services, infrastructure, and social protection policies and the promotion of shared responsibility within the household and the family as nationally appropriate. | – Impact on low- and moderate-income families – Gender disparities in tax cuts |

| SDG 10: Reduced Inequalities | Target 10.4: Adopt policies, especially fiscal, wage, and social protection policies, and progressively achieve greater equality. | – Tax inequality index – Income tax rates for different income brackets – Corporate tax rates – Sales and excise tax rates |

| SDG 16: Peace, Justice, and Strong Institutions | Target 16.6: Develop effective, accountable, and transparent institutions at all levels. | – Role of lawmakers in making policy changes – Transparency in tax system |

Behold! This splendid article springs forth from the wellspring of knowledge, shaped by a wondrous proprietary AI technology that delved into a vast ocean of data, illuminating the path towards the Sustainable Development Goals. Remember that all rights are reserved by SDG Investors LLC, empowering us to champion progress together.

Source: itep.org

Join us, as fellow seekers of change, on a transformative journey at https://sdgtalks.ai/welcome, where you can become a member and actively contribute to shaping a brighter future.