Ghana’s banks are not lending enough to sectors where it matters most, like agriculture and manufacturing – The Conversation

Report on the Sectoral Distribution of Bank Lending in Ghana and its Impact on Sustainable Development Goals

Introduction

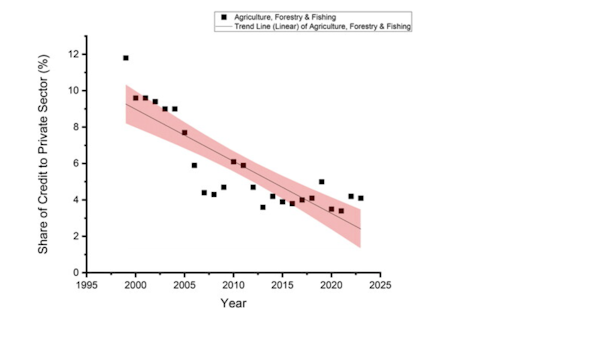

An analysis of bank lending in Ghana from 1999 to 2023 reveals a significant and sustained decline in credit allocation to the nation’s productive sectors, namely agriculture and manufacturing. This trend poses a direct challenge to the achievement of several key Sustainable Development Goals (SDGs), particularly those related to poverty reduction, economic growth, and industrialization. Access to substantial and affordable financial credit is essential for economic transformation, and its distribution is a critical factor in fostering inclusive and sustainable development.

Key Findings on Credit Allocation (1999-2023)

Data from the past 25 years indicates a clear diversion of financial resources away from sectors fundamental to broad-based economic growth and job creation.

Statistical Decline in Productive Sector Lending

- The share of total bank credit allocated to the agricultural sector fell by approximately 65%.

- The share of total bank credit allocated to the manufacturing sector fell by approximately 56%.

- As a specific example, manufacturing’s share of total bank lending decreased from 25% in 1999 to just 11% by 2023.

Comparative Sectoral Averages

Over the 25-year period, the average share of total bank credit was distributed as follows:

- Services Sector: 20.7%

- Commerce and Finance: 17.3%

- Manufacturing: 14.6%

- Agriculture: 5.8%

Implications for Ghana’s Sustainable Development Goals (SDGs)

The misallocation of credit toward unproductive sectors directly undermines Ghana’s progress on its national development agenda and the SDGs.

Impact on Specific Goals

- SDG 8 (Decent Work and Economic Growth): By starving the agricultural and manufacturing sectors of necessary credit, the financial system fails to support the creation of substantial, well-paid, and sustainable jobs. This hinders inclusive economic growth and promotes informal, low-productivity employment.

- SDG 9 (Industry, Innovation, and Infrastructure): The sharp decline in lending to manufacturing is a major impediment to industrialization. Without financial support for entrepreneurial innovation and capacity expansion, Ghana’s ability to build a resilient and diversified industrial base is severely constrained.

- SDG 2 (Zero Hunger): Agriculture is the second largest employer and is critical for food security and providing raw materials for industry. Reduced credit to this sector threatens agricultural productivity, rural livelihoods, and the goal of achieving zero hunger.

- SDG 1 (No Poverty): The lack of investment in sectors that employ a large portion of the population, particularly in rural areas, limits opportunities for poverty reduction and shared prosperity.

Causal Factors and Policy Failures

Two primary factors have been identified as drivers of this dysfunctional credit allocation, both of which work against the developmental objectives outlined in the SDGs.

- Foreign Domination of the Banking Sector: Approximately 50% of banks in Ghana are foreign-owned. These institutions often exhibit greater risk aversion and are less inclined to provide credit to small and medium-scale enterprises (SMEs) in the productive sectors, which are the engines of job creation (SDG 8).

- Misaligned Monetary Policy: The Bank of Ghana’s singular focus on monetary stability through inflation-targeting has led to high interest rates. This policy discourages private sector borrowing for productive investment while making investment in government securities more attractive for banks. This approach neglects the central bank’s developmental mandate, as outlined in The Bank of Ghana (Amendment) Act 2016, to support the government’s economic policy and ensure an efficient credit system aligned with national goals.

Policy Recommendations for SDG-Aligned Financial Reform

A strategic reorientation of financial and monetary policy is required to ensure that the banking system contributes effectively to Ghana’s sustainable development.

- Return to Directed Credit Policies: Implement policies that guide credit towards priority sectors essential for achieving the SDGs, such as agriculture (SDG 2) and manufacturing (SDG 9). This can include the use of credit ceilings, preferential interest rates, and mandatory lending ratios for these sectors.

- Support for Indigenous Banking: Foster greater indigenous participation in the banking system to ensure that financial institutions are more aligned with national development priorities and are more willing to fund local SMEs.

- Revitalize National Development Banks: Strengthen and recapitalize institutions like the Agricultural Development Bank and the National Investment Bank to provide targeted, long-term financing for projects that directly support the Sustainable Development Goals.

Analysis of Sustainable Development Goals (SDGs) in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The article on bank lending in Ghana connects to several Sustainable Development Goals by highlighting the critical role of finance in fostering sustainable and inclusive economic development. The primary SDGs addressed are:

- SDG 2: Zero Hunger: The article directly addresses this goal by discussing the sharp decline in bank lending to the agricultural sector in Ghana. Agriculture is fundamental to food security, and a lack of financial investment, as detailed in the study, hinders the sector’s productivity and growth, which is essential for ending hunger.

- SDG 8: Decent Work and Economic Growth: This is a central theme. The article argues that directing credit towards “productive sectors” like agriculture and manufacturing is “crucial to creating substantial, sustainable, and shared economic growth.” It explicitly states that when these sectors are denied credit, “well-paid and sustainable jobs cannot be created.”

- SDG 9: Industry, Innovation and Infrastructure: The article’s focus on the decline of financial credit to the manufacturing sector directly relates to this goal. Sustainable industrialization, a key component of SDG 9, is dependent on investment and financial support to expand “manufacturing capacity and outputs.” The lack of affordable credit for enterprises, especially SMEs, is a major barrier to industrial growth.

- SDG 17: Partnerships for the Goals: The article touches upon this goal by discussing issues of finance and policy coherence. It critiques the Bank of Ghana’s monetary policy, the influence of foreign-owned banks, and the legacy of IMF-led financial reforms, all of which relate to strengthening the means of implementation and ensuring that domestic and international financial systems support national development priorities.

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the issues discussed, the following specific SDG targets can be identified:

- Target 2.a: Increase investment, including through enhanced international cooperation, in rural infrastructure, agricultural research and extension services, technology development and plant and livestock gene banks in order to enhance agricultural productive capacity in developing countries, in particular least developed countries.

- Explanation: The article’s core finding is the “sharp decline” in bank lending to agriculture. This lack of financial credit represents a failure to increase investment in the sector, directly undermining its productive capacity.

- Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation, including through a focus on high-value added and labour-intensive sectors.

- Explanation: The article identifies agriculture and manufacturing as crucial “productive sectors” for Ghana’s economic transformation. The decline in credit to these sectors inhibits diversification away from services and prevents the kind of investment needed for technological upgrading and increased productivity.

- Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all.

- Explanation: The article critiques the Ghanaian banking system for not generating enough “affordable, and accessible financial credit for all businesses.” It points to the “dysfunction of the financial system” in allocating credit away from productive sectors, thus failing to expand meaningful access to financial services that support development.

- Target 9.2: Promote inclusive and sustainable industrialization and, by 2030, significantly raise industry’s share of employment and gross domestic product.

- Explanation: The significant drop in the share of bank credit to manufacturing, from 25% in 1999 to 11% in 2023, directly works against the goal of promoting industrialization. Without adequate financing, the manufacturing sector cannot grow to increase its share of employment and GDP.

- Target 9.3: Increase the access of small-scale industrial and other enterprises, in particular in developing countries, to financial services, including affordable credit, and their integration into value chains and markets.

- Explanation: The article explicitly mentions that foreign-owned banks, which dominate the sector, “are less likely to lend to small and medium-scale enterprises (SMEs).” This directly highlights the challenge of SMEs in accessing affordable credit, which is the central focus of this target.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Yes, the article provides specific quantitative data that can serve as direct indicators for measuring progress.

- Indicator for Targets 2.a, 8.10, and 9.3: Share of total bank credit allocated to specific sectors.

- Explanation: The article provides precise figures that can be used to track financial flows to key sectors. This data serves as a proxy for official indicators like the “agriculture orientation index” (for 2.a) or the “Proportion of small-scale industries with a loan or line of credit” (for 9.3). The specific data points mentioned are:

- The share of total bank credit to the agricultural sector fell by about 65% between 1999 and 2023.

- The share of total bank credit to the manufacturing sector fell by about 56% in the same period.

- The share of lending to manufacturing businesses fell from “about 25% of total bank lending” in 1999 to “about 11%” by 2023.

- Over the last 25 years, the average share of total bank credit was 5.8% for agriculture and 14.6% for manufacturing, compared to 20.7% for the services sector.

- Explanation: The article provides precise figures that can be used to track financial flows to key sectors. This data serves as a proxy for official indicators like the “agriculture orientation index” (for 2.a) or the “Proportion of small-scale industries with a loan or line of credit” (for 9.3). The specific data points mentioned are:

- Indicator for Target 9.2: Industry’s share of total credit as a proxy for investment in industrialization.

- Explanation: While the official indicator is “Manufacturing value added as a proportion of GDP,” the article uses the share of credit allocated to manufacturing as a leading indicator of investment in the sector. A sustained increase in this share would imply progress towards the goal of promoting industrialization, while the documented decline indicates a regression.

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 2: Zero Hunger | 2.a: Increase investment in agriculture to enhance productive capacity. | The share of total bank credit to the agricultural sector, which fell by 65% from 1999-2023 and averaged only 5.8% over the period. |

| SDG 8: Decent Work and Economic Growth | 8.2: Achieve higher levels of economic productivity through diversification and focus on labour-intensive sectors. 8.10: Strengthen domestic financial institutions to expand access to financial services. |

The low and declining share of credit to productive sectors (agriculture and manufacturing) versus the high share to the services sector (20.7% average). |

| SDG 9: Industry, Innovation and Infrastructure | 9.2: Promote inclusive and sustainable industrialization. 9.3: Increase the access of small-scale enterprises to financial services, including affordable credit. |

The share of total bank credit to the manufacturing sector, which fell from 25% in 1999 to 11% in 2023. The article also implies a lack of lending to SMEs. |

Source: theconversation.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0