How Sustained Net Income Growth and No Buybacks This Quarter Could Shape International Bancshares’ (IBOC) Story – simplywall.st

Corporate Performance and Sustainable Development Goal (SDG) Alignment Analysis: International Bancshares Corporation

1.0 Executive Summary

This report analyzes the third-quarter 2025 financial results of International Bancshares Corporation (IBC) through the framework of the United Nations Sustainable Development Goals (SDGs). The analysis indicates that while the corporation’s financial performance supports economic growth objectives outlined in SDG 8, concerns related to corporate governance may present challenges to its alignment with SDG 16. Capital allocation decisions are also reviewed for their potential impact on long-term sustainable value creation.

2.0 Financial Performance and Economic Impact

2.1 Q3 2025 Earnings Overview

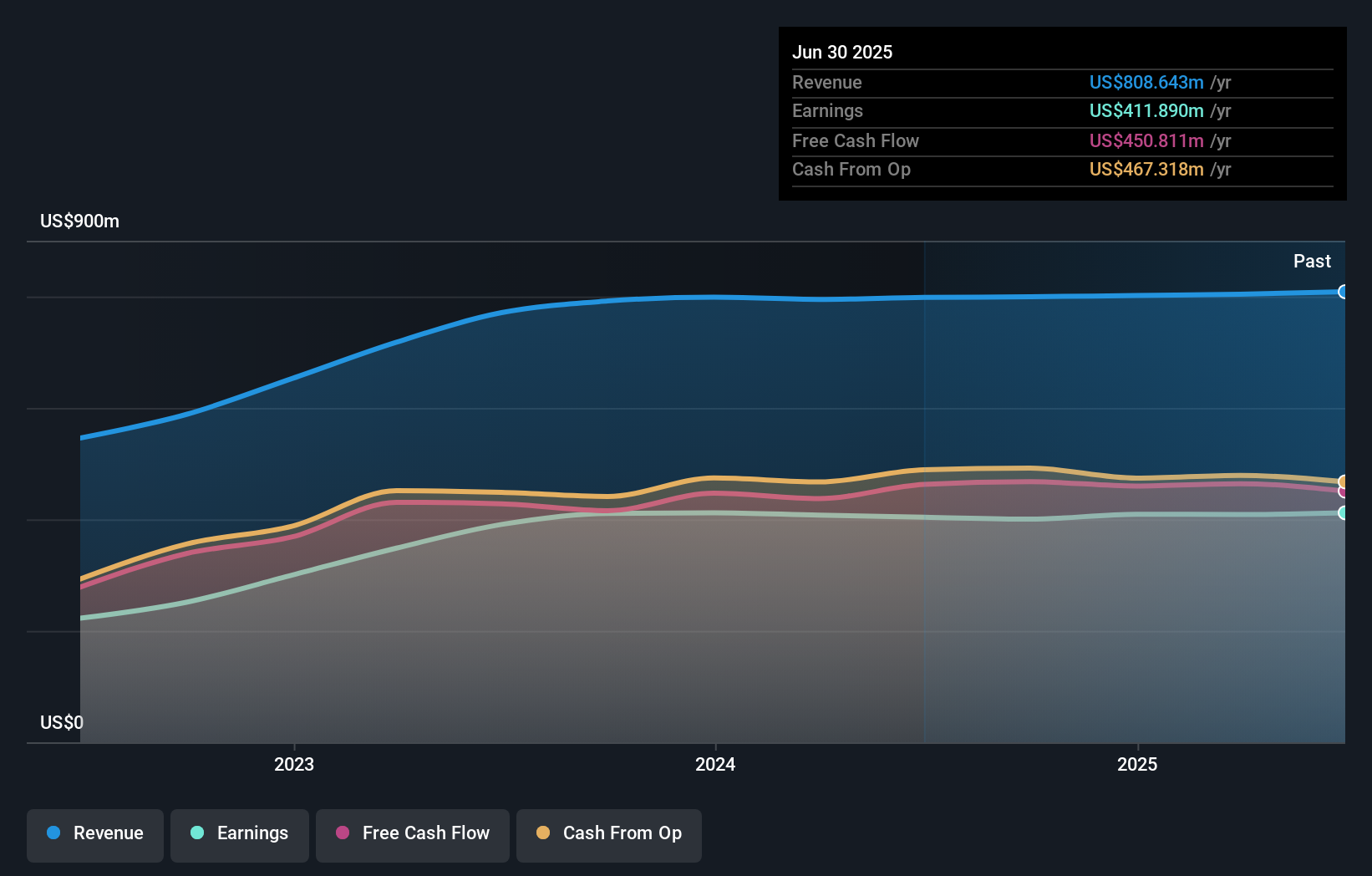

For the quarter ending September 30, 2025, International Bancshares Corporation reported strong financial results, demonstrating its role in fostering economic stability.

- Net Interest Income: US$172.23 million

- Net Income: US$108.38 million

- Earnings Per Share: Consistent quarterly and year-to-date growth reported.

2.2 Alignment with SDG 8: Decent Work and Economic Growth

The sustained year-over-year growth in net income and net interest income underscores the corporation’s capacity to contribute to SDG 8. As a stable financial institution, IBC’s profitability enables it to provide capital to businesses and individuals, thereby supporting job creation, promoting sustained economic activity, and contributing to the financial system’s resilience.

3.0 Governance and Institutional Integrity

3.1 Capital Allocation and Governance Indicators

Recent corporate actions and governance structures warrant examination in the context of long-term sustainability and institutional strength.

- Share Repurchase Program: No shares were repurchased during the most recent tranche, signaling a potential shift in capital deployment priorities or increased management caution. This decision impacts how value is returned to stakeholders and reinvested for sustainable growth, a key consideration for SDG 17 (Partnerships for the Goals).

- Board Composition: A lack of board refreshment was noted, which could indicate a need for new perspectives to navigate evolving economic and social landscapes.

- Insider Transactions: Recent insider selling has been observed, a factor relevant to shareholder confidence and management alignment.

3.2 Alignment with SDG 16: Peace, Justice, and Strong Institutions

The observations regarding slow board refreshment and insider selling are directly relevant to SDG 16, which calls for effective, accountable, and inclusive institutions at all levels. Strong corporate governance is a cornerstone of a stable and just society. A lack of fresh perspectives on the board and questions regarding insider activities could pose risks to the institution’s long-term accountability and transparency, which are fundamental tenets of this goal.

4.0 Conclusion and Outlook

International Bancshares Corporation’s Q3 2025 financial results demonstrate a positive contribution toward SDG 8 (Decent Work and Economic Growth) through stable profitability. However, to fully align with broader sustainable development objectives, particularly SDG 16 (Peace, Justice, and Strong Institutions), attention must be given to enhancing corporate governance practices. Strengthening board composition and ensuring transparent capital management are critical for reinforcing the corporation’s role as a responsible and resilient institution supporting long-term, inclusive economic development.

Analysis of Sustainable Development Goals in the Article

1. Relevant Sustainable Development Goals (SDGs)

- Based on a thorough analysis of the provided article, no Sustainable Development Goals (SDGs) are directly addressed or connected to the issues discussed. The article’s content is exclusively focused on the financial performance of International Bancshares Corporation, including its earnings, net income, share value, and investment narrative from a shareholder’s perspective. The topics discussed, such as profitability, capital deployment, and board refreshment, are framed entirely within the context of corporate finance and investor risk, rather than the broader social, environmental, and economic development objectives of the SDGs.

2. Specific SDG Targets

- As no relevant SDGs could be identified from the article’s content, it is not possible to identify any specific targets. The text does not contain information related to promoting inclusive economic growth, ensuring sustainable consumption, combating climate change, reducing inequality, or any other specific aim outlined in the SDG targets. The discussion of “growth” refers strictly to corporate earnings and not to sustainable or inclusive economic growth as defined by the SDGs.

3. Indicators for Measuring Progress

- The article does not mention or imply any indicators that can be used to measure progress towards SDG targets. The metrics mentioned, such as “net interest income,” “net income,” “earnings per share,” and “share repurchases,” are standard financial performance indicators. They are used to assess the company’s profitability and value for shareholders, not to measure contributions to sustainable development.

Summary Table

4. SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| No relevant SDGs were identified in the article. | No relevant targets were identified in the article. | No relevant indicators were identified in the article. |

Source: simplywall.st

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0